SJC gold bar price

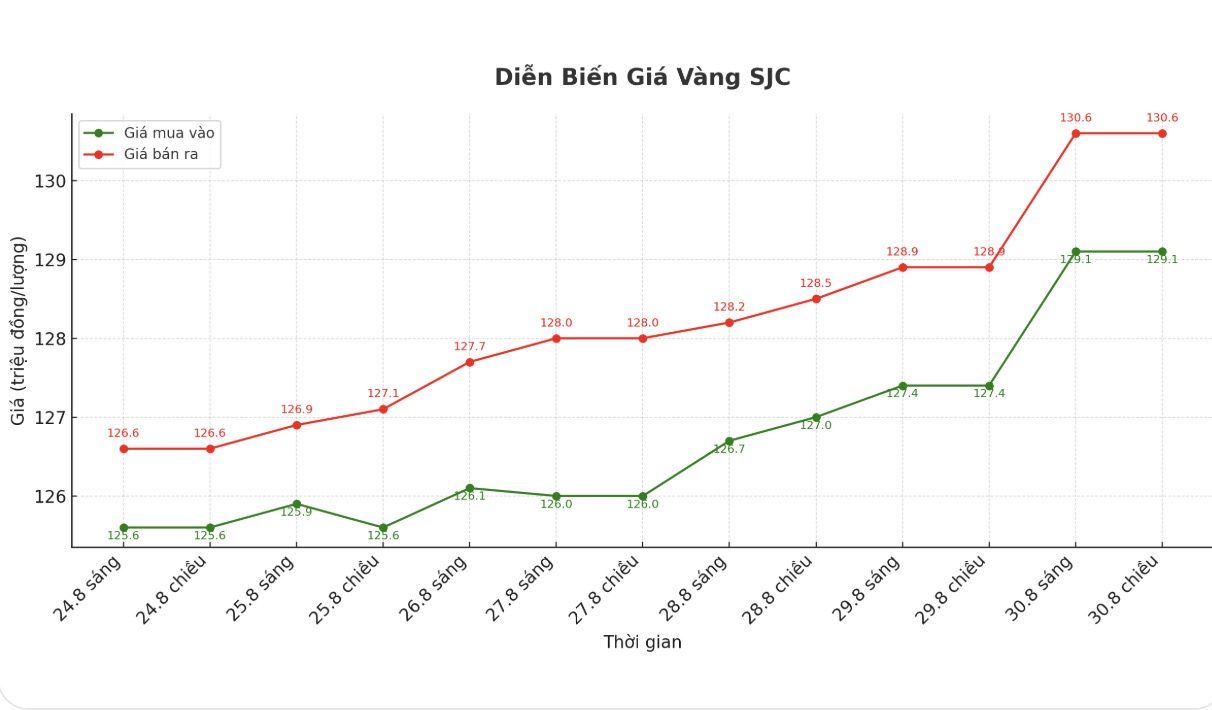

At the end of the trading session of the week, Saigon Jewelry Company SJC listed the price of SJC gold at 129.1-130.6 million VND/tael (buy in - sell out).

Compared to the closing price of last week's trading session (August 24, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by 3.5 million VND/tael for buying and increased by 4 million VND/tael for selling. The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 128.6-130.6 million VND/tael (buy in - sell out).

Compared to a week ago, the price of SJC gold bars was increased by 3 million VND/tael for buying and increased by 4 million VND/tael for selling. The difference between the buying and selling prices of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

If buying SJC gold at Saigon Jewelry Company SJC and Bao Tin Minh Chau in the session of August 24 and selling in today's session (31.8), buyers will make a profit of 2.5 million and 2 million VND/tael respectively.

9999 gold ring price

Bao Tin Minh Chau listed the price of gold rings at 122.6-125.6 million VND/tael (buy - sell); increased by 3.6 million VND/tael in both directions. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 122.3-125.3 million VND/tael (buy - sell), an increase of 4 million VND/tael in both directions compared to a week ago. The difference between buying and selling is 3 million VND/tael.

If buying gold rings in the session of August 24 and selling in today's session (8.31), buyers at Bao Tin Minh Chau will make a profit of VND600,000/tael, while the profit when buying in Phu Quy is VND1 million/tael.

World gold price

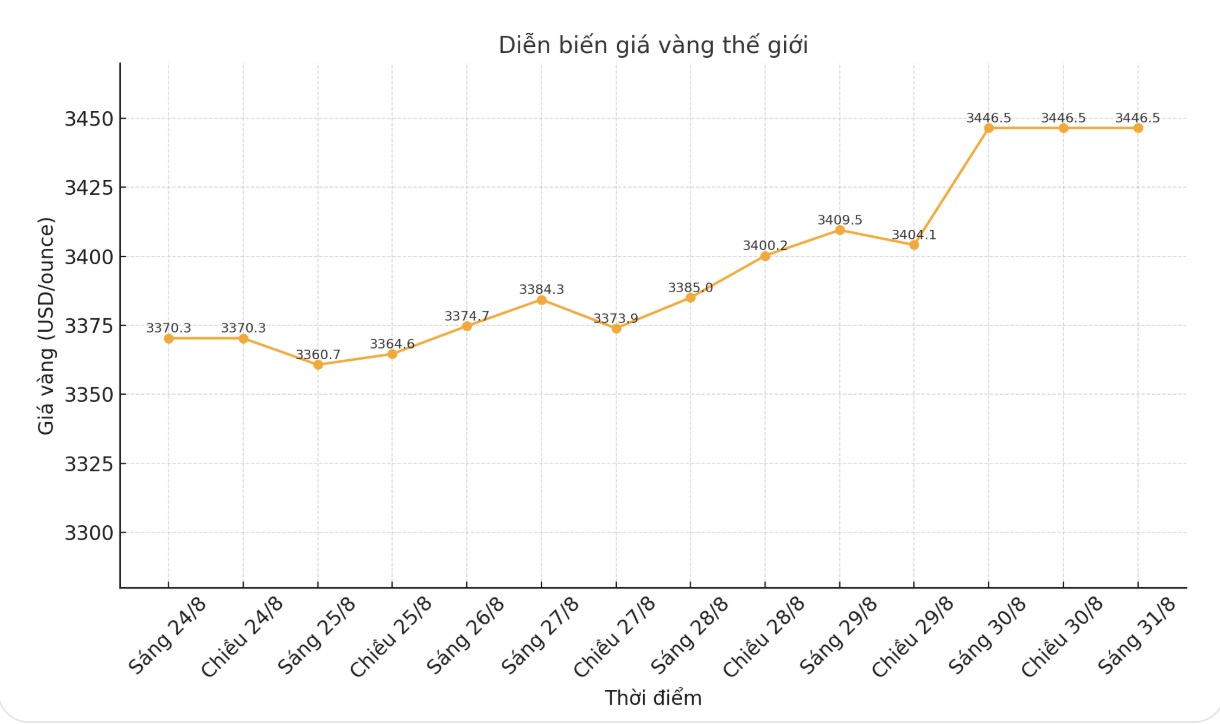

At the end of the trading session of the week, the world gold price was listed at 3,446.5 USD/ounce, up 76.2 USD/ounce compared to the closing price of the previous trading session.

Gold price forecast

Michele Schneider - Strategy Director of Market Gauge said that the gold buying signal was activated after the "harmony" speech of the Chairman of the US Federal Reserve (FED) - Mr. Jerome Powell at the annual conference in Jackson Hole.

Mr. Powell acknowledged that the change in the risk balance in the economy could lead to a policy adjustment, and expressed little concern about dragging inflation back to 2%, focusing more on slowing growth and a weakening labor market.

Data released by the US Commerce Department shows that the core personal consumption expenditure (PCE) price index - the FED's preferred inflation measure - increased by 2.9% over the past 12 months, as expected. Despite rising inflation, the market is almost certain that the Fed will cut interest rates in September.

Phillip Streible - Chief Strategist at Blue Line Futures predicts gold prices will continue to increase in the short term, but need to close above 3,500 USD/ounce to confirm the trend. December gold delivery contracts on the CME have risen to $3,511.50 an ounce, up more than 1% on the day and nearly 3% for the week. He said gold is rising because the market is starting to smell the risk of inflation.

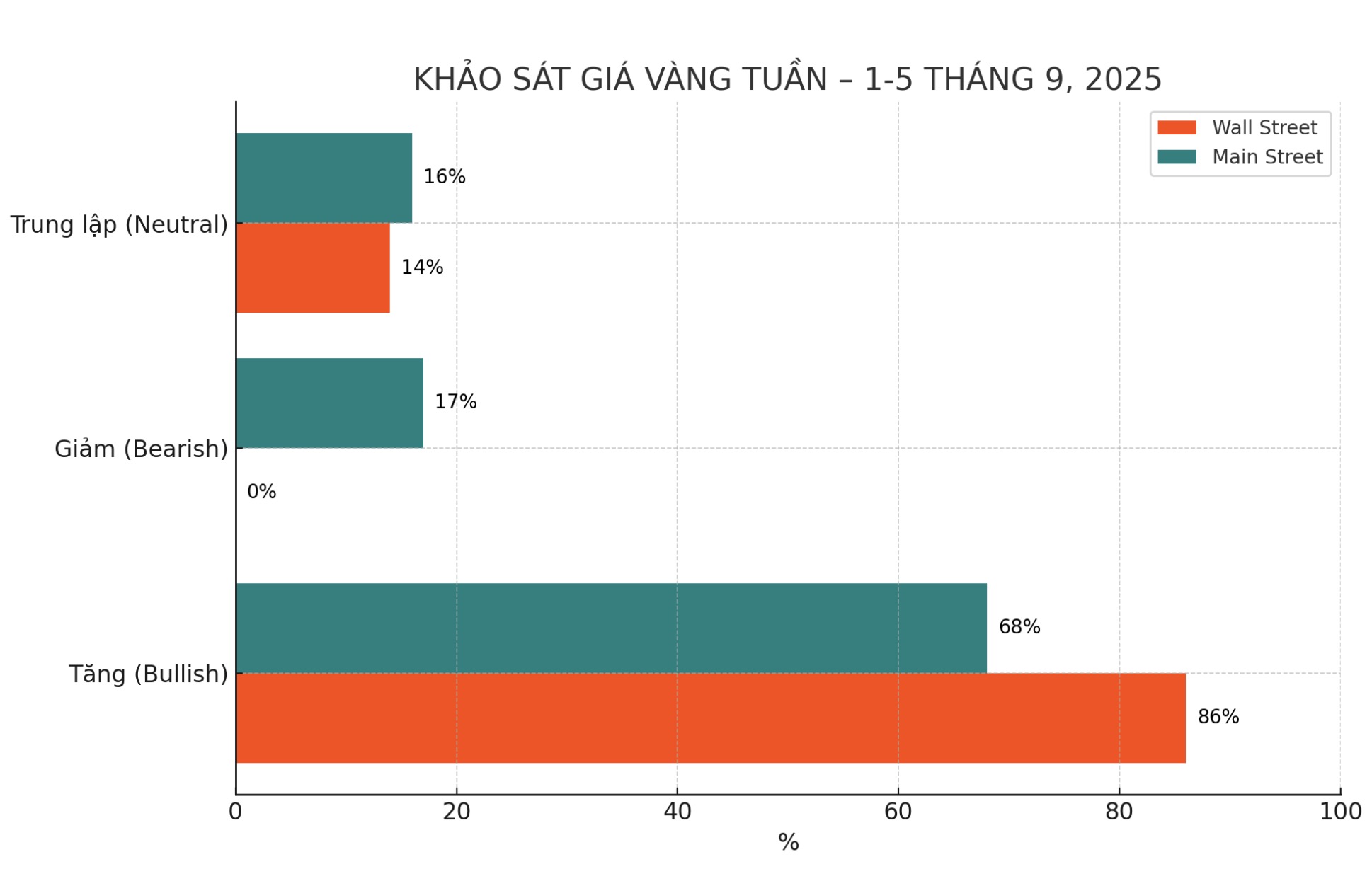

The weekly gold survey of an international financial information platform shows that Wall Street is fully supportive of the scenario of gold prices continuing to increase. While the majority of retail investors also expect the precious metal to rise next week.

This week, there were 14 analysts participating in the survey. After last week's strong price increase, no expert predicts that gold will decrease. Of these, 12 people (86%) expect gold prices to rise next week, while the remaining 2 people (14%) expect gold to move sideways.

179 investors participated in online voting. After a week of strong gold gains, optimism is also spreading: 121 investors (68%) predict gold prices will continue to increase, 30 people (17%) believe gold will decrease, while 28 people (16%) predict gold will fluctuate sideways in the following week.

Next week will be a shorter trading week for the world market as North American markets close on Monday to celebrate Labor Day. The focus will be on US employment data.

On Tuesday, the market will receive the August ISM manufacturing PMI, followed by the JOLTS job opportunity data on Wednesday.

There will be an ADP jobs report for August on Thursday, along with weekly jobless claims and the ISM services PMI.

The week ended on Friday with the US non-farm Payrolls August report. Investors and traders will be monitoring signs of weak jobs as a further confirmation of expectations that the Fed will cut interest rates in the middle of the month.

See more news related to gold prices HERE...