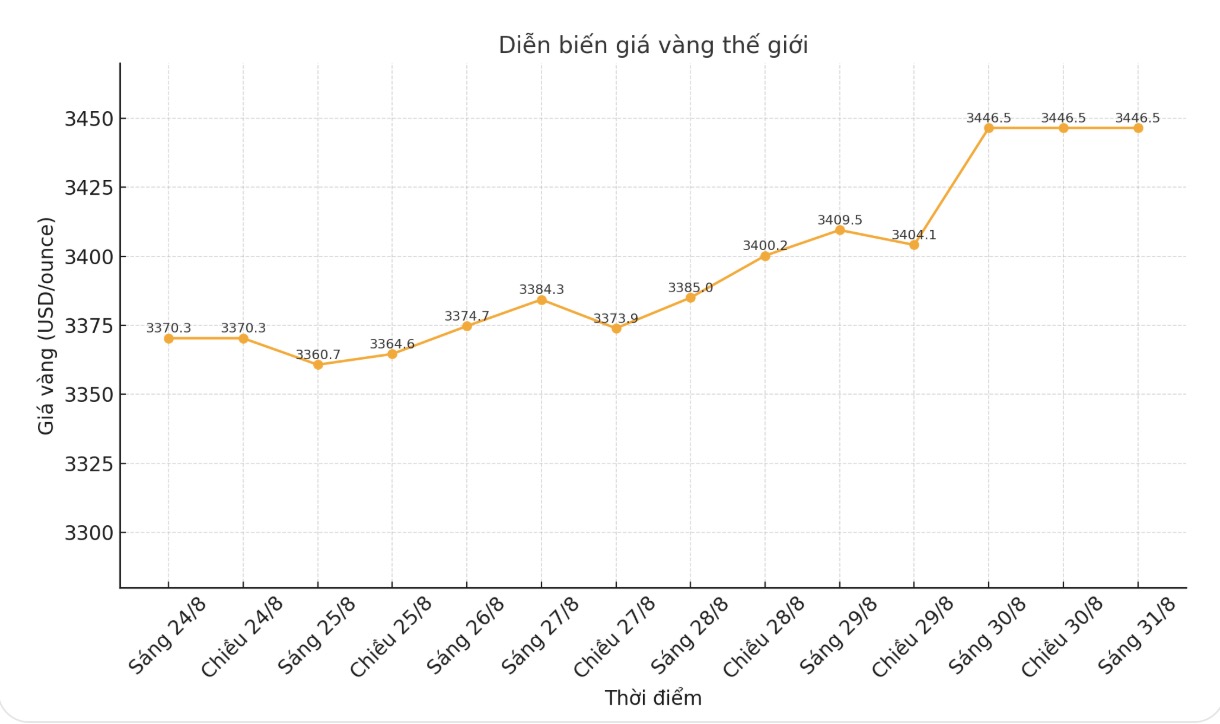

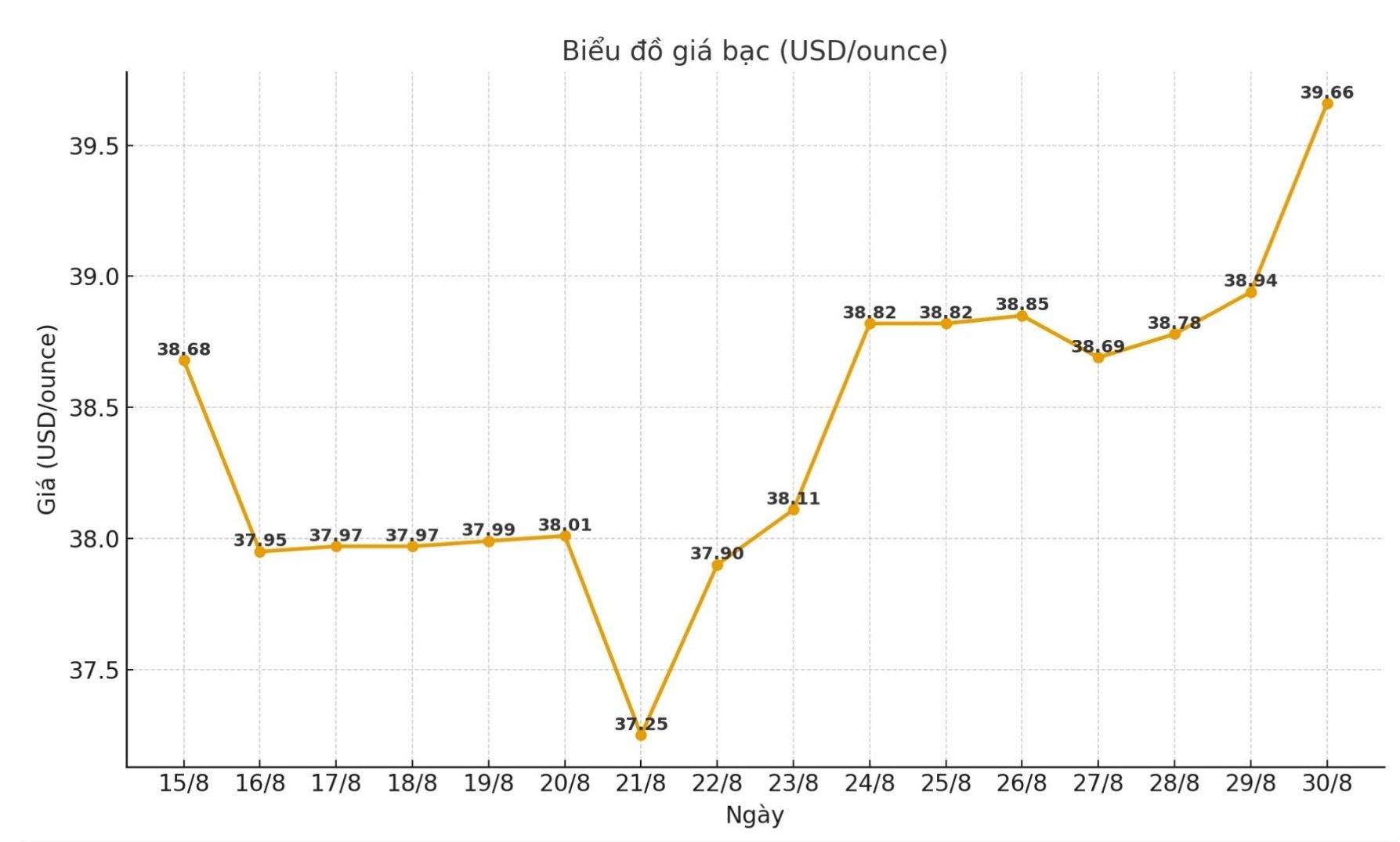

World gold prices are closing the week at a record level of over 3,440 USD/ounce, while silver is approaching the threshold of 40 USD/ounce. At the closing price of the most recent session, spot silver reached 39.72 USD/ounce, up more than 2% for the week and could record the highest weekly closing price since August 2011.

Previously, investors have paid attention to the move of the Harvard Fund when it invested heavily in SPDR Gold Shares (NYSE: GLD) - the world's largest gold ETF.

However, the second quarter also recorded a notable deal for silver: Saudi Arabia Central Bank invested 30.5 million USD in iShares Silver Trust (NYSE: SLV) and nearly 10 million USD in Global X Silver Miners ETF (NYSE: SIL).

According to experts, this move is not aimed at "mentarizing" silver as the role of gold, but is likely to be implemented through a national asset fund managed by Saudi Arabia.

Although this investment is still small compared to the level of capital poured into the technology sector, it reflects that silver is gradually being seen as a valuable investment channel, beyond the role of an industrial metal.

The attractiveness of silver comes from the ratio of prices to gold. Although the gold/ silwer ratio fell sharply from a peak of over 104 in April, it is still higher than 86, while the historical average is only about 5060.

The disadvantage of silver is that the market size is half as small as gold, causing stronger price fluctuations and is often not chosen by large funds such as gold - a traditional safe-haven asset.

For now, the demand for silver has been driven largely by individual investors who do not want to spend $3,500 on a gold bar.

The fact that a national asset fund has begun to pay attention to silver is considered a turning point, opening up new opportunities for this white metal.

Update on domestic silver prices

At the end of the trading session of the week, the price of 999 999 coins (1 tael) at Ancarat Golden Rooster Company was listed at 1.511 - 1.547 million VND/tael (buy - sell). The price of 2024 Ancarat 999 (1kg) silver bars at Ancarat Metallurgy Company was listed at 40.294 - 41.254 million VND/kg (buy - sell).

Meanwhile, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.521 - 1.568 million VND/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 40.559 - 41.813 million VND/kg (buy - sell).

Over the past 12 months, domestic silver prices have increased by about 40%, currently trading around 1.54 million VND/tael. Despite a few corrections in late July and mid-August, many investors are still optimistic that silver still has room to continue to move up in the coming time.