Gold investors may need to be patient, as gold prices are forecast to continue to fluctuate within a wide range due to the unstable economic and geopolitical situation.

In the context of gold prices being neutral, analysts believe that this precious metal will continue to fluctuate in the current price range during the month, with support at 3,100 USD/ounce and resistance at 3,400 USD/ounce. Market sentiment has changed as gold is currently trading in the middle of this range.

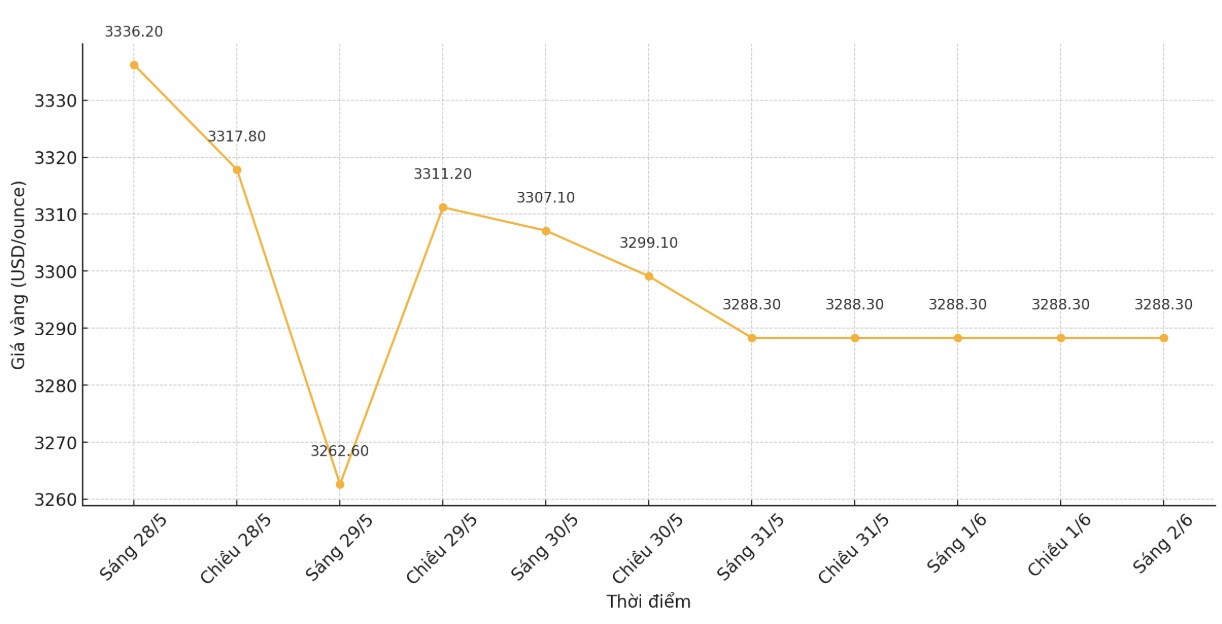

Despite falling last week, spot gold still recorded a slight increase in the month, extending a streak of 5 consecutive months of increase. However, in the futures market, the rally ended when gold closed the month below $2.

The highlight of this month's price action is the high volatility. The range in May reached 324.9 USD - down from the record 539.5 USD in April but still much higher than the 20-year average of about 89 USD/ounce.

Analysts say gold will maintain a positive foundation in the long term, but short-term fluctuations are weakening the increase.

Its not surprising to see gold fluctuating strongly, which reflects the chaos in US policy. They are very inconsistent, said Chantelle Schieven, head of research at Capitalight Research.

She said gold prices will move sideways in the summer as investors await the full impact of the trade war that US President Donald Trump is wagering.

Gold prices will increase by the end of the year, but the market is currently in a waiting period. It will take us another 6 to 8 months to clearly see the impact of these policies on prices and the economy, she said.

The above comments were made in the context of somewhat cooling inflation data. Over the past 12 months, the core PCE index - the FED's preferred inflation measure - has increased by 2.5%, down from the 2.7% adjustment in March.

Despite the slight cooling of consumer price pressure, the expectation of 1-year inflation remains high - exceeding 6%.

Eugenia Mykuliak - Founder and CEO of B2PRIME Group commented: The spectacular increase of nearly 60% of gold since 2024 comes from a combination of macroeconomic and geopolitical factors. Inflation and monetary policy are the focus. Despite signs of a decline in the first quarter of 2025, concerns about US tariffs, trade policies and financial health are increasing the risk of stagflation.

Selling pressure last week was partly due to a federal jury rejecting the previously issued tax cut by President Donald Trump.

Although gold may not be ready to conquer the old peak, negative sentiment in the market is still very low.

Ricardo Evangelista - Senior Analyst at ActivTrades commented: The downward pressure on gold is limited by tax-related instability, rising geopolitical tensions, and growing concerns about global economic prospects. In addition, fiscal risks from the US government's tax cut are cautious for investors. In the context of many uncertainties, gold's safe-haven role will still be maintained around the $3,300/ounce mark.

Although gold is moving sideways, volatility is expected to remain high this week with a series of important economic data. The focus is on the non-farm payrolls report on Friday, but the market will also closely monitor the industrial labor and production data for the week.

Analysts continue to look for signs that the US labor market is cooling down - a factor that could prompt the Fed to reconsider its neutral stance.

Mr.kuliak said that he is also closely monitoring inflation data: "In the short term, if the CPI released on June 11 unexpectedly increases or geopolitical tensions escalate, gold prices may move towards the 3,400 USD/ounce area, even testing the psychological mark of 3,500 USD/ounce.

Conversely, if the Fed keeps a strong voice and macro data remains positive, gold prices could consolidate below $3,300/ounce. The current support level is 3,215 USD/ounce, and if it is penetrated, it can be adjusted further, said this expert.

Economic data schedule next week

Monday: US manufacturing ISM index.

Tuesday: US Job Opportunity Report (JOLTS).

Wednesday: ADP implementation, Bank of Canada monetary policy, ISM service data.

Thursday: European Central Bank monetary policy meeting, US weekly jobless claims application.

Friday: US Non-farm Payrolls.