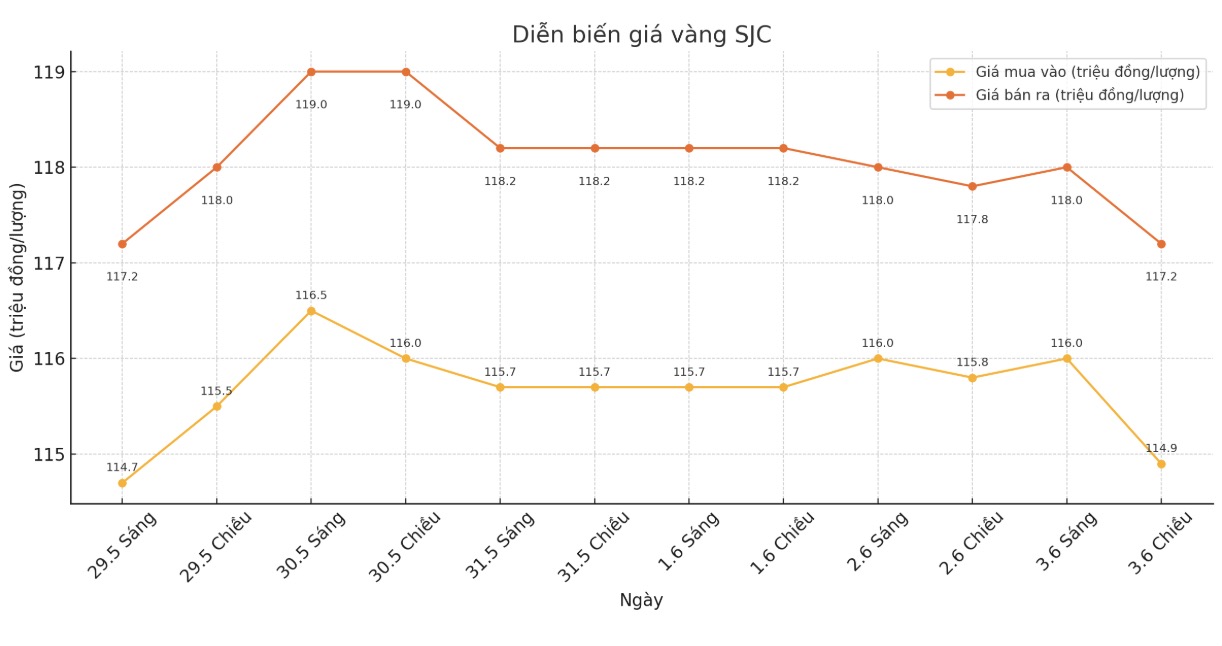

SJC gold bar price

As of 6:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND114.9-117.2 million/tael (buy - sell), down VND900,000/tael for buying and down VND600,000/tael for selling. The difference between buying and selling prices is at 2.3 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 114.9-117.2 million VND/tael (buy - sell), down 900,000 VND/tael for buying and down 600,000 VND/tael for selling. The difference between buying and selling prices is at 2.3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 114.9-117.2 million VND/tael (buy - sell), down 900,000 VND/tael for buying and down 600,000 VND/tael for selling. The difference between buying and selling prices is at 2.3 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 114.4-117.2 million/tael (buy - sell), down VND 900,000/tael for buying and down VND 600,000/tael for selling. The difference between buying and selling prices is at 2.8 million VND/tael.

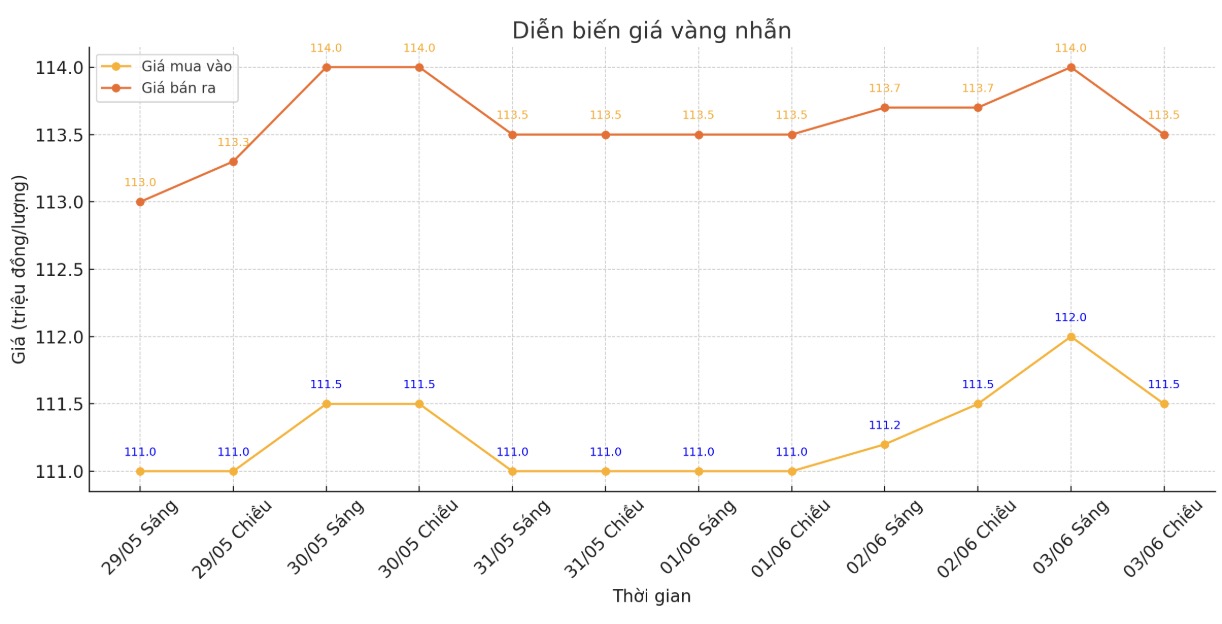

9999 gold ring price

As of 6:30 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 111.5-113.5 million VND/tael (buy - sell), unchanged for buying and down 200,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113.2-116.2 million VND/tael (buy in - sell out), down 300,000 VND/tael for both. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111-114 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

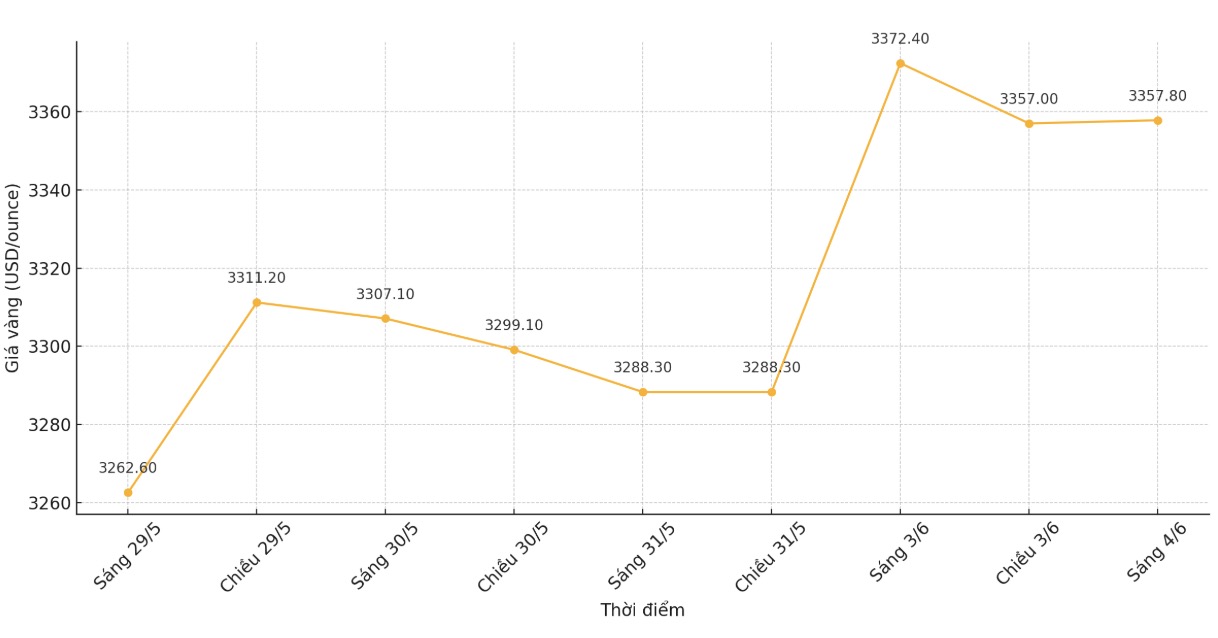

World gold price

At 6:30 a.m., the world gold price was listed at 3,357.8 USD/ounce, down 18.6 USD.

Gold price forecast

Gold and silver prices were under selling pressure due to normal price adjustments after a strong increase on Monday. August gold contract fell 24.80 USD to 3,372.4 USD/ounce. July delivery silver price decreased by 0.129 USD to 34.565 USD/ounce.

US stock indexes increased in the middle of the session. Investors during the day are trying to put aside the exchange of words between the US and China about trade policy. However, this concern continues to appear and promote risk-off sentiment, which is beneficial for safe-haven assets such as gold and silver.

Technically, August gold buyers still dominated in the short term. The next upside target for buyers is to close above $3,450/ounce. In contrast, the short-term target for the bears is to push prices below $3,200/ounce.

The first resistance level is 3,400 USD/ounce, followed by 3,417.8 USD/ounce. First support was $3,350/ounce, followed by a weekly low of $3,319.4/ounce.

Key outside markets today saw the USD index increase strongly. Nymex crude oil futures also rose, trading around $63.75 a barrel. The yield on the 10-year US government bond is currently around 4.45%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...