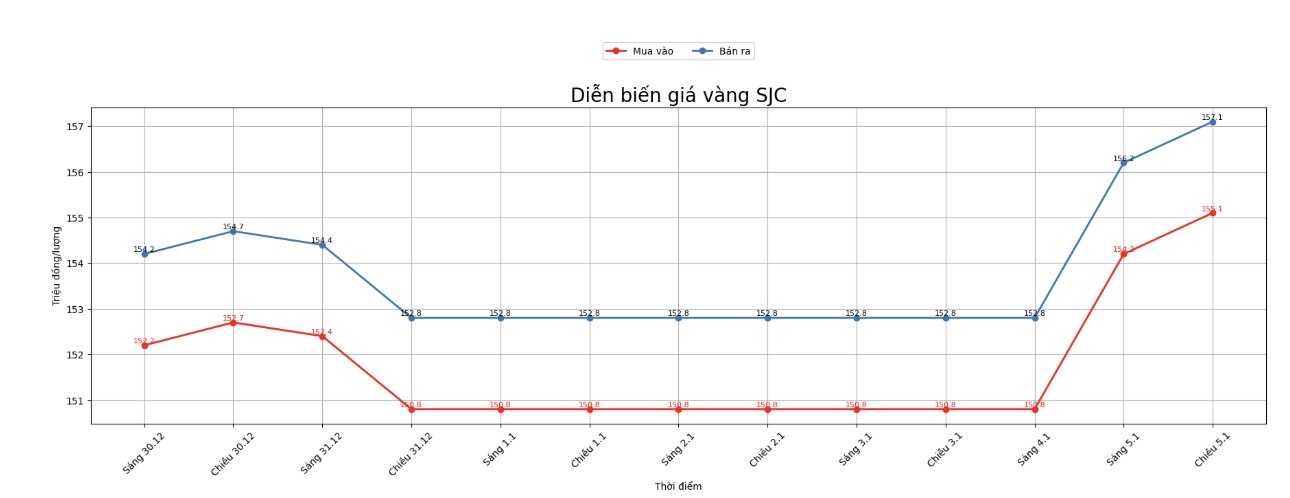

SJC gold bar price

As of 6:00 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 155.1-157.1 million VND/tael (buying - selling), an increase of 4.3 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 155.1-157.1 million VND/tael (buying - selling), an increase of 4.3 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at the threshold of 154.3-156.8 million VND/tael (buying - selling), an increase of 4 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

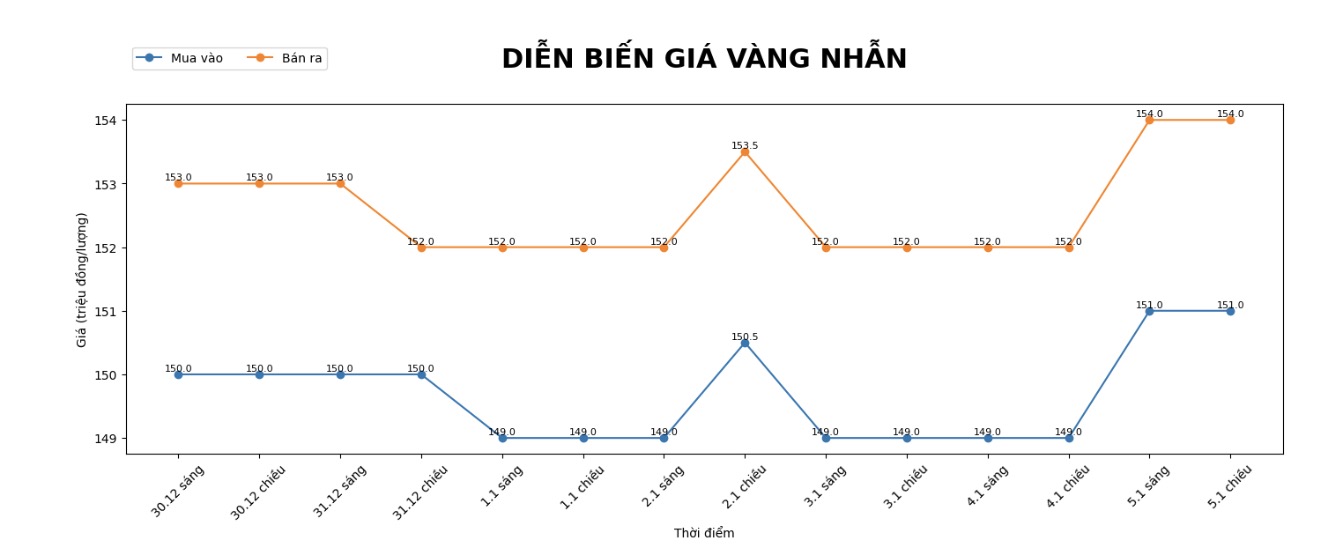

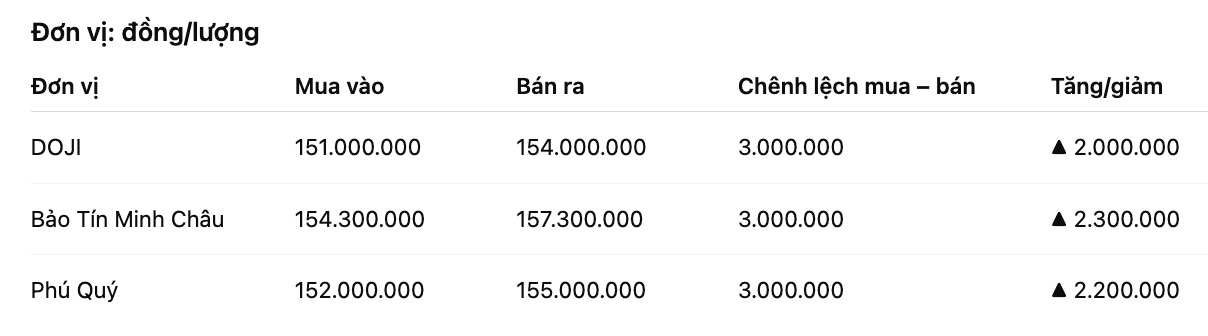

9999 gold ring price

As of 6:00 PM, DOJI Group listed the price of plain gold rings at 151-154 million VND/tael (buying - selling), an increase of 2 million VND/tael in both buying and selling directions. The difference between buying and selling is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 154.3-157.3 million VND/tael (buying - selling), an increase of 2.3 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 152-155 million VND/tael (buying - selling), an increase of 2.2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

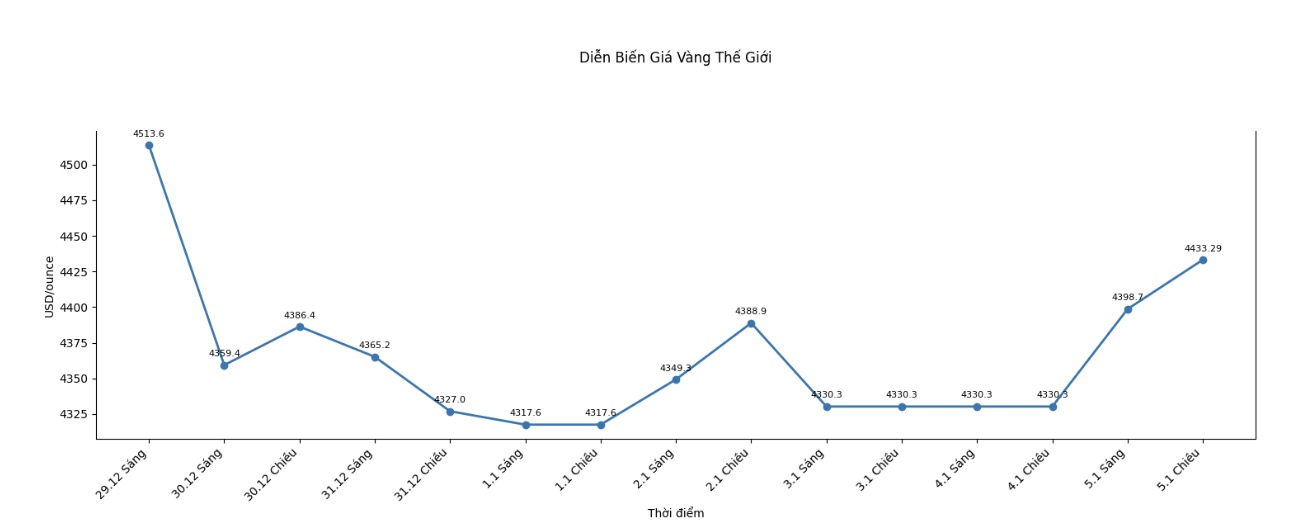

World gold price

World gold price listed at 16:42 at the threshold of 4,433.2 USD/ounce USD/ounce, up 102.9 USD compared to the previous day.

Gold price forecast

The strong increase in gold prices in the first sessions of the year is attracting great attention from investors, especially in the context of many global risk factors continuing to increase.

On the international market, gold prices jumped more than 2%, to the highest level in a week, as geopolitical tensions escalated, notably new developments related to US- Venezuela relations. In such an unstable environment, gold continues to play its role as a safe haven, attracting defensive cash flow from global investors.

Notably, the medium and long-term outlook for gold is still positively assessed by many experts and financial institutions. According to recent analysis, the upward trend of gold shows no signs of ending, although short-term corrections may appear in the market. Experts believe that these price drops are opening up accumulation opportunities for long-term visionary investors.

Sharing with Kitco News, Mr. Eric Strand - founder and portfolio manager of AuAg Funds - said that gold is still on the right long-term upward trajectory. According to him, the milestone of 5,000 USD/ounce in the next 12 months is feasible, while the further goal may even reach 10,000 USD/ounce. "Any gold adjustment in the coming year can be seen as an attractive buying opportunity, especially for patient investors" - Mr. Strand emphasized.

From a more cautious perspective, Ms. Chantelle Schieven - Head of Research at Capitalight Research - believes that questioning the price increase momentum is necessary, as gold has experienced two years of very strong growth. However, she still maintains an optimistic view, believing that the market is witnessing structural changes in the global financial system, thereby supporting a higher gold price level in the long term. According to Ms. Schieven, the formation of increasingly high technical support zones shows that the risk of a deep decline in gold is not high.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...