Venezuela exported 113 tons of gold, worth nearly 4.14 billion Swiss francs (equivalent to about 5.2 billion USD) to Switzerland from 2013 to 2016, right in the early stages of President Nicolas Maduro taking office, according to customs data and analysis by the British news agency.

This gold originated from the reserves of the Central Bank of Venezuela, and was transferred to Switzerland - one of the largest gold refining centers in the world - for processing, certification and transfer elsewhere.

This move comes as the Venezuelan government sells gold reserves to support the economy and create a source of foreign currency facing international sanctions and a profound economic crisis.

Since 2017, official gold exports from Venezuela to Switzerland have ceased, after the European Union (EU) imposed sanctions on Venezuelan officials accused of human rights violations and eroding democracy.

Switzerland then also applied similar sanctions in 2018, although not completely banning gold imports from Venezuela.

The gold sale took place during the "emergency sale" period of the Central Bank of Venezuela, when the country sought to cope with a booming inflationary economy and serious foreign currency shortages.

Market analysts assess that most of this gold reached Switzerland in the period 2012-2016, and could then be retained by financial partners, sold to Asia or other markets after refining.

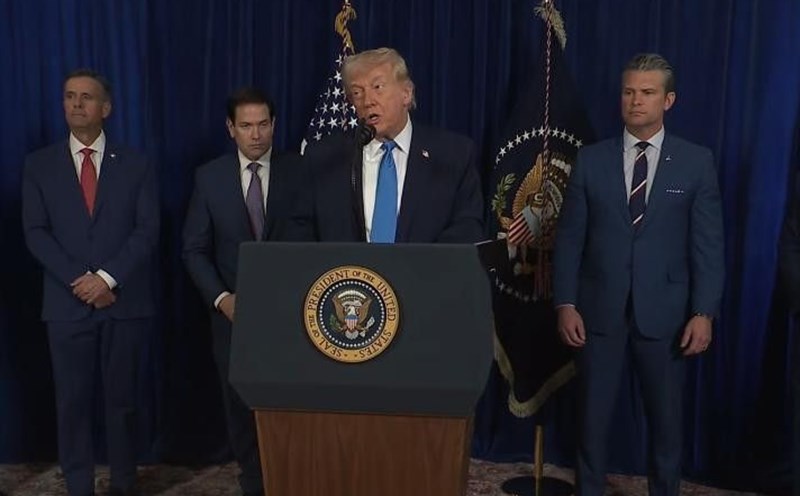

This news coincides with the latest development when Switzerland ordered the freezing of assets in the country related to Venezuelan President Nicolas Maduro and 36 associates, after he was arrested by US special forces in Caracas on January 3, 2026 and faced charges in court in New York, including drug smuggling and drug terrorism.

The Swiss government has not disclosed the specific value or origin of the frozen assets, nor is it clear whether there is any connection between gold previously transferred and assets being frozen.

Although gold was transferred to Switzerland for refining and certification, most of it has left this country or been stored in other forms, experts still have to closely monitor international asset activities related to this South American country.