Updated SJC gold price

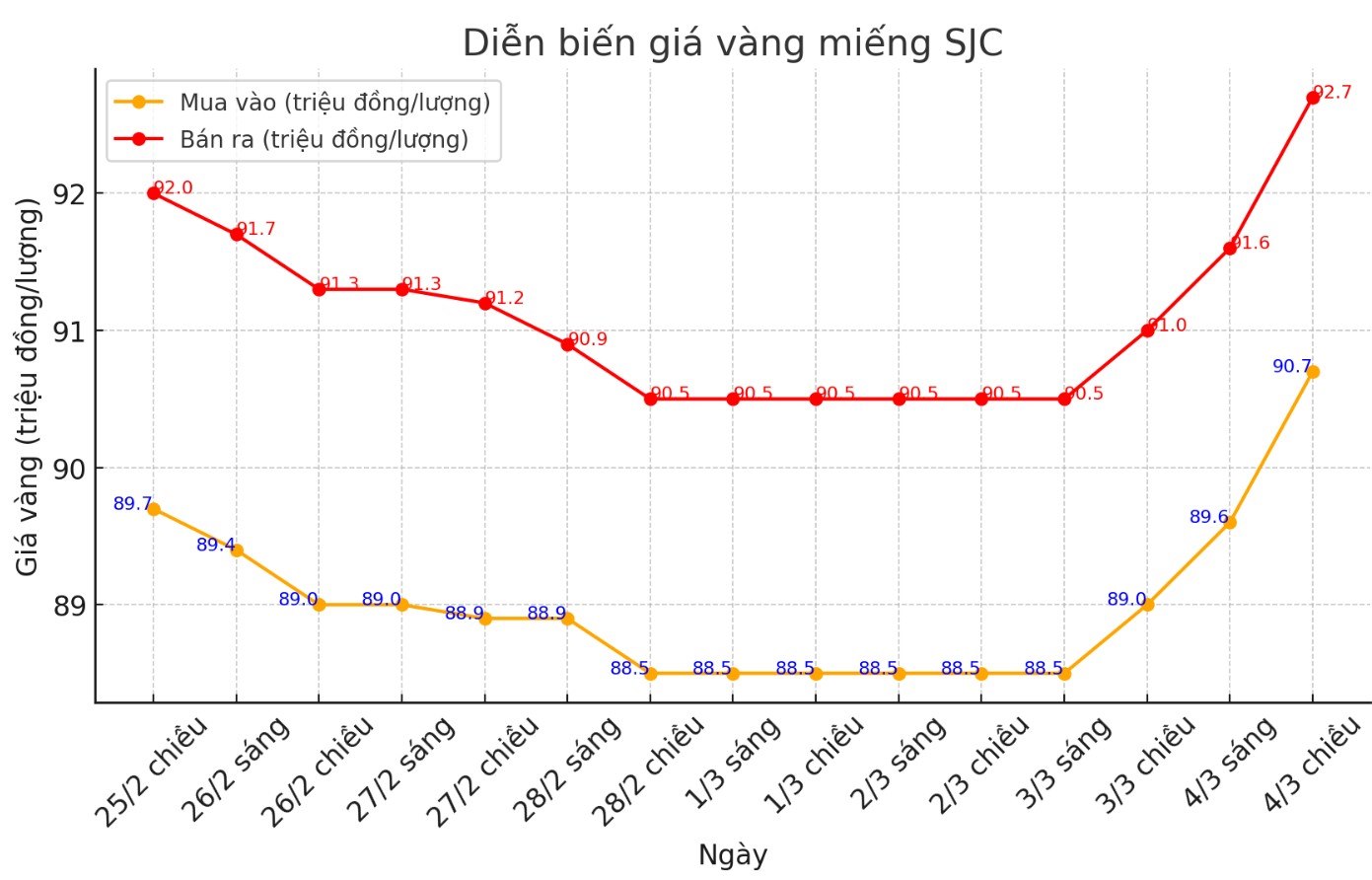

As of 5:30 p.m., DOJI Group listed the price of SJC gold bars at 90.1-92.1 million VND/tael (buy - sell), an increase of 1.1 million VND/tael for both buying and selling. The difference between the buying and selling prices of SJC gold was listed by DOJI at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company at 90.7-92.7 million VND/tael (buy - sell), an increase of 1.7 million VND/tael for both buying and selling. The difference between the buying and selling prices of SJC gold was listed by Saigon Jewelry Company at VND2 million/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 90.7-92.7 million VND/tael (buy - sell), an increase of 1.4 million VND/tael for buying and an increase of 1.7 million VND/tael for selling. The difference between the buying and selling prices of SJC gold was listed by Bao Tin Minh Chau at 1.7 million VND/tael.

9999 round gold ring price

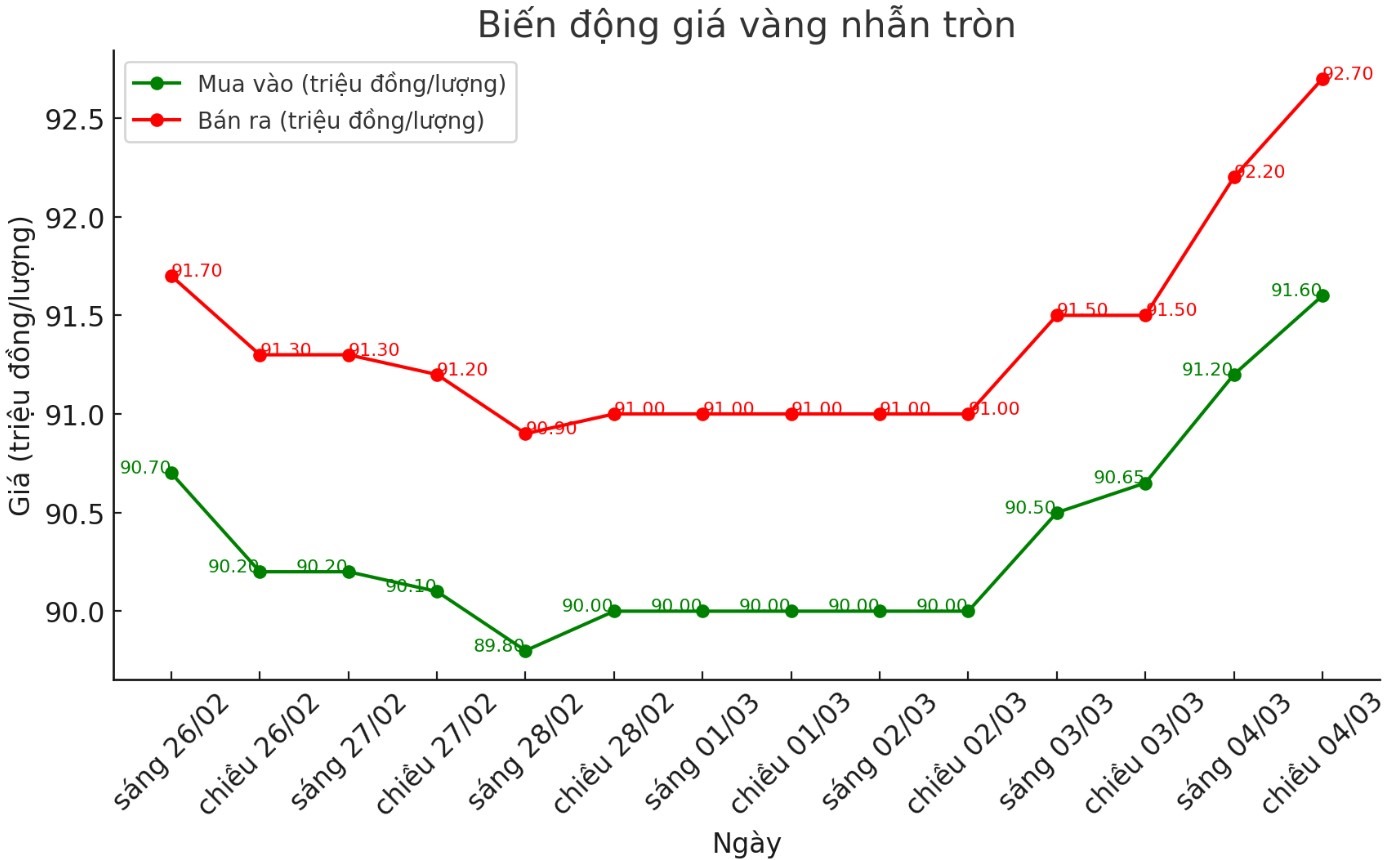

As of 5:30 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND91.6-92.7 million/tael (buy - sell); increased by VND950,000/tael for buying and increased by VND1.2 million/tael for selling. The difference between buying and selling is listed at 1.1 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 91.6-92.8 million VND/tael (buy - sell); increased by 1 million VND/tael for both buying and selling. The difference between buying and selling is 1.2 million VND/tael.

World gold price

As of 5:38 p.m., the world gold price listed on Kitco was at 2,912.4 USD/ounce, up 43.3 USD/ounce compared to the same time of the previous session.

Gold price forecast

World gold prices increased sharply in the context of the USD decreasing. Recorded at 5:30 p.m. on March 4, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 106.180 points (down 0.46%).

Gold and silver prices recorded a very strong increase thanks to increased safe-haven demand due to escalating geopolitical tensions, along with a sharp decline in the USD index when the trading week began.

Market risks have increased since the beginning of the week, following a tense meeting on Friday between US President Donald Trump and Ukrainian President Volodymyr Zelensky, raising concerns about US-Ukraine relations as well as the prospect of a ceasefire between Ukraine and Russia.

Meanwhile, US trade tariffs on Mexico, Canada and China are expected to take effect on Tuesday. Gold prices started the new week with a strong increase after recording the worst trading week in the past three months.

According to analysis by IG Group (a financial company specializing in providing online trading services, including difference contracts, Forex, stocks, commodities and cryptocurrencies), gold prices are no longer affected by investors' reactions to macroeconomic factors but mainly by physical flows and demand from central banks.

In a report released on Monday, IG analysts said that gold always has different meanings for each group of investors. Some see gold as a hedge against inflation, others see it as a safe haven.

For many, gold is an alternative to the US dollar or government bonds with interest rates. At eyeQ, our smart models take all those factors into account - inflation expectations, risk appetite (such as the VIX), USD and real yields, the report said.

Currently, these factors point to a reasonable gold price of $2,906 an ounce a gold price that should be achieved under current macro conditions, IG experts said.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...