Update SJC gold price

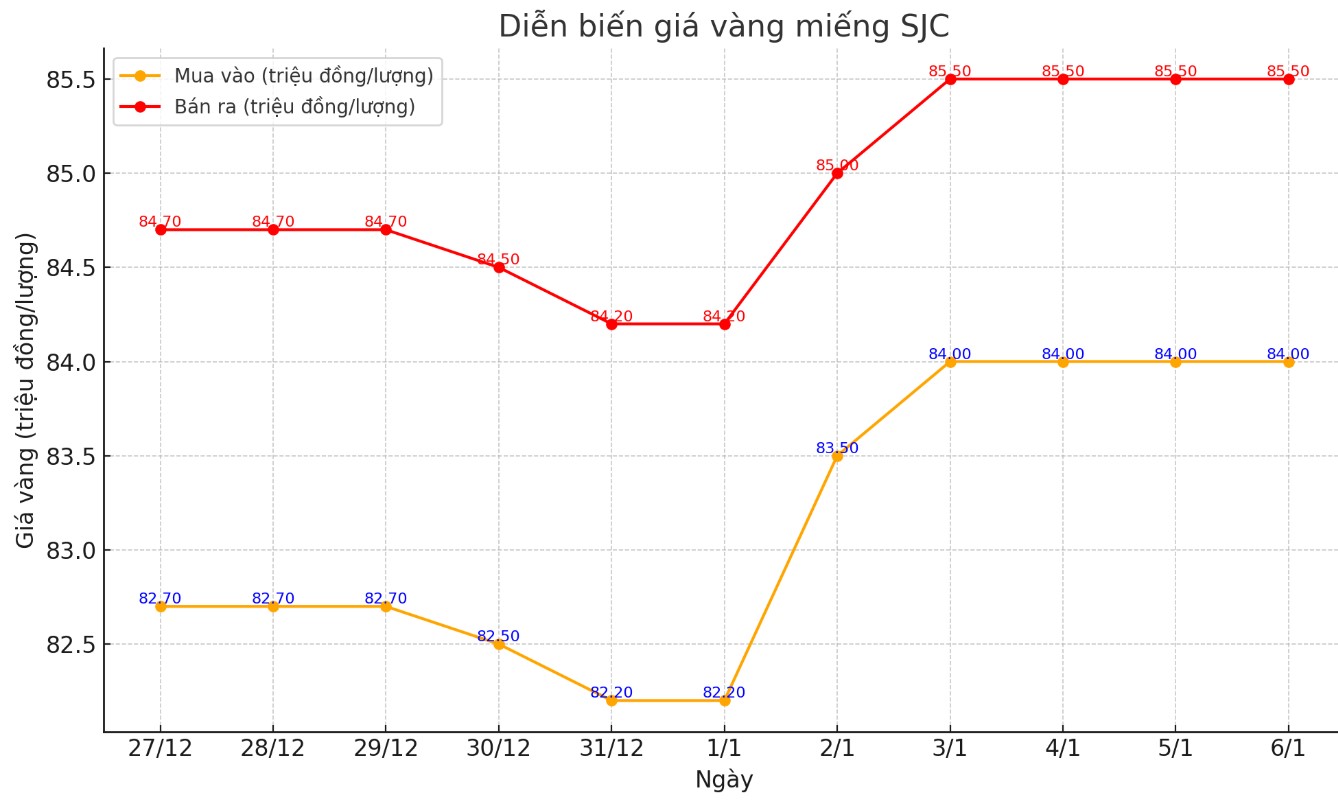

As of 10:10 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND84-85.5 million/tael (buy - sell); both buying and selling prices remained unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 84-85.5 million VND/tael (buy - sell); both buying and selling prices remain unchanged.

The difference between buying and selling prices of SJC gold at DOJI Group is at 1.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.1-85.5 million VND/tael (buy - sell); keeping both buying and selling prices unchanged.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 1.4 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

Price of round gold ring 9999

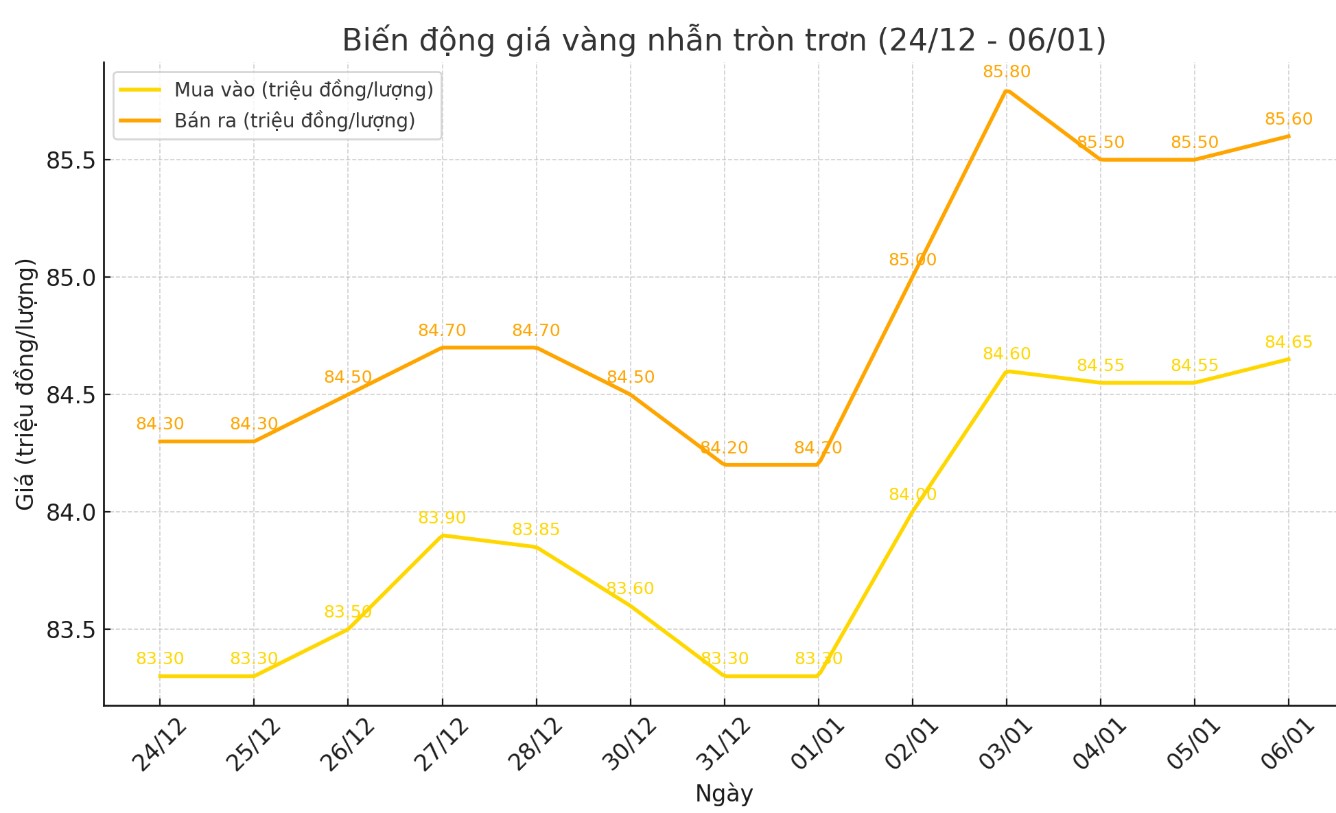

As of 9:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.65-85.6 million VND/tael (buy - sell); an increase of 100,000 VND/tael for both buying and selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 84.6-85.8 million VND/tael (buy - sell), keeping the buying price unchanged and increasing the selling price by 100,000 VND/tael compared to early this morning.

World gold price

As of 10:15 a.m., the world gold price listed on Kitco was at 2,642.68 USD/ounce, up 3 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased slightly in the context of the USD falling. Recorded at 10:10 a.m. on January 6, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 108.725 points (down 0.07%).

Chantelle Schieven, Head of Research at Capitalight Research, told Kitco News that gold's current consolidation phase is necessary for the market to maintain a sustainable upward momentum.

“I’m not at all concerned about the volatility we’re seeing. I think this lull is healthy for the market,” she said.

After gold surpassed $2,400 an ounce in 2024 — far exceeding initial forecasts — the precious metal still has plenty of room to rise in 2025, according to Schieven. She expects gold prices to fluctuate between $2,500 and $2,700 an ounce in the first half of the year before surpassing $3,000 an ounce in the second half.

“I remain as bullish on gold in 2025 as I was on 2024,” she said, acknowledging that the current accumulation phase could last for several months.

Despite the bullish factors, gold prices also face significant challenges in 2025. Fawad Razaqzada - Market Analyst at City Index - commented that the strong US dollar and high bond yields will continue to put pressure on gold in the first half of the year.

“Monetary policy is likely to remain tight into early 2025, which could support the US dollar and bond yields, reducing the appeal of gold,” he said.

Razaqzada also said that gold demand from China and India - the world's two largest gold consuming markets - are facing domestic difficulties, putting negative pressure on the price of this precious metal.

However, in the long term, Razaqzada is optimistic that gold still maintains the attraction as a valuable asset.

With macro factors at play, the big question investors are asking is whether gold prices can surpass $3,000/ounce in 2025.

Fawad Razaqzada said gold prices still have the potential to reach $3,000 an ounce in his forecast. Despite a strong dollar and slowing demand from China and India, geopolitical factors and high inflation still ensure a long-term rally.

See more news related to gold prices HERE...