Updated SJC gold price

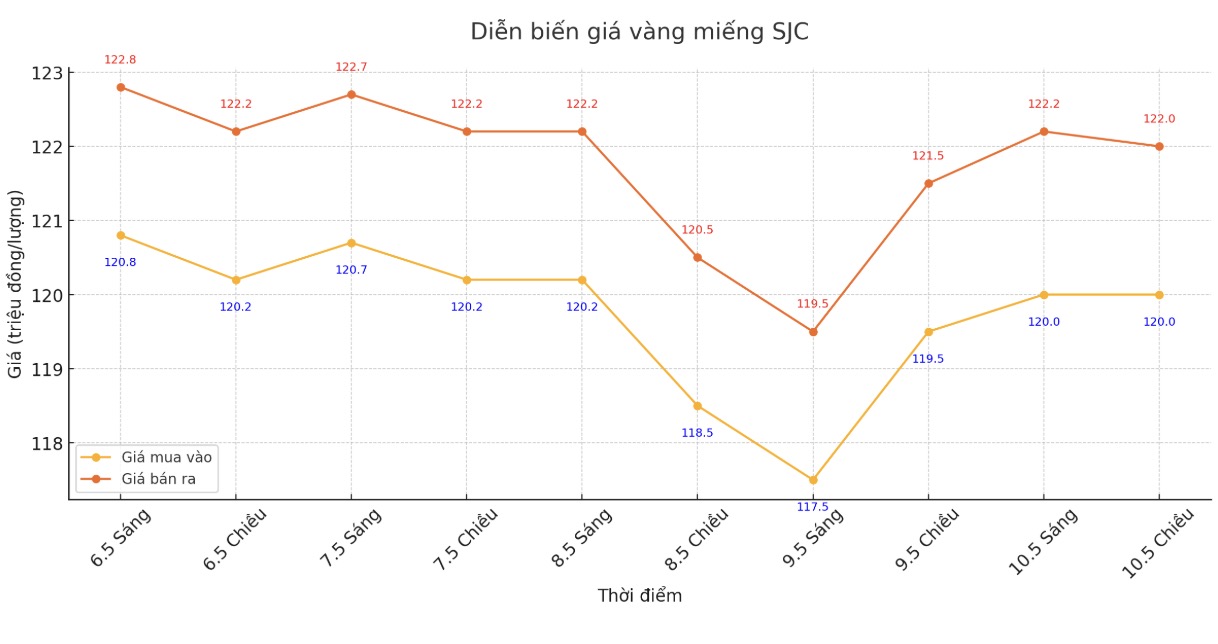

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND120-122 million/tael (buy in - sell out), an increase of VND500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 120-122 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 120-122 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 119-122 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 3 million VND/tael.

9999 round gold ring price

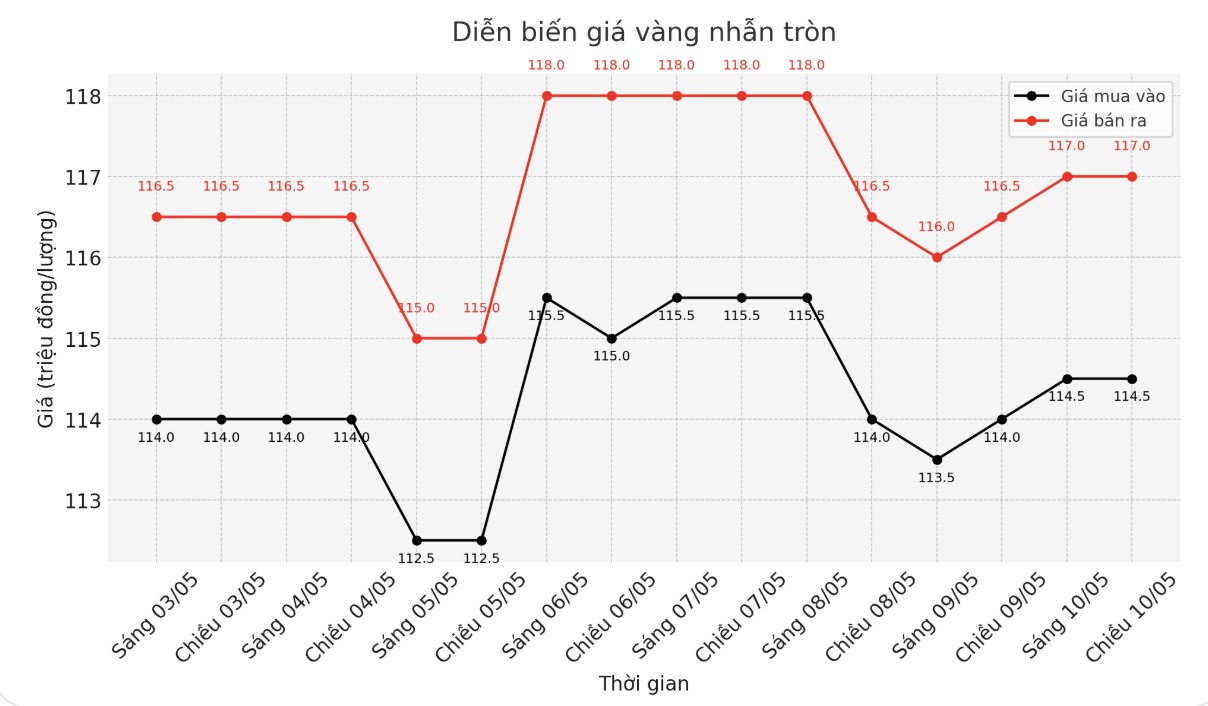

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND 114.5-117 million/tael (buy in - sell out), an increase of VND 500,000/tael. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117-120 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115-118 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

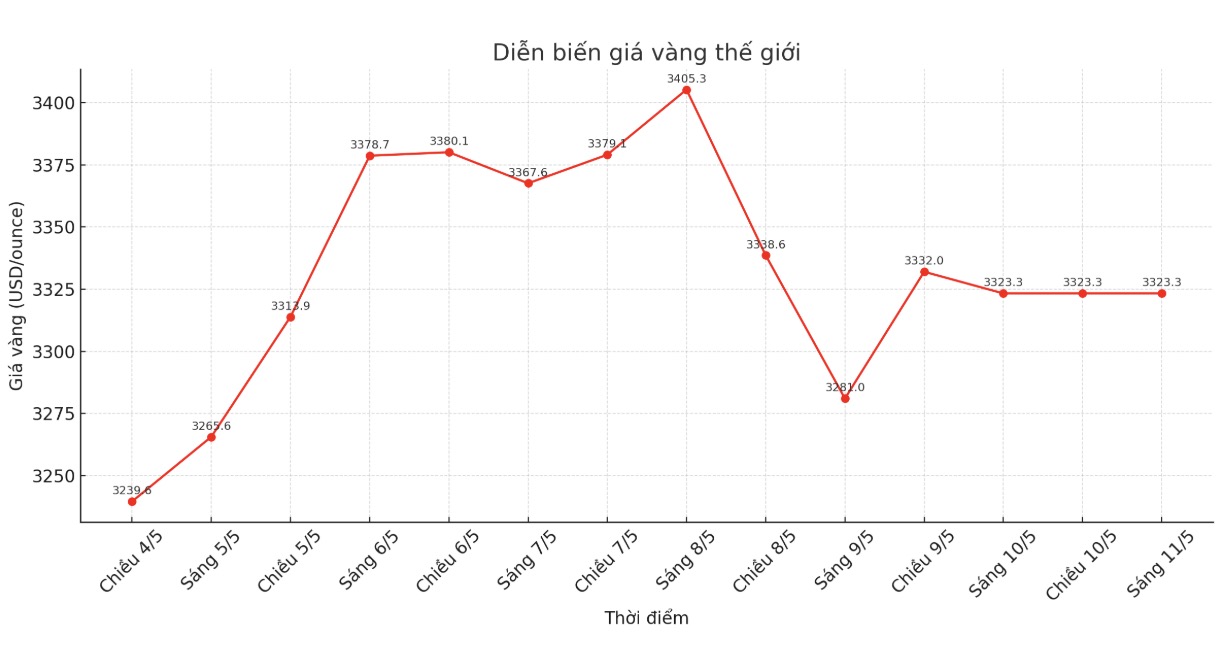

At 6:00 a.m., the world gold price listed on Kitco was around 3,323.3 USD/ounce, down 14.3 USD.

Gold price forecast

Last week, precious metals investors continued to see positive developments in gold prices, although the increase slowed down somewhat as optimism about trade tax increased.

The next week's gold price survey conducted by Kitco News shows that Wall Street analysts are clearly differentiated, with the number of people predicting prices to increase, decrease and move sideways next week being the same.

Of the 15 experts participating in the survey, each scenario received 5 forecasts, accounting for 40% of each trend. This shows significant uncertainty in the forecast of analysts.

An online survey of 267 individual investors shows that the majority still believe in gold's upward prospects. Specifically, 54% of participants expect prices to increase next week, 29% see prices falling, and 17% expect prices to remain flat.

Timerer Waterer - market analyst of KCM Trade - commented that the trend of buying gold when prices decrease is still popular. This has helped curb gold's decline, although demand for gold to keep assets has eased as the US and UK reached a trade deal.

I am still leaning towards the bullish scenario, said senior market strategist James Stanley at Forex.com. The $3,500/ounce threshold is a formidable resistance level for spot gold, but buying power remains strong as prices hit $3,200/ounce last week and $3,300/ounce this week which shows that buyers have not completely withdrawn.

Kitco senior analyst Jim Wyckoff said gold prices could fluctuate within a relatively wide range next week. Gold prices are likely to move sideways, but with unpredictable short-term fluctuations, he said.

See more news related to gold prices HERE...