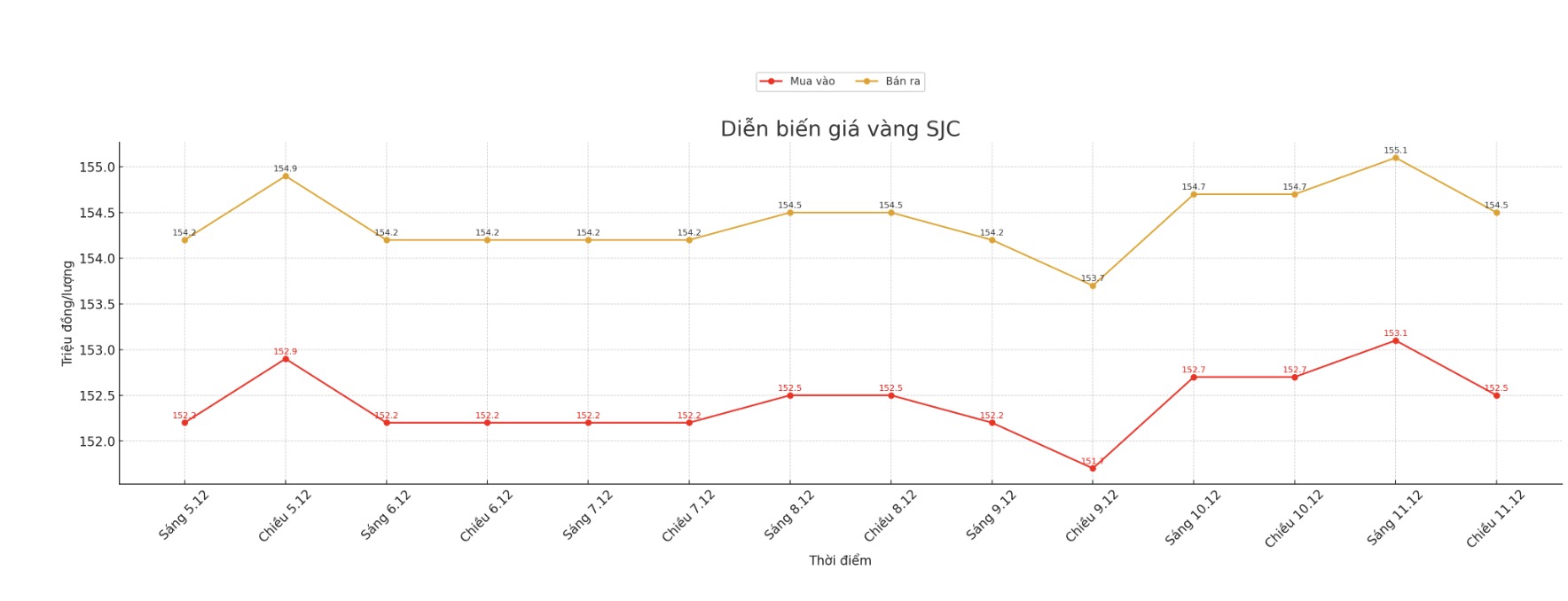

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at VND152.5-154.5 million/tael (buy in - sell out), down VND200,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 152.5-154.5 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151.5-154.5 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

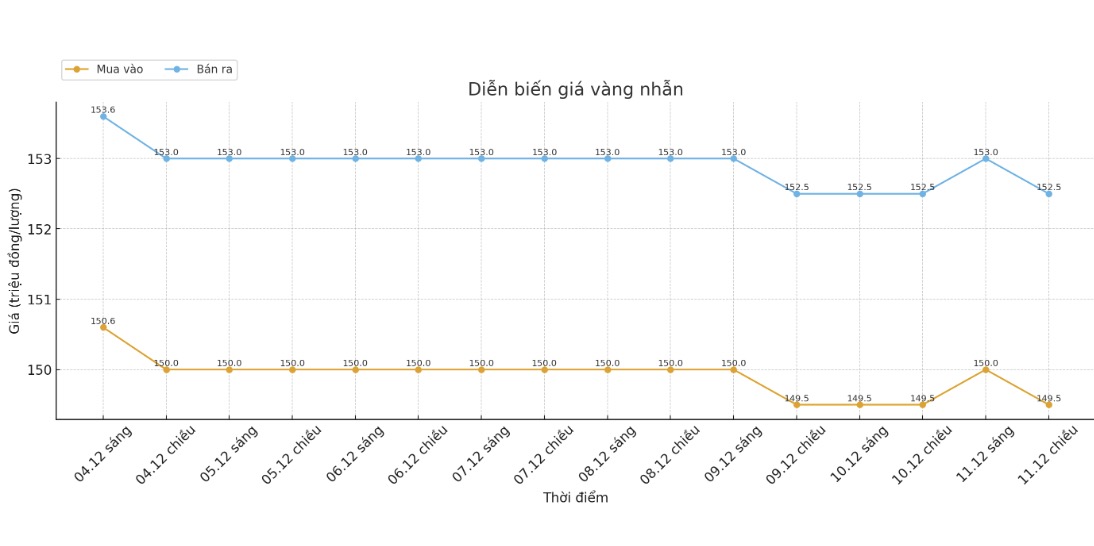

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 149.5-152.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 151-154 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150.2-153.2 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

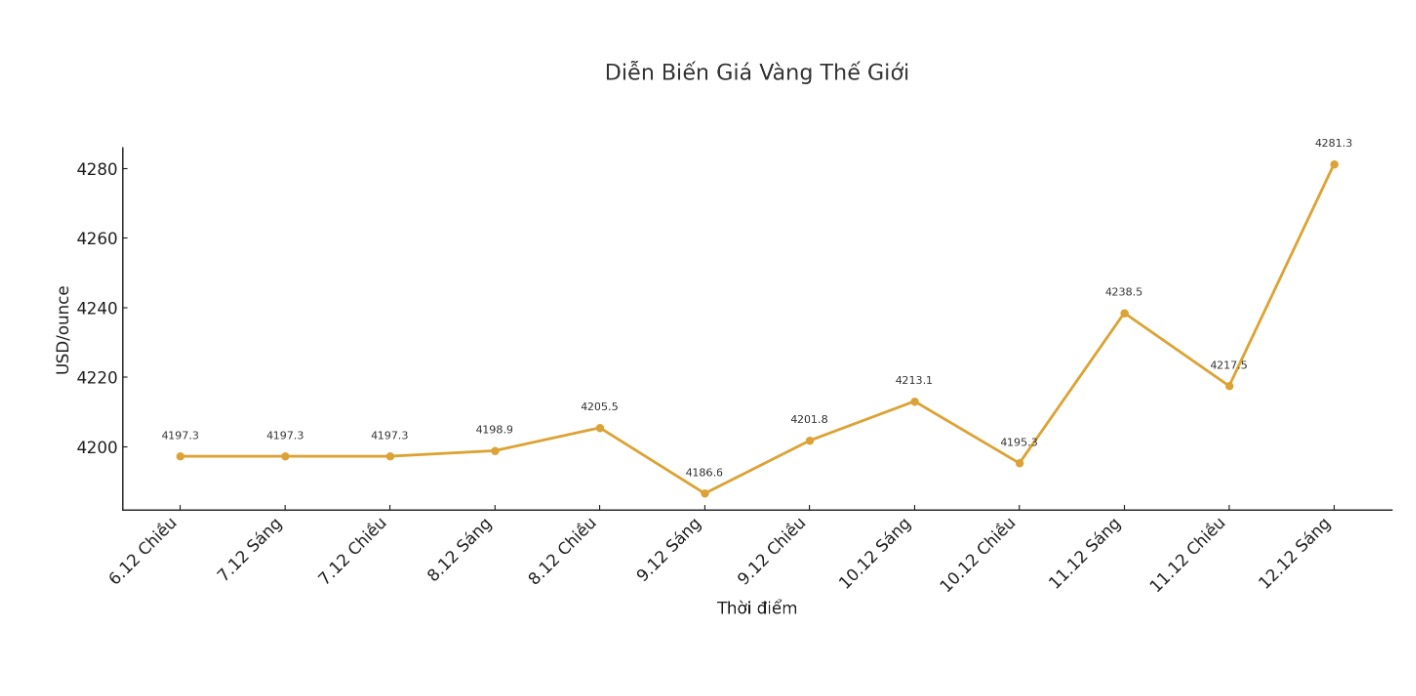

World gold price

The world gold price was listed at 7:20 a.m., at 4,281.3 USD/ounce USD/ounce, down 38.7 USD compared to a day ago.

Gold price forecast

Gold prices increased sharply in the US midday trading session on Thursday, as the precious metal was supported by the daily increase in silver prices, bringing silver to a new record high. Both precious metals have seen solid technical purchasing power and benefited from the US Federal Reserve's dovish, dovish, and dovish stance.

The sharp decline of the US dollar index to a six-week low also contributed to boosting demand for precious metals. February gold contract increased by 65.10 USD to 4,289.50 USD. The price of silver for March delivery increased by 2.80 USD to 63.82 USD and once hit a record high in the session of 64.03 USD.

The Federal Open Market Committee (FOMC) decided to cut interest rates by 0.25 percentage points on Wednesday afternoon, a move that was already predicted by the market and also the third consecutive decline in three recent FOMC meetings. FOMC voted 9-3 to lower the operating interest rate to 3.5%3.75%.

The FOMC statement shows more uncertainty about when the Fed could continue to cut interest rates. The Fed surprised by announcing that it will start buying $40 billion in Treasury bills per month from Friday, in order to reduce short-term capital costs by adding reserves to the financial system. The currency market has recently sent out an alert about increased pressure in a market worth 12.6 trillion USD in the context of the Fed narrowing the accounting balance sheet.

After the FOMC meeting and Chairman Jerome Powell's press conference on Wednesday afternoon, the US stock index increased, Treasury bond yields decreased, the USD weakened, and gold and silver prices increased simultaneously. Before this meeting, most markets thought that even though the Fed cut interest rates as expected, the Fed and Mr. Powell may issue a more Havy tone in monetary policy. However, the Fed's dovish move to buy Treasury bills has overwhelmed all signals that can be seen as tough.

In technical analysis, February gold contracts continued to maintain an upward trend as buyers set a target of bringing closing prices above strong resistance at a contract-record high of $4,433.00. On the other hand, the sellers are aiming to pull prices below a solid technical support zone at $4,100/ounce.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...