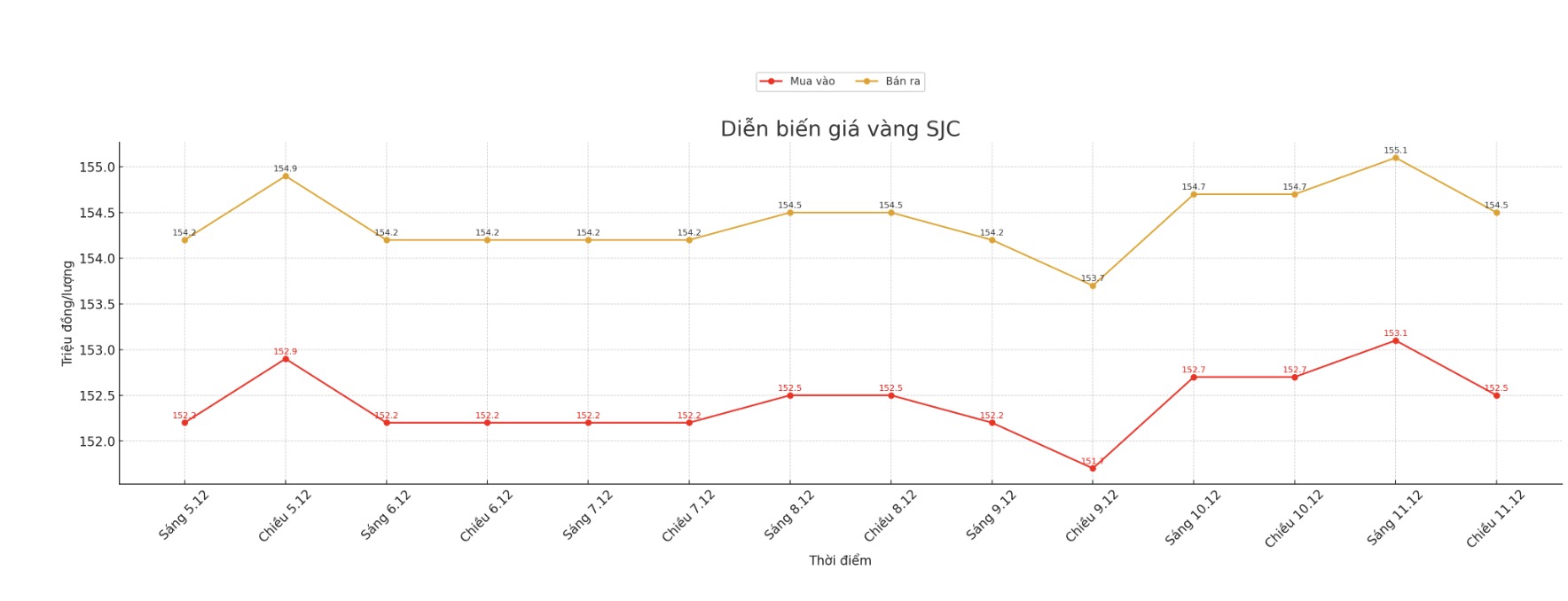

SJC gold bar price

As of 6:45 p.m., DOJI Group listed the price of SJC gold bars at VND152.5-154.5 million/tael (buy in - sell out), down VND200,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 152.5-154.5 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151.5-154.5 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

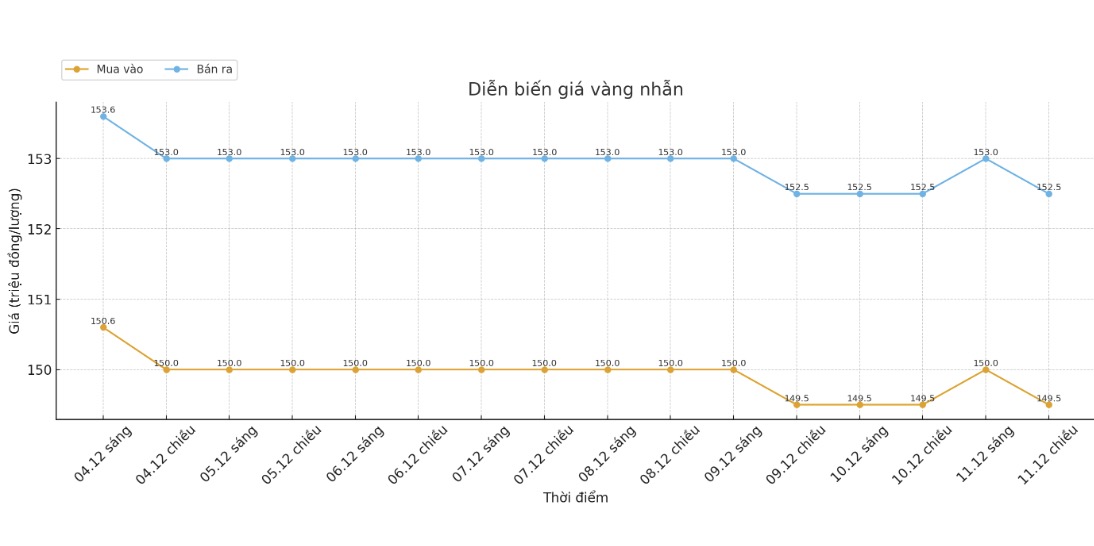

9999 gold ring price

As of 7:30 p.m., DOJI Group listed the price of gold rings at 149.5-152.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 151-154 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150.2-153.2 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

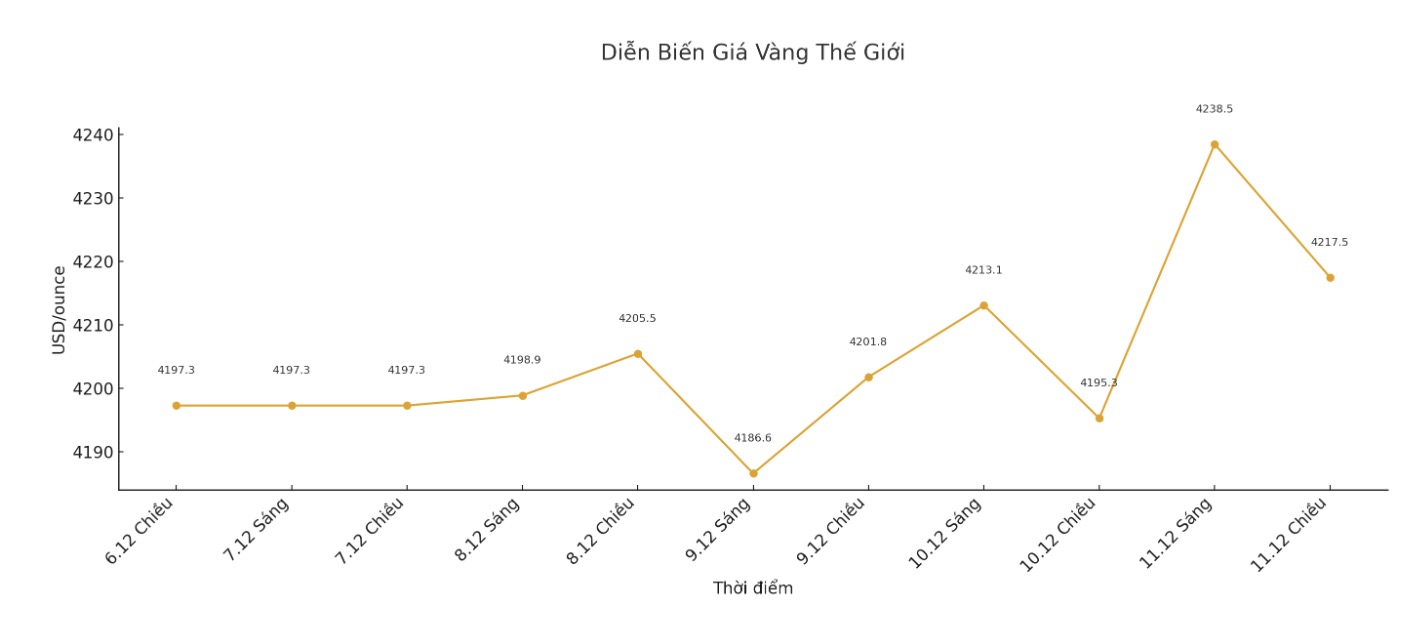

World gold price

The world gold price was listed at 7:30 p.m., at 4,217.5 USD/ounce, up 22.2 USD compared to a day ago.

Gold price forecast

World gold prices fluctuated strongly as traders considered the dividend vote of the US Federal Reserve (Fed) on cutting interest rates by 0.25 percentage points, while silver prices continued to climb to a new record level.

This is just an overbought situation (in gold) due to expectations of a rate cut something that has already happened, and so you are feeling selling pressure - independent analyst Ross Norman said, while affirming that the fundamental factors of gold are still solid.

The Fed cut interest rates by another 0.25 percentage points on Wednesday in a rare divided vote, but signaled a loose pause to monitor labor market developments and inflation, which was still a bit high.

Lower interest rates are often beneficial for non-yielding assets such as gold.

Forecasts issued after the two-day meeting showed that the majority of policymakers only forecast one rate cut in 2026. Fed Chairman Jerome Powell has given no signs of a further cut.

US President Donald Trump said on Wednesday that the Fed's cut could have been larger. Trump is expected to announce a new Fed Chairman early next year, with White House economic adviser Kevin Hassett as one of the likely candidates.

Investors are now waiting for November non-farm payroll and unemployment rate data, due on December 16, for further clues on the Fed's next move.

Spot silver prices rose 1% to $62.39 an ounce, after hitting a previous record $62.88 in the session, raising their increase since the beginning of the year to 116% thanks to strong industrial demand, reduced inventories and silver being added to the US list of important minerals.

The fundamentals of silver are still extremely positive. There is a strong push from the list of key minerals and the possibility that we will see hoarding, which could make the market even scarcer, Norman added.

For other metals, platinum prices rose 0.4% to $1,662.15, while palladium fell 1% to $1,461.50.

See more news related to gold prices HERE...