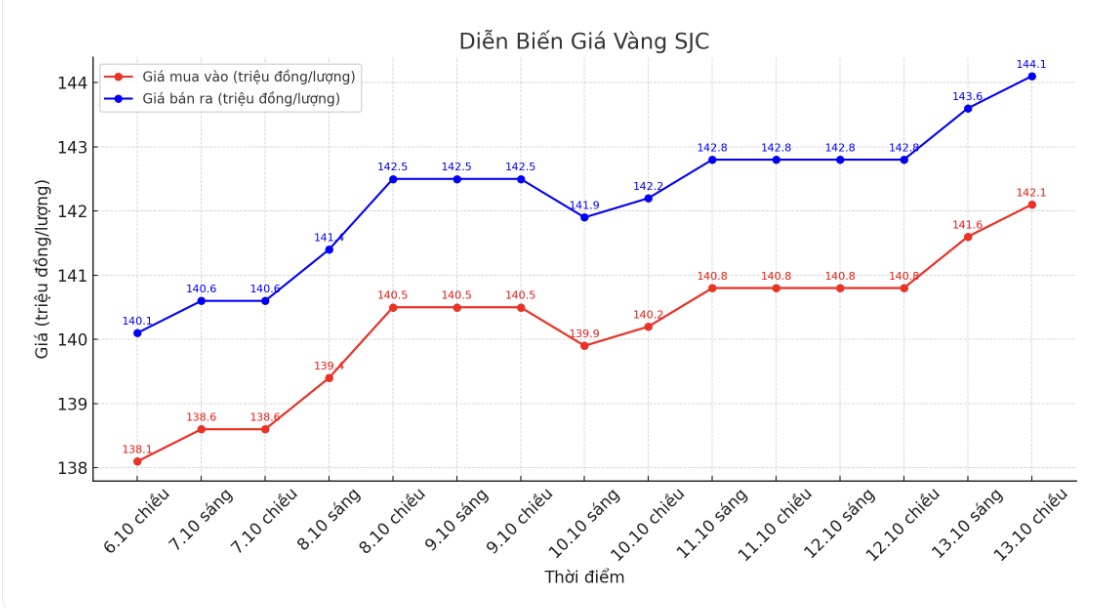

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by DOJI Group and Bao Tin Minh Chau at 142.1-144.1 million VND/tael (buy in - sell out), an increase of 1.3 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 141.3-144.1 million VND/tael (buy in - sell out), an increase of 1.3 million VND/tael in both directions. The difference between buying and selling prices is at 2.8 million VND/tael.

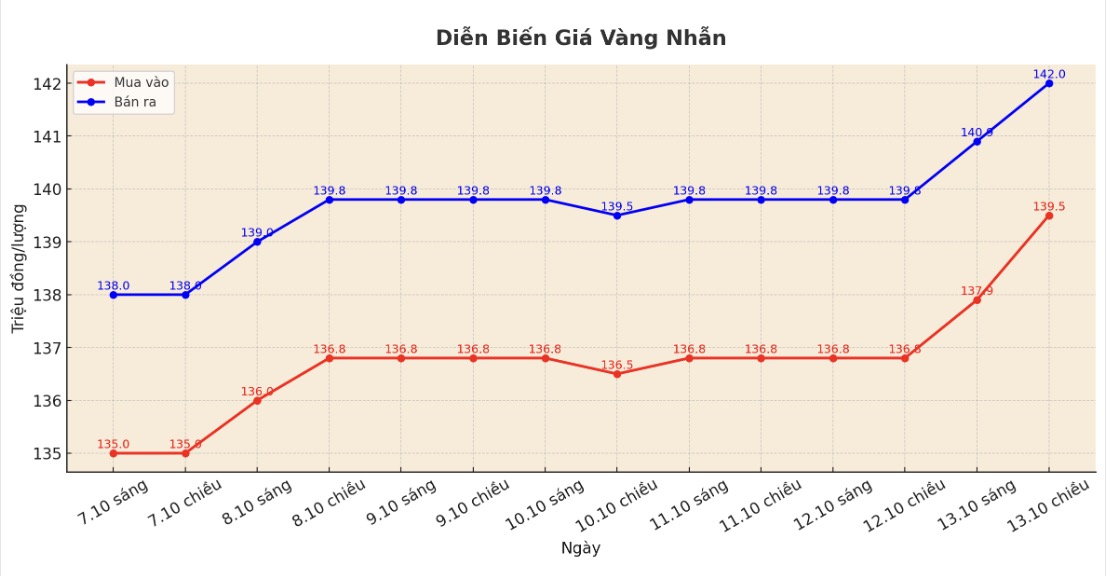

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 139.5-142 million VND/tael (buy - sell), an increase of 3 million VND/tael for buying and an increase of 2.5 million VND/tael for selling. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 141-144 million VND/tael (buy - sell), an increase of 2.6 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 139.5-142.5 million VND/tael (buy - sell), an increase of 2.2 million VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

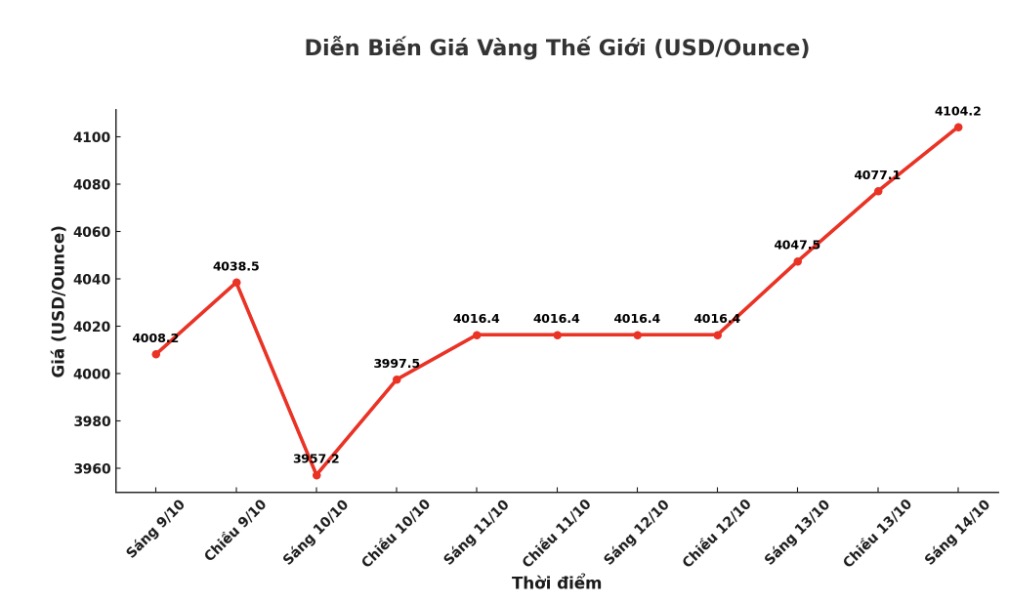

World gold price

The world gold price was listed at 0:00 at 4,104.2 USD/ounce, up 87.8 USD/ounce.

Gold price forecast

World gold prices skyrocketed as safe-haven demand in the context of the US government's continued closure and "ternature tightening" in the silver market caused buyers to maintain confidence, while sellers cautiously did not dare to face it.

UBS expert Giovanni Staunovo commented that global trade continues to be a factor of special interest to the market: "Despite signs of a temporary lull, the risk of additional tariffs still exists". He said that investment and gold purchase demand from central banks will continue to support prices, with a target of $4,200/ounce.

Meanwhile, Mr. Sean Lusk - co-director of commercial risk prevention at Walsh Trading - said that the market is looking for every reason to push gold prices up, the US Government's continued closure becoming a catalyst. It is noteworthy that even if there are factors that should put downward pressure on prices, such as a ceasefire in the Middle East or a recovery of the USD, gold still has no impact.

This expert commented that the main driving force today comes from the retail market. The "fear of missing out" (FOMO) mentality is prompting individual investors to rush to buy gold, especially as large banks such as Goldman Sachs have forecast sky-high prices.

Mr. Lusk has a cautious view: "Nothing increases forever". He analyzed that with the gradual clarification of market uncertainties, there will be little reason for gold and silver prices to remain at these historical levels and the market will only wait for a correction.

Technically, gold buyers are holding a clear advantage in the short term. The next upside target is to close above the strong resistance zone of 4,200 USD/ounce, while the nearest support zone is at 4,050 USD and 4,011 USD/ounce.

Notable economic data for the week

Tuesday: FED Chairman Jerome Powell attends a discussion at the National Association for Business Economics (NABE) Annual Meeting.

Wednesday: New York FED manufacturing survey.

Thursday: survey of FED Philadelphia's business performance.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...