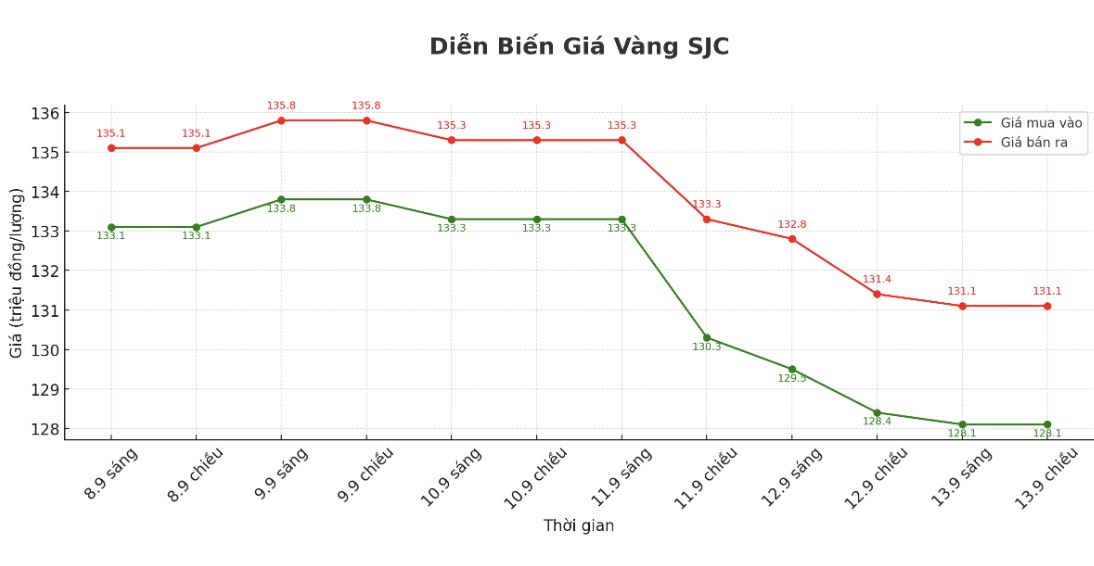

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 128.1-131.1 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 128.1-131.1 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 127.5-131.1 million VND/tael (buy - sell), keeping the same for buying and down 300,000 VND/tael for selling. The difference between buying and selling prices is at 3.6 million VND/tael.

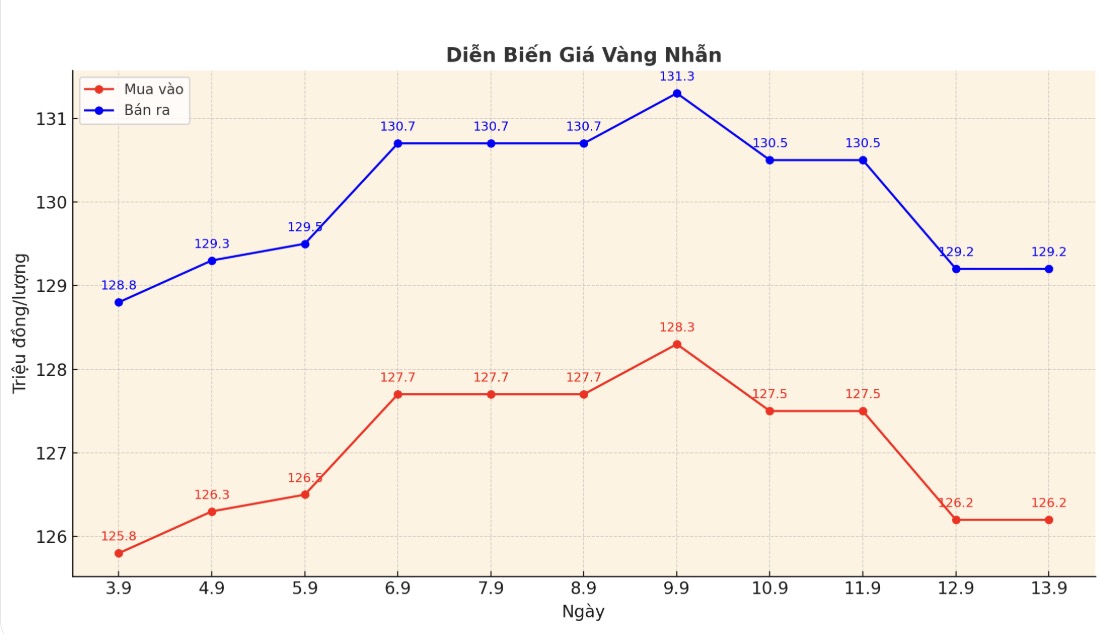

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 126.2-129.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 127-130 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 125.5-128.5 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

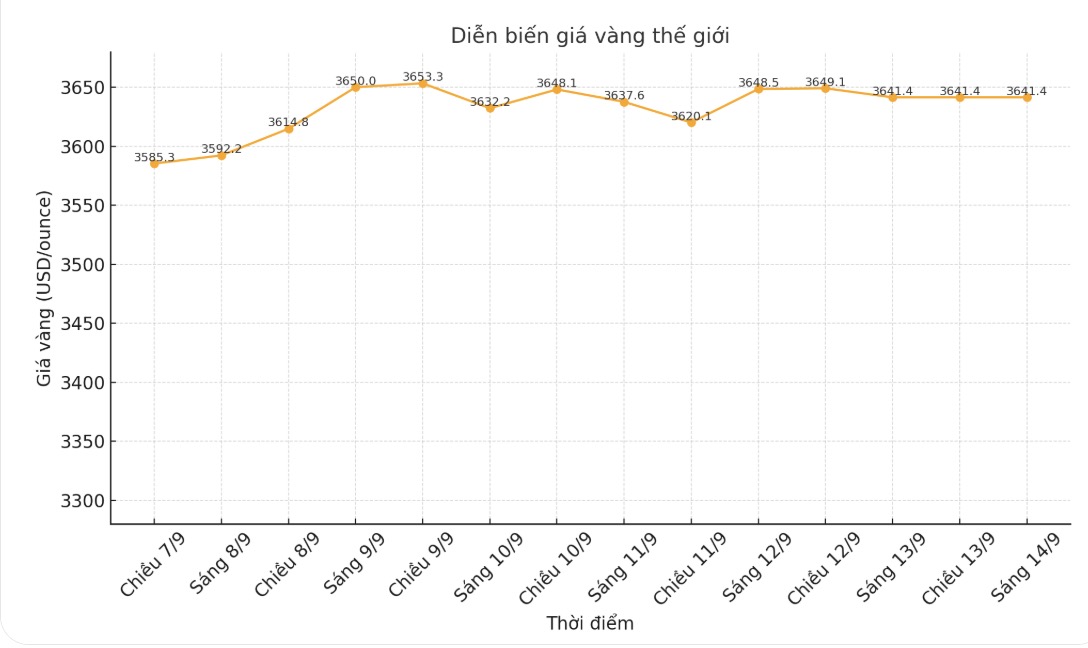

World gold price

The world gold price was listed at 6:00 a.m. at 3,641.4 USD/ounce, up 8 USD.

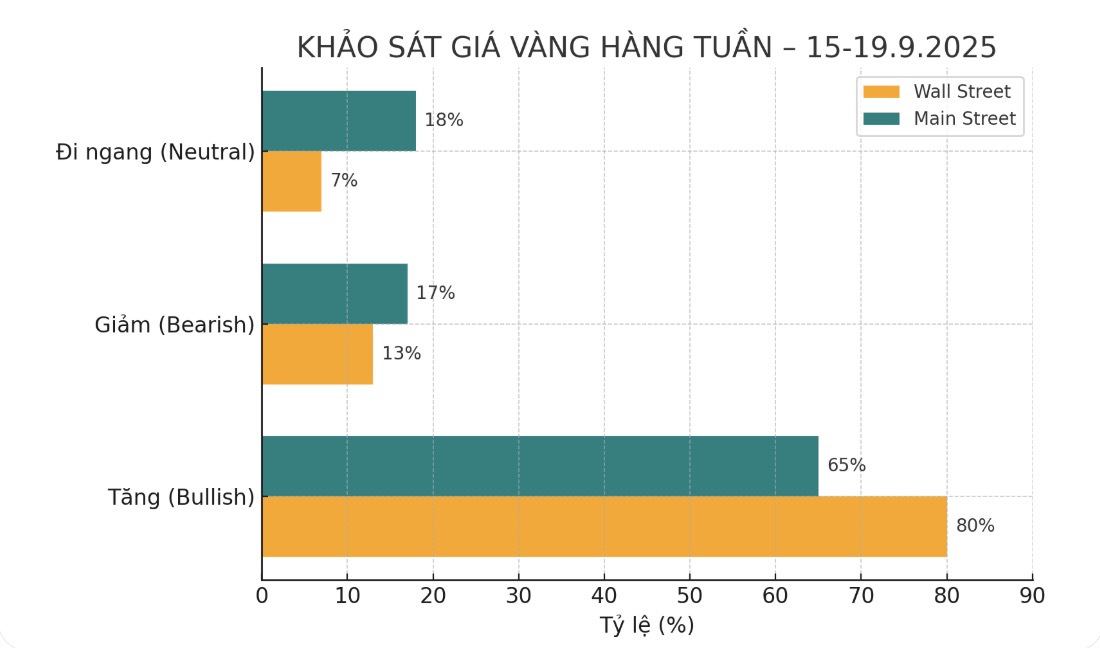

Gold price forecast

After last week's explosive increase, gold prices continued to have a strong trading week.

The latest weekly gold survey with Wall Street experts shows that the majority are still overwhelmingly optimistic despite gold prices anchored around their all-time highs.

Of the 15 analysts, 12 experts (equivalent to 80%) predict gold prices will increase next week. Only 2 people (accounting for 13%) predict prices will decrease. The remaining expert (accounting for 7%), said that gold prices will move sideways.

Meanwhile, Kitco's online poll recorded 268 votes, showing that individual investors have reduced their bet on price increases before the Fed makes a decision.

174 investors (equivalent to 65%) predict gold prices will increase next week. Meanwhile, 46 people (accounting for 17%) predict prices will decrease. The remaining 48 investors (accounting for 18%) predict prices will move sideways next week.

Lukman Otunuga - Senior Analyst at FXTM - said that a 50 basis point cut next week could easily put gold prices above $3,700/ounce. However, he advised investors to be cautious.

Since the market is expected to cut 25 basis points, the important thing is the updated dot plot chart, deciding whether gold will continue to increase or adjust. The market is expecting a total decrease of 50 basis points after September. Dot plots need to be suitable or higher to keep gold prices stable.

Any lower level can trigger a technical adjustment. Technically, if gold closes above $3,650 an ounce, prices could retest $3,675 and $3,700 an ounce. Conversely, if prices close below $3,650/ounce, prices could fall to $3,600 and $3,570/ounce, the expert said.

Michael Brown - Senior Analyst at Pepperstone - said that the market is over-evaluating the Fed's ability to loosen while inflation remains high. He predicted that the FED would hardly cut by 50 basis points next week.

I think the Fed could disappoint expectations, as the next cuts depend on economic prospects, while dot plots are likely to remain unchanged, signaling expectations of a 50 basis point cut for the whole year. While the market is discounting about 70 basis points, this could lead to a hawkish reaction, dragging down stocks, bonds and gold.

However, Brown remains optimistic in the long term: I see every correction in gold as a buying opportunity, as reserve funds continue to diversify and the Feds independence continues to erode.

Ole Hansen - Head of Commodity Strategy at Saxo Bank - also said he is looking beyond short-term fluctuations, as technical momentum could push prices up to $3,800/ounce. The current question is whether cutting interest rates will become a profit-taking opportunity. I think it is possible, but in general, this only strengthens the story of price increases, so every adjustment is a buying opportunity.

In addition to the Fed's policy meeting, next week will also be filled with events from other central banks: the Bank of Canada meeting on Wednesday morning (expected to cut 25 basis points); the Bank of England meeting on Thursday (most likely to keep interest rates unchanged); and the Bank of Japan also expected to keep interest rates unchanged on Thursday.

The US economic data to watch next week include: Empire State Production Survey (Monday), Retail Sales (Tuesday), Construction-shelved and licensed housing (Wednesday),Week Unemployment Claims and Philadelphia Fed Production Survey (Thursday).

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...