Gold price developments last week

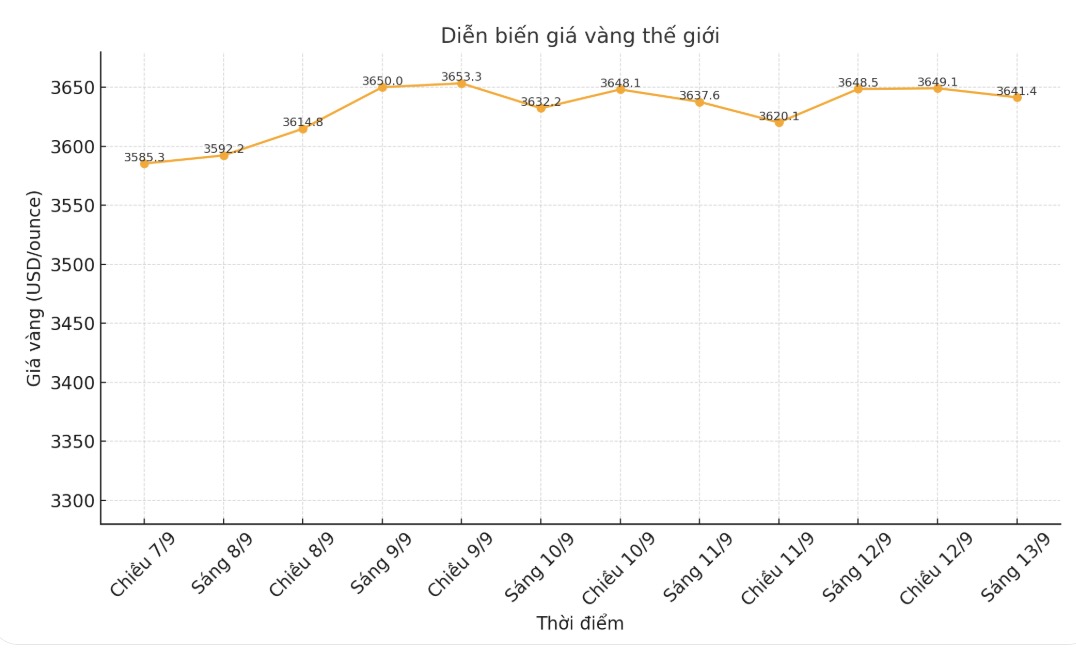

After last week's explosive increase, gold prices continued to have a strong trading week. Spot gold opened the week at $3,590.69 an ounce, but has barely traded below $3,600 an ounce for long. By 3 a.m. EDT, gold prices had reached $3,604 an ounce, and by the time North American markets opened on Monday, gold prices had risen to $3,631.70 an ounce.

Strong price increases were recorded throughout the sessions and in all regions this week, with the opening of the Asian session on Tuesday pushing gold prices from 3,637 USD/ounce at 20:00 USD Eastern time to 3,653 USD/ounce at 10:15.

After repeated efforts to break the $3,650/ounce middle, North American traders have pushed prices to a weekly high, just below $3,675/ounce, 15 minutes after opening.

Gold prices then recorded the first sharp decline of the week, falling to $3,635/ounce at 11am and continuing to fall to $3,621/ounce at 9:15pm on Tuesday evening.

This development has formed a range of fluctuations for gold prices for the rest of the week, as economic data supports further interest rate cuts to bring gold prices back to the mid-range of $3,650/ounce, while the weakening sentiment has caused gold to fall around $3,620/ounce once again.

When the August Consumer Price Index (CPI) report was released at 8:30 a.m. on Thursday, gold prices were reviewing this support level and soaring by another 20% in just a few minutes, thereby setting a short-term support zone above 3,630 USD/ounce.

In the Asia session, gold made a final effort to break above the $3,650 mid-range, but once again stalled above $3,656/ounce, after which traders accepted to let gold prices fluctuate between $3,640 and $3,652/ounce as it entered the weekend.

Gold price forecast for next week

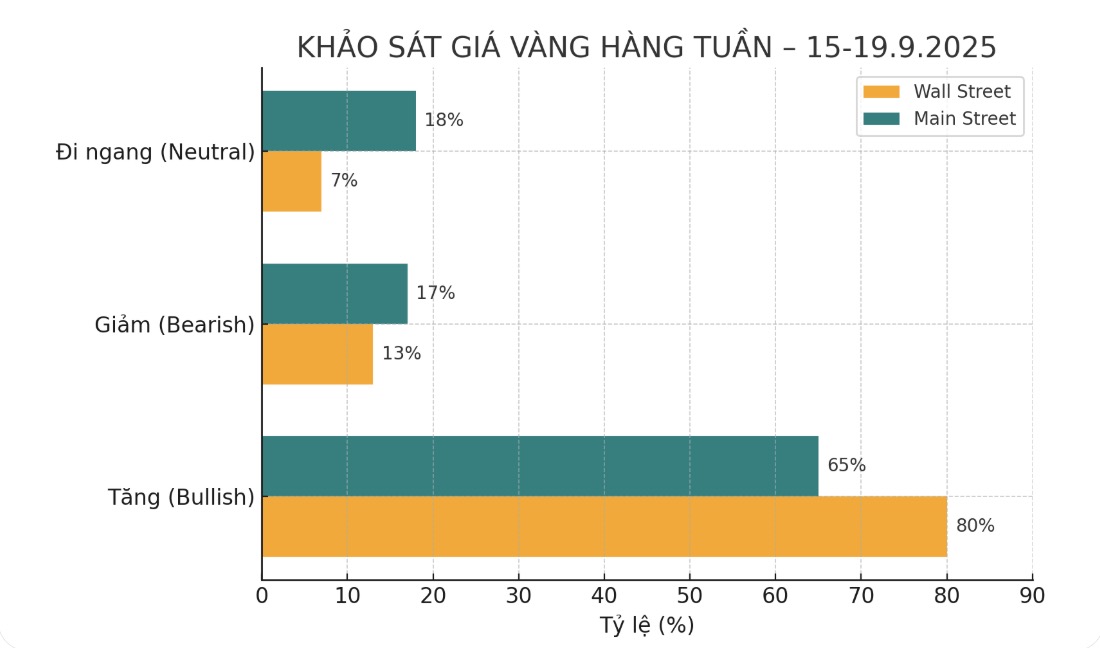

The latest weekly gold survey with Wall Street experts shows that the majority are still overwhelmingly optimistic despite gold prices anchored around their all-time highs.

Of the 15 analysts, 12 experts (equivalent to 80%) predict gold prices will increase next week. Only 2 people (accounting for 13%) predict prices will decrease. The remaining expert (accounting for 7%), said that gold prices will move sideways.

Meanwhile, Kitco's online poll recorded 268 votes, showing that individual investors have reduced their bet on price increases before the Fed makes a decision.

174 investors (equivalent to 65%) predict gold prices will increase next week. Meanwhile, 46 people (accounting for 17%) predict prices will decrease. The remaining 48 investors (accounting for 18%) predict prices will move sideways next week.

Economic data to watch next week

Next week will be an important week with a series of major economic information, including many interest rate decisions by central banks - including the FED - and many data that can strongly impact the market.

Empire State manufacturing survey will be released on Monday, followed by the US Retail Sales report for August on Tuesday morning.

By Wednesday, the market will receive data on Construction Starting Houses and Construction Permits for August. Then there is the monetary policy decision of the Bank of Canada (BoC), before all eyes were on Washington for the FED's interest rate announcement and Chairman Jerome Powell's press conference in the afternoon.

There will be a monetary policy decision by the Bank of England (BoE) on Thursday morning, followed by a US weekly jobless claims report and a Philly Fed manufacturing survey.

The economic week ended with the monetary policy decision of the Bank of Japan (BoJ) on Thursday evening.

See more news related to gold prices HERE...