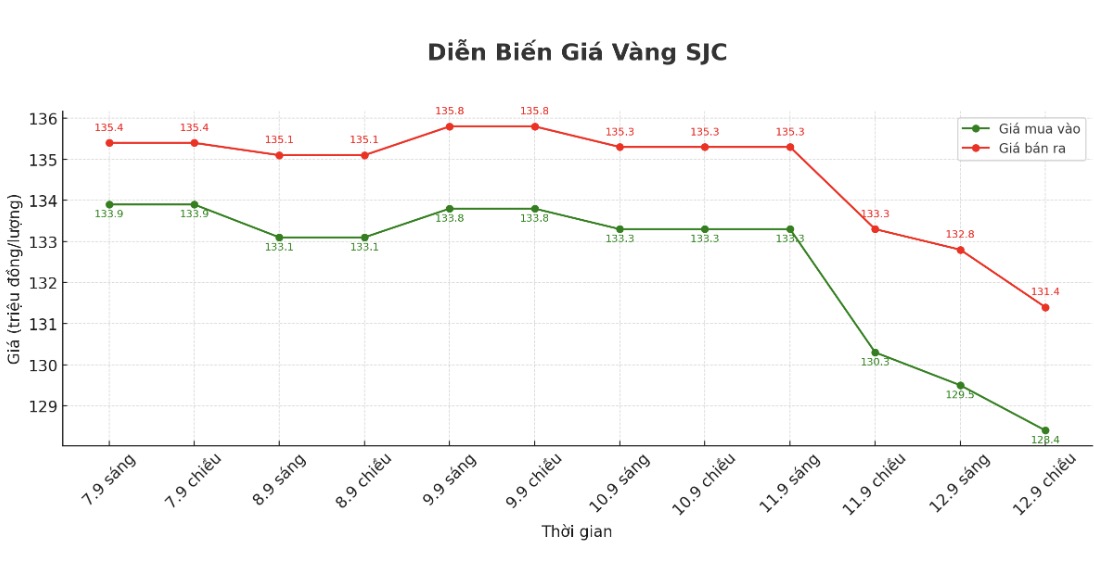

SJC gold bar price

As of 6:00 a.m. on September 13, the price of SJC gold bars was listed by DOJI Group at VND 128.4-131.4 million/tael (buy - sell), down VND 1.9 million/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 128.4-131.4 million VND/tael (buy - sell), down 1.9 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 127.5-131.4 million VND/tael (buy in - sell out), down 2.5 million VND/tael in both directions. The difference between buying and selling prices is at 3.9 million VND/tael.

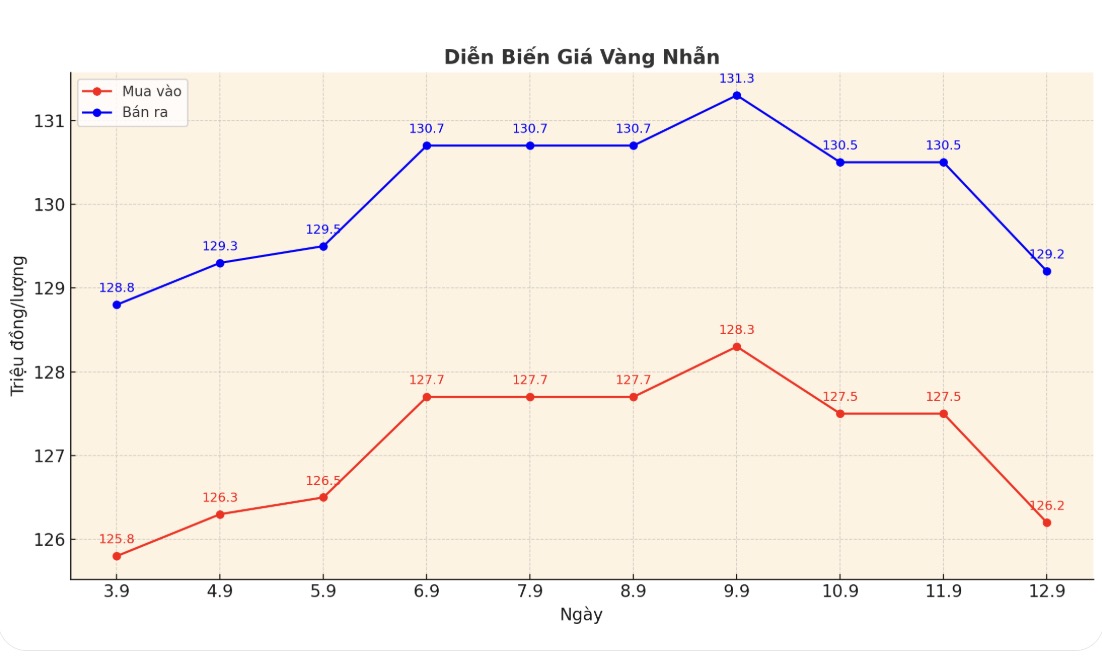

9999 gold ring price

As of 6:00 a.m. on September 13, DOJI Group listed the price of gold rings at 126.2-129.2 million VND/tael (buy in - sell out), down 1.3 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 127-130 million VND/tael (buy - sell), down 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 125.7-128.7 million VND/tael (buy - sell), down 1.3 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

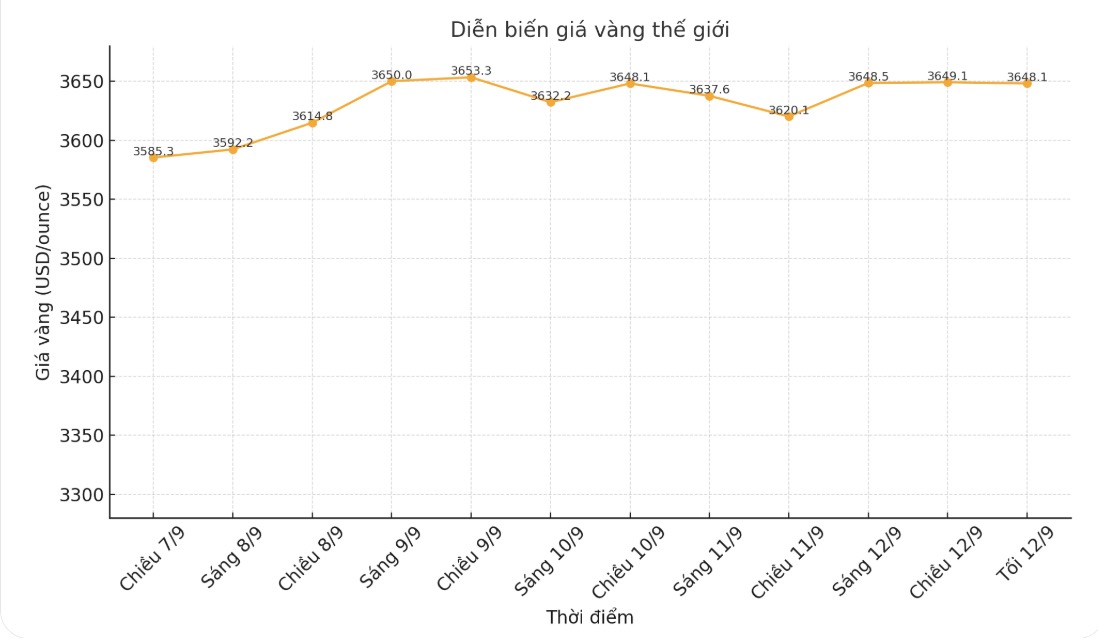

World gold price

The world gold price was listed at 8:45 p.m. on September 12 at 3,633.4 USD/ounce, down 18.5 USD.

Gold price forecast

World gold prices fluctuated around high levels, while silver prices soared to a 14-year high as safe-haven demand appeared at the weekend and technical factors increased prices, also boosting buying from investors analyzing the chart.

This week, gold hit an all-time high of $3,674.27 an ounce (at spot). Spot gold prices have also surpassed the inflation rate peak set on January 21, 1980, when prices reached 850 USD/ounce, equivalent to about 3,590 USD today, according to a valuation method.

Golds rally is driven by growing concerns about the US economic outlook, as investors seek a hedge against inflation and a weak currency, and prices could soar if the stock market begins to weaken, Bloomberg reported.

The global stock market fluctuated in different directions overnight. The US stock index is expected to open slightly as the New York trading session begins.

In other news, US Treasury Secretary Bessent will meet with Chinese Deputy Prime Minister He Lap Phong in Madrid (Spain) next week to discuss trade, economic and national security issues, showing progress in negotiations between the two sides.

The discussion will also mention TikTok's status and efforts to combat money laundering, according to the schedule released by the Ministry of Finance. These exchanges pave the way for a possible summit between General Secretary and President of China Xi Jinping and US President Donald Trump.

The US and India are also getting closer to resolving their differences in a trade deal, according to Sergio Gor, who was nominated by President Trump to be US Ambassador to India.

Speaking at a hearing before the US Senate on Thursday, he said that India's purchase of Russian oil is still a major source of tension, as the US asked India to end this activity and imposed the tax as a sanctions measure.

US mortgage rates fell the most in a year this week, stimulating demand for refinancing, according to Bloomberg. The average interest rate for a 30-year fixed-rate loan fell to 6.35% from 6.5% last week, according to Freddie Mac.

The reduced interest rate will support home buying, according to Kevin Peranio - a partner of Paramount Residential mortgage Group. Loan costs have been trending down for many months and continue to decline after last Friday's weak jobs report, increasing the possibility of the Federal Reserve (FED) cutting interest rates more.

By Monday, borrowers could lock in a 30-year rate of 6.27%, their lowest in nearly a year, according to data from Optimal Blue (Texas). By Tuesday, when interest rates increased slightly, the refinancing volume increased to the highest level since 2022.

In outside markets, the US dollar index increased slightly, crude oil prices also increased slightly, trading around 62.50 USD/barrel. The yield on the US 10-year Treasury note is currently at 4.05%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...