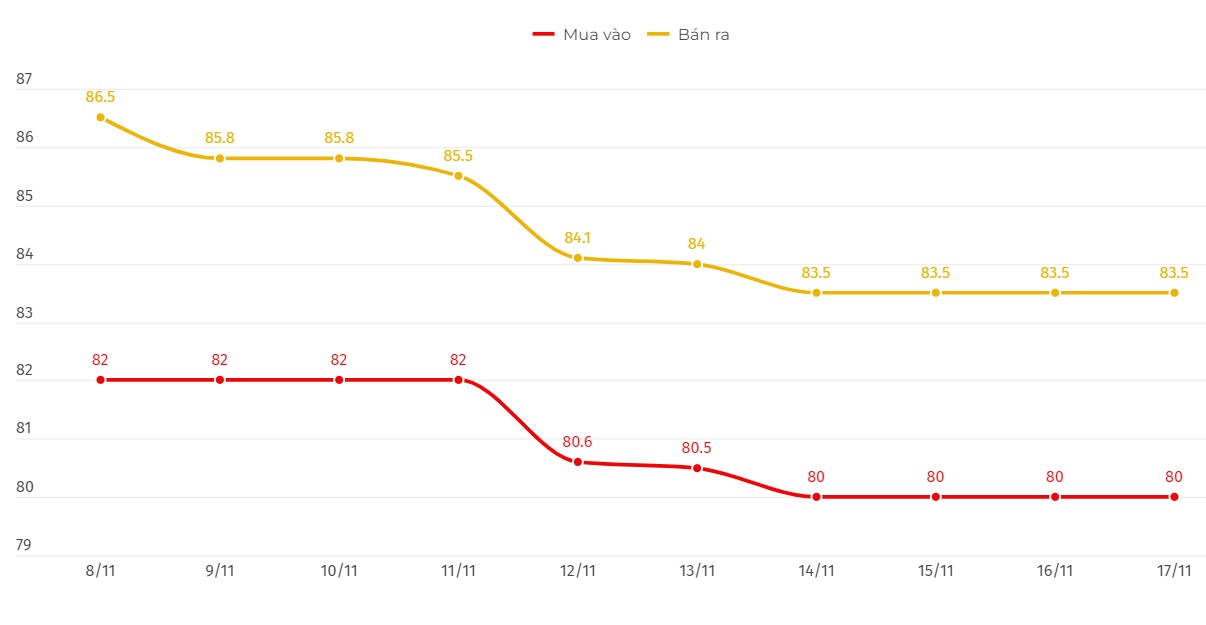

SJC gold bar price

As of 6:00 a.m. on November 18, the price of SJC gold bars listed by DOJI Group was at 80-83.5 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold prices at DOJI remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at DOJI Group is at 3.5 million VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the price of SJC gold at 80-83.5 million VND/tael (buy - sell). Compared to the beginning of the previous trading session, the gold price at Saigon Jewelry Company SJC remained unchanged in both buying and selling directions. The difference between the buying and selling price of SJC gold at Saigon Jewelry Company SJC was at 3.5 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold at 80.3-83.5 million VND/tael (buy - sell). Compared to the beginning of the previous trading session, the gold price at Bao Tin Minh Chau remained the same in both buying and selling directions. The difference between the buying and selling price of SJC gold at Bao Tin Minh Chau was at 3.2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 3.2-3.5 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

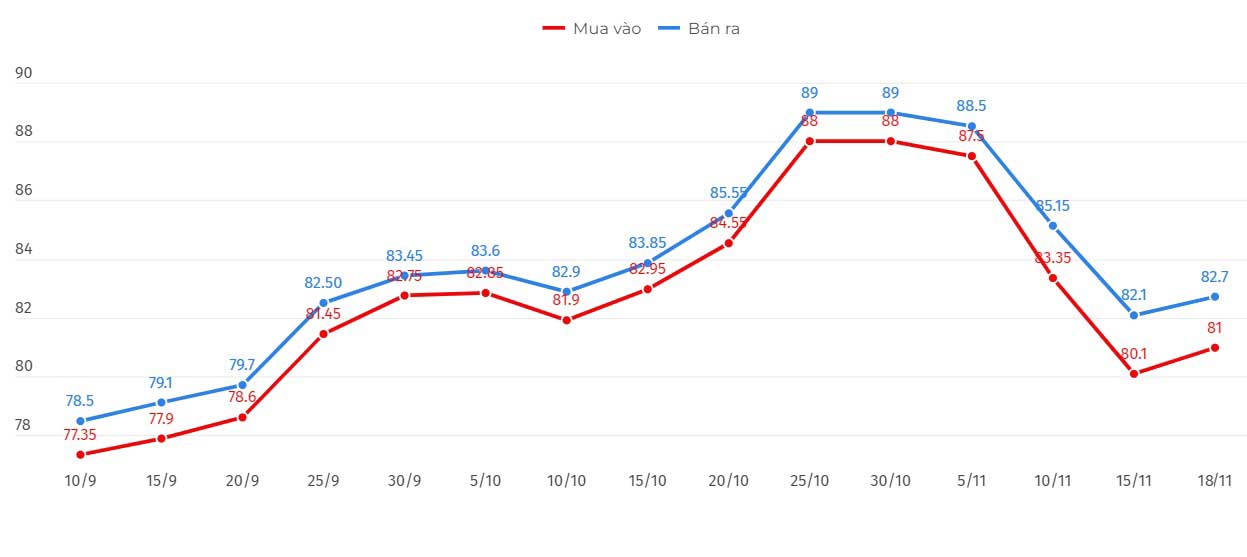

9999 gold ring price

As of 6:00 a.m. on November 18, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 81-82.7 million VND/tael (buy - sell), unchanged in both selling directions compared to the beginning of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 81.03-82.68 million VND/tael (buy - sell); keeping both selling prices unchanged compared to the beginning of the previous trading session.

In recent sessions, the price of gold rings has often fluctuated in the same direction as the world market. Domestic investors can refer to the world gold price before investing or taking profits.

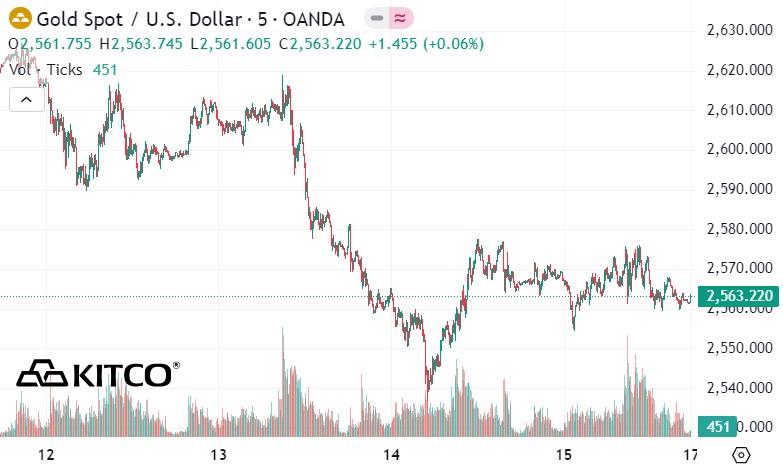

World gold price

As of 6:00 a.m. on November 17 (Vietnam time), the world gold price listed on Kitco recovered to 2,563.2 USD/ounce.

Gold Price Forecast

World gold prices fell as the USD index remained high. Recorded at 6:00 a.m. on November 18, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 106.620 points (up 0.02%).

After the US presidential election and new moves from the US Federal Reserve (FED), the USD price skyrocketed, putting pressure on gold. In addition, the stable geopolitical environment also makes it difficult for gold to recover.

In a recent note, CBA Bank experts emphasized that the greenback's recovery shows that the market is expecting inflation to increase due to tax cuts and tariffs.

President-elect Donald Trump’s tariff policies are raising concerns that interest rates will have to stay high for longer to counter inflation, which is helping to push the dollar higher and putting pressure on precious metals, according to Citi’s global head of commodities research Maximilian Layton.

Notably, the world's leading gold trust fund, SPDR Gold Trust, continued to sell a large amount of gold last week, about 6.92 tons of gold. From the beginning of the month to the end of November 15, the SPDR fund sold a total of nearly 22 tons of gold, and in the first 6 months of the year, the fund sold a net 50 tons of gold. This move shows a dramatic reversal of large cash flows for gold.

This week’s economic calendar focuses on the US housing sector. The market will receive data on US housing starts and building permits for October on Tuesday, MBA mortgage applications on Wednesday and October existing home sales on Thursday.

Other highlights include the Philly Federal Reserve manufacturing index on Thursday, with market participants watching to see if the Philadelphia region sees a strong increase in manufacturing activity like nearby New York state. Finally, the University of Michigan consumer sentiment for November.

See more news related to gold prices HERE...