Update SJC gold price

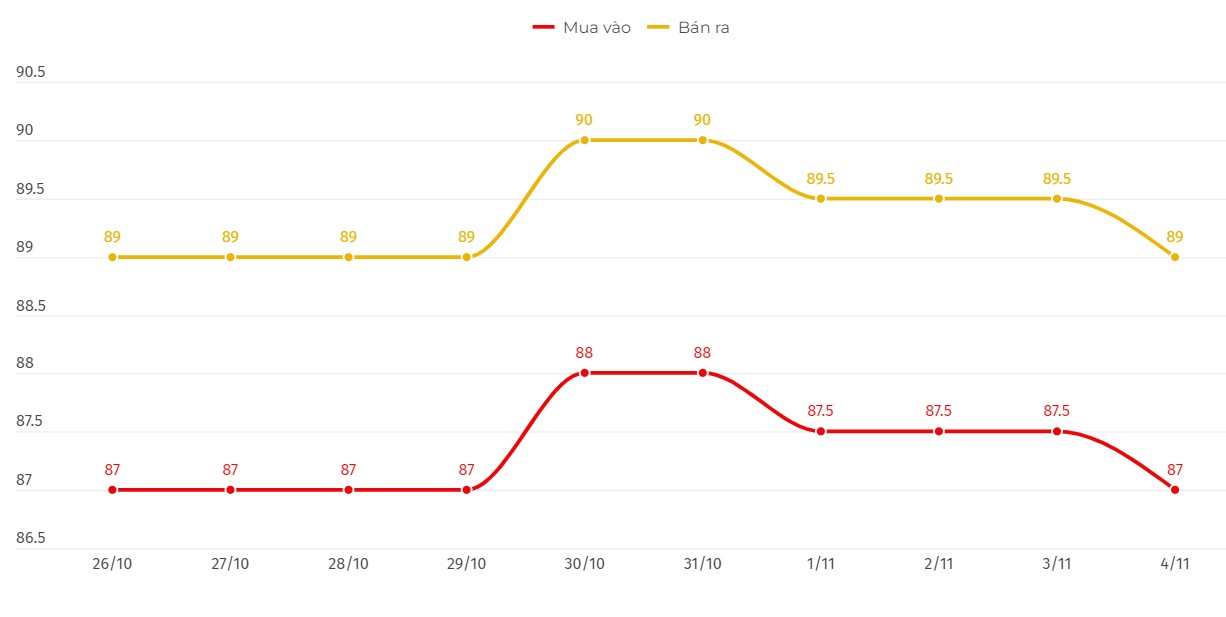

As of 9:00 a.m., the price of SJC gold bars was listed by DOJI Group at 87-89 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold price at DOJI decreased by 500,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 87-89 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the gold price at Saigon Jewelry Company SJC decreased by 500,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 87-89 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold price at Bao Tin Minh Chau decreased by 500,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

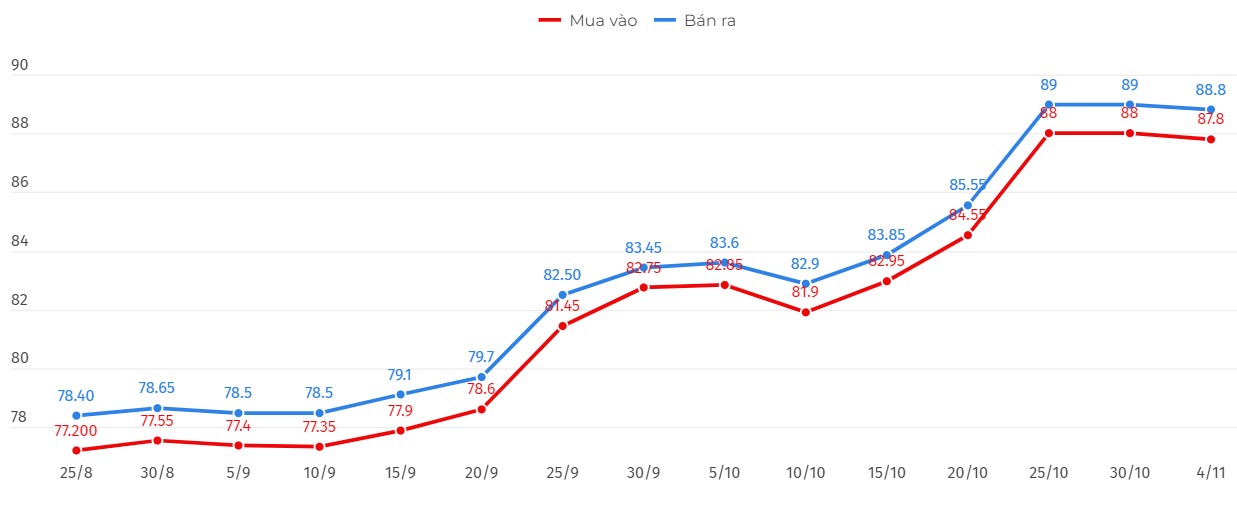

Price of round gold ring 9999

As of 9am today, the price of 9999 Hung Thinh Vuong round gold ring at DOJI is listed at 87.8-88.8 million VND/tael (buy - sell), down 200,000 VND/tael in both directions.

Bao Tin Minh Chau listed the price of gold rings at 87.78-88.78 million VND/tael (buy - sell); down 400,000 VND/tael in both directions.

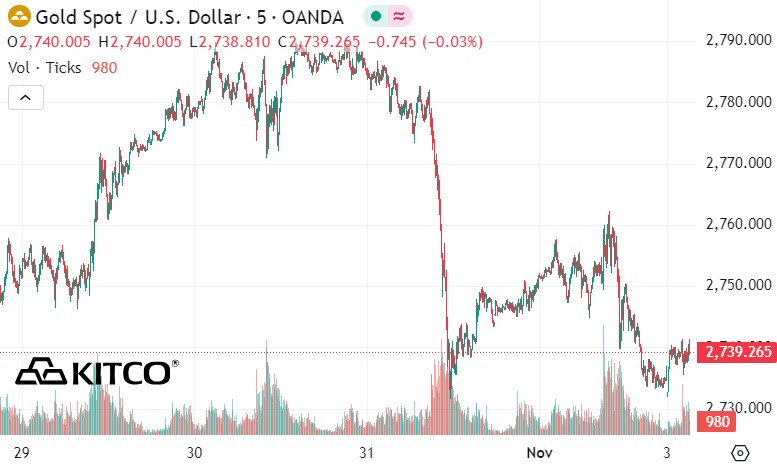

World gold price

As of 9:00 a.m., the world gold price listed on Kitco was at 2,739.2 USD/ounce, a slight increase of 2.8 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased as the USD index decreased. Recorded at 9:00 a.m. on November 4, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 103.690 points (down 0.49%).

After the decline last weekend, gold prices this week received quite positive forecasts from experts. Adrian Day - Chairman of Adrian Day Asset Management - said that gold prices will increase this week:

“The resilience of gold has been incredible. There are all sorts of reasons for different groups to buy. Lower interest rates in a sluggish economy and unchecked inflation are the combination that is driving gold higher,” said Adrian Day.

Rich Checkan, president of Asset Strategies International, said gold prices will continue to rise this week. According to him, there are many variables that can trigger price fluctuations in either direction. Disappointing employment data could be enough to push the US Federal Reserve (FED) to cut another 25 basis points. Lower interest rates are good for gold.

Rich Checkan believes that the profit-taking in recent days has been enough to push gold prices up to nearly $2,800 an ounce. In the long term, there is no doubt that gold prices will go higher.

James Stanley, senior market strategist at Forex.com, said he expects gold to make fresh gains this week. “There have been a number of potential pullbacks over the past few months,” he said. “But now, there’s a lot of buying on the dip.”

On the other hand, Marc Chandler, managing director at Bannockburn Global Forex, said he was bearish: “Gold hit a record high last week, but has stalled below $2,800 an ounce. It is worth noting that gold sold off sharply when US stocks fell on October 31.”

He noted that five G10 central banks are meeting this week: “The Fed and BOE are expected to cut by 25 basis points. Sweden will cut by 50 basis points; Norway and Australia will keep it the same.”

Economic Data to Watch This Week

Monday: Reserve Bank of Australia monetary policy decision

Tuesday: Institute for Supply Management (ISM) Purchasing Managers' Index (PMI), US Presidential and Congressional Elections

Thursday: Bank of England monetary policy decision, US weekly jobless claims, US Federal Reserve monetary policy decision.

Friday: University of Michigan Consumer Psychology Preliminary.

See more news related to gold prices HERE...