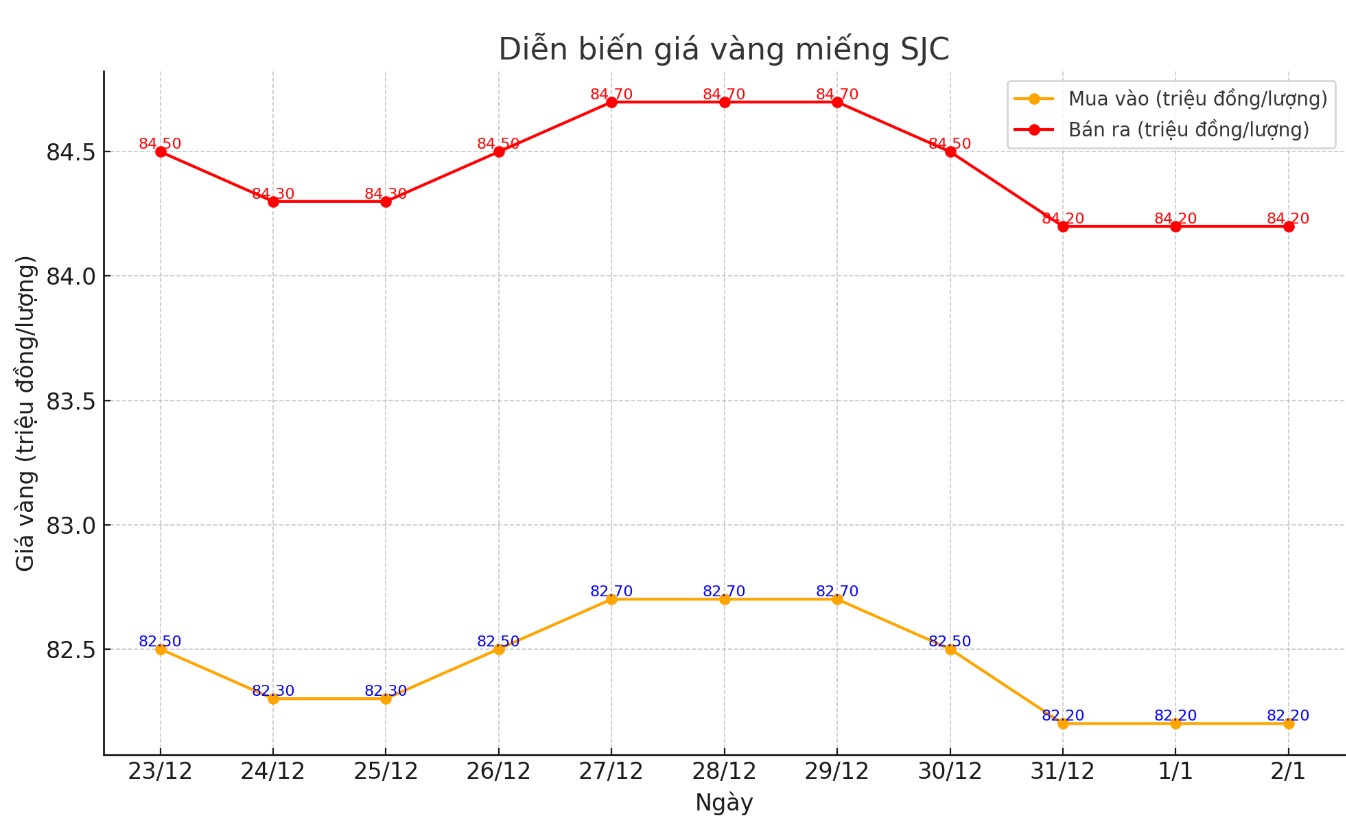

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars listed by Saigon Jewelry Company SJC was at 82.2-84.2 million VND/tael (buy - sell), unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 82.2-84.2 million VND/tael (buy - sell), unchanged.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.2-84.2 million VND/tael (buy - sell), unchanged.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around VND2 million/tael. Experts say that this difference is still very high, causing investors to face the risk of losing money when buying in the short term.

The difference between the buying and selling price is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

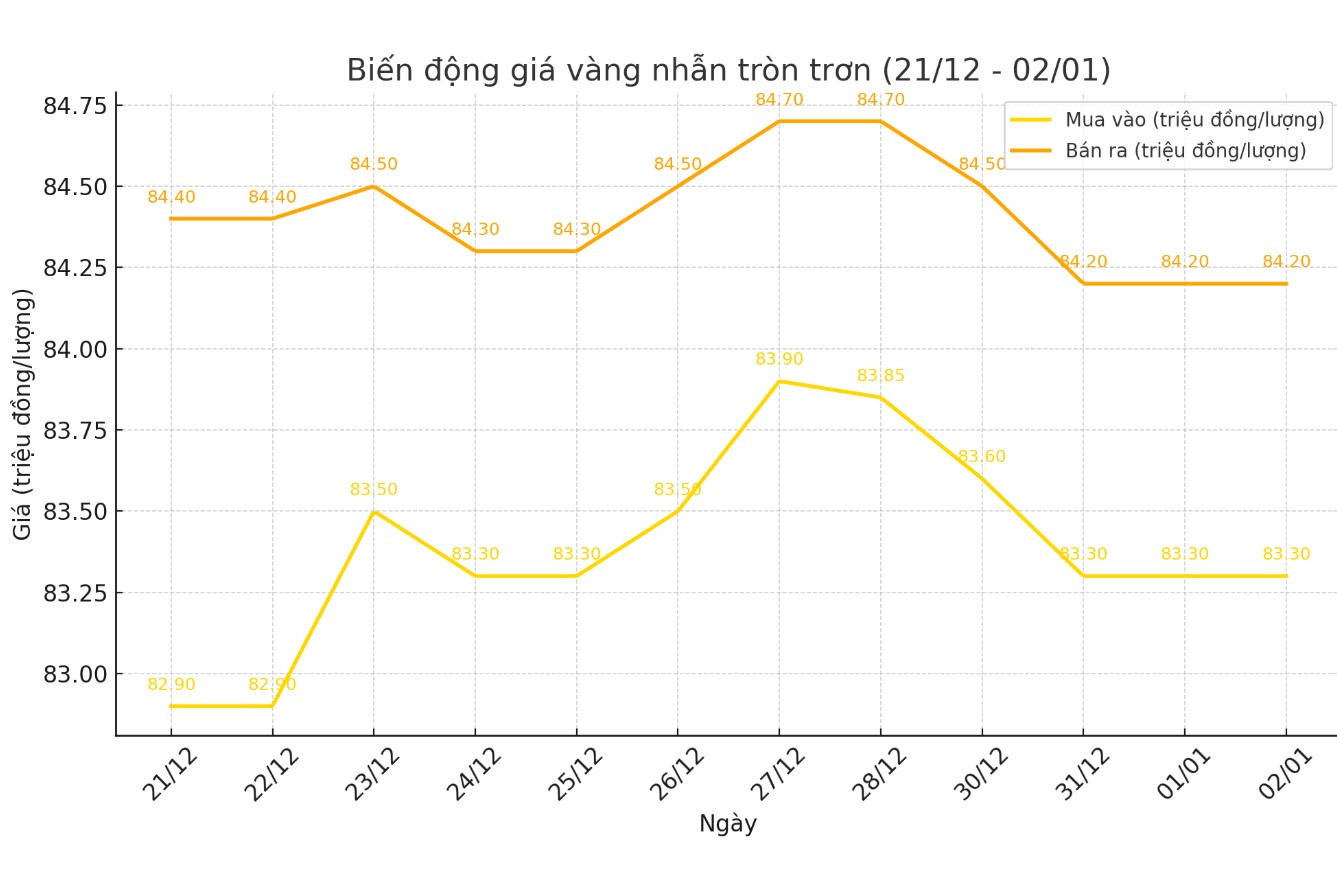

Price of round gold ring 9999

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.30-84.20 million VND/tael (buy - sell); unchanged.

Bao Tin Minh Chau listed the price of gold rings at 82.6-84.2 million VND/tael (buy - sell), unchanged.

World gold price

As of 0:00 on January 2 (Vietnam time), the world gold price listed on Kitco was at 2,624.2 USD/ounce.

Gold Price Forecast

Gold ends 2024 with its strongest year since 2010. 2024 has been a year of significant volatility for the gold market, as the precious metal closed out a year of record-breaking gains. Strong central bank buying, geopolitical uncertainties, and loose monetary policy were the main drivers of gold’s price gains.

In its policy meeting at the end of 2024, the US Federal Reserve (FED) decided to cut interest rates for the third consecutive time, but also signaled that it would slow down the rate easing roadmap in 2025. In addition, the incoming US administration of President Donald Trump is expected to have a major impact on global economic policies.

"Geopolitical tensions are expected to remain high into 2025 with central banks continuing to buy gold, while the US debt situation is likely to worsen and the budget deficit will increase, increasing safe-haven demand for the metal," said Peter Grant, vice president and senior metals strategist at Zaner Metals.

Agreeing, Aneeka Gupta, director of macroeconomic research at WisdomTree, said that heightened geopolitical risks, central bank demand, looser monetary policy and inflows from exchange-traded funds have created a solid foundation for gold to rally in 2024.

Ms. Gupta predicts that gold will likely continue to be supported in 2025, despite facing some difficulties such as a strong USD and a slowing pace of Fed easing.

“Speculators could be in for another good year if geopolitical tensions rise under Trump, whose concept has been confirmed as a safe haven for investors,” said Han Tan, chief market analyst at Exinity Group.

Meanwhile, Daan Struyven, commodity strategist at Goldman Sachs, predicted: “We expect gold prices to rise to $3,000/ounce, driven by demand from central banks and a cyclical increase in holdings of exchange-traded funds.”

See more news related to gold prices HERE...