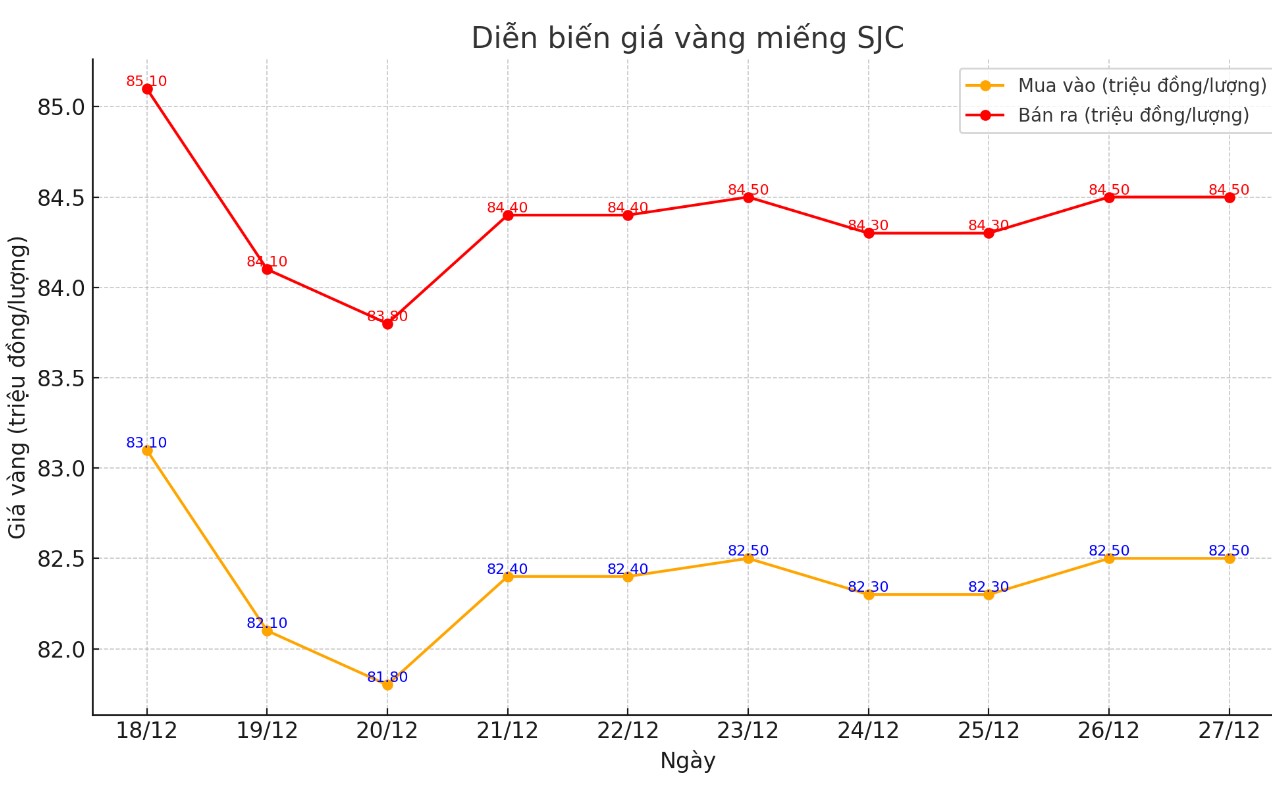

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 82.5-84.5 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 82.5-84.5 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.5-84.5 million VND/tael (buy - sell), up 200,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around VND2 million/tael. Experts say that this difference is still very high, causing investors to face the risk of losing money when buying in the short term.

The difference between the buying and selling price is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

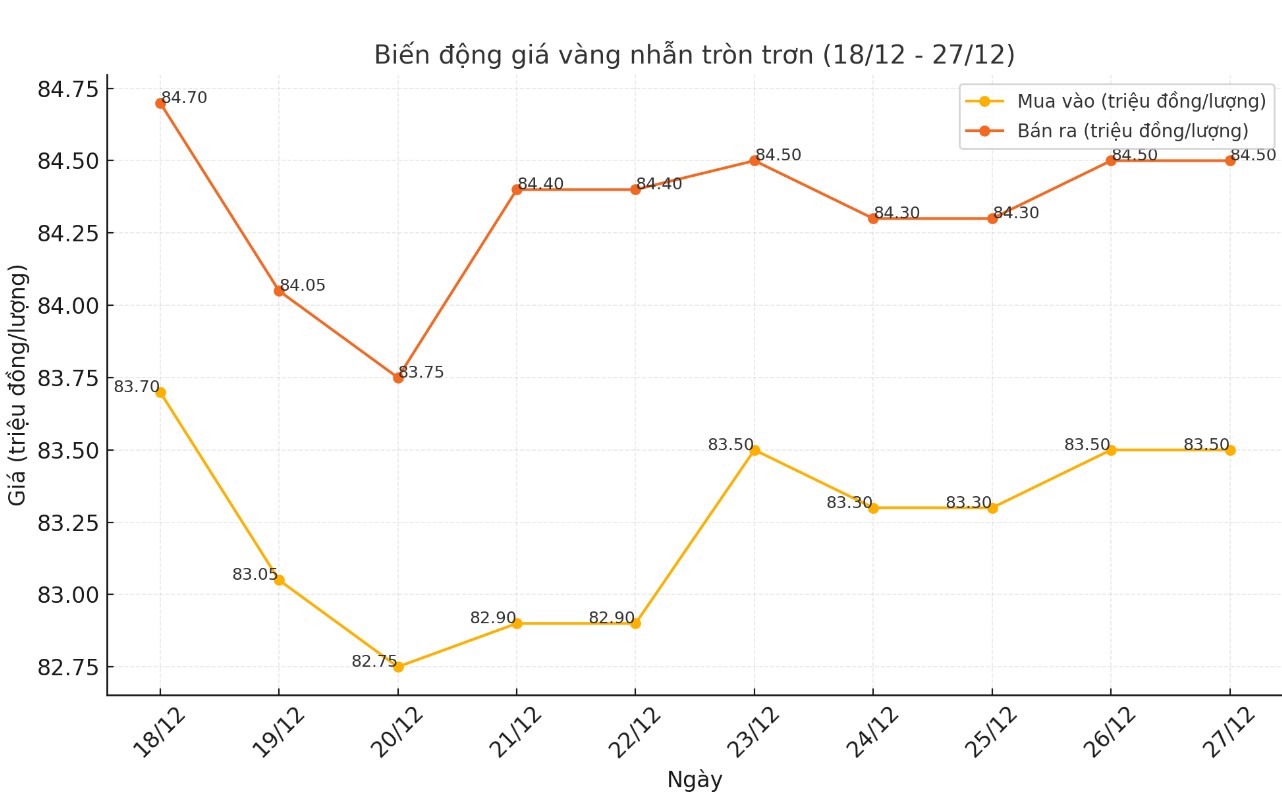

Price of round gold ring 9999

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.5-84.5 million VND/tael (buy - sell); an increase of 200,000 VND/tael for both buying and selling compared to the beginning of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 82.7-84.5 million VND/tael (buy - sell), an increase of 200,000 VND/tael for both buying and selling compared to the close of yesterday's trading session.

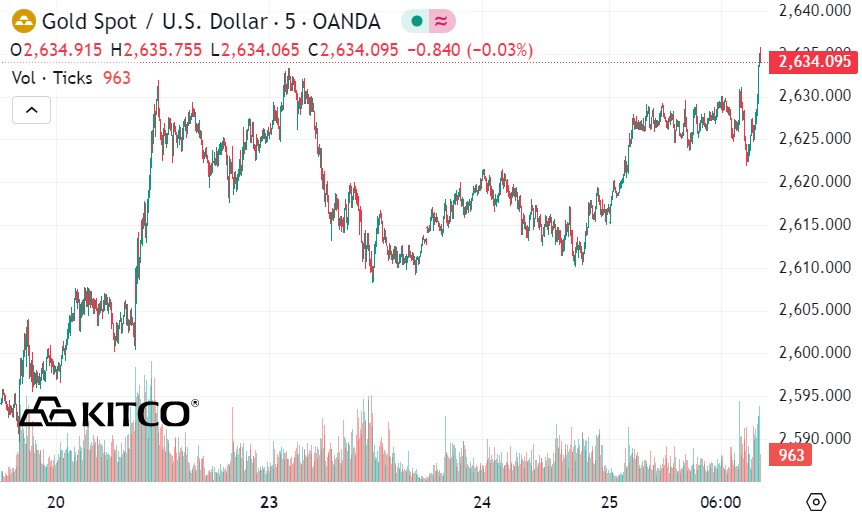

World gold price

As of 10:20 p.m. on December 26 (Vietnam time), the world gold price listed on Kitco was at 2,634 USD/ounce, an increase of 17.2 USD/ounce.

Gold Price Forecast

World gold prices increased as the USD index decreased slightly. Recorded at 22:30 on December 26, the US Dollar Index, which measures the greenback's fluctuations against 6 major currencies, was at 107,990 points (down 0.02%).

Gold prices received support and rose after the release of weaker-than-expected US labor market data. The number of Americans filing for unemployment benefits for the first time exceeded economists' forecasts.

Initial claims for unemployment benefits fell to a seasonally adjusted 219,000 for the week ended Dec. 21, the Labor Department said Thursday. That was slightly higher than forecasts, with the consensus forecasting 218,000. The previous week’s figure was unchanged at 220,000.

Continuing claims, which reflect the number of people receiving benefits, reached 1.910 million in the week ended Dec. 14. That was higher than the forecast of 1.875 million and also higher than the previous week's revised 1.864 million.

In overnight news, the World Bank raised its forecast for China’s economic growth in 2024 and 2025, but warned that falling household and business confidence, along with problems in the real estate sector, would hold back growth. Thanks to recent policy easing and a near-term pick-up in exports, the World Bank raised its forecast for China’s GDP growth this year to 4.9%, up from its June forecast of 4.8%. Growth in 2025 is forecast to slow to 4.5%.

Major overseas markets today saw Nymex crude oil futures slightly higher, trading around $70.50 a barrel. The yield on the 10-year US government bond is currently at 4.629%.

On the chart, February gold futures bulls and bears are in a near-term balance. The bulls’ next target is a close above the resistance level of $2,700/oz. Meanwhile, the bears’ target is to push the price below the November low of $2,565/oz.

See more news related to gold prices HERE...