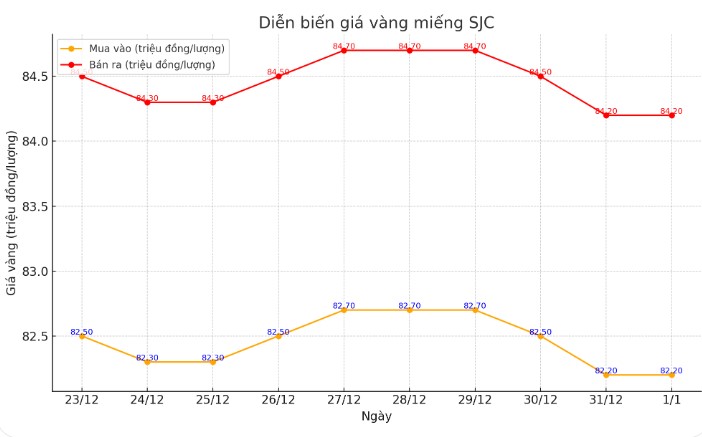

Update SJC gold price

As of 5:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 82.2-84.2 million VND/tael (buy - sell), unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 82.2-84.2 million VND/tael (buy - sell), unchanged.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.2-84.2 million VND/tael (buy - sell), unchanged.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

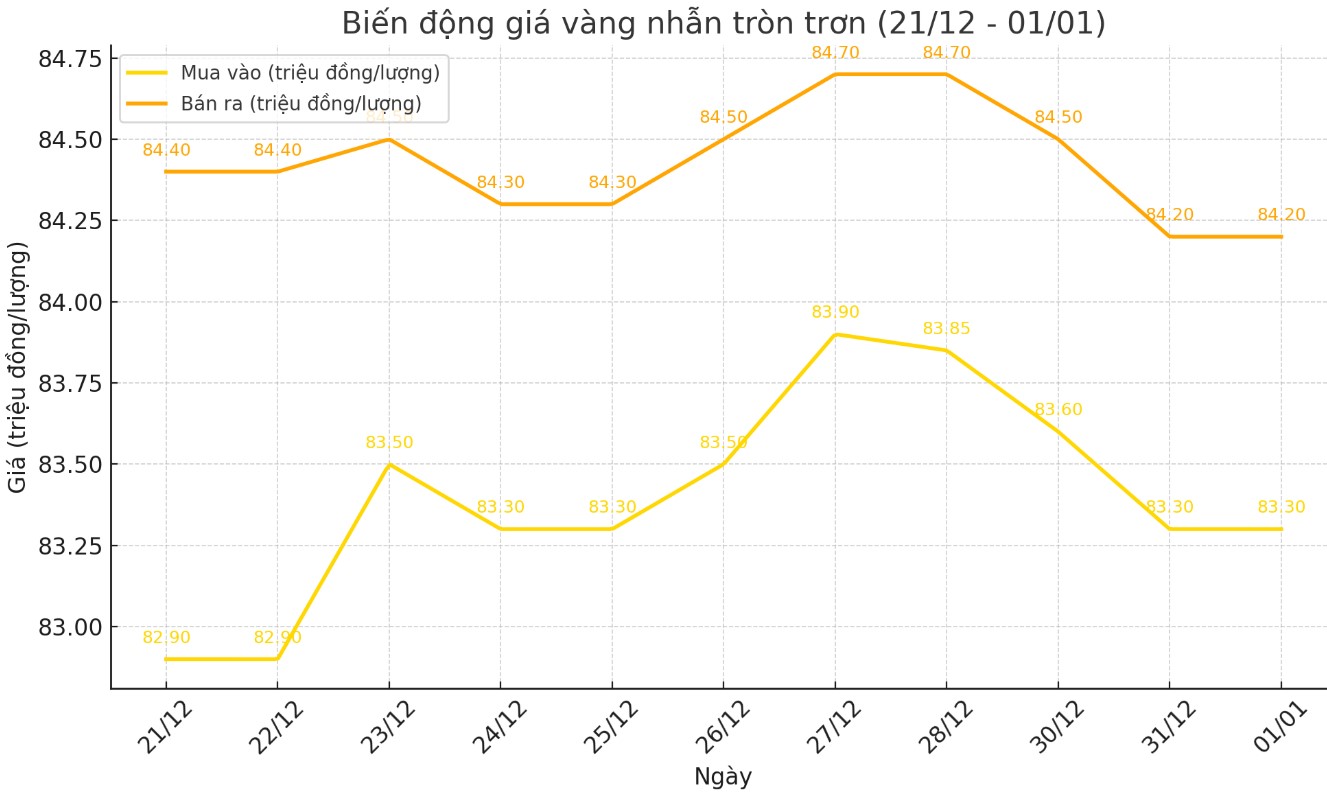

Price of round gold ring 9999

As of 7:30 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.30-84.20 million VND/tael (buy - sell); unchanged.

Bao Tin Minh Chau listed the price of gold rings at 82.6-84.2 million VND/tael (buy - sell), unchanged.

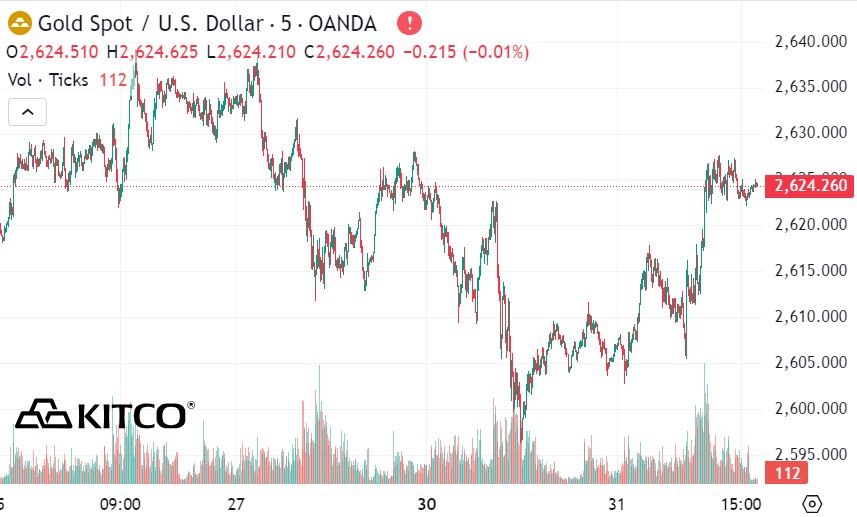

World gold price

As of 8:20 p.m., the world gold price listed on Kitco was at $2,624.2/ounce.

Gold Price Forecast

World gold prices remain high despite the increase in the USD index. Recorded at 5:00 p.m. on January 1, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 108.280 points (up 0.32%).

In 2024, the precious metal rose by $560 per ounce, or 27.2%. The precious metal has seen an unprecedented rally, peaking in October 2024 when it rose more than 30%, marking its best performance since 1979.

This year, gold prices are said to be strongly influenced by the US dollar. Many experts believe that the monetary policy of the US Federal Reserve (FED) is still the main driver of global financial markets, especially gold prices, as the organization tries to balance between persistent inflationary pressures and supporting economic activity.

Expectations for the Fed’s monetary policy have changed dramatically in the last few weeks of 2024. At its last monetary policy meeting on December 18, 2024, the Fed said it was likely to cut interest rates only twice next year. Meanwhile, updated economic projections in September showed the potential for as many as four rate cuts.

Chantele Schieven, Head of Research at Capitalight Research, is optimistic about the outlook for the gold market in 2025. According to her, gold prices could fluctuate between $2,500 and $2,700 per ounce in the first half of the year, and could potentially surpass $3,000 per ounce in the second half. However, the gold market is expected to face many challenges as investors continue to focus on the strength of the US economic recovery. Some of the policies expected from President-elect Donald Trump are expected to boost economic growth in the first half of the year.

Since winning the US presidential election in November 2024, Donald Trump has announced his intention to extend the 2017 tax credits. In addition, he has threatened to impose tariffs on major trading partners such as China, Canada, Mexico and the European Union.

He has also proposed a plan to deport illegal immigrants and recently expressed his desire to annex Canada and Greenland. Policies such as tax cuts and import tariffs are expected to support economic growth, leading to an increase in bond yields and the value of the dollar. However, these policies also pose the risk of increasing inflation.

According to Ms. Chantele Schieven, the uncertainties surrounding Mr. Trump's policies will continue to strengthen the role of gold as a safe-haven asset in the context of global economic and political volatility.

See more news related to gold prices HERE...