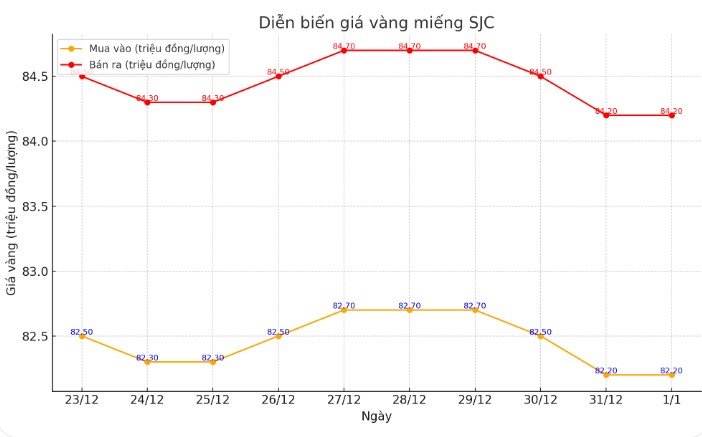

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 82.2-84.2 million VND/tael (buy - sell), down 300,000 VND/tael.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 82.2-84.2 million VND/tael (buy - sell), down 300,000 VND/tael.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.2-84.2 million VND/tael (buy - sell), down 300,000 VND/tael.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around VND2 million/tael. Experts say that this difference is still very high, causing investors to face the risk of losing money when buying in the short term.

The difference between the buying and selling price is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

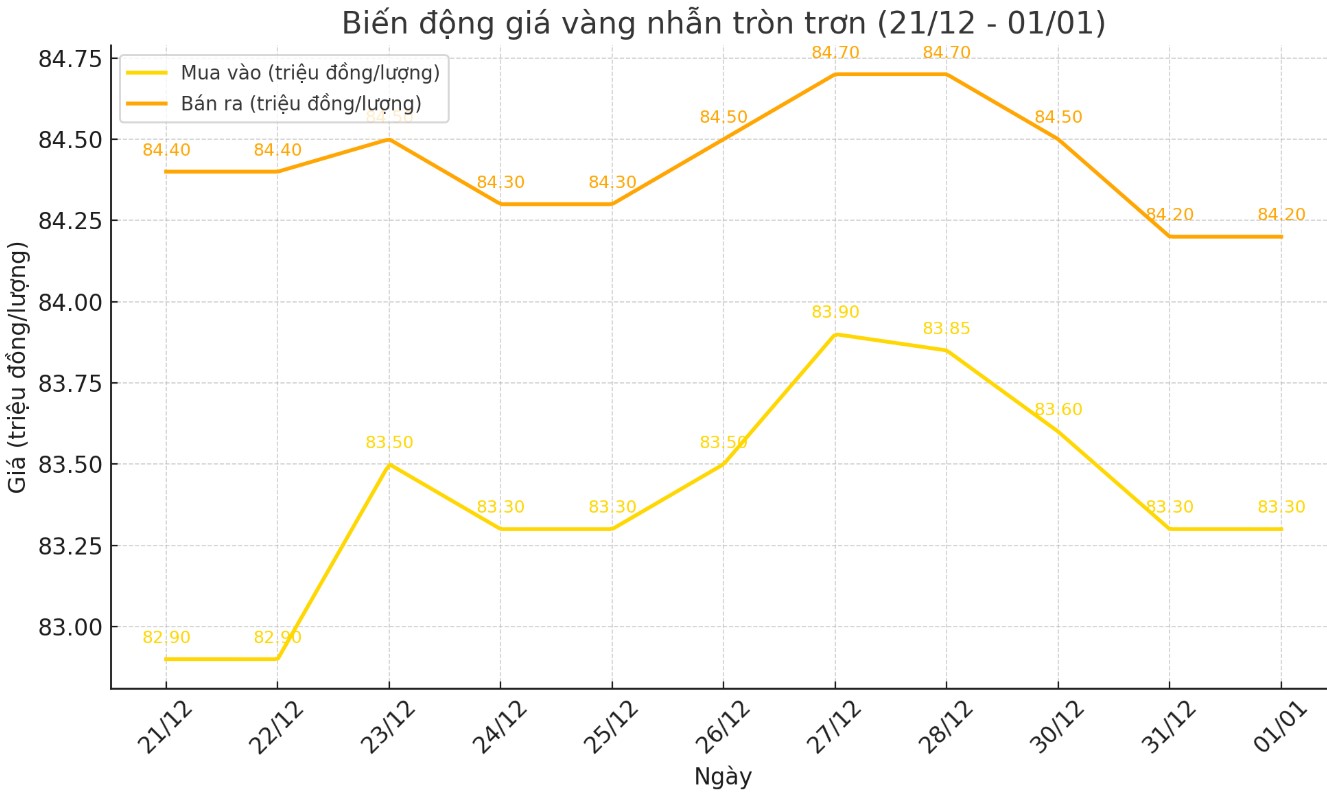

Price of round gold ring 9999

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.30-84.20 million VND/tael (buy - sell); down 300,000 VND/tael for both buying and selling compared to the beginning of yesterday's trading session.

Bao Tin Minh Chau listed the price of gold rings at 82.6-84.2 million VND/tael (buy - sell), down 300,000 VND/tael for both selling prices compared to the beginning of yesterday's trading session.

In recent sessions, the price of round, smooth gold rings in the country has often moved in the same direction as the world. Investors can refer to the world market developments to grasp and predict the direction of the price of precious metals in the country.

In the context of the world market recording a strong recovery, domestic gold prices are likely to be adjusted up by businesses in the first trading session of 2025.

World gold price

As of 3:00 a.m. on January 1 (Vietnam time), the world gold price listed on Kitco was at 2,624.1 USD/ounce, up 22.2 USD/ounce compared to early this morning.

Gold Price Forecast

World gold prices increased despite the increase in the USD. Recorded at 3:00 a.m. on January 1, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 108.285 points (up 0.33%).

This year, gold prices are said to be strongly influenced by the US dollar. Many experts believe that the monetary policy of the US Federal Reserve (FED) is still the main driver of global financial markets, especially gold prices, as the organization tries to balance between persistent inflationary pressures and supporting economic activity.

Expectations for the Fed’s monetary policy have shifted significantly in the last few weeks of 2024. At its last monetary policy meeting on December 18, the Fed said it was likely to cut interest rates only twice next year. Meanwhile, updated economic projections in September showed the potential for as many as four rate cuts.

Analysts said that the FED's change in monetary policy direction towards slower easing is reasonable, as the economy is expected to remain quite stable at least in the first half of the new year.

Most major banks have revised their interest rate expectations. Fixed income analysts at Bank of America agree with the Fed's forecast, expecting only two rate cuts next year. Wells Fargo is more cautious, predicting just one rate cut in 2025.

BlackRock, the world's largest fund manager, is betting big on "American exceptionalism" by sharply increasing the proportion of US stocks in its portfolio.

Analysts at BlackRock say the US economy is best positioned to benefit from “major forces” in the economy, such as the rise of artificial intelligence (AI), that are upending the traditional business cycle.

In other major markets, Nymex crude oil futures edged up slightly and traded around $71.75 a barrel. The yield on the 10-year US Treasury note is currently around 4.6%.

On the short-term technical chart, the February gold futures market shows that both bulls and bears are in balance. The next price target for bulls is a close above the resistance level of $2,700. Conversely, the nearest price target for bears is to push futures below the November low of $2,565/ounce.

See more news related to gold prices HERE...