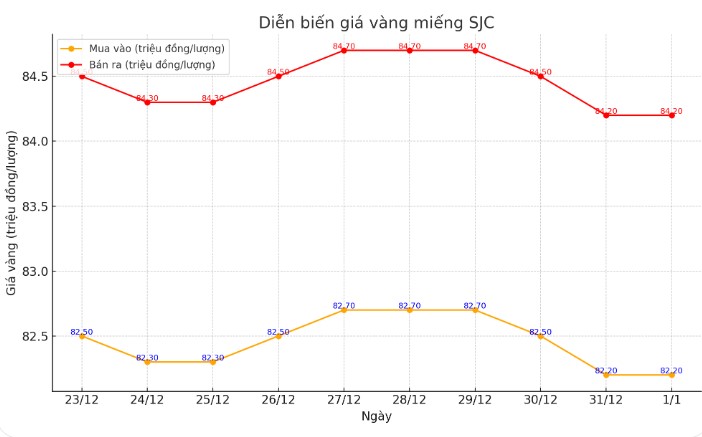

Update SJC gold price

As of 10:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 82.2-84.2 million VND/tael (buy - sell); unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 82.2-84.2 million VND/tael (buy - sell); unchanged.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.2-84.2 million VND/tael (buy - sell); unchanged.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say that this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

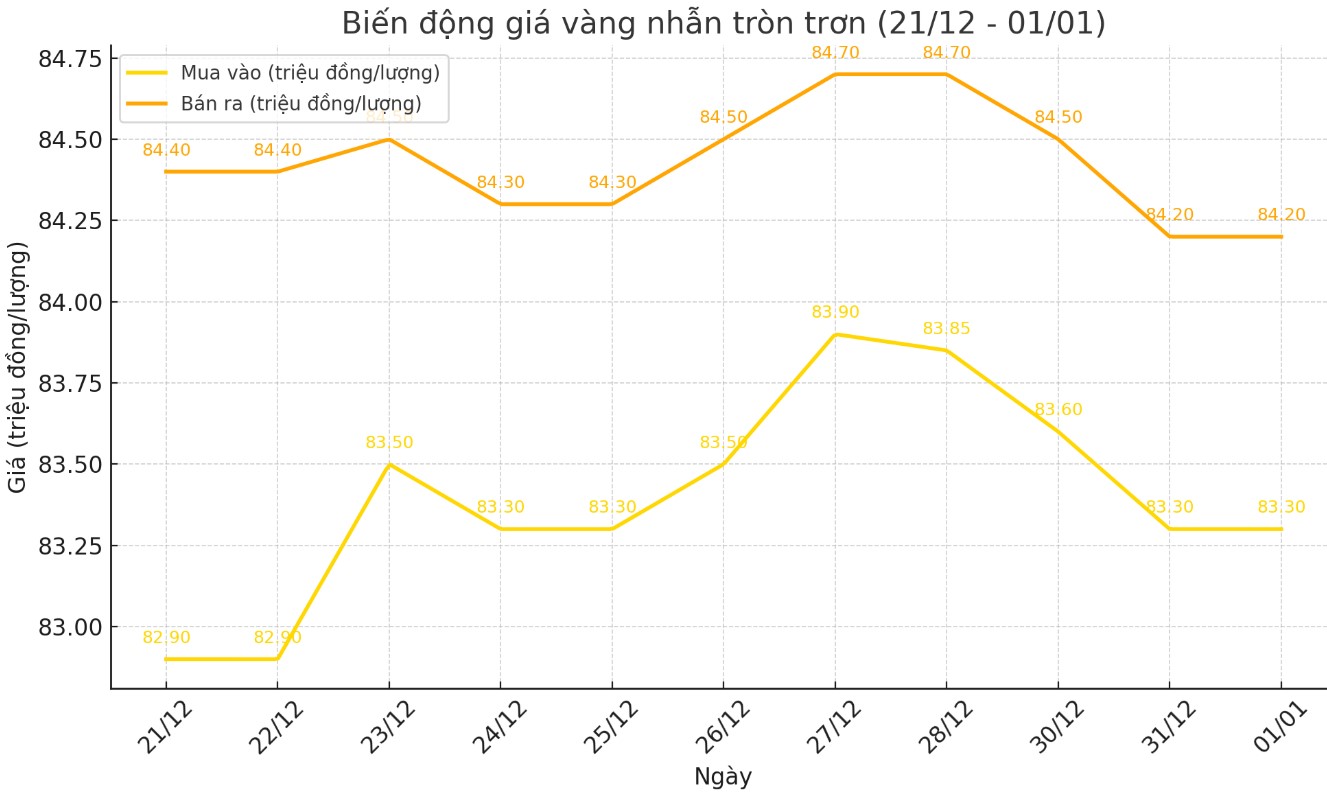

Price of round gold ring 9999

As of 10:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.3-84.2 million VND/tael (buy - sell); unchanged from early this morning.

Bao Tin Minh Chau listed the price of gold rings at 82.6-84.2 million VND/tael (buy - sell), unchanged from early this morning.

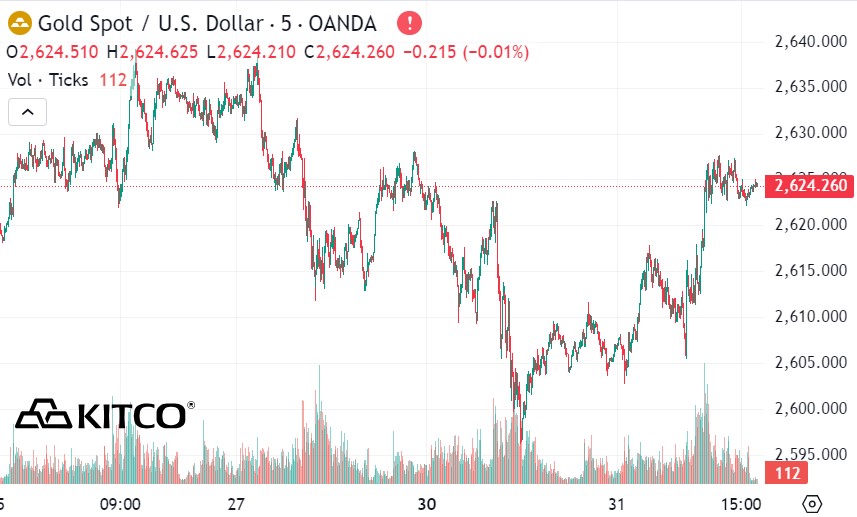

World gold price

As of 9:35 a.m., the world gold price listed on Kitco was at 2,624.2 USD/ounce, up 17.1 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased despite the increase in the USD. Recorded at 9:40 a.m. on January 1, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 108.280 points (up 0.32%).

Investors are looking for a new signal to stimulate the market. On the first day of the new year, major financial markets around the world simultaneously suspended trading.

Factors such as escalating geopolitical risks, gold buying demand from central banks, loose monetary policies globally, and inflows into exchange-traded funds are the main drivers of gold's price increase in 2024, said Aneeka Gupta, director of macroeconomic research at WisdomTree.

Ms. Gupta also said that the precious metal is expected to continue to be supported in 2025, despite facing some obstacles from the strength of the US dollar and a slower pace of policy easing from the US Federal Reserve (FED).

Investor sentiment remains under pressure due to uncertainties surrounding monetary policy in 2025 and President-elect Donald Trump’s plans to control inflation. Despite a decline from the beginning of the year, inflation remains persistently above the US Federal Reserve’s 2% target.

At its last policy meeting of 2024, the Fed decided to cut interest rates for the third time in a row. However, the US Central Bank signaled that the rate cut roadmap could be adjusted more slowly in 2025.

Global geopolitical tensions could increase under President Donald Trump, prompting investors to seek gold as a safe haven, said Han Tan, senior market analyst at Exinity Group. He said this will be a great opportunity for speculators to continue to reap success next year.

Daan Struyven, a commodity strategist at Goldman Sachs, predicts that gold prices could reach $3,000 an ounce. He explains that increased demand from central banks and the trend of holding gold through exchange-traded funds, fueled by the Fed's interest rate cuts, will be the main factors supporting this price increase.

See more news related to gold prices HERE...