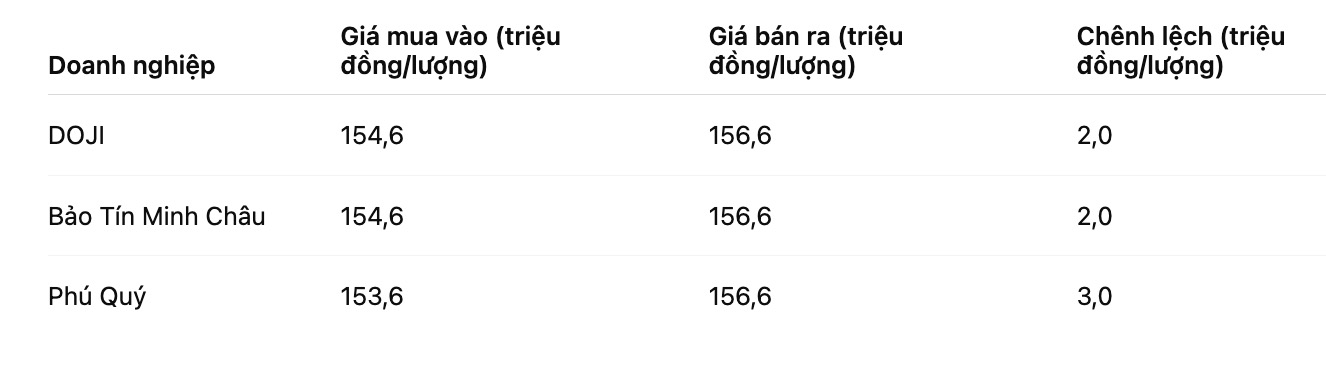

SJC gold bar price

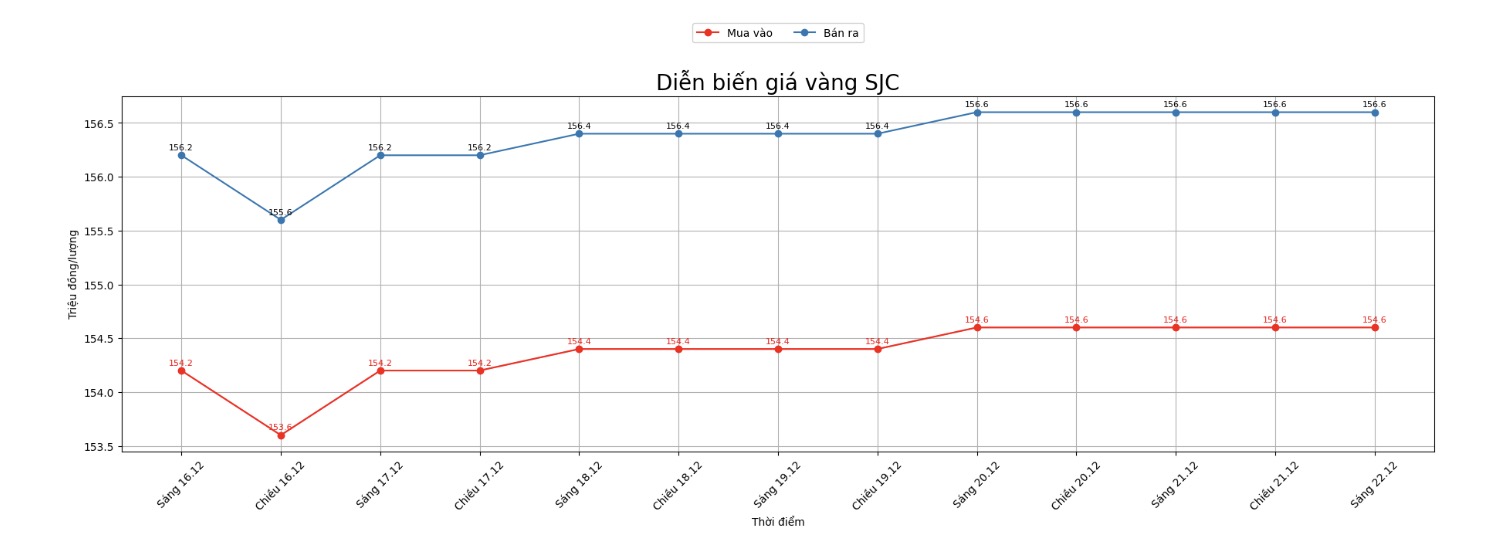

As of 6:00 a.m., the price of SJC gold bars was listed by DOJI Group at 154.6-156.6 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 154.6-156.6 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 153.6-156.6 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 3 million VND/tael.

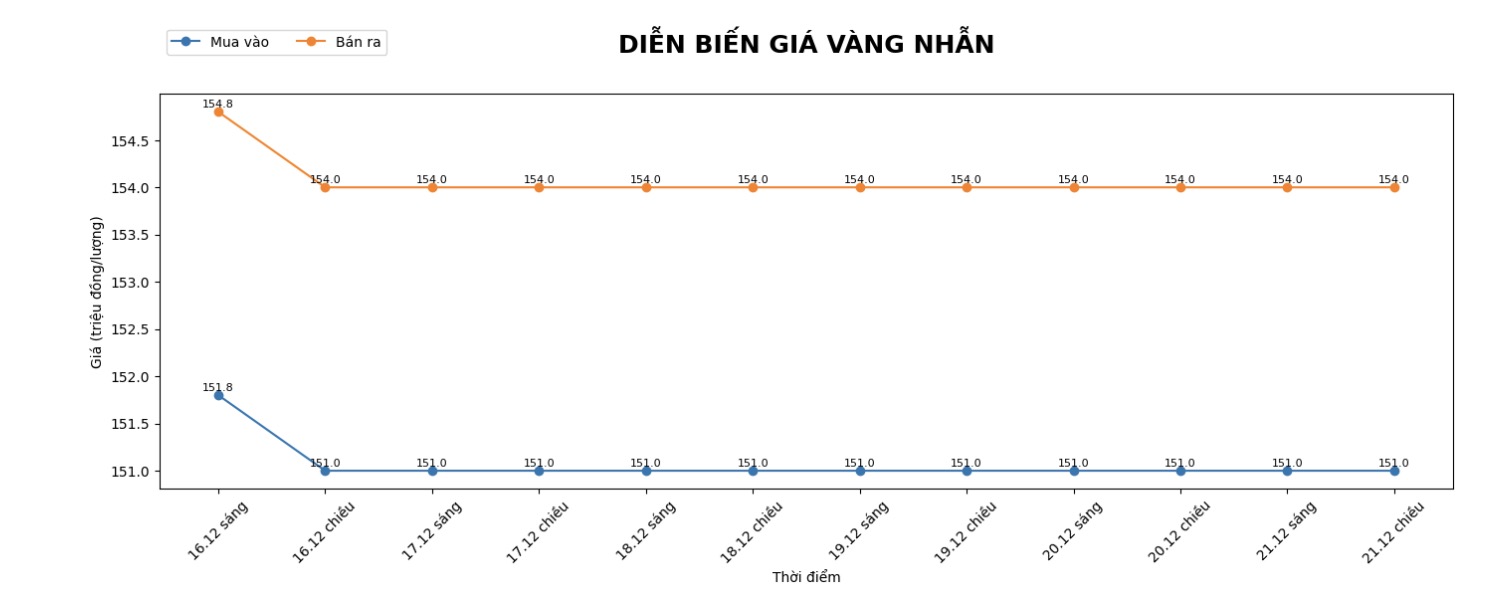

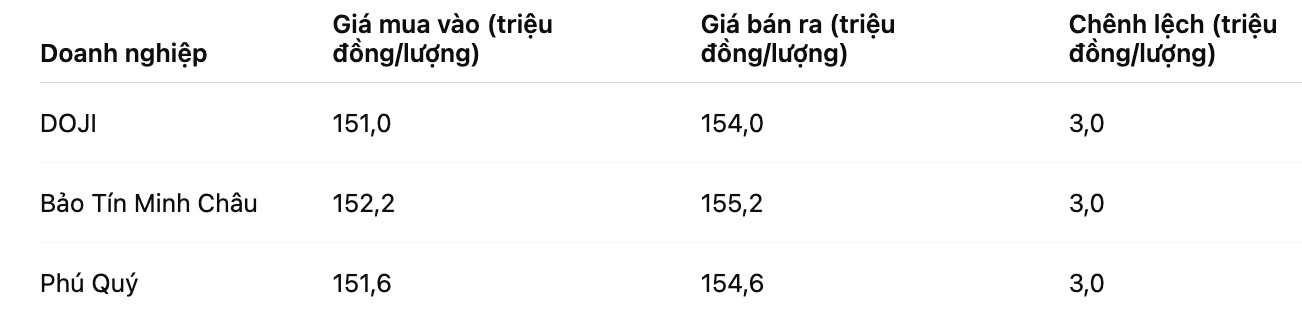

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 151-154 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 152.2-155.2 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 151.6-154.6 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

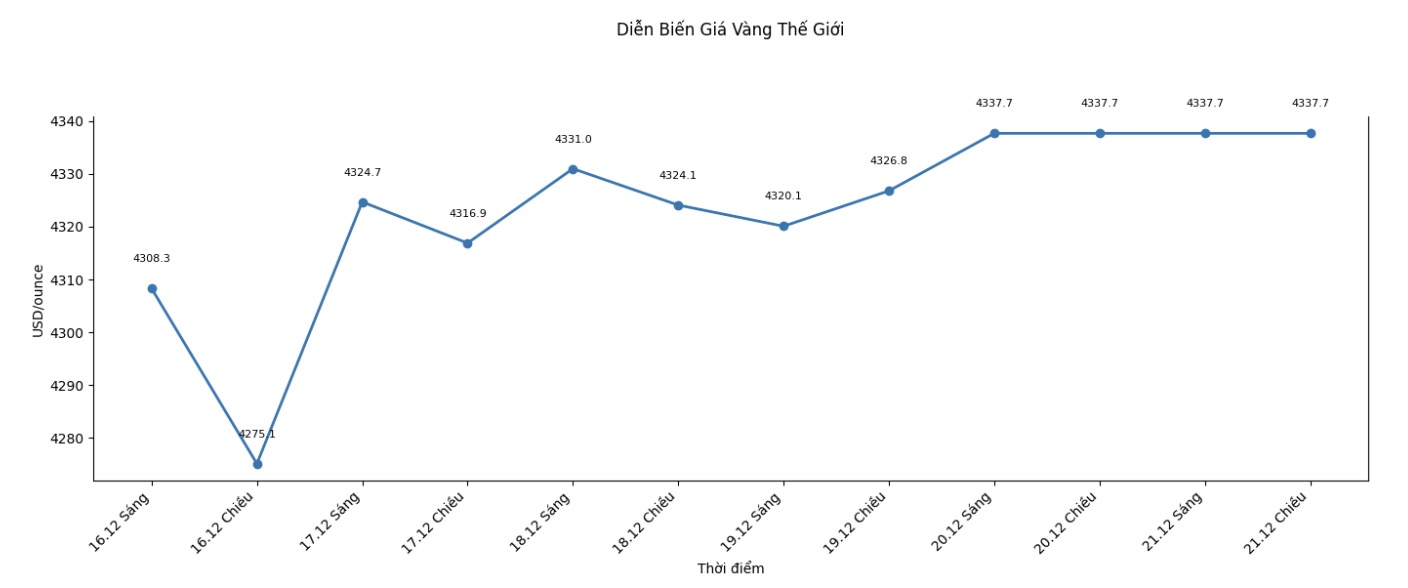

World gold price

The world gold price was listed at 6:00 a.m., at 4,337.7 USD/ounce.

Gold price forecast

Preparing to enter 2026, the precious metals market is forecast to remain vibrant, but the trend between gold and silver has clearly differentiated. A survey by Kitco News shows that individual investors are leaning towards silver, while gold continues to play the role of a safe haven asset.

According to TD Securities, the low interest rate environment, weak currencies and the need to diversify portfolios could push gold prices to new peaks, even surpassing $4,400/ounce in the first half of 2026.

The Fed's interest rate cuts, concerns about US public debt and the independence of monetary policy further strengthen the appeal of gold. TD forecasts gold's long-term price range to be around 3,5004,400 USD/ounce, in the context of the US economy showing signs of stagnation.

On the contrary, Heraeus was more cautious when he said that the precious metals market could correct in the first half of 2026 due to increased too strongly and falling into a state of "overbuy". However, central bank buying and low real interest rates are expected to keep gold prices high, with a wide range of $3,750 to $5,000/ounce.

For silver, Heraeus warned of a large volatility after a period of heating up in 2025. Tight supply, ETF flows and investment demand have pushed up silver prices, but the market needs time to adjust. In addition, demand for silver in solar power, jewelry and consumer goods, especially in India, may weaken as prices remain high. Heraeus forecasts silver in 2026 to fluctuate around $43.62/ounce.

Overall, the outlook for precious metals in 2026 is still positive in the long term but there are potential corrections. Gold is suitable for investors who prioritize safety, while silver is more attractive to those who accept risks to seek high profits.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...