SJC gold bar price

As of 5:45 p.m., DOJI Group listed the price of SJC gold bars at 153.6-155.6 million VND/tael (buy - sell), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 153.6-155.6 million VND/tael (buy - sell), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 152.6-155.6 million VND/tael (buy - sell), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

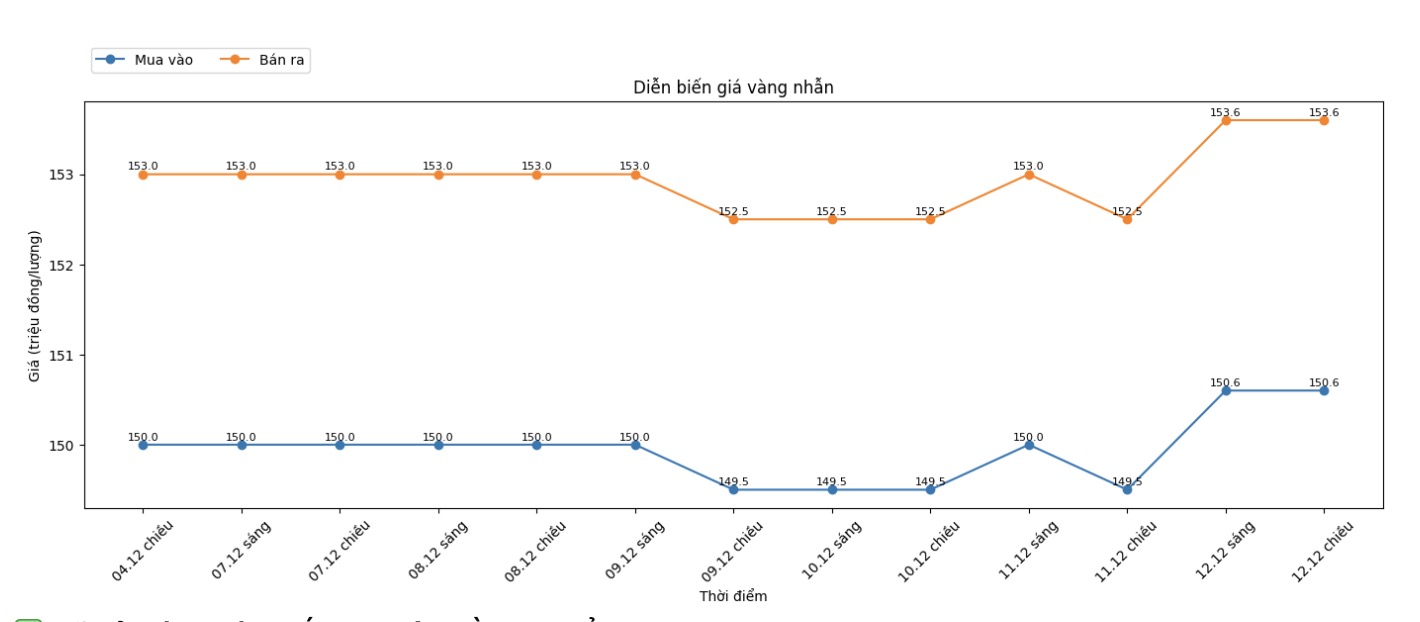

9999 gold ring price

As of 5:45 p.m., DOJI Group listed the price of gold rings at 150.6-153.6 million VND/tael (buy - sell), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 151.8-154.8 million VND/tael (buy - sell), an increase of 800,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150.8-153.8 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

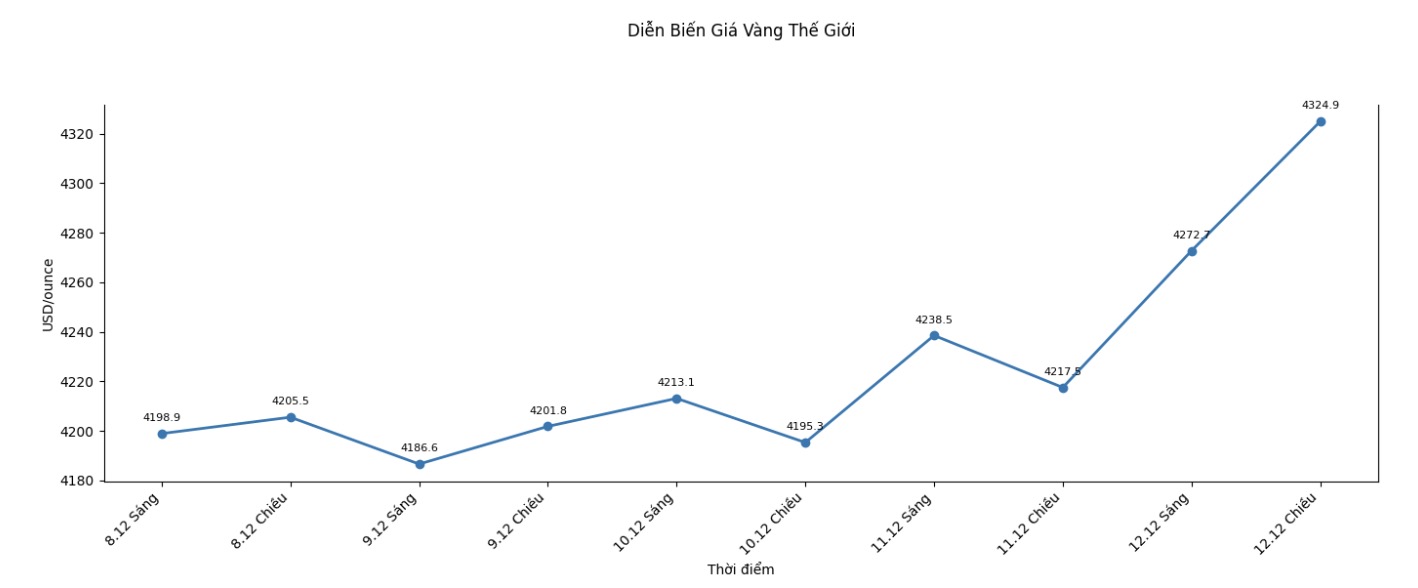

World gold price

The world gold price was listed at 5:45 p.m., at 4,324.9 USD/ounce, up sharply by 107.4 USD compared to a day ago.

Gold price forecast

Gold prices rose to a seven-week high on Friday, supported by a weakening US dollar, expectations of a rate cut and increased safe-haven demand due to geopolitical tensions, while silver prices also hit record levels. The USD is approaching a two-month low and is on a downward trend for the third consecutive week, making gold cheaper for investors holding other currencies.

In addition, the sharp increase in weekly jobless claims in the US, along with US-Venezuela tensions, is supporting gold prices and maintaining safe-haven demand, said Mr. Zain Vawda, an analyst at MarketPulse of OANDA.

The number of unemployment claims in the US increased the most in nearly 4 and a half years last week, reversing the sharp decline of the previous week.

The US Federal Reserve (Fed) cut interest rates by 25 basis points for the third time this year on Wednesday, but signaled caution for further cuts.

Investors are now betting on two rate cuts next year, and the US non-farm payrolls report due next week could provide further clues on the Fed's upcoming policy direction.

Non-yielding assets such as gold often benefit in a low-yielding environment.

Geopolitically, the US is preparing to intercept additional Venezuelan oil tankers after seizing an oil tanker this week.

Meanwhile, in India, gold discounts continued to expand during the week as demand remained weak, despite the wedding season, while high spot gold prices also reduced demand in China.

Spot silver prices rose 0.5% to $63.87/ounce, after hitting a new record high of $64.32/ounce, and are heading for a 9.5% increase for the week. Since the beginning of the year, silver prices have more than doubled, supported by strong industrial demand, declining inventories and the list of essential minerals of the US.

Cold is being supported by industrial demand amid concerns about a shortage of supply, continued tightening markets, along with speculative waves, mainly from individual investors, thereby boosting capital flows into silver ETFs, said Ole Hansen, head of commodity strategy at Saxo Bank.

In other precious metals, platinum prices rose 0.8% to $1,708.11 an ounce, while palladium rose 2.2% to $1,510.95 an ounce. Both are looking forward to a week of price increases.

See more news related to gold prices HERE...