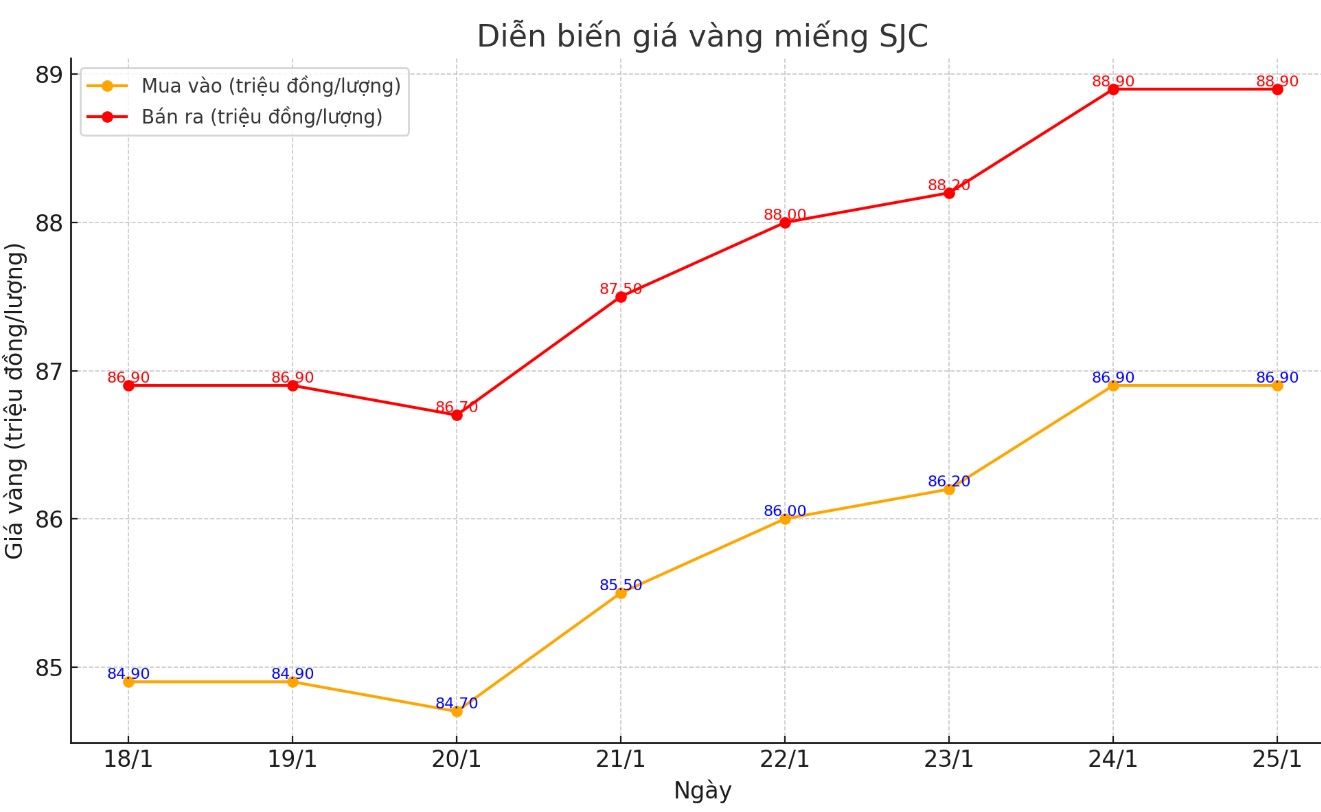

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND86.8-88.8 million/tael (buy - sell); an increase of VND700,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 86.9-88.9 million VND/tael (buy - sell); an increase of 800,000 VND/tael for both buying and selling.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 86.8-88.8 million VND/tael (buy - sell); increased 700,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

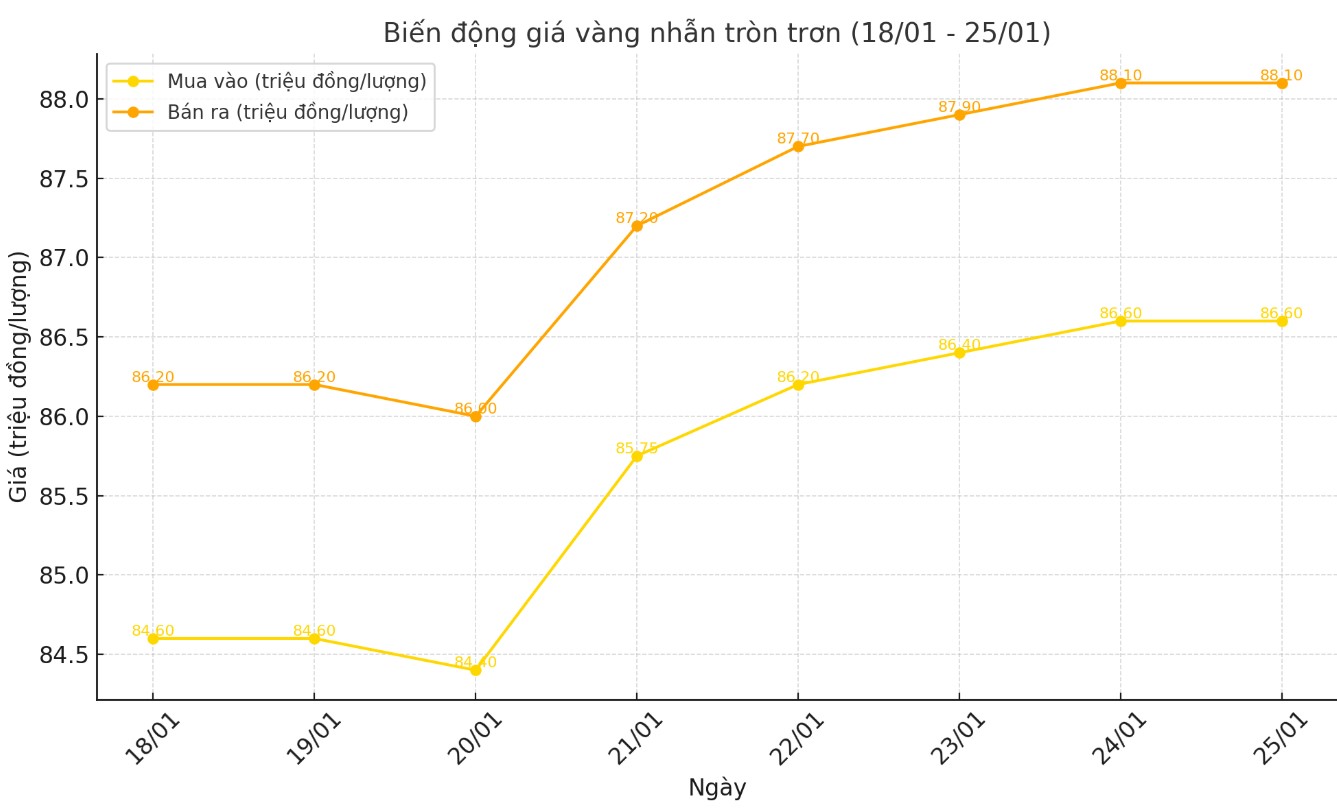

Price of round gold ring 9999

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 86.6-88.1 million VND/tael (buy - sell); an increase of 200,000 VND/tael for both buying and selling compared to the beginning of the trading session yesterday morning.

Bao Tin Minh Chau listed the price of gold rings at 86.6-88.8 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and an increase of 750,000 VND/tael for selling compared to early this morning.

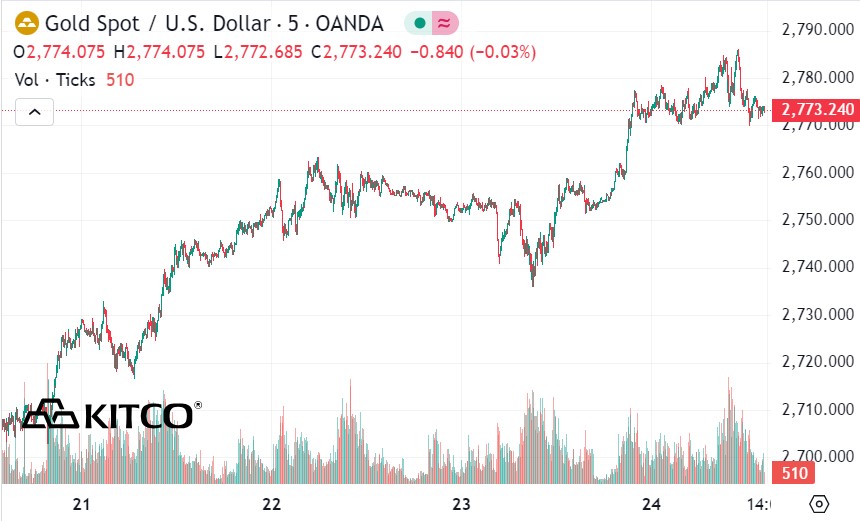

World gold price

As of 1:45 a.m. on January 25, the world gold price listed on Kitco was at 2,773.2 USD/ounce, up 19.6 USD/ounce compared to early this morning.

Gold Price Forecast

World gold prices increased amid a cooling USD index. Recorded at 1:45 a.m. on January 25, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107.245 points (down 0.58%).

Gold prices rose as US President Donald Trump eased tensions over China tariffs, according to Kitco.

Gold prices hit their highest in nearly three months and edged closer to a record high on comments from Donald Trump that appeared to be more conciliatory on US-China trade relations. The comments supported gold but weighed on the dollar index.

Gold futures for February delivery rose $22.4 to $2,787.4 an ounce.

Jim Wyckoff, senior analyst at Kitco, said the market was somewhat calmed overnight after Trump appeared to soften his stance on China, saying in an interview with Fox News that he “would prefer” not to resort to tariffs.

“Wall Street is optimistic that Mr. Trump, who famously used rising stock prices as a measure of success in his first term, will not implement the harsh policies in his agenda, which have raised concerns about the inflation outlook and the national finances,” Bloomberg reported today.

“Of course, it’s a gamble, with Trump’s high-profile comments expected next week amid an already busy trading period thanks to the Fed’s policy meeting and a big tech earnings season,” Bloomberg added.

In a speech on Thursday, Mr. Trump said he would “demand” that the Fed lower interest rates immediately.

Asian and European stocks were mostly higher overnight, although there was some mixed sentiment. US stocks are expected to open slightly lower when trading begins in New York. US indices are taking a breather after two weeks of strong gains that brought them close to record highs.

In other notable news, the Bank of Japan raised its key interest rate to a 17-year high and took a more positive view on rising inflation, fueling expectations of further rate hikes to support the Japanese yen.

Major markets today saw Nymex crude oil futures slightly increase and trade around $75/barrel. The yield on the 10-year US Treasury note is currently at 4.62%.

See more news related to gold prices HERE...