Update SJC gold price

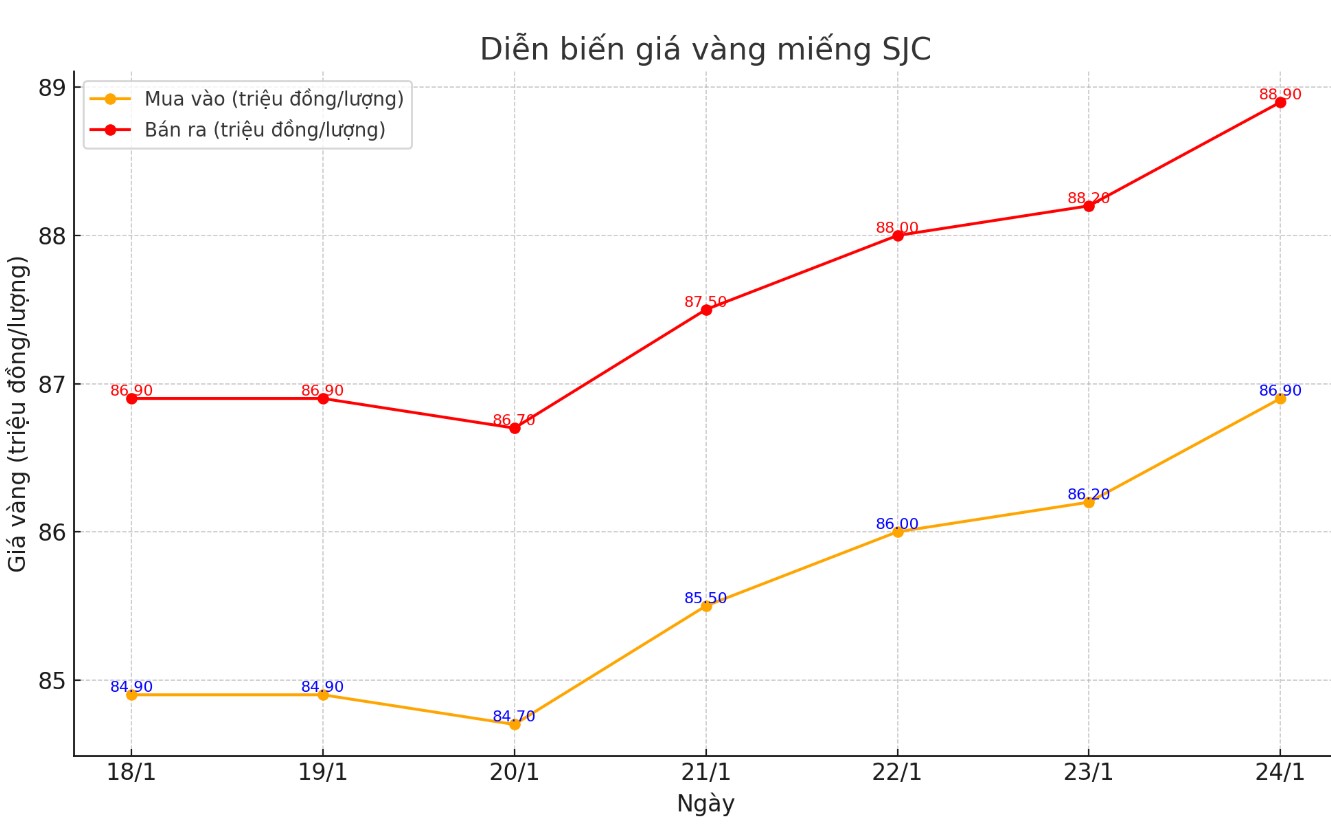

As of 10:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND86.9-88.9 million/tael (buy - sell); an increase of VND800,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 86.5-88.5 million VND/tael (buy - sell); an increase of 400,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 86.9-88.9 million VND/tael (buy - sell); increased 800,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

Price of round gold ring 9999

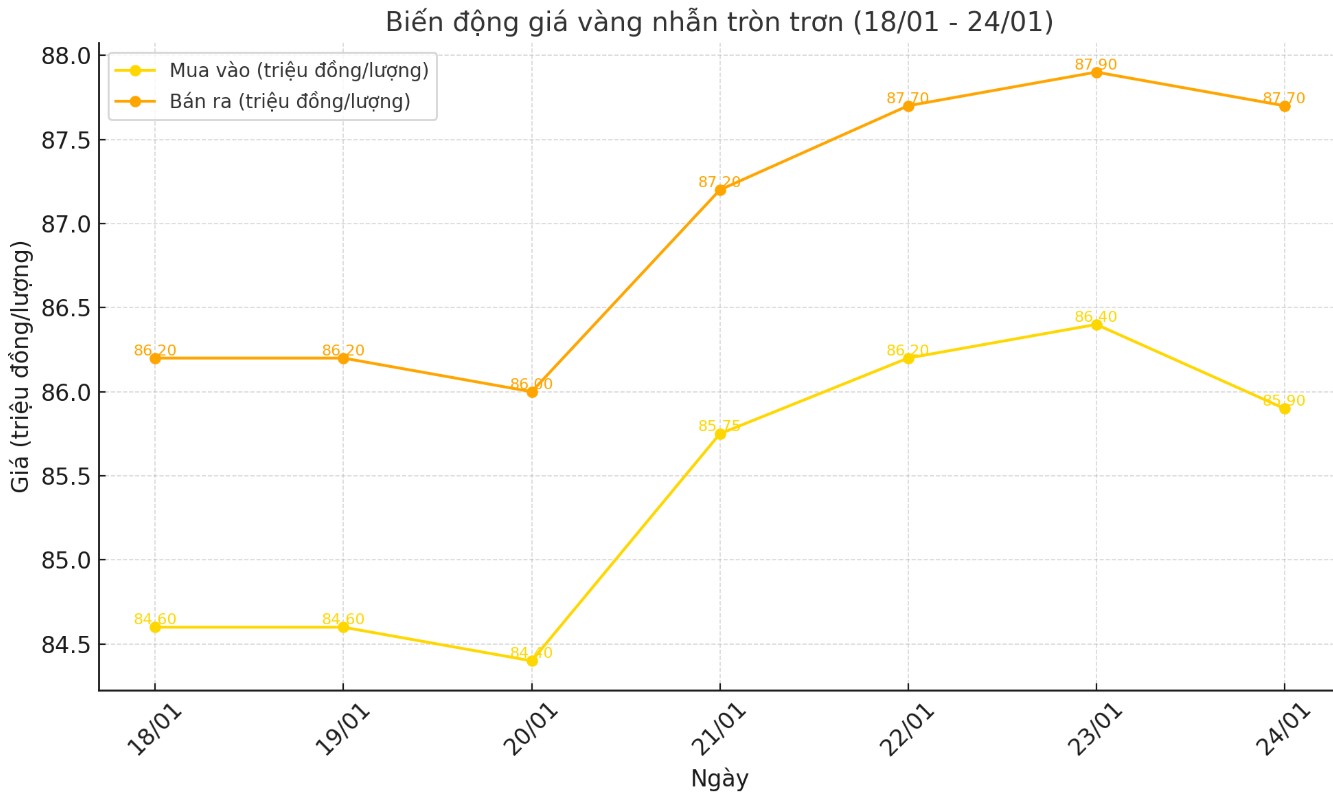

As of 10:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 85.9-87.7 million VND/tael (buy - sell); down 500,000 VND/tael for buying and down 200,000 VND/tael for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 86.2-88.7 million VND/tael (buy - sell), down 200,000 VND/tael for buying and up 350,000 VND/tael for selling compared to early this morning.

World gold price

As of 10:30 a.m., the world gold price listed on Kitco was at 2,771.3 USD/ounce, up 18.5 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased amid a decline in the US dollar. At 10:45 a.m. on January 24, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 107.660 points (down 0.19%).

According to Daniel Pavilonis, senior market strategist at RJO Futures, the gold price movement in the middle of the week was mainly influenced by the volatility of the US dollar. After a period of price increase, the US dollar experienced a sell-off, thereby supporting the recovery of gold prices from the low of the day.

“Today’s developments largely reflect the signals being sent from the White House. I believe some of the volatility is due to expectations around this issue,” Pavilonis said.

Most traders still believe the US Federal Reserve will keep interest rates unchanged at its upcoming policy meeting. Data from CME Group's FedWatch Tool shows the probability of a rate stay at 99.5%.

The content has been rephrased with the main ideas unchanged but using different wording to ensure no duplication.

Next week, the European Central Bank (ECB) and the US Federal Reserve (FED) will hold monetary policy meetings. The ECB is expected to cut interest rates by 25 basis points, while the FED will keep interest rates unchanged.

A rate cut by the ECB would weaken the euro against the dollar. A weaker euro typically increases the attractiveness of the dollar, making gold, which is priced in dollars, more expensive for investors using other currencies. This could put downward pressure on gold prices.

However, lower interest rates typically reduce bond yields, which in turn drives investors to safe-haven assets like gold. This could support gold prices in the medium term.

The Fed's decision to keep interest rates unchanged shows the stability of monetary policy in the US. This could cause the USD to continue to maintain its strength, creating downward pressure on gold prices.

So if the ECB does cut rates and the Fed keeps them unchanged, gold prices could face short-term downward pressure due to the strength of the USD. However, the decline may not be as deep if bond yields fall and safe-haven sentiment increases.

Investors can closely monitor detailed policy signals from the ECB and the FED, as well as the movements of the USD and US Treasury yields before making a decision.

See more news related to gold prices HERE...