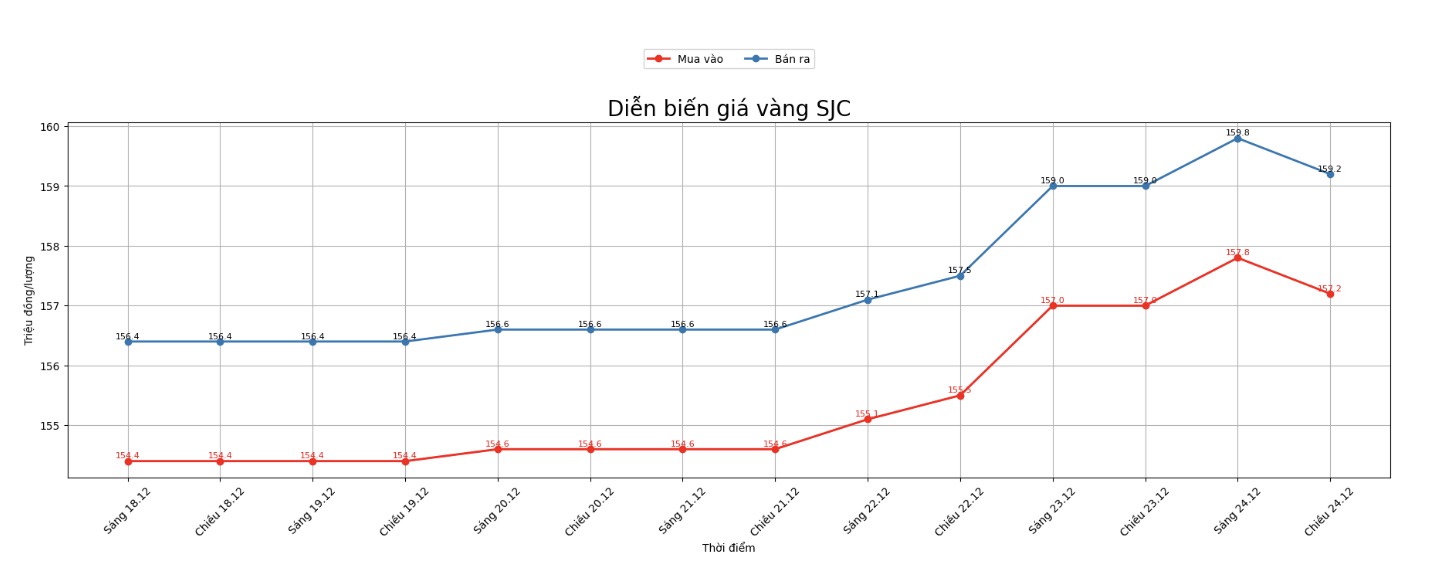

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 157.2-159.2 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 157.2-159.2 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 156.2-159.2 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

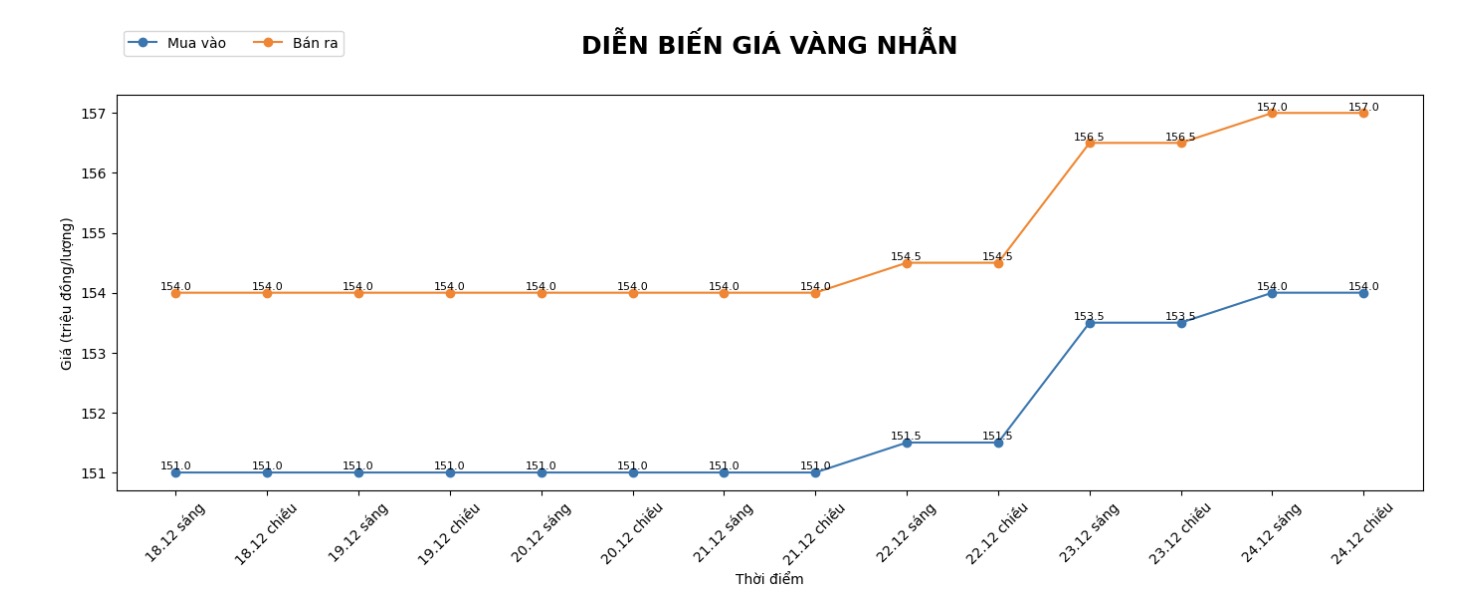

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 154-157 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 155.5-158.5 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 154.8-157.8 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

The world gold price was listed at 8:45 p.m. on December 24, at 4,483 USD/ounce.

Gold price forecast

World gold prices fell amid a wave of profit-taking from investors after hitting an all-time high on Wednesday.

Gold prices fell to near a session low after the US released more positive than expected labor market data, as the number of first-time unemployment claims fell lower than economists expected.

According to the announcement of the US Department of Labor released on Wednesday, the number of initial unemployment claims (adjusted according to seasonal factors) in the week ended December 20 reached 214,000 applications. This figure is lower than the consensus forecast of 223,000 petitions. The previous week's figure was kept unchanged at 224,000 orders.

After the data was released at 8:30 a.m. (east US time), spot gold prices continued to trade near the lowest level in the session, last recorded at 4,480.59 USD/ounce, down 0.09% on the day.

Meanwhile, the four-week average of first-time unemployment claims - often seen as a more reliable reflection of the labor market trend due to reduced weekly fluctuations - reached 216,750 claims, down from 217,500 claims last week and lower than the forecast of 219,000 claims.

The number of unemployment benefit applications continues, reflecting the number of people receiving benefits, increasing to 1.923 million people in the week ended December 13. This is higher than the adjusted figure last week of 1.885 million people and also exceeds the forecast of 1.9 million people.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...