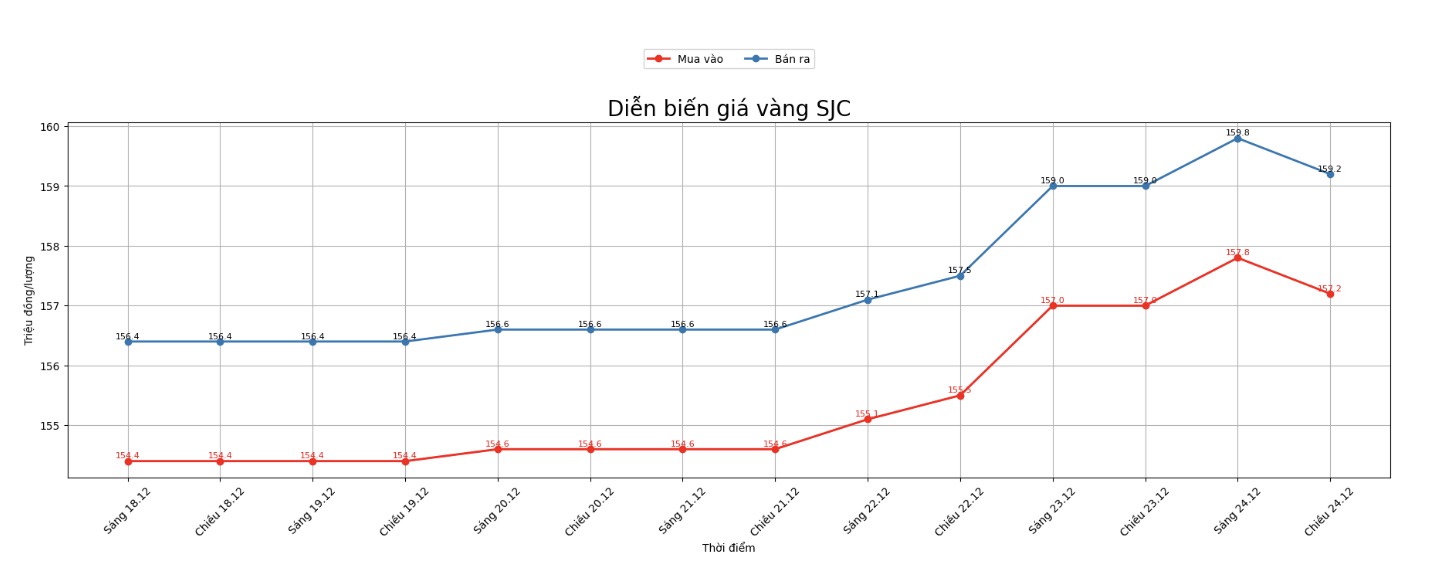

SJC gold bar price

As of 5:20 p.m., DOJI Group listed the price of SJC gold bars at 157.2-159.2 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 157.2-159.2 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 156.2-159.2 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

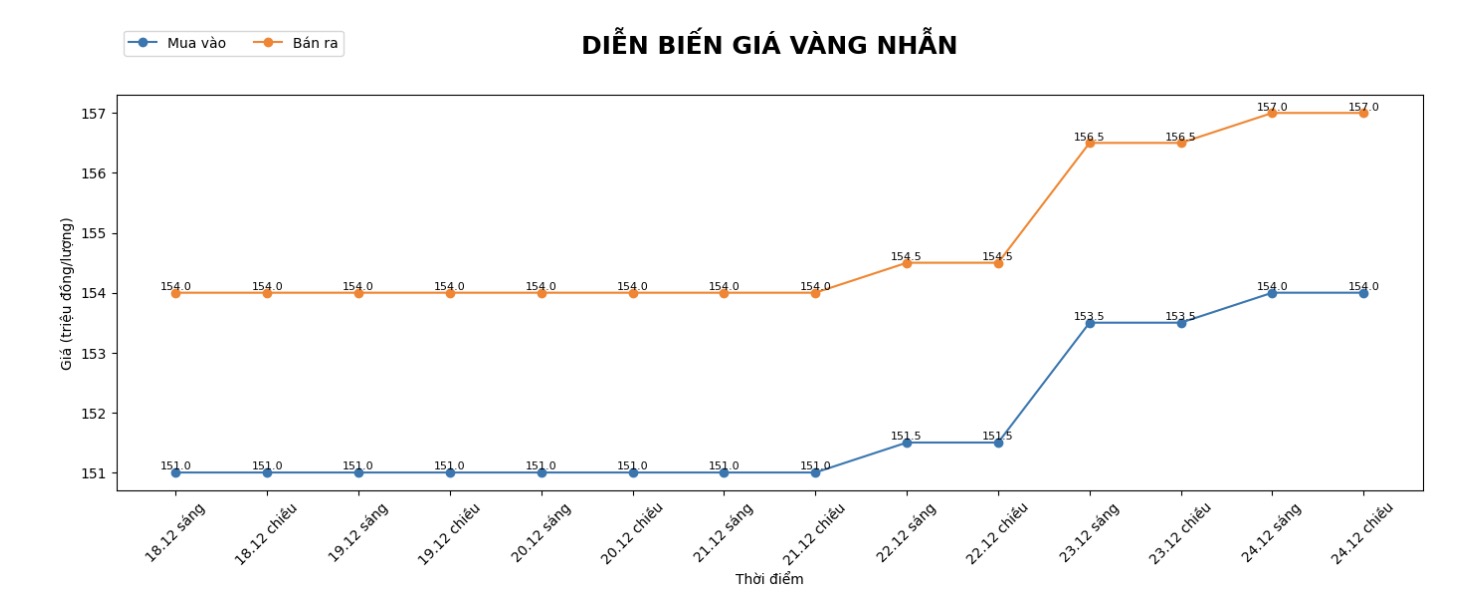

9999 gold ring price

As of 5:20 p.m., DOJI Group listed the price of gold rings at 154-157 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 155.5-158.5 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 154.8-157.8 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

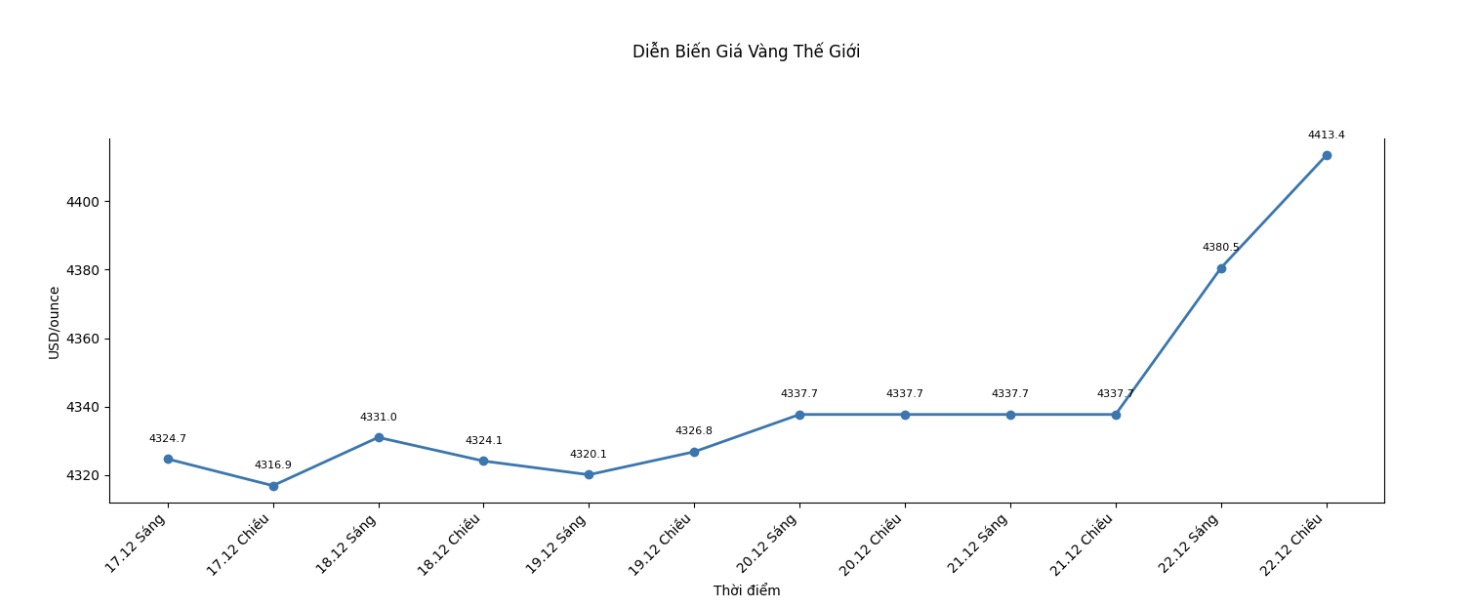

World gold price

The world gold price was listed at 5:20 p.m., at 4,492.5 USD/ounce, up 9.5 USD compared to a day ago.

Gold price forecast

According to Mr. Charlie Morris - Investment Director (CIO) and founder of ByteTree, the gold rally is likely to continue in 2026, even as Bitcoin, artificial intelligence (AI) and technology stocks may enter the correction phase. Notably, the weakening of the cryptocurrency market could also become a supporting factor for silver prices in the coming time.

ByteTree is the unit that builds the BOLD index, combining Bitcoin and gold according to the risk allocation method. On that basis, the 21Shares BOLD ETP fund is listed in many European markets.

The core theory of the BOLD index is that gold and Bitcoin are two alternative assets with low correlation, so balancing the portfolio between these two assets brings a big advantage in the long term.

Mr. Morris said he is still very optimistic about the long-term outlook for both Bitcoin and gold. Five years ago, when the precious metals market had not yet entered its current strong uptrend, he predicted that gold prices could reach $7,000/ounce by 2030 - a figure that was considered beyond imagination at that time. However, with gold prices having risen by about $2,500 in just the past five years, this forecast is increasingly taken seriously.

According to Mr. Ilya Spivak - Head of Global Macro at Tastylive, the precious metal is increasingly speculative, associated with the view that in the context of de- globilization, investors need an asset that plays a neutral intermediary role, not subject to sovereignty risks, especially when tensions between the US and China continue.

Mr. Spivak believes that thin liquidity at the end of the year has affected the recent price increase, but the general trend is likely to continue. Accordingly, gold prices may move towards the 5,000 USD/ounce mark in the next 612 months, while silver may approach the 80 USD/ounce level when the market reacts to important psychological thresholds.

Since the beginning of the year, gold prices have increased by more than 70% - the strongest increase in a year since 1979 - thanks to safe-haven demand, expectations of US interest rate cuts, strong central bank purchases, de-dollarization trends and cash flow into ETFs. The market is currently pricing in the possibility of two US interest rate cuts next year.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...