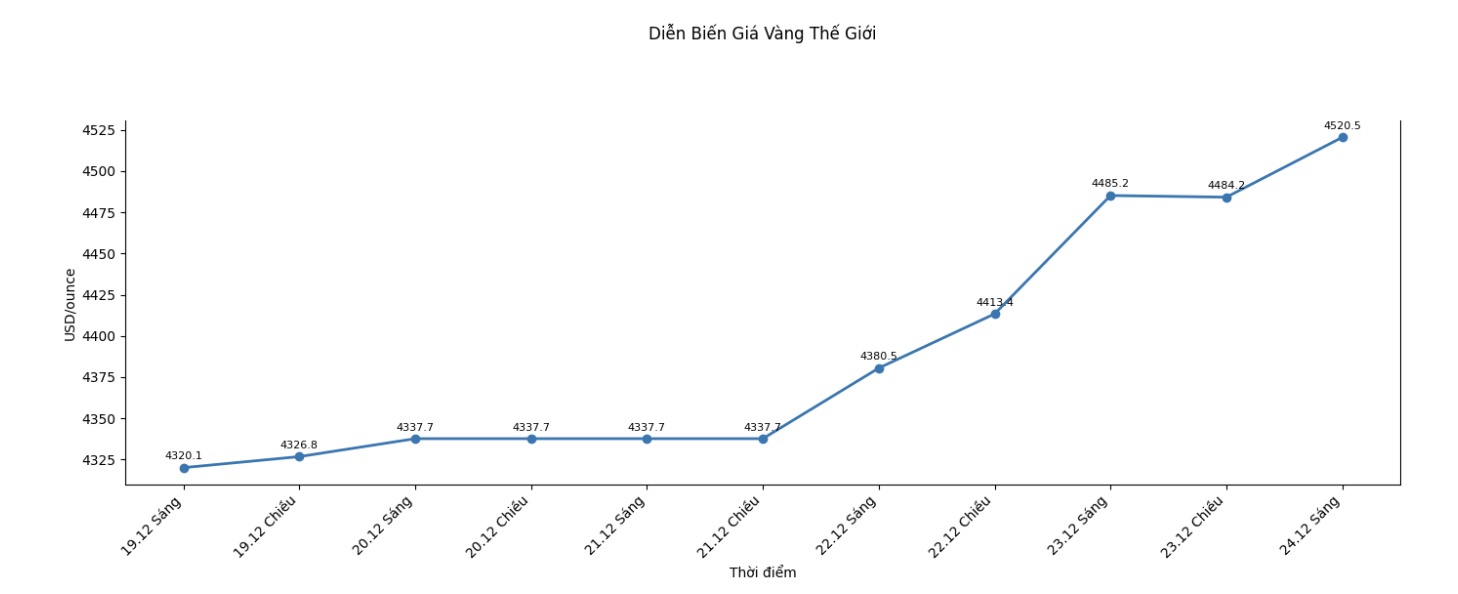

World gold prices continued to set a new record when they surpassed the 4,500 USD/ounce mark, in the context of escalating geopolitical tensions in Venezuela and expectations of the US continuing to loosen monetary policy. Along with gold, silver and platinum prices also increased sharply, setting all-time highs, reflecting the wave of cash flow into the precious metal group.

In the latest trading session, spot gold prices at one point reached 4,525.77 USD/ounce, before adjusting slightly. Gold's rally has been reinforced by its safe-haven role, especially after the US increased pressure on Venezuela through the blockade of oil tankers. Prolonged geopolitical tensions have increased demand for gold as a hedge against risk, especially in the context of uncertain economic prospects and global monetary policy.

At the same time, the market is betting that the Federal Reserve will continue to cut interest rates next year, after three consecutive interest rate cuts. The low interest rate environment reduces the attractiveness of fixed-yield assets, while supporting the prices of non-yielding precious metals such as gold and silver. The USD is also under pressure to decrease, thereby further supporting the increase in gold prices in the greenback.

Since the beginning of the year, gold prices have increased by more than 70%, towards the strongest annual increase since 1979. This increase is not only short-term but also supported by structural factors. According to World Gold Council data, total gold holdings in gold ETFs have increased for most of this year, reflecting the increasingly clear trend of asset diversification by global investors.

One of the important drivers of the gold market is persistent buying from central banks. This demand has remained high for many consecutive years, as countries seek to reduce their dependence on the USD and increase the proportion of gold in foreign exchange reserves. Although the expected buying volume this year is lower than last year, analysts still consider this a large buying level in terms of absolute value, enough to create a solid foundation for gold prices in the medium term.

Gold ETFs also play a pivotal role in the current price increase. Gold holdings in SPDR Gold Trust the worlds largest gold ETF have increased by more than 20% since the beginning of the year, showing that institutional investors continue to view gold as a value- preservation channel in the context of increasing macro risks. According to analysts, the combination of physical demand and financial investment flows is creating a more sustainable demand base compared to previous price increase cycles.

After adjusting from the peak of 4,381 USD/ounce in October - when the market was considered too hot - gold prices have quickly recovered. This development shows that the platform demand is still strong enough to absorb profit-taking pressure, thereby strengthening the prospect of maintaining an upward trend next year. In that context, Goldman Sachs Group Inc. forecasts gold prices could reach $4,900/ounce by the end of 2026, with the risk of leaning up if supporting factors continue to persist.

Not only gold, the silver market also recorded a remarkable increase. Silver prices have risen more than 150% this year, surpassing the $70/ounce mark for the first time and setting new records. Unlike previous increases that were largely based on financial leverage, the current increase in silver is said to be supported by physical demand, in the context of supply at many major trading centers being disrupted after a "short squeeze" in October.

platinum also emerged as a bright spot, rising as much as 160% since the beginning of the year and surpassing the $2,300/ounce mark the highest level since Bloomberg began data counting. Tight supply, high borrowing costs and production disruptions in South Africa are pushing the platinum market into the third consecutive year of shortages, thereby strengthening the long-term uptrend of this metal.

In general, the fact that gold prices have exceeded 4,500 USD/ounce not only reflects short-term fluctuations in the market, but also shows the growing role of gold in the global investment portfolio.

In the context of low interest rates, a weak USD and geopolitical risks showing no signs of cooling down, the question is no longer whether gold prices will remain high, but whether the scenario of reaching 4,900 USD/ounce by the end of 2026 will become a reality.