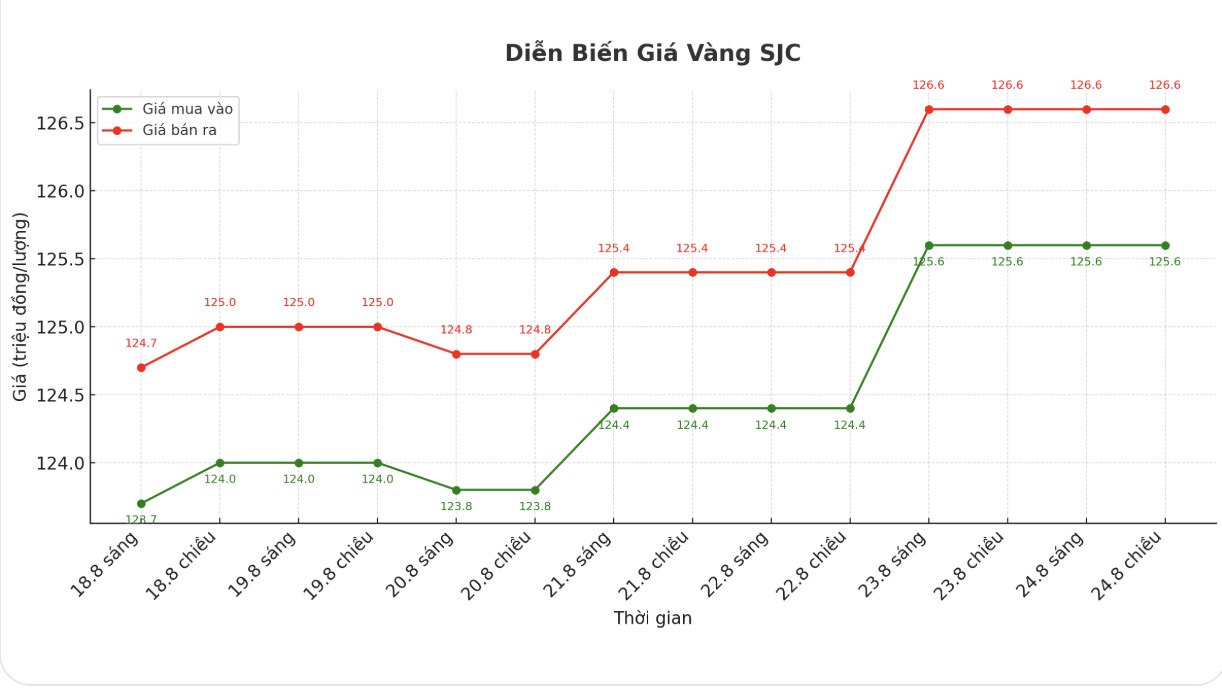

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by DOJI Group at VND125.6-126.6 million/tael (buy in - sell out). The difference between buying and selling prices is at 1 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 125.6-126.6 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 124.6-126.6 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

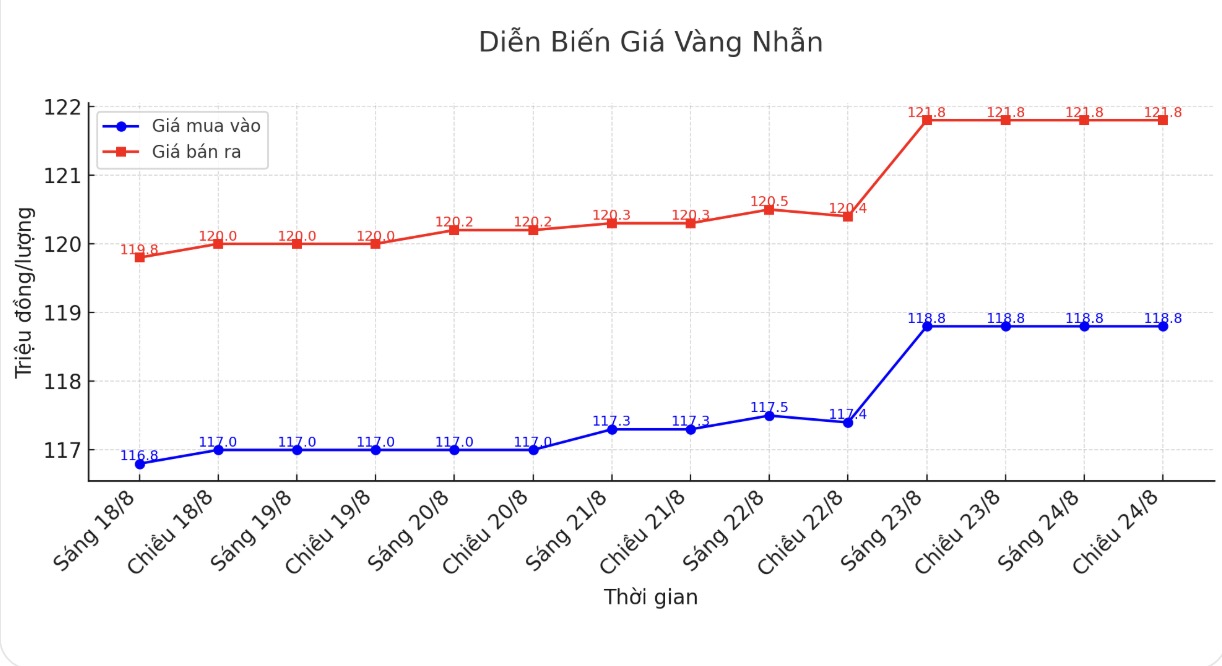

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 118.8-121.8 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 119-122 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 118.3-121.3 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

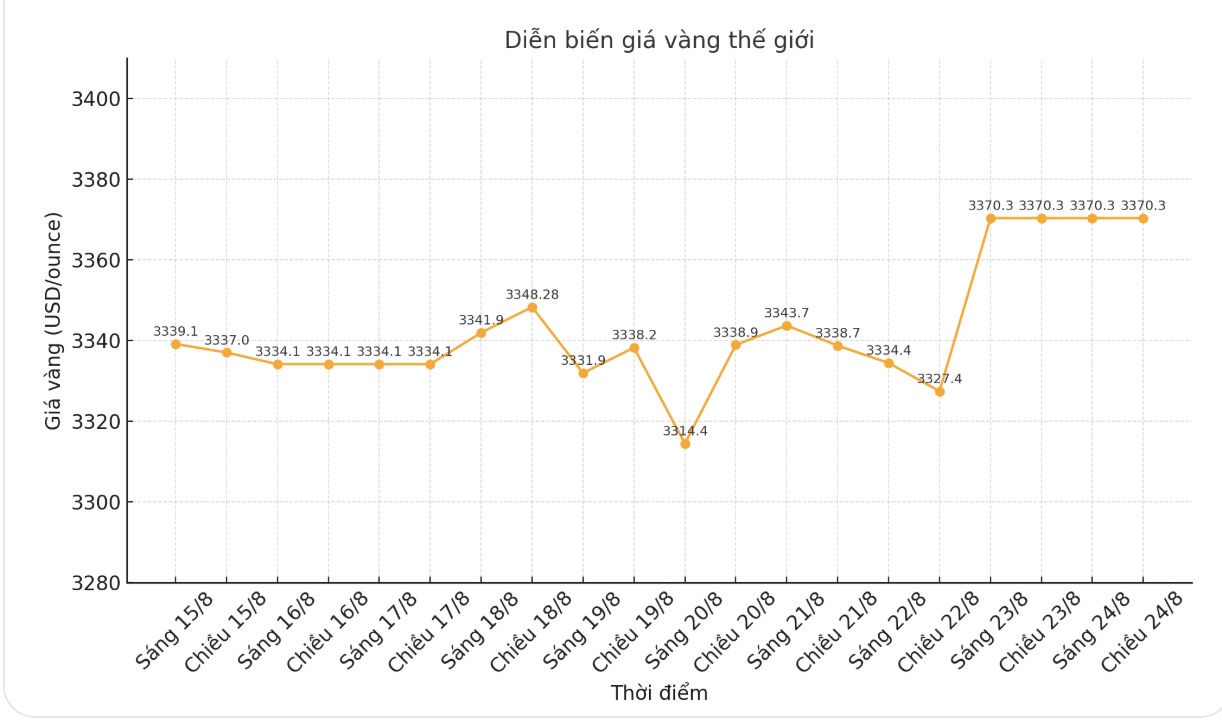

World gold price

The world gold price was listed at 6:00 a.m. at 3,370.3 USD/ounce.

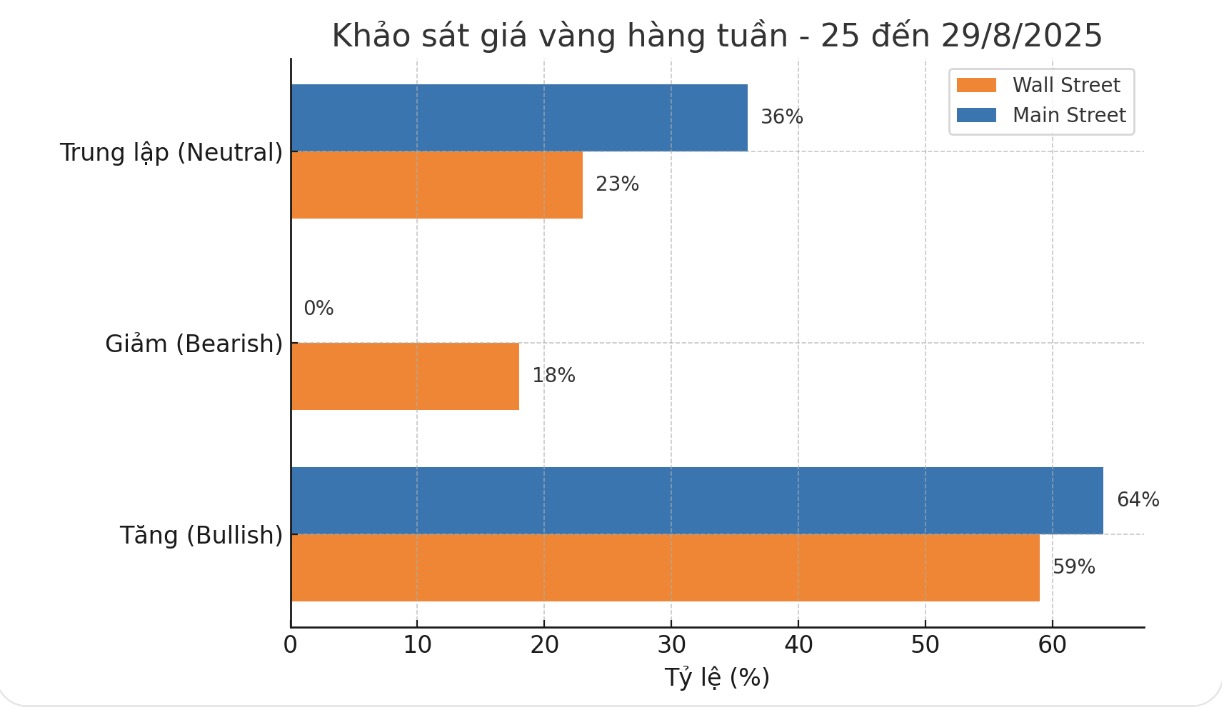

Gold price forecast

The dovish signal from FED Chairman Jerome Powell at Jackson Hole last week sent the USD plummeting, creating a boost for gold and silver prices.

Federal Reserve Chairman Jerome Powell in his anticipated speech at the Jackson Hole Conference gave the dovish tone that the market expected, creating significant fluctuations in the currency and commodity markets.

Mr. Powell's carefully worded language has given traders a reassurance about the monetary policy roadmap, especially the signal that interest rate cuts are likely to start from next month.

The immediate market reaction was very clear: the USD weakened strongly as investors adjusted their expectations. The USD index fell 0. 90% to 97.73, reflecting the relationship between expectations of monetary easing and the strength of the greenback. The weakening of the US dollar has created favorable conditions for the precious metal, which often benefits in this context.

In addition to the FED factor, concerns about the independence of monetary policy also support gold. US President Donald Trump's announcement that he would remove Fed Governor Lisa Cook if she did not resign has raised concerns about political intervention, causing cash flow to seek safe assets.

This week, 13 market analysts participated in a gold survey, and none predicted a decrease in prices. Eight analysts (62%) see gold rising in the short term. Meanwhile, five analysts (38%) are neutral on the precious metal.

Meanwhile, an online poll of small investors recorded 194 votes. 115 retail traders (59%) expect gold prices to increase this week, 35 people (18%) predict gold will decrease, and the remaining 44 people (23%) believe that gold prices will move sideways in the short term.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...