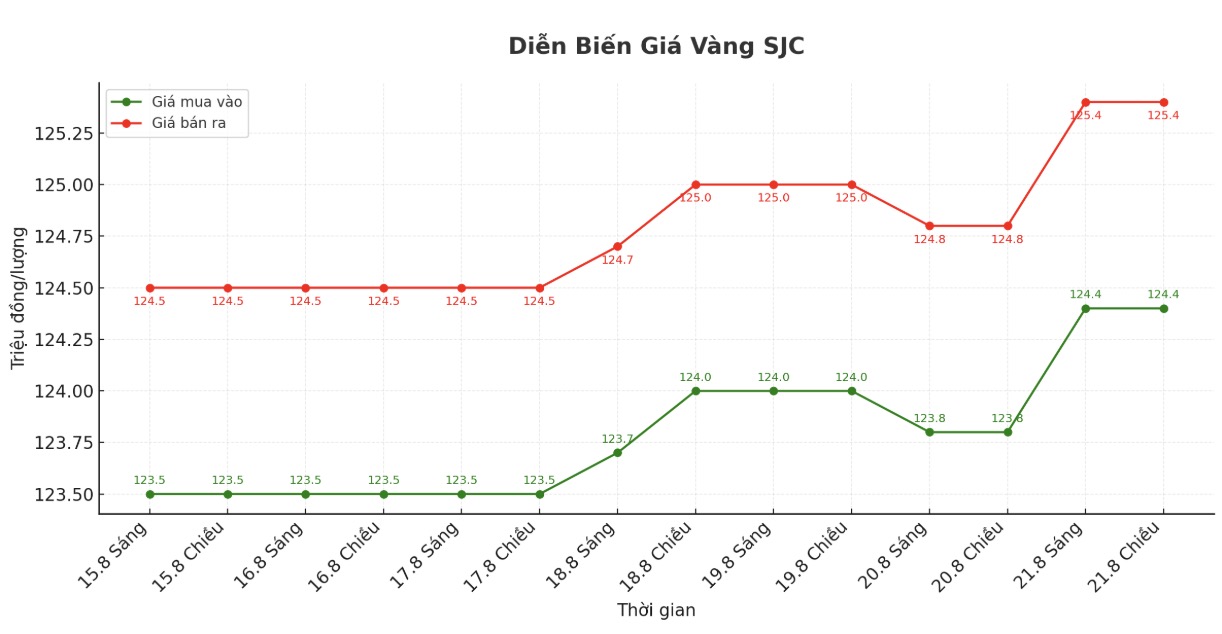

Updated SJC gold price

As of 9:05, the price of SJC gold bars was listed by DOJI Group at 124.4-125.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 124.4-125.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 123.4-125.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

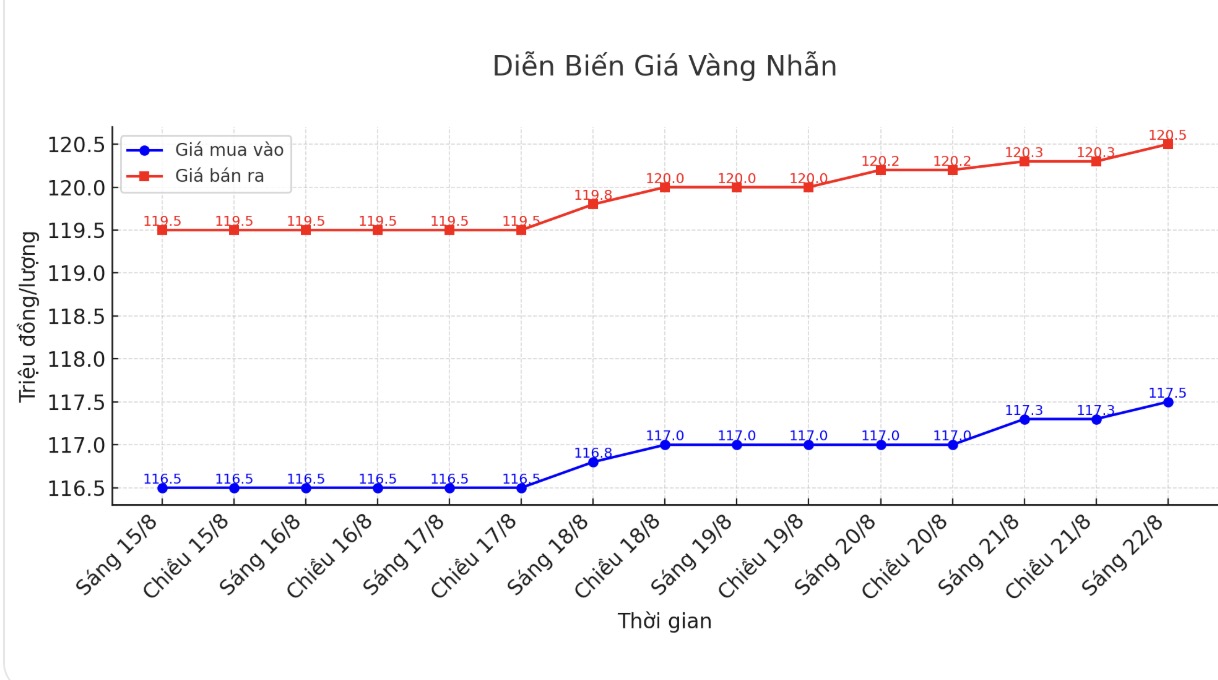

9999 round gold ring price

As of 9:07 a.m., DOJI Group listed the price of gold rings at 117.5-120.5 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.7/20.7 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 117.2-120.2 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

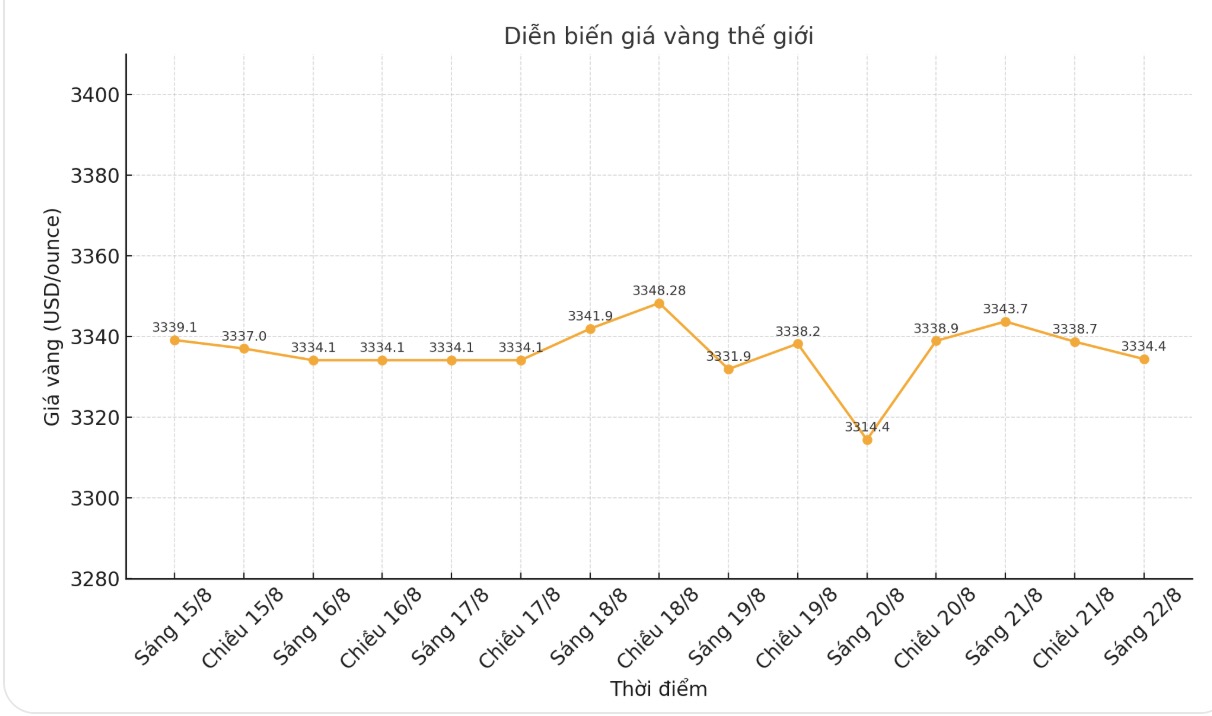

World gold price

At 8:55 a.m., the world gold price was listed around 3,334.4 USD/ounce, down 9.3 USD compared to a day ago.

Gold price forecast

According to experts, gold prices in the short term are unlikely to increase sharply, most likely continuing to move sideways. Some comments say that if the US Federal Reserve (FED) cuts interest rates by 0.25 percentage points as the market is predicting, gold prices could reach $3,400/ounce.

Conversely, if the Fed maintains its policy, the precious metal could slide to $3,300/ounce. In the context of increasing economic and geopolitical instability, gold is still considered a safe haven, but the upcoming trend will depend largely on the Fed's move.

Currently, world gold prices are in a slight correction as investors pay attention to the speech of FED Chairman Jerome Powell at the Jackson Hole conference - an annual event that has a great influence on global monetary policy.

The CME FedWatch tool shows that confidence in the possibility of the Fed cutting interest rates in September has declined significantly. If the probability was almost certain a week ago, now it is only about 75%.

The minutes of the July meeting also showed that only two members voted to lower interest rates, making the market even more cautious. This lack of expectations for policy easing has become the biggest obstacle for gold.

In fact, gold has gone through a series of 6 sessions of decline in the last 9 sessions. In just the past 10 days, gold futures have lost more than $100 worth, currently fluctuating around $3,384.5 an ounce.

From the historical peak set on April 22 to now, prices have only decreased by about 3.9%. In particular, over the past 80 days, gold has remained firmly above the threshold of 3,300 USD/ounce, showing significant resilience despite pressure from the USD and interest rates.

Analysts say that although short-term fluctuations may continue to occur, core factors driving gold are still positive. As long as the $3,300/ounce support zone has not been broken, the upward trend of gold in the medium and long term will continue.

There are growing expectations that the Fed Chairman will give a clear signal on a policy shift on Friday, but whether gold can bounce strongly to surpass the $3,400/ounce resistance level is still uncertain, said Fawad Razaqzada, an analyst at City Index and FOREX.com.

In another development, demand for gold reserves from central banks, especially China, will continue to be a factor supporting gold prices. However, investors' cautious sentiment in the face of political developments, such as US President Donald Trump's statement on intervention in the Fed, could cause short-term fluctuations.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...