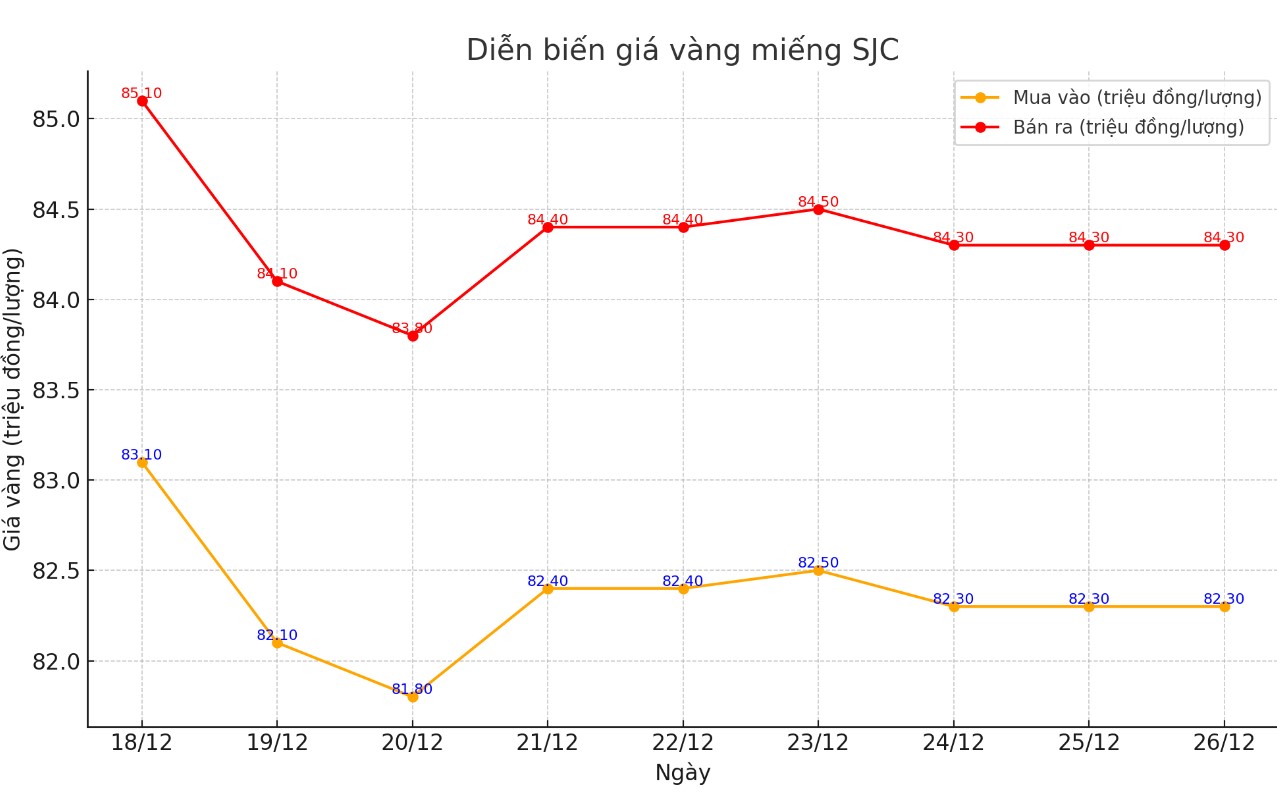

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 82.3-84.3 million VND/tael (buy - sell), unchanged in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 82.3-84.3 million VND/tael (buy - sell), unchanged in both directions.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.3-84.3 million VND/tael (buy - sell), unchanged in both directions.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around VND2 million/tael. Experts say that this difference is still very high, causing investors to face the risk of losing money when buying in the short term.

The difference between the buying and selling price is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

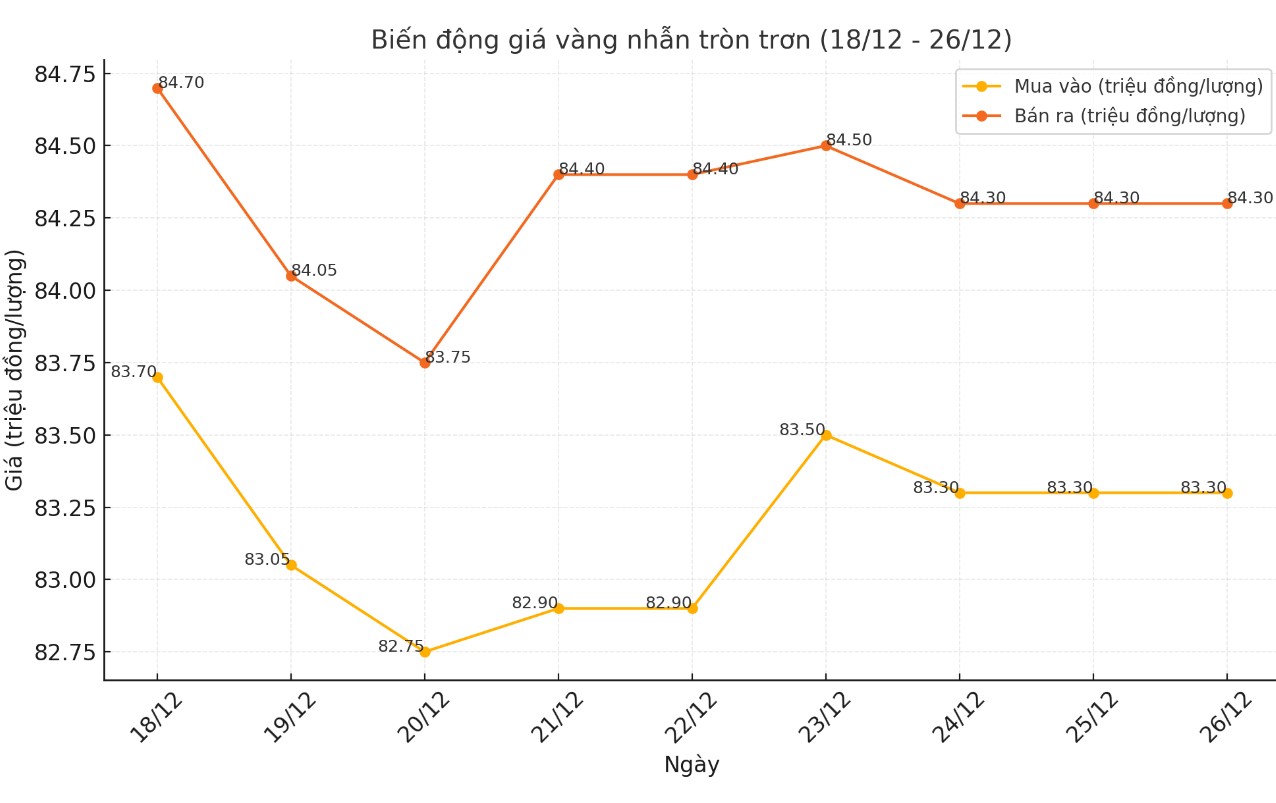

Price of round gold ring 9999

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.3-84.3 million VND/tael (buy - sell); both buying and selling prices remain the same compared to the beginning of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 82.5-84.3 million VND/tael (buy - sell), keeping both buying and selling prices unchanged compared to the beginning of yesterday's trading session.

World gold price

As of 1:30 a.m. on December 26 (Vietnam time), the world gold price listed on Kitco was at 2,616.8 USD/ounce, up 4.1 USD/ounce.

Gold Price Forecast

World gold prices increased despite the USD index remaining very strong. Recorded at 1:30 a.m. on December 26, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 108 points (up 0.18%).

World gold prices did not change much as the market rested during Christmas.

Gold prices continued to break records in 2024, rising by 27% compared to the beginning of the year. According to experts, this trend is likely to continue in 2025, driven by factors such as geopolitical tensions, demand for gold from central banks and loose monetary policies.

Zain Vawda, a market analyst at OANDA, predicts that if there are no major geopolitical changes, gold prices could stabilize around $2,800 an ounce. He believes that in the context of global economic and political instability, gold remains the leading safe investment channel.

George Milling-Stanley, chief gold strategist at State Street Global Advisors, believes that 2025 could be a milestone for gold prices, thanks to strong market support. According to State Street's forecast, gold prices have a 50% chance of staying in the $2,600-$2,900/ounce range and a 30% chance of exceeding $2,900-$3,100/ounce. Conversely, the possibility of gold prices falling to $2,200-$2,600/ounce is only 20%.

“We believe there is an 80% chance that gold prices will remain the same or move higher in 2025,” Milling-Stanley said, noting that the wider range of forecasts reflects the increasing uncertainty in global financial markets.

Meanwhile, Tom Bruce - macro investment strategist at Tanglewood Total Wealth Management - commented that gold prices will face some short-term obstacles, especially rising real yields and the US economy maintaining a stable growth rate.

According to Bruce, the yield on the 10-year US Treasury could surpass 5%, putting pressure on gold prices. However, he is optimistic that the precious metal will increase by about 10% next year, although it will not surpass the $3,000/ounce mark.

“Gold may be volatile in the short term, but the long-term uptrend is still maintained thanks to central bank buying, which is a big driver of the market,” Mr. Bruce shared.

Experts agree that 2025 will be a volatile but promising year for the gold market. Geopolitical tensions, global fiscal policy and the need to hoard gold will remain the main factors shaping prices. Despite short-term challenges, gold continues to assert its position as a safe haven asset amid potential risks.

See more news related to gold prices HERE...