SJC gold bar price

As of 6:00 a.m. on July 2, the price of SJC gold bars was listed by Saigon Jewelry Company at VND 118.7/20.7 million/tael (buy in - sell out); increased by VND 1.2 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 118.7 - 20.7 million VND/tael (buy - sell); increased by 1.2 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.7-120.7 million VND/tael (buy in - sell out); increased by 1.2 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.1-120.7 million VND/tael (buy - sell); increased by 1.3 million VND/tael for buying and increased by 1.2 million VND/tael for selling. The difference between buying and selling prices is at 2.6 million VND/tael.

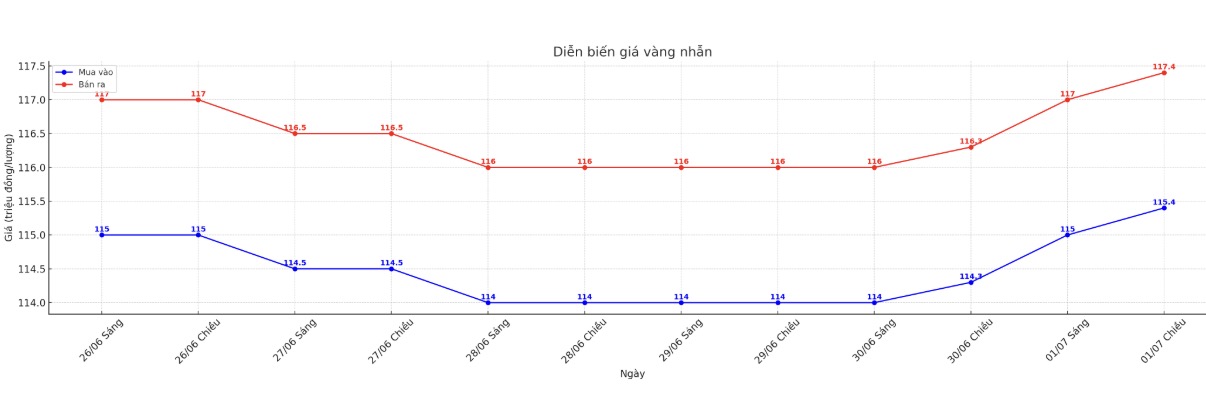

9999 gold ring price

As of 6:00 a.m. on July 2, DOJI Group listed the price of gold rings at VND 115.4-117.4 million/tael (buy - sell), an increase of VND 1.1 million/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.5-118.5 million VND/tael (buy - sell), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.3-117.3 million VND/tael (buy in - sell out), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

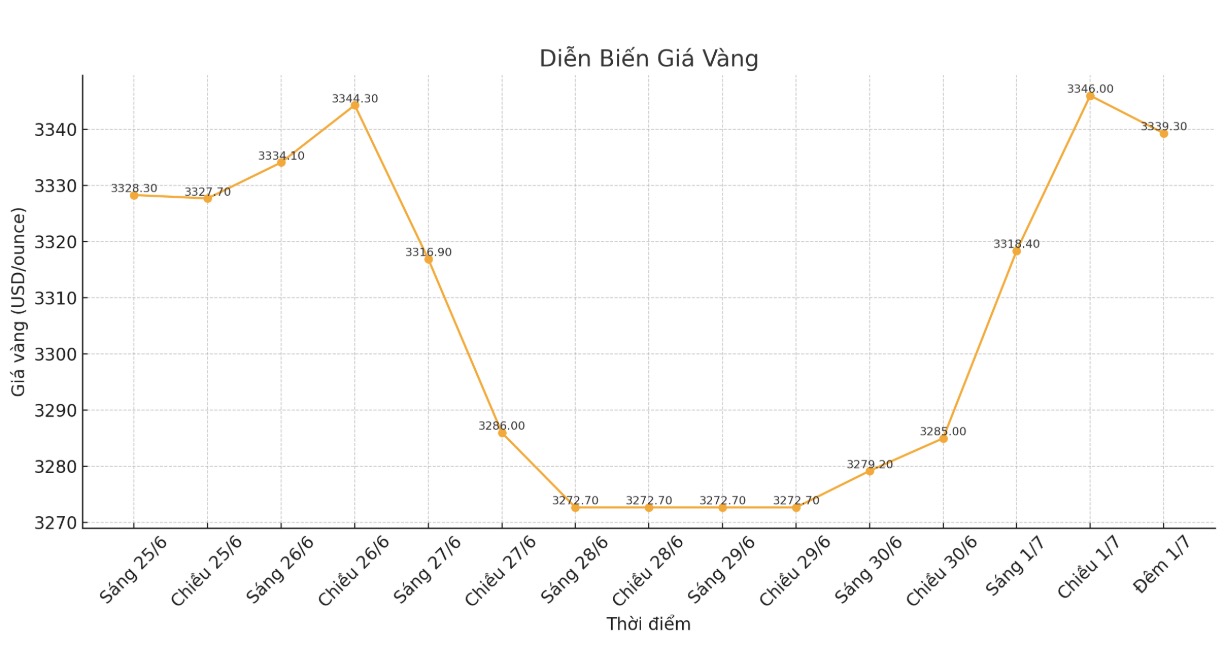

World gold price

Recorded at 22:50 on July 1, spot gold was listed at 3,339.3 USD/ounce, up 46.3 USD.

Gold price forecast

Gold prices have skyrocketed, silver prices have also increased solidly in today's trading session. The two precious metals were supported by the weakening USD index, falling to its lowest level in 3.5 years overnight.

In addition, falling US Treasury yields create more favorable conditions for gold if the US Federal Reserve (FED) considers lowering interest rates.

August gold contracts increased by 54.9 USD, to 3,362.7 USD/ounce. September delivery silver price increased by 0.513 USD, to 36.685 USD/ounce.

Asian and European stocks fluctuated in opposite directions overnight. US stock indexes are expected to open down today in New York, due to profit-taking after Nasdaq and the S&P 500 both set new records in the second session.

In overnight news, the June consumer price index (CPI) of the Eurozone increased by 2.0% compared to the same period last year, in line with market forecasts and higher than the 1.9% increase in May.

Traders are starting to pay attention to the US Department of Labor's June employment report, due out on Thursday (a day earlier due to the US National Day holiday on July 4). The non-farm payrolls figure is forecast to increase by 110,000, down from the 139,000 increase in the May report.

Technically, gold buyers for August delivery are still holding the advantage in the short term. The next upside target for buyers is to close above the resistance level of $3,400/ounce. On the contrary, the sellers aim to push the price below 3,200 USD/ounce.

The first resistance level was seen at $3,375/ounce, then $3,400/ounce. First support was $3,350/ounce, followed by an overnight low of $3,313.70/ounce.

In outside markets, the USD index continued to weaken and hit a 3.5-year low overnight. Nymex crude oil futures increased slightly, trading around 65.75 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.19%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...