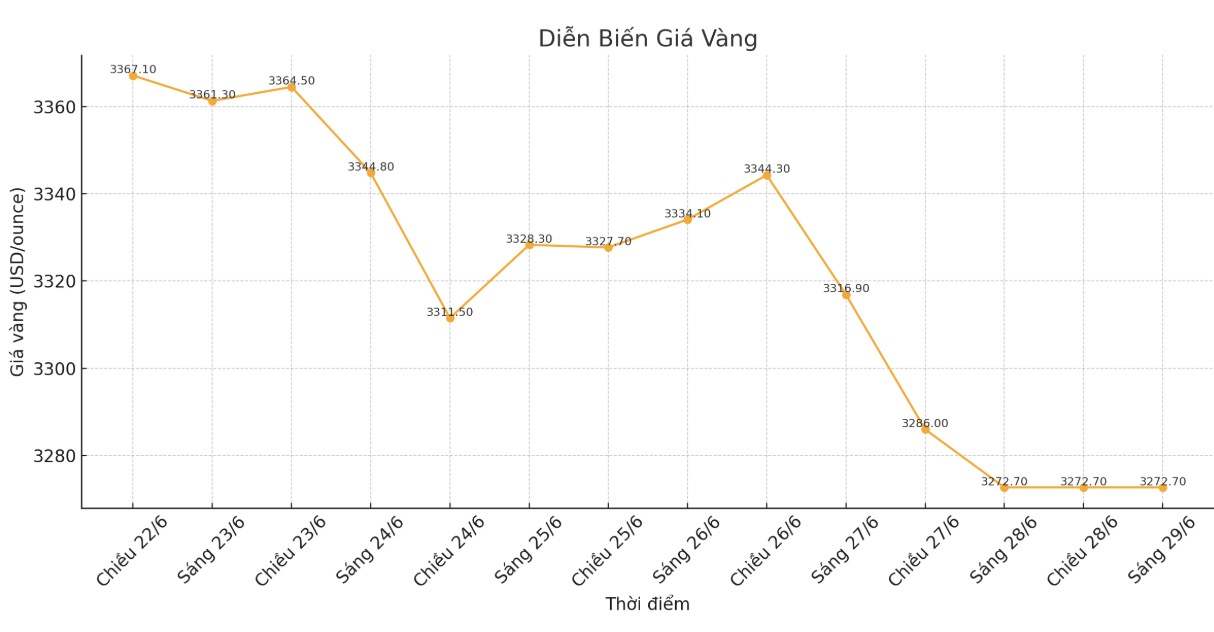

Gold price developments last week

After a week of geopolitical tensions that did not flare up as worried, economic data continued to cool down, the buying pressure for speculative prices on gold seems to have exhausted. Gold prices fell below $3,300/ounce.

Spot gold prices started the week at $3,380.1 an ounce, but the precious metal quickly lost momentum and rarely remained above this threshold in the following sessions.

After falling and testing the short-term support zone around $3,350/ounce, gold prices rebounded to $3,380/ounce at 7:45 a.m. (EDT) Monday morning. At 12:30 noon, spot prices hit a weekly peak of $3,391/ounce.

However, the support zone of $3,350/ounce quickly turned into resistance from the Asian trading session that evening. At 2:30 a.m. EDT. Tuesday, gold prices fell below $3,320 an ounce. When the North American market opened, the precious metal slid below $3,300/ounce for the first time.

Gold prices then recovered slightly, maintaining trading in the range of 3,315 to 3,350 USD/ounce for the next two days. However, gold could not overcome this resistance zone. By the end of Thursday, spot prices fell below $3,300/ounce.

This time, gold is out of sync. Prices continued to weaken throughout trading sessions in Asia and Europe on Friday, finally reaching the bottom of the week at $3,256/ounce just 15 minutes before the North American market opened.

prices then recovered to around $3,275/ounce at 10:15 a.m., but that was also a final effort. By the end of the weekend trading session, gold prices fluctuated within a narrow range of about 10 USD and closed at 3,272.7 USD/ounce.

Market sentiment

A weekly gold market survey by a unit that tracks precious metals shows that industry experts are increasingly pessimistic about the short-term outlook for gold, while individual investors are still maintaining a slightly inclined towards the uptrend.

This week, 17 Wall Street experts participated in the survey. Experts say increased risk appetite has reduced the attractiveness of gold. Six (35%) predict gold prices will rise next week, nine (53%) see prices falling, while the remaining two (12%) see prices moving sideways.

Meanwhile, 233 votes in Kitco's online survey showed that individual investors still tend to be more optimistic. There are 119 people (51%) expecting prices to increase, 63 people (27%) predict prices to decrease, while the remaining 49 people (21%) think prices will move sideways.

Notable US economic data next week

After a week of market focusing on US consumer health data, next week investors will focus on the employment report and production and service data, in the context of the US National Day holiday (July 4), causing the information announcement schedule to be adjusted.

The ISM manufacturing PMI and the JOLTS vacant employment data will be released on Tuesday. Wednesday is the ADP jobs report. Thursday, the market will receive the US non-farm payrolls report (issued earlier than usual), weekly jobless claims and ISM service PMI.

See more news related to gold prices HERE...