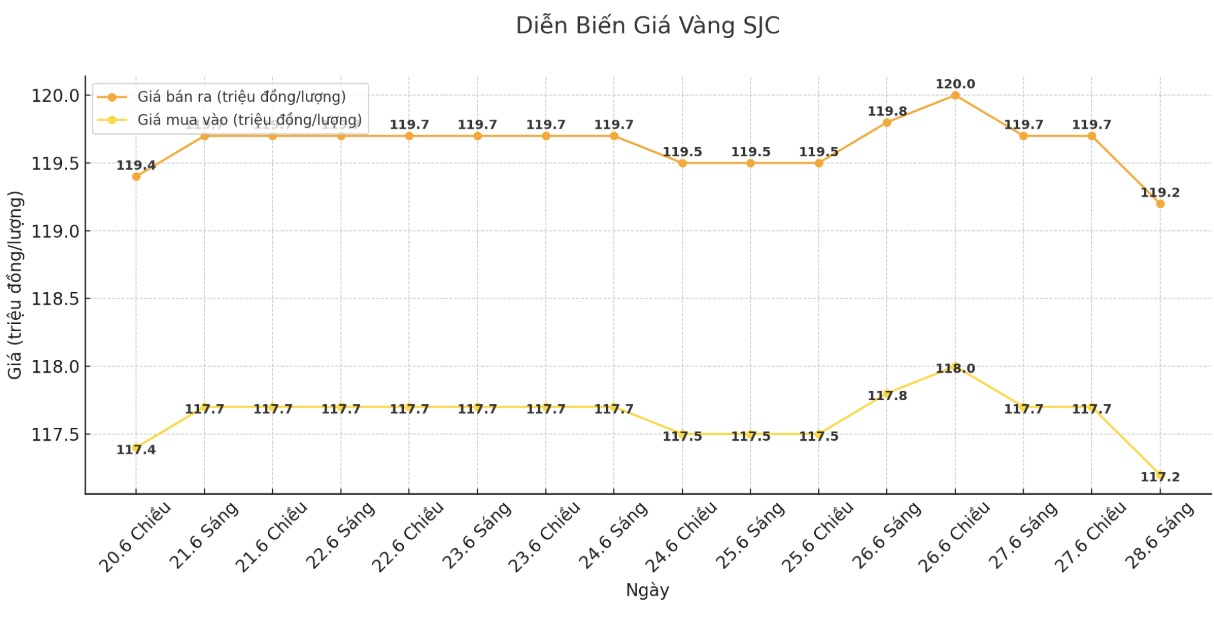

SJC gold bar price

As of 6:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.2-119.2 million VND/tael (buy in - sell out); down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 117.2-119.2 million VND/tael (buy - sell); down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.2-119.2 million VND/tael (buy in - sell out); down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 116.5-119.2 million VND/tael (buy - sell); down 700,000 VND/tael for buying and down 500,000 VND/tael for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

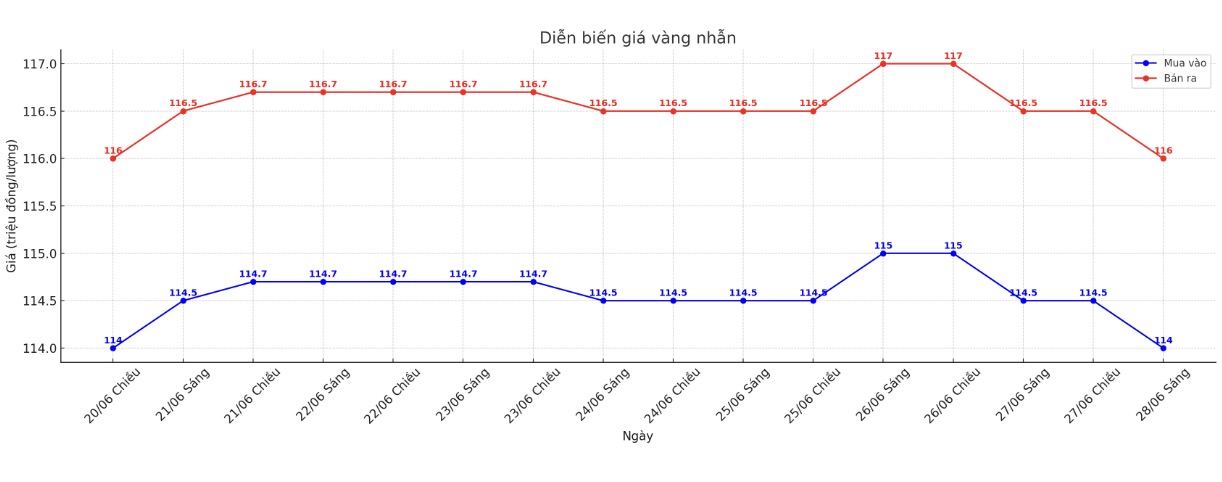

9999 gold ring price

As of 5:45 p.m., DOJI Group listed the price of gold rings at 114-116 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.1-117.1 million VND/tael (buy - sell), down 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.1-116.1 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

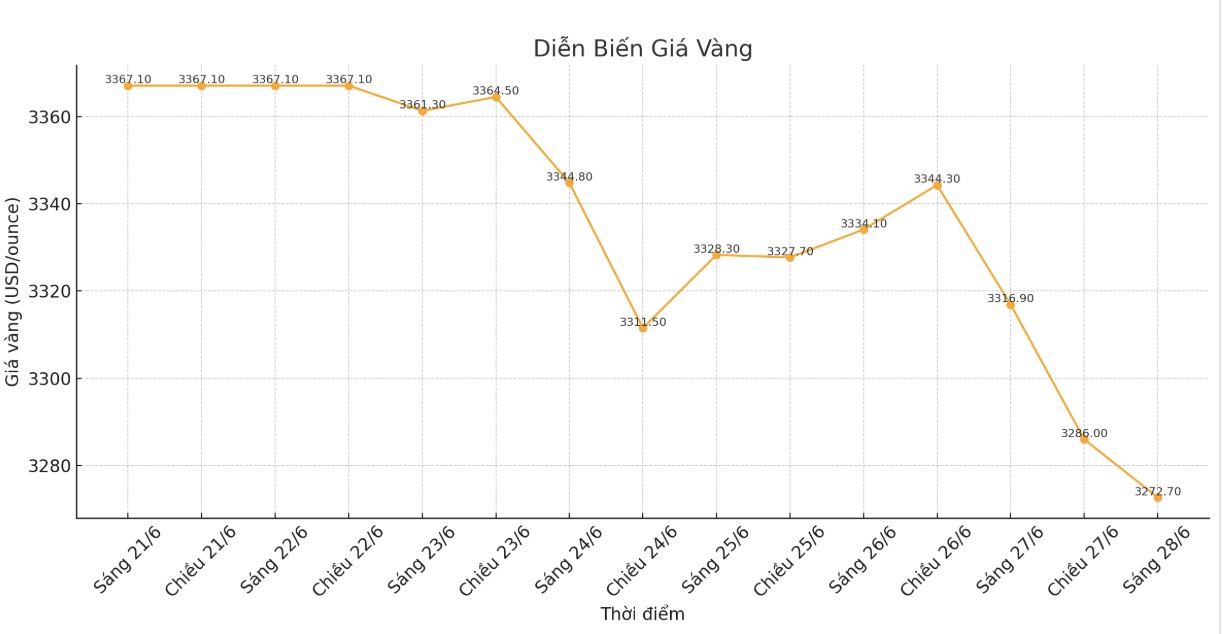

World gold price

The world gold price was listed at 6:10 p.m. at 3,272.2 USD/ounce, down 13.9 USD.

Gold price forecast

Jesse Colombo, an independent precious metals analyst and author of the Bubble Bubble report, said investors should prepare for a short-term downside scenario as the summer trading season begins next week with a long weekend on July 4.

Colombo expects gold prices to remain within a wide range of $3,200 to $3,500/ounce. Gold prices have fallen nearly 3% for the week. Despite the decline, the precious metal still maintained the initial support level of 3,250 USD/ounce.

In addition to the seasonal factor, economic sentiment has improved as the US signals progress on trade agreements and a ceasefire between Israel and Iran to ease regional tensions.

With the US and China completing their trade framework and Israel/Iran respecting the ceasefire agreement, investors are rushing back on risky assets, withdrawing capital from safe havens. This market sentiment could put additional downward pressure on gold prices ahead of a new eventful week, said Lukman Otunuga, senior analyst at FXTM.

Overall, gold is getting negative, heading for the second consecutive week of decline. If it closes below $3,300/ounce for the week, prices could fall to $3,250/ounce and even the psychological mark of $3,200/ounce. Conversely, if it breaks above $3,300 an ounce again, gold could recover to $3,330 - $3,360/ounce, he added.

Meanwhile, Robert Minter - ETF Strategy Director predicted that gold prices will continue to accumulate as the US Federal Reserve (FED) maintains a neutral monetary policy.

WisdomTree expert Nitesh Shah said that gold prices have previously increased sharply and are now adjusting the market back to a more reasonable level after that period of hot increase.

Some experts from the US Federal Reserve (FED) such as Neel Kashkari and Thomas Barkin believe that new tariff policies could increase inflation in the next few months. However, if interest rates remain high, gold will be less attractive because it does not bring interest rates like other assets, such as bonds.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...