SJC gold bar price

As of 5:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.5-111.5 million VND/tael (buy in - sell out); increased by 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 117.5-111.5 million VND/tael (buy - sell); increased by 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.5-111.5 million VND/tael (buy in - sell out); increased by 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 116.8-111.5 million VND/tael (buy - sell); increased by 500,000 VND/tael for buying and decreased by 500,000 VND/tael for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

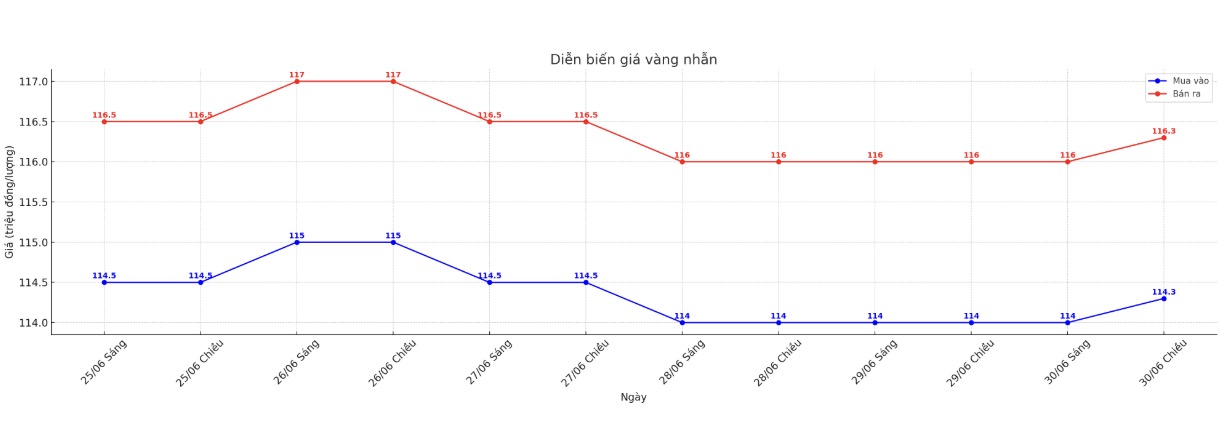

9999 gold ring price

As of 5:30 p.m., DOJI Group listed the price of gold rings at 114.3-116.3 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.4-117.4 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.3-116.3 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

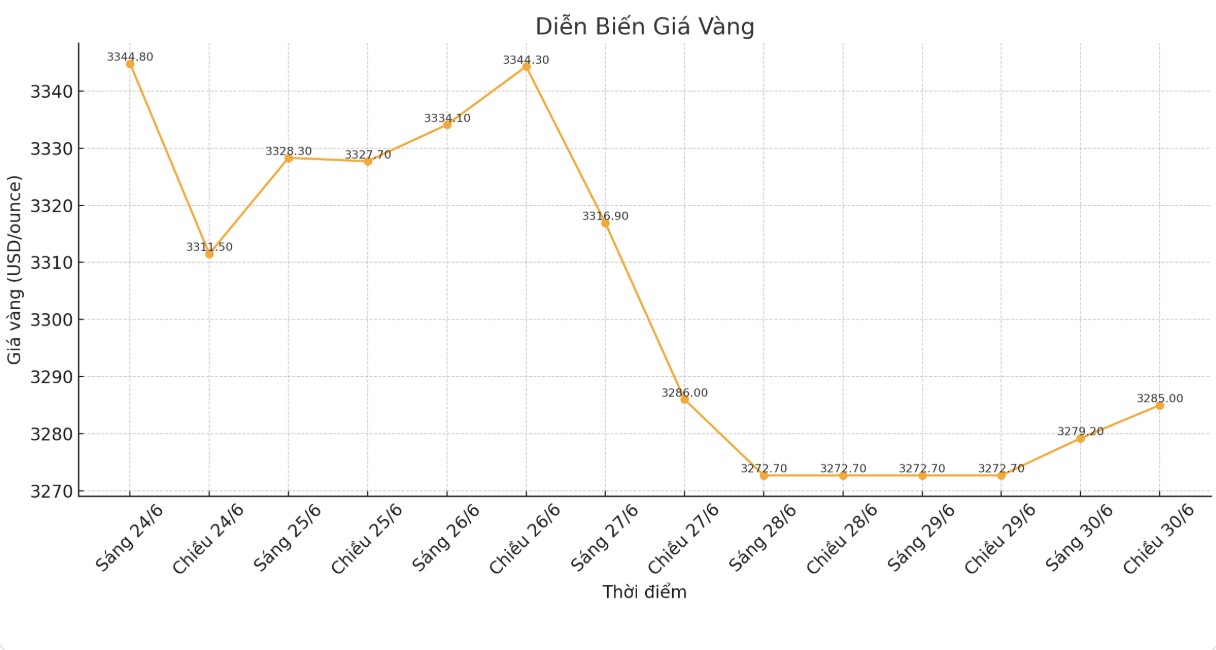

World gold price

The world gold price was listed at 5:30 p.m. at 3,285 USD/ounce, up 12.8 USD.

Gold price forecast

Gold prices reversed and increased slightly in the trading session on Monday. The precious metal is supported by a weakening US dollar, after hitting its lowest level in more than a month before due to the ease of US-China trade tensions, reducing safe-haven demand and promoting risk-taking psychology.

There is not much optimism surrounding tariff negotiations and events in the Middle East, which puts gold at a disadvantage compared to risky assets, said Tim Waterer, market analyst at KCM Trade.

Asian stocks flourished, Wall Street futures increased, while the USD (.DXY) index decreased by 0.3%. A weak US dollar makes USD-denominated gold cheaper for buyers holding other currencies.

The US and China have addressed issues related to rare earth and magnet exports to the US, Finance Minister Scott Bessent said on Friday. He added that the Trump administration could complete many other trade deals before the September 1 Labor Day holiday.

Canada also lifted digital service tariffs targeting US technology companies late Sunday, just hours before they were officially applied, to promote the stalemate of trade negotiations with the US.

The ceasefire between Iran and Israel after 12 days of conflict has been maintained, further reducing demand for shelter in gold.

The US dollar continues to be under pressure, which is limiting golds decline. However, the 3,250 USD/ounce threshold is considered an important support level. If it breaks through this mark, gold could fall sharply to $3,200, Waterer added.

When the geopolitical and economic situation is stable, demand for gold as a safe asset often decreases. In addition, in the context of high interest rates, the attractiveness of non-interest-bearing assets such as gold is further weakened.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...