SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 157.4-159.4 million VND/tael (buying - selling), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 157.4-159.4 million VND/tael (buying - selling), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at the threshold of 156.2-159.2 million VND/tael (buying - selling), an increase of 400,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of gold rings at the threshold of 154-157 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 156.3-159.3 million VND/tael (buying - selling), an increase of 1 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 155.2-158.2 million VND/tael (buying - selling), an increase of 700,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

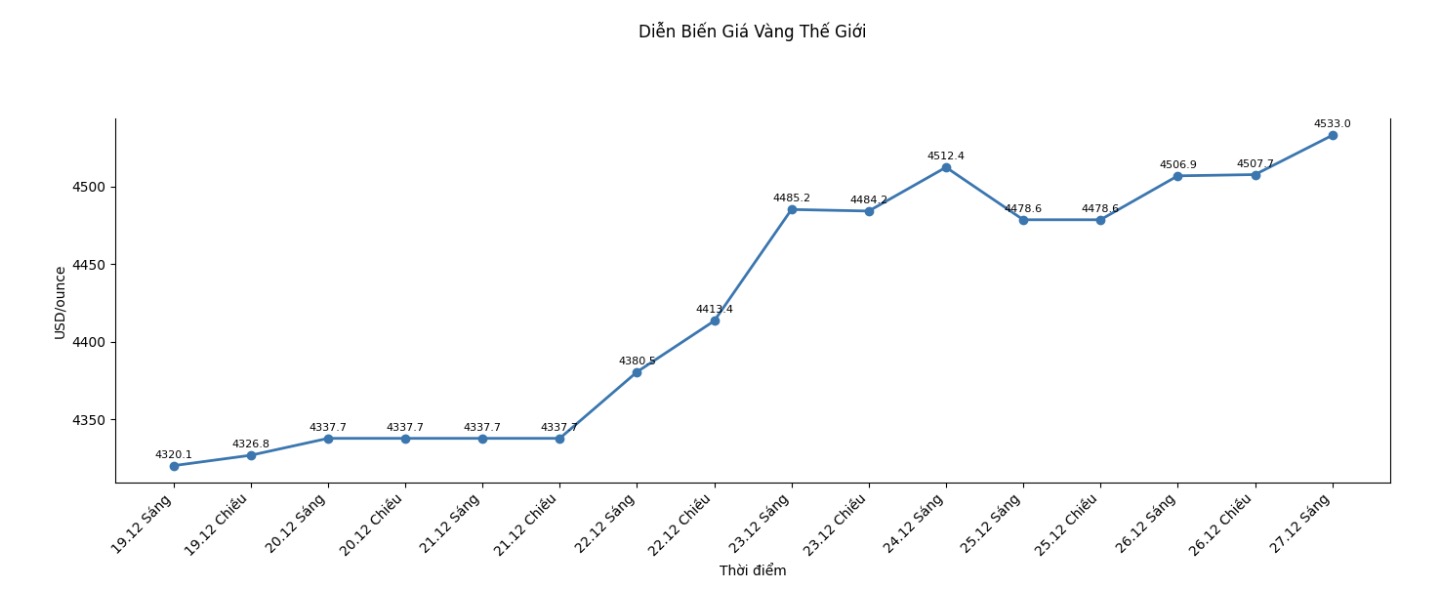

World gold price

World gold prices listed at 6:00 am were at 4,533 USD/ounce, up 54.4 USD/ounce compared to the previous day.

Gold price forecast

The world gold market surged, continuing to show strength in the trading session last night.

Gold price outlook in 2026 is being assessed very positively by major financial institutions, in the context of prolonged geopolitical instability, the trend of monetary policy easing and the process of diversifying global reserves becoming increasingly clear.

According to Goldman Sachs commodity strategists, gold is considered the most attractive investment channel in the entire commodity group in the coming year. This bank believes that if not only central banks but also private investors strongly hold gold, precious metal prices could completely exceed the base level of 4,900 USD/ounce.

Goldman Sachs believes that the US-China strategic competition in the fields of technology, artificial intelligence and geopolitics, along with major fluctuations in the global energy market, will continue to shape commodity trends.

In the base scenario, solid global GDP growth and the US Federal Reserve (Fed) cutting interest rates by about 50 basis points in 2026 will create a favorable environment for gold and precious metals.

Notably, Goldman Sachs is particularly optimistic about gold due to persistent purchasing power from central banks. Forecasts in 2026, the amount of gold purchased by central banks may reach an average of about 70 tons per month, many times higher than the period before 2022. The reason comes from concerns about geopolitical risks after Russia's freezing of foreign exchange reserves, the proportion of gold in the reserves of many emerging economies – especially China – remains low, along with record gold demand according to international surveys.

Regarding specific price movements, Goldman Sachs forecasts that gold may adjust to the 4,200 USD/ounce zone in the first quarter of 2026, then recover to over 4,400 USD in the second quarter, setting a new historical peak around 4,630 USD in the third quarter and approaching the 4,900 USD/ounce mark by the end of the year. In the context of fiscal, geopolitical and monetary risks still present, gold continues to be considered the top safe-haven and value preservation asset in 2026.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...