In the most active forecast group, J.P. Morgan Global Research ( global research and analysis department of JPMorgan Chase & Co., one of the world's largest investment banks) believes that gold prices could average around $5,055/ounce in the fourth quarter of 2026.

According to this research team, in the scenario of continued increase in investment demand and central banks maintaining strong net buying, gold prices could even approach the 5,400 USD/ounce range.

J.P. Morgan Global Research emphasized that prolonged geopolitical risks, along with high public debt levels in many major economies, will continue to drive capital flows to safe-haven assets such as gold.

Sharing the same view on the uptrend, Goldman Sachs (a multinational investment bank and financial services corporation headquartered in the US) predicts that gold prices could reach around $4,900/ounce in December 2026.

According to Goldman Sachs, the global monetary policy cycle is gradually shifting from a tightening to an easing phase, causing the opportunity cost of holding gold to drop significantly.

The organization also noted that inflation, despite signs of cooling down in some economies, still risks staying above medium-term targets, thereby strengthening gold's risk-off role.

From a market structure perspective, the World Gold Council believes that 2026 may witness strong fluctuations in gold prices.

The World Gold Council believes that the interweaving of supporting and hurting factors will prevent the gold market from following a direct uptrend. While demand from central banks and long-term investors continues to play a pivotal role, the possibility of a global economic recovery or the strengthening of the USD could create deep corrections in the short term.

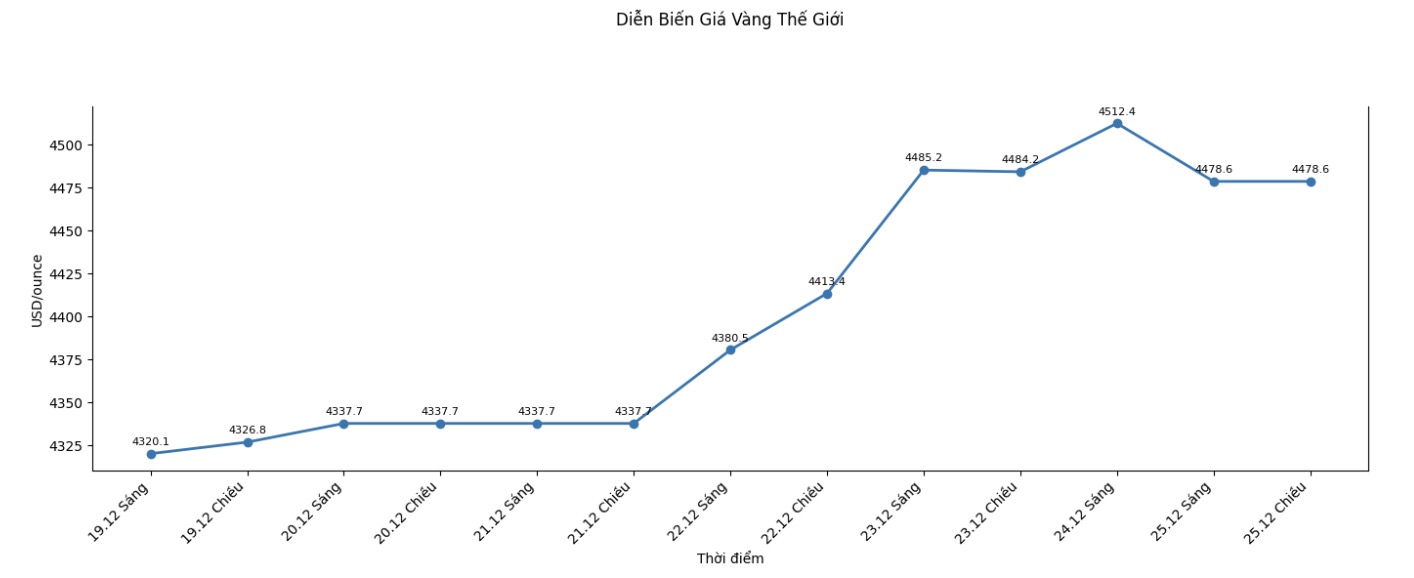

Some analysts and other market strategy groups have offered a more moderate scenario, according to which gold prices in 2026 may fluctuate commonly in the range of 4,500 4,800 USD/ounce.

These forecasts say that although gold is still supported by a high-risk environment and more loose monetary policy, the increase may be limited if the global economy improves significantly and investor risk appetite increases. However, even in this scenario, the forecast price is still significantly higher than the average of many decades ago.

Some detailed analysis reports even put the average price of gold for the whole year of 2026 at around 4,300 4,400 USD/ounce. This is considered a balancing scenario between positive factors and underlying risks, reflecting the view that gold will maintain a long-term uptrend but cannot avoid cyclical adjustment periods. Experts say this price is still enough to affirm the strategic role of gold in the global investment portfolio.

In addition to forecast figures, many institutions also emphasized the growing role of central banks in the gold market. Continuous net buying in recent years has been seen as a fundamental factor, helping the gold market to have higher stability against short-term shocks. At the same time, the trend of diversifying foreign exchange reserves and reducing dependence on strong currencies continues to be seen as a long-term driving force to support gold prices.

The outlook for gold prices in 2026 is generally assessed in a positive direction, but there are no signs of strong fluctuations. The actual market developments will depend largely on the direction of global interest rates, the strength of the USD and the geopolitical situation.

In that context, gold continues to be seen as a long-term strategic asset, but experts recommend that investors be cautious with hot spikes and be ready to face unexpected corrections in the precious metal's upward journey.

See more news related to gold prices HERE...