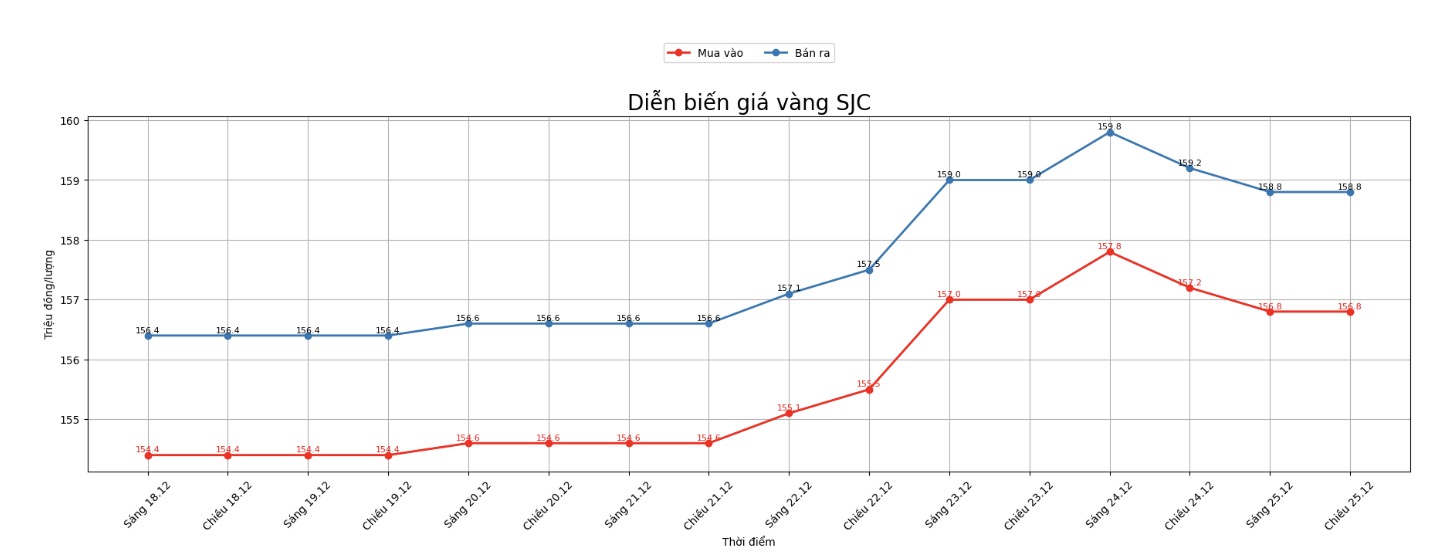

SJC gold bar price

As of 6:30 p.m., DOJI Group listed the price of SJC gold bars at 156.8-158.8 million VND/tael (buy in - sell out), down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 156.8-158.8 million VND/tael (buy - sell), down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 155.8-158.8 million VND/tael (buy in - sell out), down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

9999 gold ring price

As of 5:20 p.m., DOJI Group listed the price of gold rings at 154-157 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 155.3-158.3 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 154.5-157.5 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

The world gold price was listed at 6:37 p.m. at 4,478.6 USD/ounce, down 13.9 USD compared to a day ago.

Gold price forecast

Gold and silver prices fell as profit-taking pressure increased after a series of hot increases. Before that, both precious metals had consecutively broken records.

Safety-haven demand and increasing technical signals have pushed the two metals to very high price levels. Small gold and silver traders are also falling into a FOMO state (fear of missing out) due to the strong increase in the market.

Those who buy late at the buying positions are playing with the fire and may have to pay. Meanwhile, platinum prices this week soared to an all-time high, trading above $2,300/ounce for the first time due to tight supply and record high borrowing costs. The metal has gained more than 150% this year, its biggest yearly gain since Bloomberg began collecting data in 1987.

platinum is heading for the third consecutive year in a deficit due to supply disruptions in South Africa - a major producer country.

Google Inc., chief investment officer at ByteTree, said golds rally is likely to continue into 2026. He also said that the weakening of the cryptocurrency market could create momentum to help silver prices increase more strongly in the coming time. In contrast, Bitcoin, artificial intelligence (AI) and the technology sector may stagnate next year. Mr. Charlie Morris was particularly optimistic about the long-term outlook for gold.

According to J.P. Morgan (one of the world's largest financial - banking corporations, headquartered in the US), after a year of unprecedentedly strong price increases, the global gold market is expected to continue to maintain an upward trend in 2026.

According to the latest report from J.P. Morgan Global Research believes gold could average $5,055 an ounce by the fourth quarter of 2026, driven by persistent demand from investors and central banks, along with the emergence of new demand sources.

In 2025, gold prices have hit new peaks many times and surpassed the $4,000/ounce mark for the first time. The main driving force comes from strong cash flow into gold ETFs, central bank buying demand and investor asset diversification in the context of declining US interest rates and weakening the USD.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...