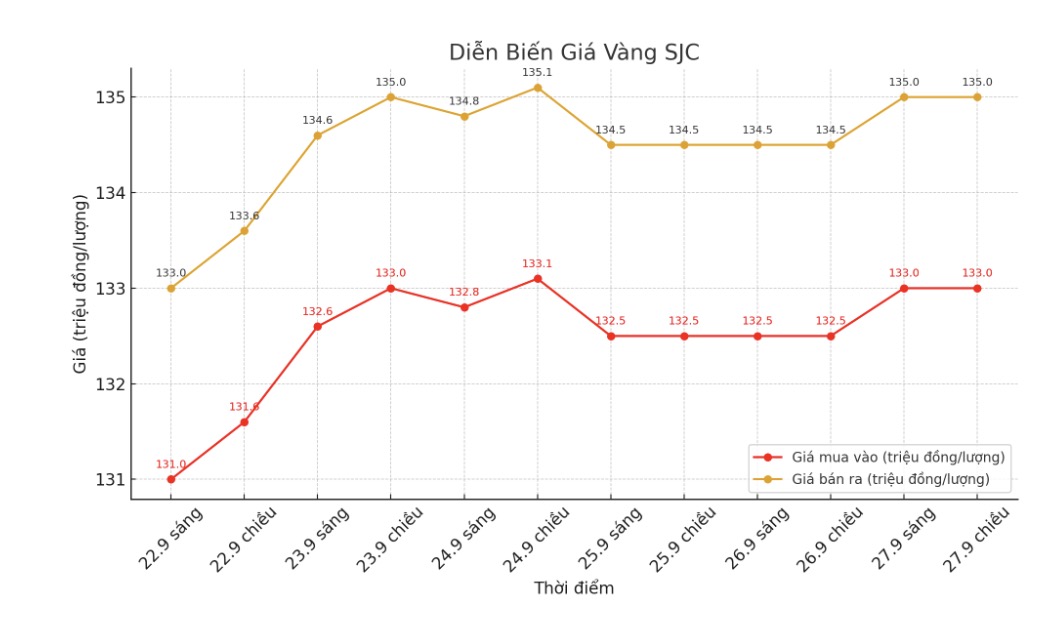

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at VND133-135 million/tael (buy in - sell out), an increase of VND500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 133-135 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 132.5-135 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

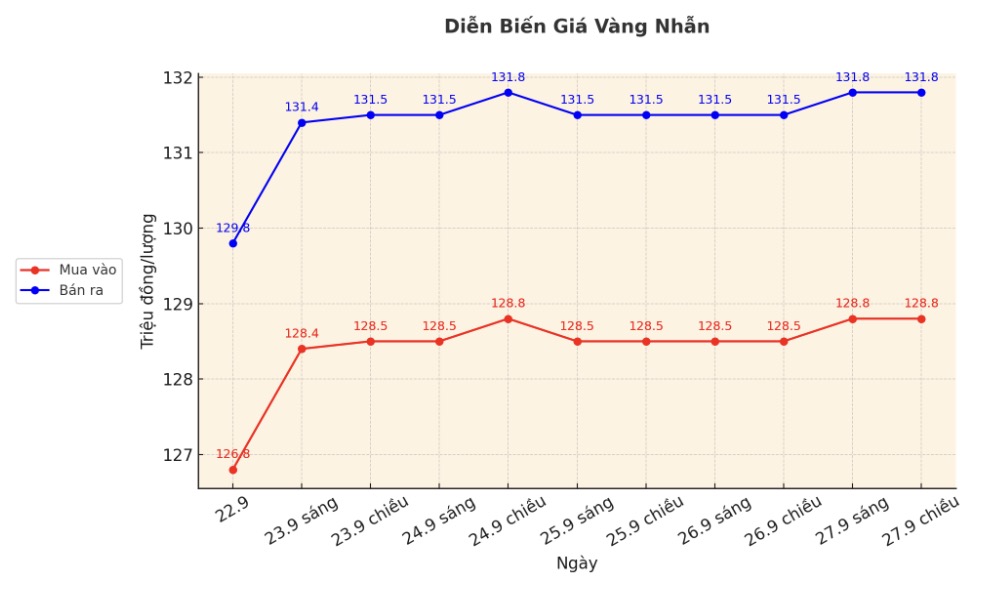

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 128.8-131.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 129.1-132.1 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 128.8-131.8 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

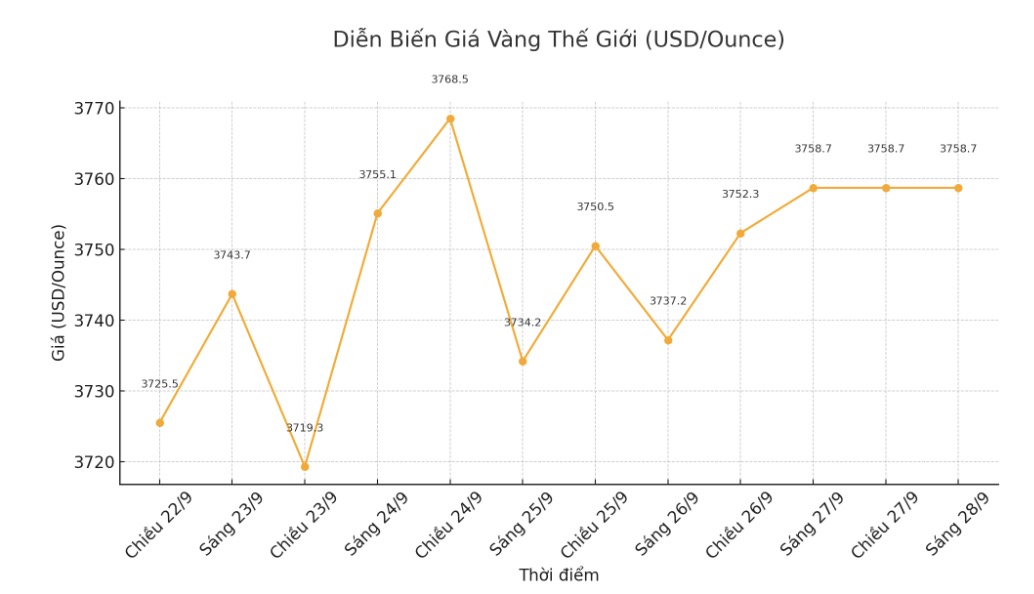

World gold price

The world gold price was listed at 6:00 a.m. at 3,758.7 USD/ounce, up 74.7 USD compared to a week ago.

Gold price forecast

The gold survey with Wall Street experts shows unprecedented optimism, after gold prices continued to increase despite many obstacles.

This week, 19 experts participated in the survey. 16 experts, or 84%, predict gold prices will continue to increase next week, no one predicts a decrease. The remaining three, or 16%, see prices moving sideways.

According to Neils Christensen - an analyst at Kitco News, as many investors and countries lose confidence in the USD, US Treasury bond yields will increase. In this context, gold is still considered the last global monetary asset. Therefore, the latest price increase comes as prices are close to record levels.

Prices are meaningless as gold is considered an assurance to preserve assets. As evidence, the world's largest gold ETF SPDR Gold Shares (NYSE: GLD) recorded a record one-day capital flow of more than 18 tons of gold last Friday.

Barbara Lambrecht - commodity analyst at Commerzbank - commented that the market may need a new "fire" to push prices above $3,800, for example, a US jobs report disappointed for the third consecutive time. However, she predicted that the US labor market may improve slightly.

Although optimism is dominant, some experts advise investors to be cautious at the current price.

David Morrison - senior analyst at Trade Nation - warned: "The yesterday MacD index is still too much to buy. Gold may need to adjust deeper or move sideways for a while to accumulate more momentum before reaching a new peak. However, I believe gold will soon hit a new record before creating a long-term peak.

Notable economic data next week

Monday: Waiting for signing a house contract (USA).

Tuesday: JOLTS job positions (USA), Consumer confidence index (USA).

Wednesday: ADP Private sector Employment Report (US), ISM Manufacturing PMI.

Thursday: Application for weekly unemployment benefits (US).

Friday: US Non-farm Payrolls, ISM Services PMI.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...