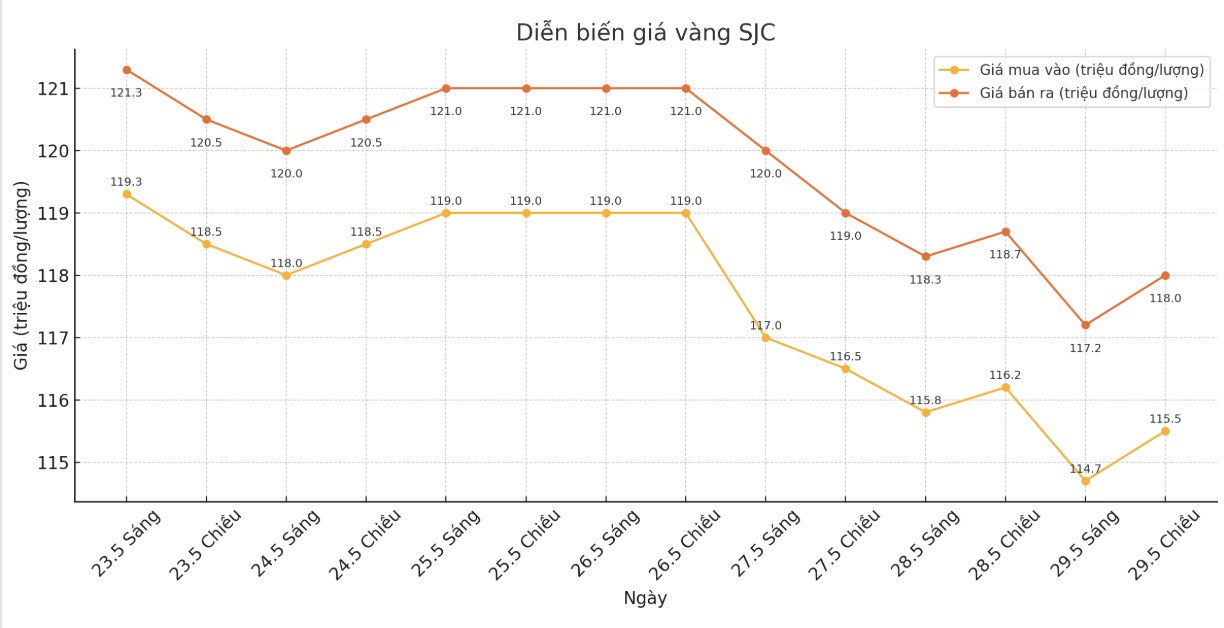

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND115.5-118 million/tael (buy in - sell out), down VND700,000/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 115.5-118 million VND/tael (buy - sell), down 700,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 115.5-118 million VND/tael (buy - sell), down 700,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND 114.5-118 million/tael (buy - sell), down VND 1.2 million/tael for buying and down VND 700,000/tael for selling. The difference between buying and selling prices is at 3.5 million VND/tael.

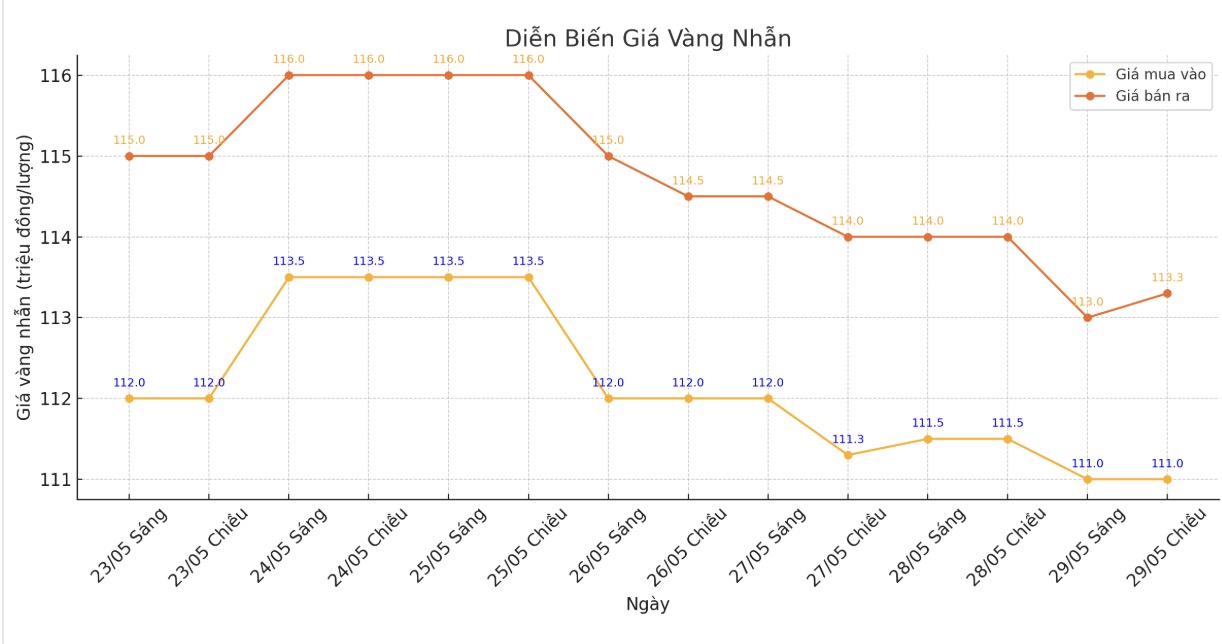

9999 round gold ring price

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 111-113.3 million VND/tael (buy - sell), down 500,000 VND/tael for buying and down 700,000 VND/tael for selling. The difference between buying and selling prices is at 2.3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113.3-116.3 million VND/tael (buy - sell), down 500,000 VND/tael for selling. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 110.8-113.8 million VND/tael (buy - sell), down 700,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

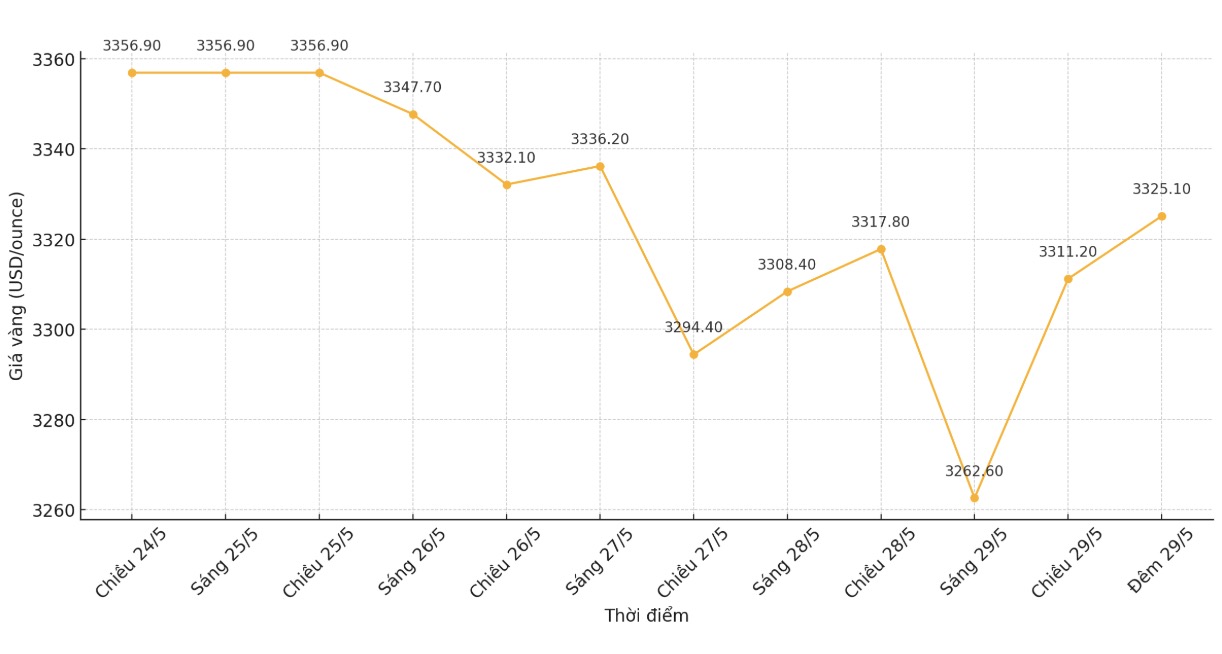

World gold price

At 11:12 p.m. on May 29, the world gold price listed on Kitco was around 3,325.1 USD/ounce.

Gold price forecast

Gold prices recovered slightly despite investors' risk-off sentiment being high, as US stocks hit a three-month peak last night. Demand for safe-haven metals is limited.

August gold contract is currently up 3.5 USD to 3,325.9 USD/ounce. July delivery silver price is currently up 0.315 USD to 33.475 USD/ounce.

The market is paying attention to the information of a council of three judges of the US International Trade Court in New York who has just ruled to reject tariffs called "liberation days" issued by US President Donald Trump. This is a comprehensive tax policy, published on April 2, 2025, in order to impose a basic tax rate of 10% with most goods imported into the US, and a higher tax rate for countries with large trade surplus. The Trump administration called this "liberation day" with argument that this policy would help free the US economy from dependence on imports.

The federal court, which has the authority to try commercial disputes across the United States, said Trump had exceeded his authority under the International Emergency Economic Powers Act (IEEPA) by imposing these tariffs without Congress' approval. The Donald Trump administration has filed an appeal.

Asian and European stock markets fluctuated in opposite directions in the trading session last night. US stock indexes are expected to open for strong increases in New York today. Market sentiment is currently quite positive.

The minutes of the FOMC meeting released on Wednesday afternoon did not come as many surprises, however, according to the Wall Street Journal, this minutes clearly show that the US Federal Reserve (FED) is not ready to cut interest rates in the near future. The Minutes also expressed increasing concerns about the risk of stagnant inflation, which means slowing growth accompanied by high inflation.

Overseas markets saw the USD index increase slightly today. Nymex crude oil futures also edged up slightly and are trading around $62/barrel. The yield on the 10-year US Treasury note is currently at 4.55%.

Investors are watching the US PCE core inflation index, a Fed's preferred inflation measure, to assess monetary policy prospects and the impact on gold prices.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...