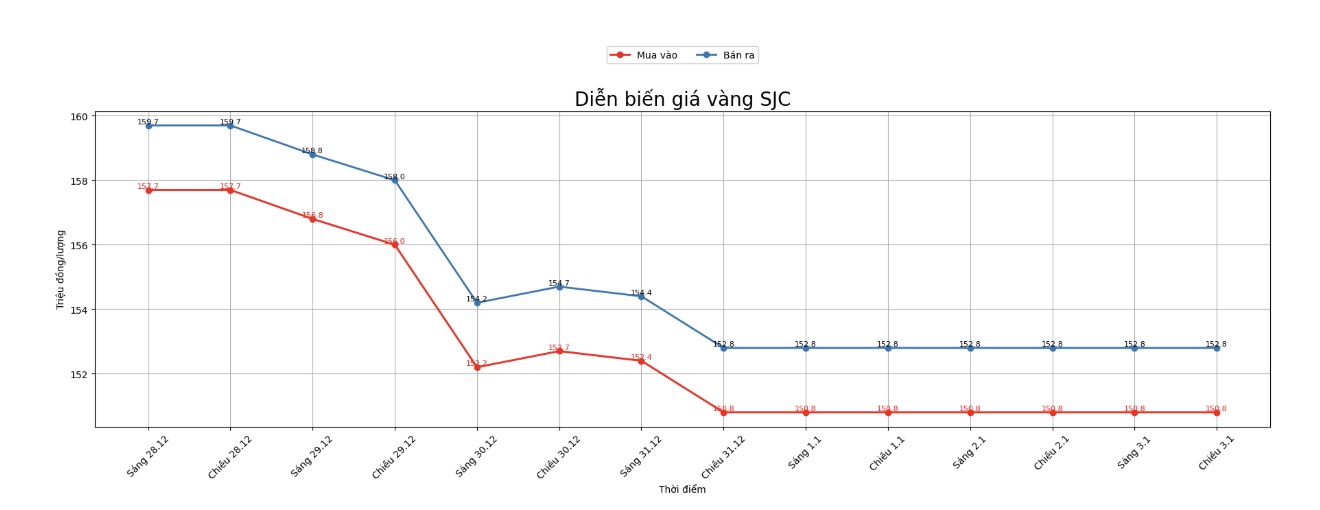

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 150.8-152.8 million VND/tael (buying - selling). The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 150.8-152.8 million VND/tael (buying - selling). The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at the threshold of 150.3-152.8 million VND/tael (buying - selling). The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

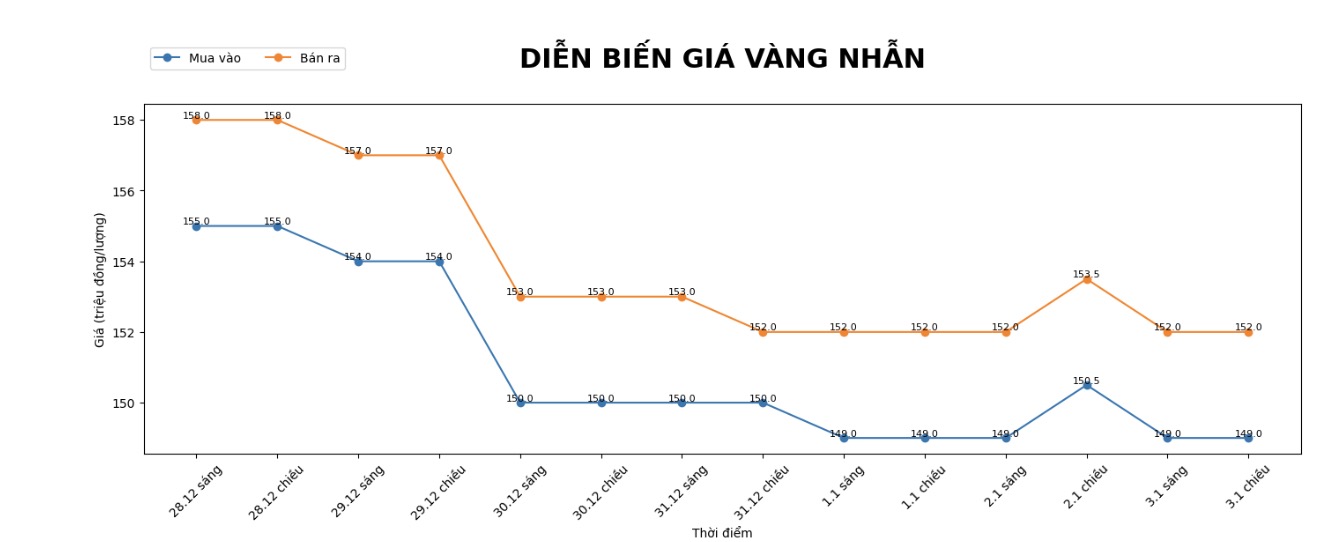

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of plain gold rings at the threshold of 149-152 million VND/tael (buying - selling). The difference between buying and selling is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 152-155 million VND/tael (buying - selling). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 149.8-152.8 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

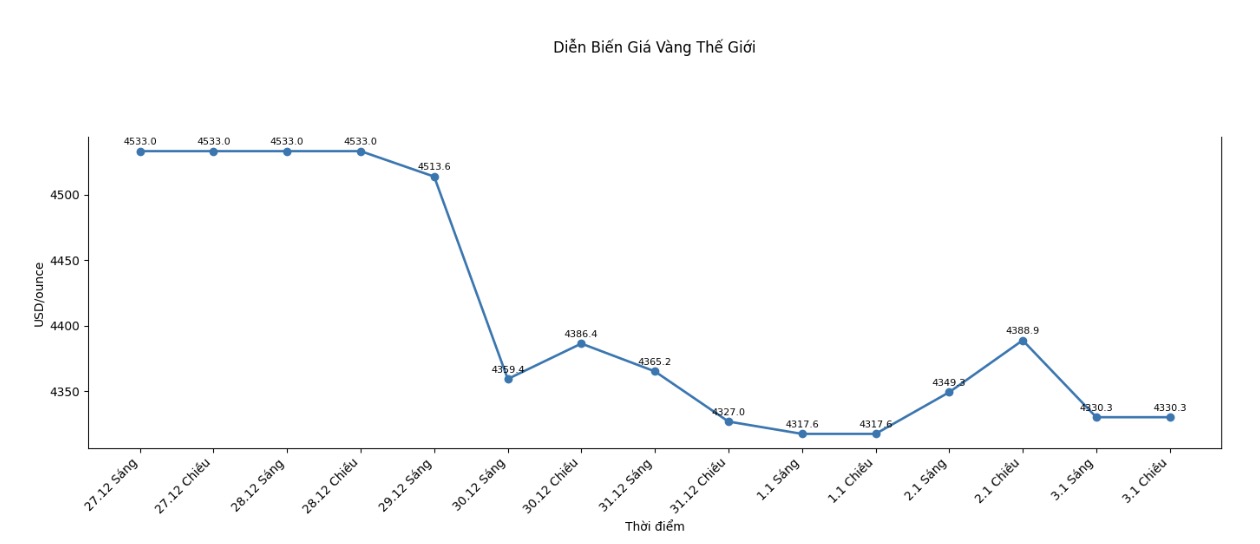

World gold price

World gold price listed at 6:00 am at the threshold of 4,330.3 USD/ounce, down 15.4 USD/ounce.

Gold price forecast

In 2026, the world gold market is assessed by many organizations and investors to still maintain a positive trend, although strong corrections may appear interspersed.

The current price level is considered an important accumulation zone, as gold continuously stands firm above the 4,300 USD/ounce mark amid geopolitical instability and uncertainties surrounding global monetary policy.

New survey results show that optimistic sentiment is prevailing in the individual investor community. Most opinions believe that gold prices still have room to increase and are likely to set new records this year.

Notably, the gold forecasting group fluctuating in the 5,000 – 6,000 USD/ounce range accounted for the highest proportion, reflecting strong expectations for the safe haven role of precious metals in the face of global economic and political risks.

From an organizational perspective, many major Wall Street banks continue to maintain positive views, although more cautious about the growth rate compared to the previous period.

Goldman Sachs identified gold as a prominent investment option in the commodity group in 2026, emphasizing the important support coming from the persistent net buying demand of central banks.

According to the organization's assessment, in the scenario of asset diversification continued to expand, gold prices could completely exceed the threshold of 4,900 USD/ounce.

Sharing the same view, J.P. Morgan believes that the gold price increase cycle has not closed when long-term drivers have not weakened. Ms. Natasha Kaneva - Head of Global Commodity Strategy at J.P. Morgan - said that the upward trend of gold may not take place in a straight line, but factors such as reserve demand, geopolitical concerns and a low real interest rate environment are still strong enough to bring prices close to the 5,000 USD/ounce mark by the end of 2026.

In the short term, gold prices are likely to continue to fluctuate strongly according to geopolitical developments, US interest rate expectations and fluctuations of the USD. In the domestic market, the high buying-selling gap is increasing risks for individual investors.

Experts recommend that people be cautious when depositing money, prioritizing long-term strategies instead of short-term "surfing" in the context of still complex fluctuations.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...