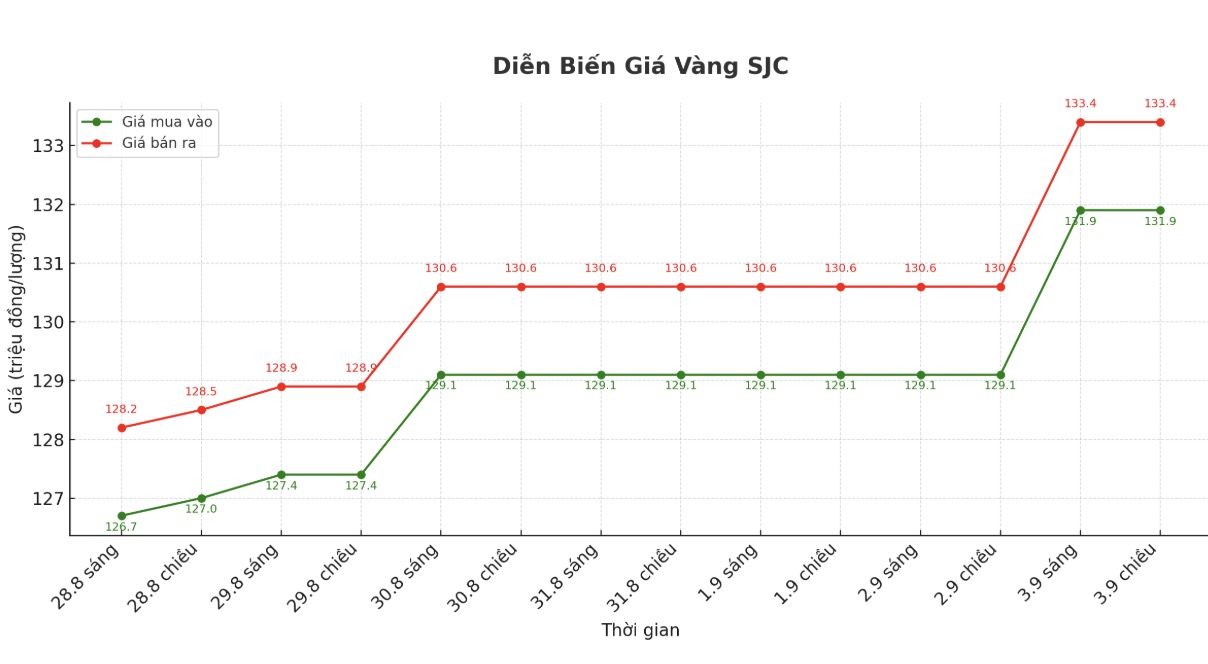

SJC gold bar price

As of 6:00 a.m. on September 4, the price of SJC gold bars was listed by DOJI Group at VND 131.9-133.4 million/tael (buy - sell), a sharp increase of VND 2.8 million/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 131.4-133.4 million VND/tael (buy - sell), an increase of 2.8 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 131-133.4 million VND/tael (buy - sell), an increase of 2.9 million VND/tael for buying and an increase of 2.8 million VND/tael for selling. The difference between buying and selling prices is at 2.4 million VND/tael.

9999 gold ring price

As of 6:00 a.m. on September 4, DOJI Group listed the price of gold rings at VND125.8-128.8 million/tael (buy in - sell out), an increase of VND1.3 million/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 126-129 million VND/tael (buy - sell), an increase of 1.3 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 125.5-128.5 million VND/tael (buy in - sell out), an increase of 1.2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

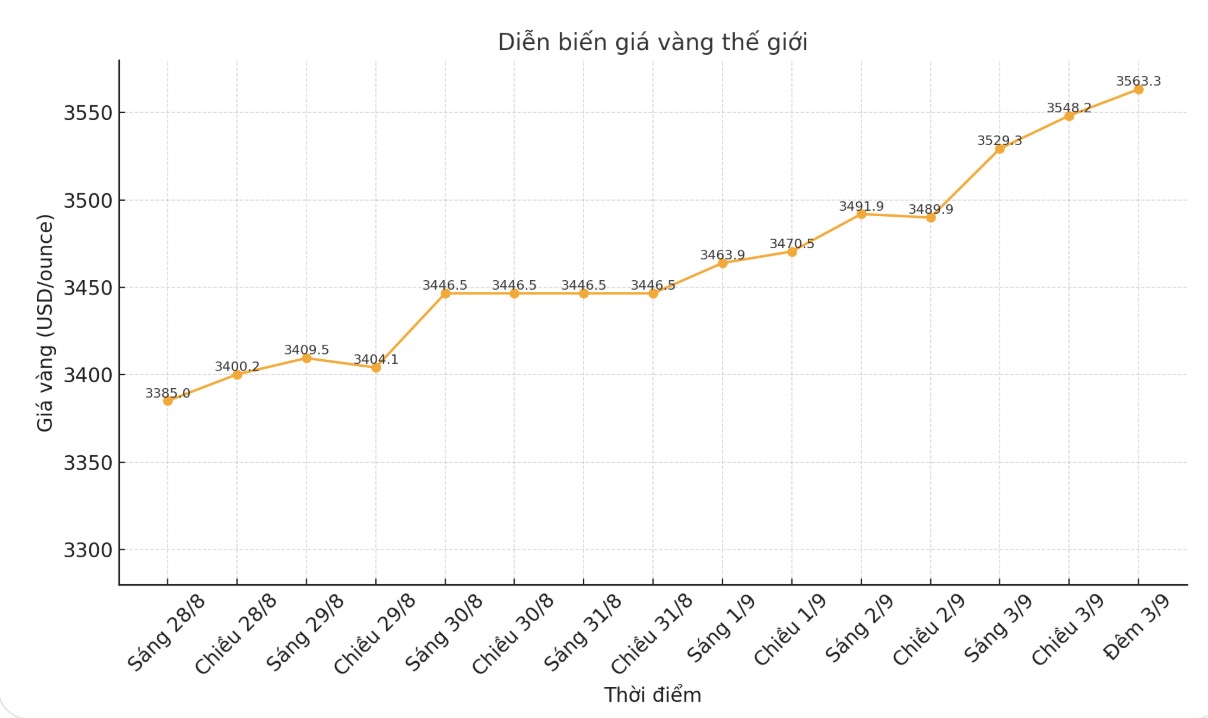

World gold price

The world gold price was listed at 23:00 on September 3 at 3,563.3 USD/ounce, up sharply by 44.7 USD.

Gold price forecast

Gold prices rose higher at noon on Wednesday and continued to set new records. Silver prices are also steady, reaching a 14-year high.

Safety-haven demand has stood out in the two precious metals this week, entering a volatile period of the stock and financial markets in September and October.

December gold futures eventually rose $17.5 to $3,630.1 an ounce. December silver futures rose $0.318, reaching $41.91/ounce.

US economic data released on Wednesday showed the JOLTS report on the number of vacant jobs was weaker. The report (June data) shows that the US joblessness rate fell to 7.437 million, down slightly from the previous month and the lowest level since April.

The report also pointed out that the labor market is slowing, with the number of recruited people decreasing. This is beneficial for the "puppet" in US monetary policy and also supports the gold and silver speculative side.

Global bond yields are rising (falling), mainly due to concerns about inflation, government debt sales and fiscal discipline. This is also a positive factor for gold and silver as a safe-haven asset, although the increase in capital yields is not a beneficial factor.

US Treasury yields have risen, with 30-year bonds currently approaching 5%, while bond yields in the UK, Australia and Japan have also increased.

The sell-off reflects traders' concerns about large public spending and inflation risks, with Bloomberg's global bond yield metrics falling 0.4% on Tuesday.

Market watchers for a long time know that history shows that September and October are often unstable in the stock, financial and currency markets, causing negative impacts on the agricultural product market.

Major outside markets today recorded a decrease in the USD index, crude oil prices decreased and traded around 63.75 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.23%.

Notable US economic data this week

Wednesday: JOLTS employment data.

Thursday: ADP, unemployment claims, ISM services PMI.

Friday: Non-farm payrolls report.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...