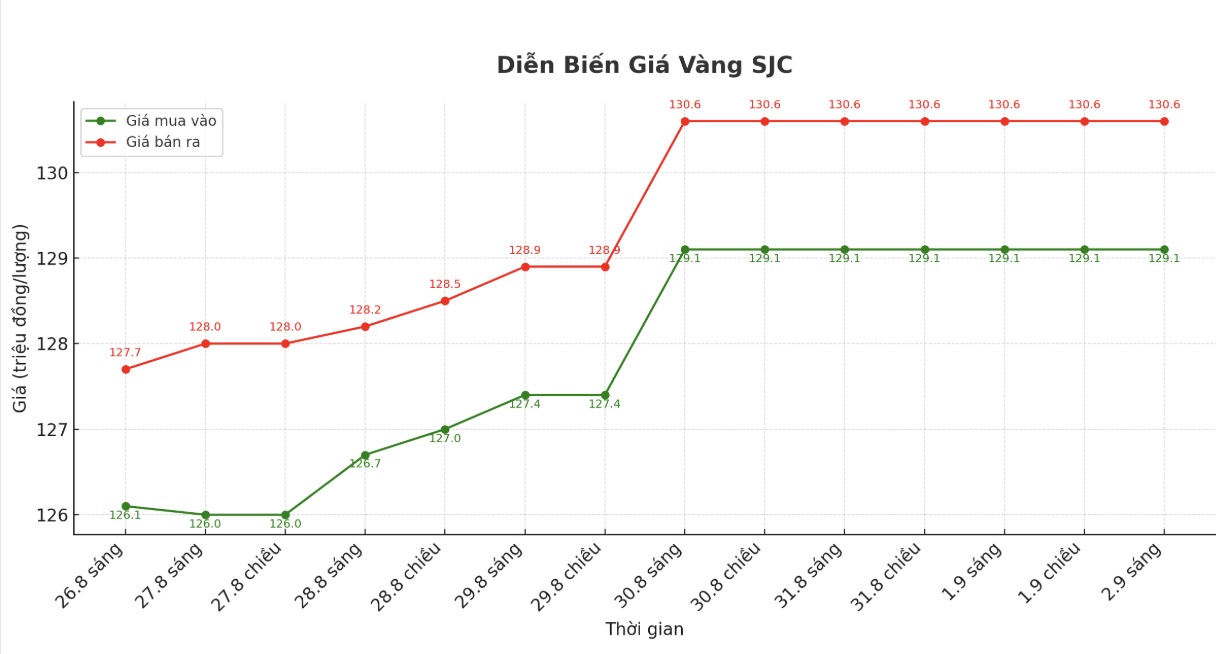

SJC gold bar price

As of 7:10 p.m., DOJI Group listed the price of SJC gold bars at 129.1-130.6 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 128.6-130.6 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 128.1-130.6 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.5 million VND/tael.

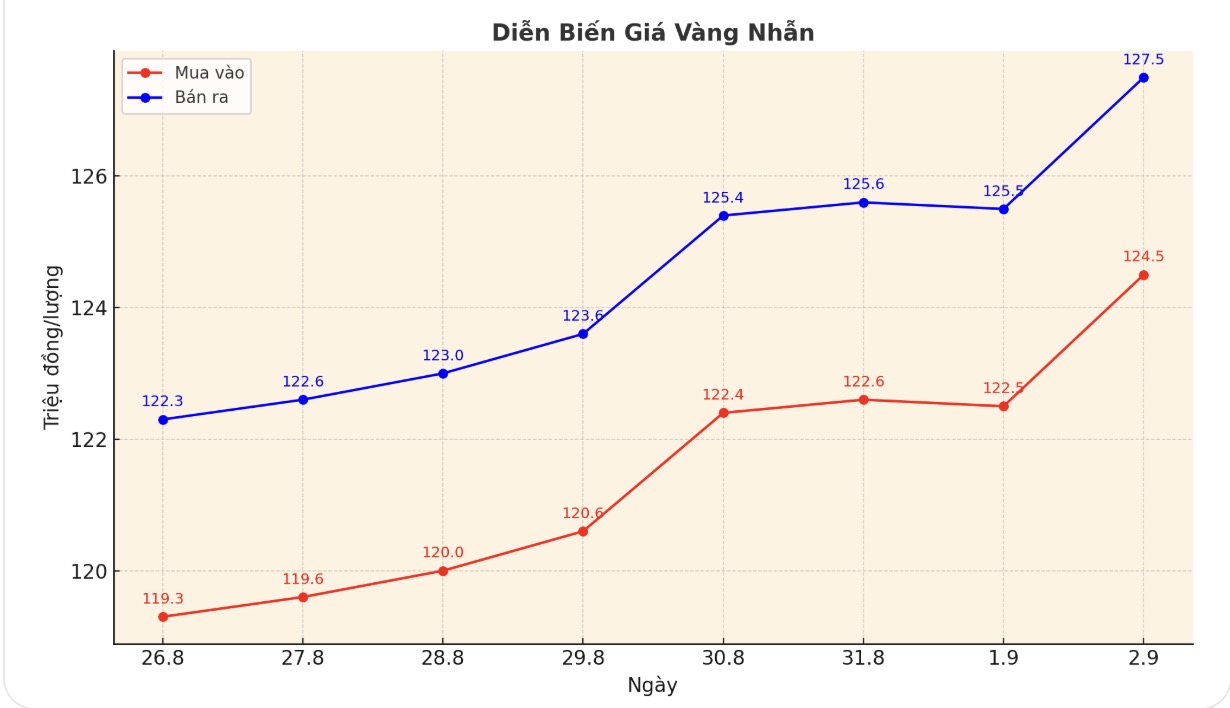

9999 gold ring price

As of 6:30 p.m., DOJI Group listed the price of gold rings at 124.5-127.5 million VND/tael (buy in - sell out), an increase of 2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 124.7-127.7 million VND/tael (buy - sell), an increase of 1.9 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 124.3-127.3 million VND/tael (buy - sell), an increase of 1.8 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

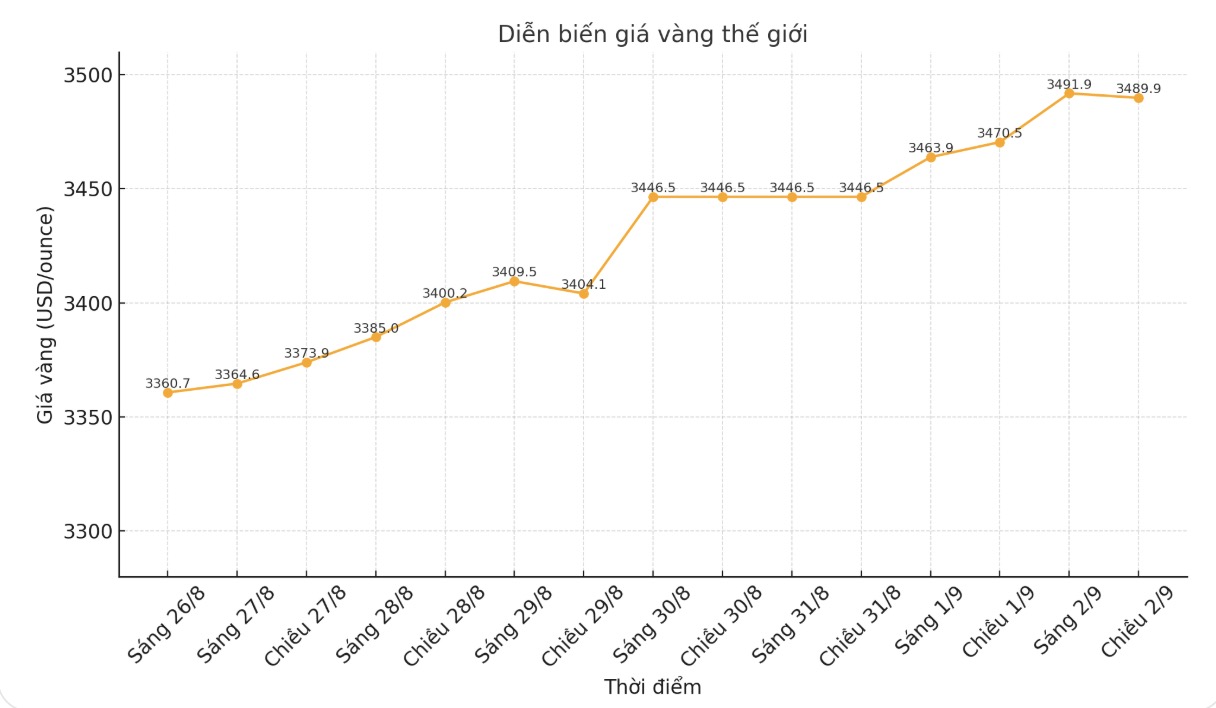

World gold price

The world gold price was listed at 6:30 p.m. at 3,489.9 USD/ounce, up 19.4 USD.

Gold price forecast

Gold prices increased sharply, many times climbing to $3,500/ounce and setting a new record as growing expectations of the US Federal Reserve (FED) cutting interest rates this month have boosted demand for precious metals.

Spot gold prices rose 0.1%, to $3,480.57/ounce at 11:25 GMT, after hitting a record high of $3,508.5/ounce in the previous session. Since the beginning of the year, gold has increased by 32%. US December gold futures increased by 0.9%, to 3,549 USD/ounce.

The gold rally will be strongly affected by whether the Feds rate cut roadmap is in line with market expectations, Han Tan, chief analyst at Nemo.money, said.

He added: Gold still has enough support from fundamental factors, from central bank purchases to safe-haven demand especially if trade tariffs cause significant damage to global economic growth next year.

According to CME's FedWatch tool, investors are currently pricing in a 90% chance of a 25 basis point rate cut on September 17. Gold, which does not yield, often has positive developments in a low interest rate environment.

Gold has long been considered a reliable protective channel against economic and geopolitical fluctuations. In 2025, gold has repeatedly set records, thanks to the buying power of central banks in a downward trend dependent on the US dollar, increased demand for shelter due to trade and geopolitical instability, along with the general weakness of the greenback.

Spot gold prices have risen 27% in 2024 and surpassed $3,000/ounce for the first time in March this year, as US President Donald Trump's trade policies raised concerns, dragging investors to safe-haven assets. Meanwhile, Trump has repeatedly criticized the Fed and Chairman Jerome Powell for not cutting interest rates.

Investors are now waiting for the US non-farm payrolls report due on Friday to assess the scale of the upcoming rate cut.

"All indicators - both fundamental and technical - have shown a sustained increase," said Hugo Pascal, a precious metals trader at In Proved. Although it is certainly not going up in a straight line, the market is still in a state of "buy when adjusted"... In addition, gold is still an asset that is not correlated with stocks, real estate and credit".

SPDR Gold Trust the worlds largest gold ETF reported a 1.01% increase in holdings to 977.68 tons on Friday, the highest level since August 2022. In a quarterly survey by Reuters in July, analysts forecast the average gold price in 2025 to be 3,220 USD/ounce, much higher than the January forecast of 2,756 USD/ounce.

Meanwhile, spot silver prices fell 0.4%, to $40.50 an ounce, after hitting their highest level since September 2011 in the previous session. platinum fell 0.8%, to $1,388.22; palladium lost 1.3%, to $1,123.14/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...