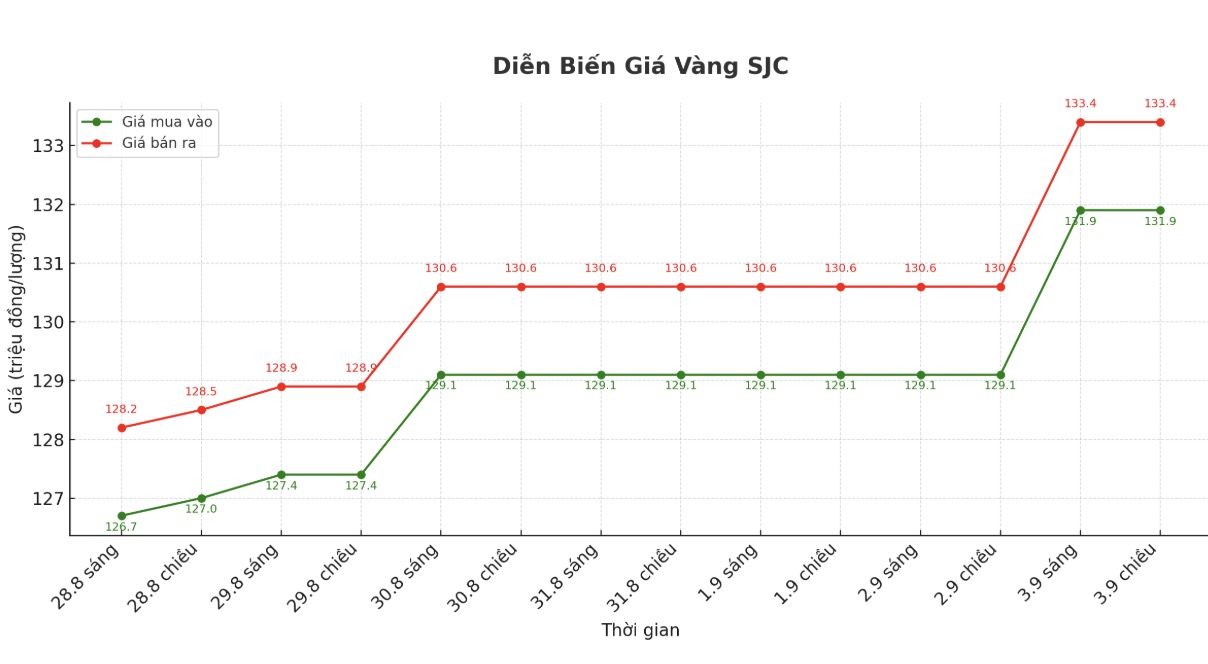

SJC gold bar price

As of 6:45 p.m., DOJI Group listed the price of SJC gold bars at VND 131.9-133.4 million/tael (buy - sell), a sharp increase of VND 2.8 million/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 131.4-133.4 million VND/tael (buy - sell), an increase of 2.8 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 131-133.4 million VND/tael (buy - sell), an increase of 2.9 million VND/tael for buying and an increase of 2.8 million VND/tael for selling. The difference between buying and selling prices is at 2.4 million VND/tael.

9999 gold ring price

As of 6:45 p.m., DOJI Group listed the price of gold rings at 125.8-128.8 million VND/tael (buy - sell), an increase of 1.3 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 126-129 million VND/tael (buy - sell), an increase of 1.3 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 125.5-128.5 million VND/tael (buy in - sell out), an increase of 1.2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors who intend to surf.

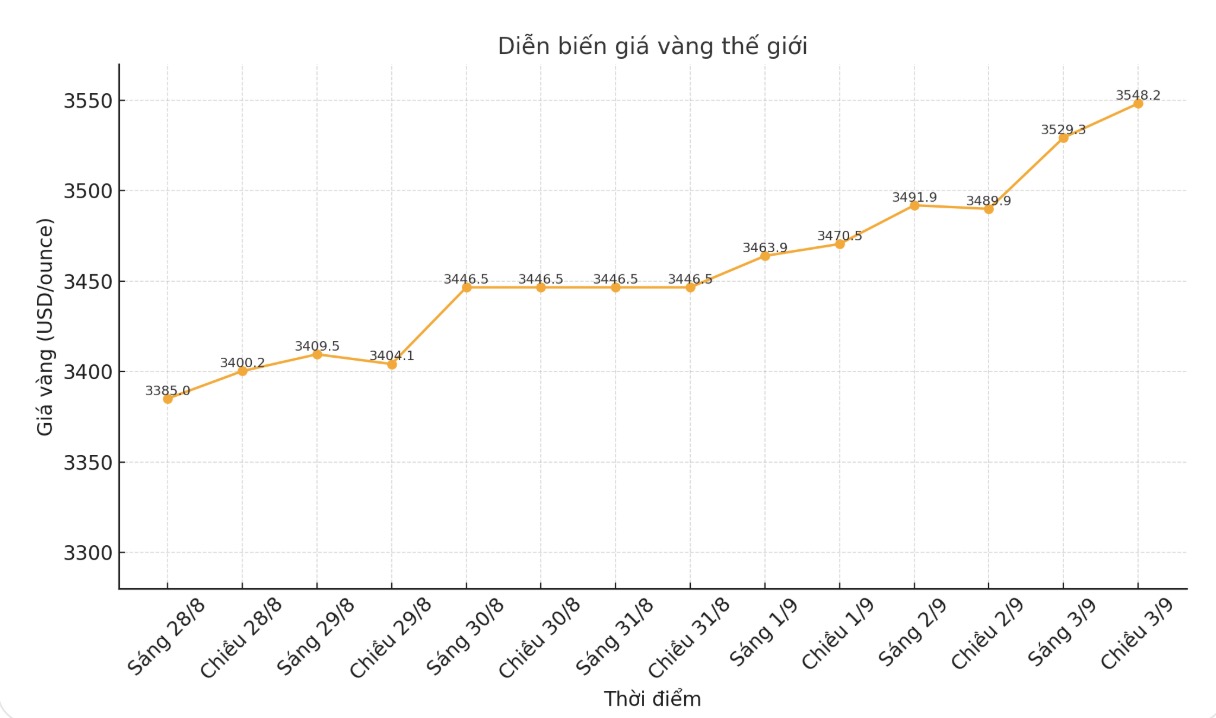

World gold price

The world gold price was listed at 6:30 p.m. at 3,548.2 USD/ounce, up 58.3 USD.

Gold price forecast

Gold's latest rally was driven by expectations of a US rate cut, concerns about the independence of the Federal Reserve (FED) and strong demand from investors and central banks. It is likely that the above series of factors will bring gold prices to new records in the coming weeks.

According to analysts, spot gold hit a historic peak of $3,527.5 an ounce at 5:00 p.m. GMT on Tuesday, and could fluctuate between $3,600 - $3,900 an ounce in the short and medium term, even testing the $4,000/ounce mark by 2026 if economic and geopolitical instability continues.

Since the beginning of the year, gold has increased by more than 34%. Reuters surveys show that the average price forecast for 2025 has been continuously increased: from 2,756 USD/ounce in January, to 3,065 USD/ounce in April, and most recently 3,220 USD/ounce in July.

FED Chairman Jerome Powell admitted that the risk of employment is increasing, causing the financial market to bet on an interest rate cut in September.

The fulcrum for gold is the weak USD outlook, under the impact of interest rate cut expectations, capital flows away from US assets and economic instability related to tariffs, said Ricardo Evangelista, senior analyst at ActivTrades.

The US dollar has fallen nearly 11% since Donald Trump returned to the White House in January. The weaker greenback makes gold - which is priced in USD - cheaper for holders of other currencies.

Meanwhile, Mr Trump's criticism of Chairman Powell and his efforts to remove Governor Lisa Cook have raised concerns about the Fed's independence, thereby stimulating more cash flow to gold.

The most explosive factor could be intervention in the Fed and concerns about the safe-haven of the US dollar, said Carsten Menke, an expert at Julius Baer.

In addition, security tensions in the Middle East, the Russia-Ukraine conflict and demand for gold from central banks also reinforce the attractiveness of the precious metal. The Chinese central bank added gold to its reserves for the ninth consecutive month in July.

Data from the World Gold Council shows that central banks plan to increase the proportion of gold in reserves, while reducing the proportion of USD in the next 5 years.

The escalation of gold prices in parallel with the central banks buying move is causing the share of gold in foreign exchange reserves of many countries to increase sharply - Michael Hsueh - precious metals expert at Deutsche Bank commented.

Not only central banks, gold ETFs also attract significant capital. SPDR Gold Trust - the world's largest gold ETF said its holdings have increased to 977.68 tons, up 12% since the beginning of the year and reaching the highest level since August 2022.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...