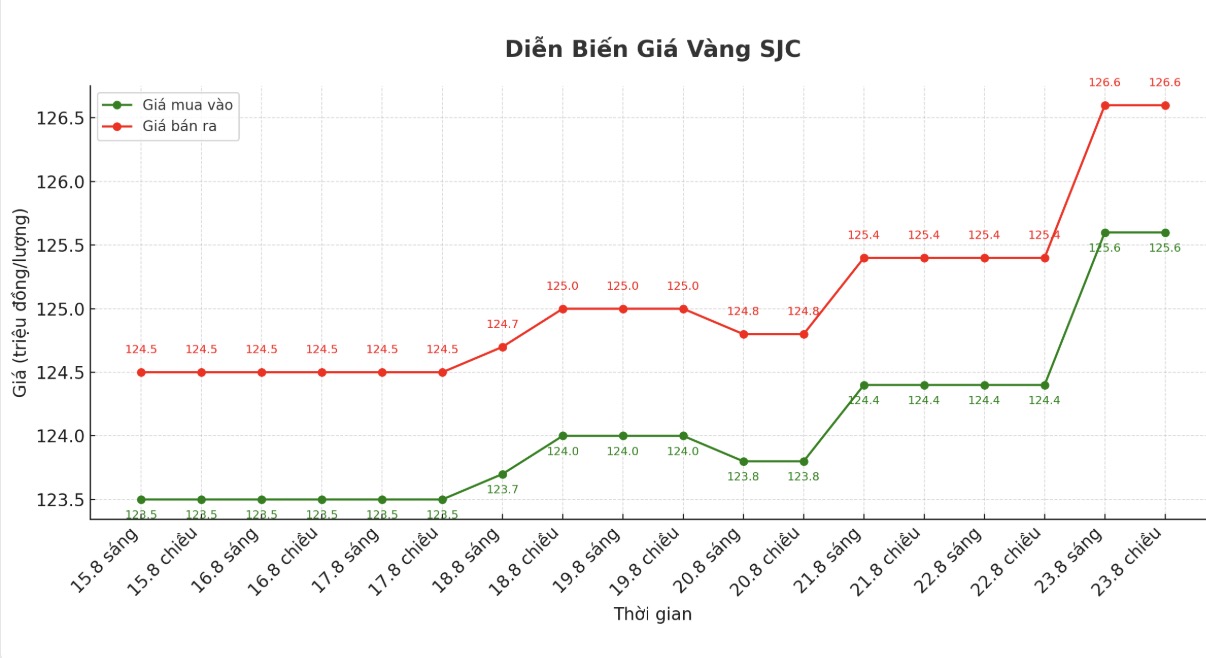

SJC gold bar price

As of 6:50 p.m., DOJI Group listed the price of SJC gold bars at VND125.6-126.6 million/tael (buy in - sell out), a sharp increase of VND1.2 million/tael in both directions. The difference between buying and selling prices is at 1 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 125.6-126.6 million VND/tael (buy - sell), a sharp increase of 1.2 million VND/tael in both directions. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 124.6-126.6 million VND/tael (buy - sell), a sharp increase of 1.2 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

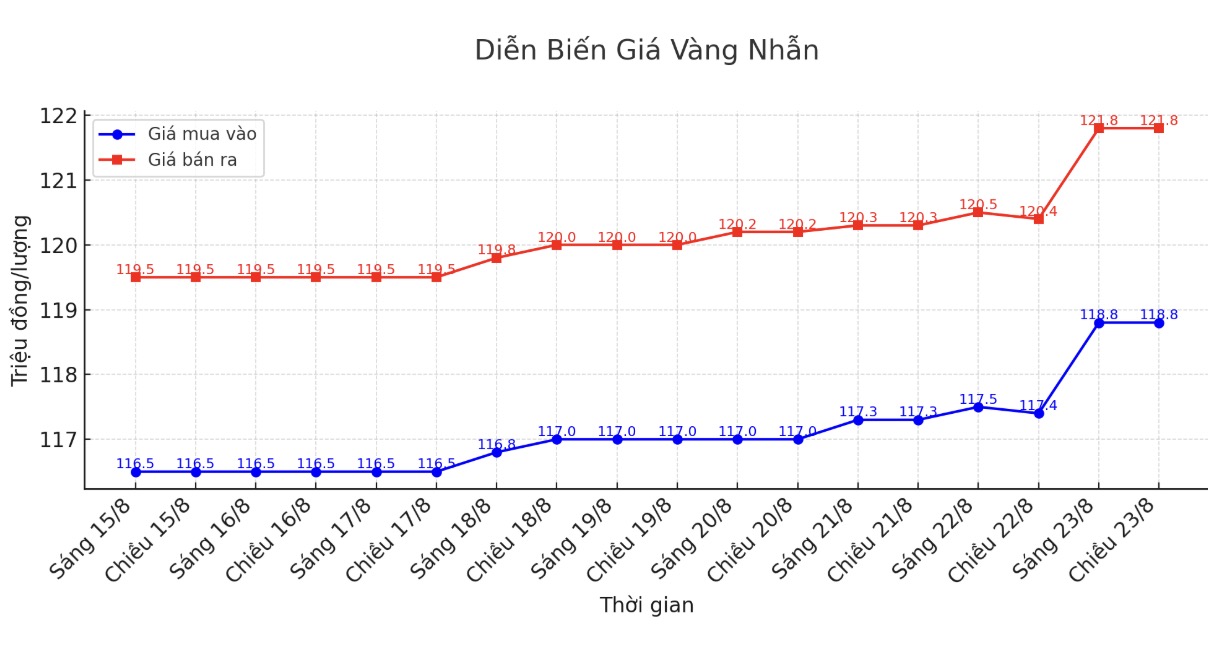

9999 gold ring price

As of 6:50 p.m., DOJI Group listed the price of gold rings at 118.8-121.8 million VND/tael (buy - sell), an increase of 1.4 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 118.7-121.7 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 118.3-121.3 million VND/tael (buy - sell), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

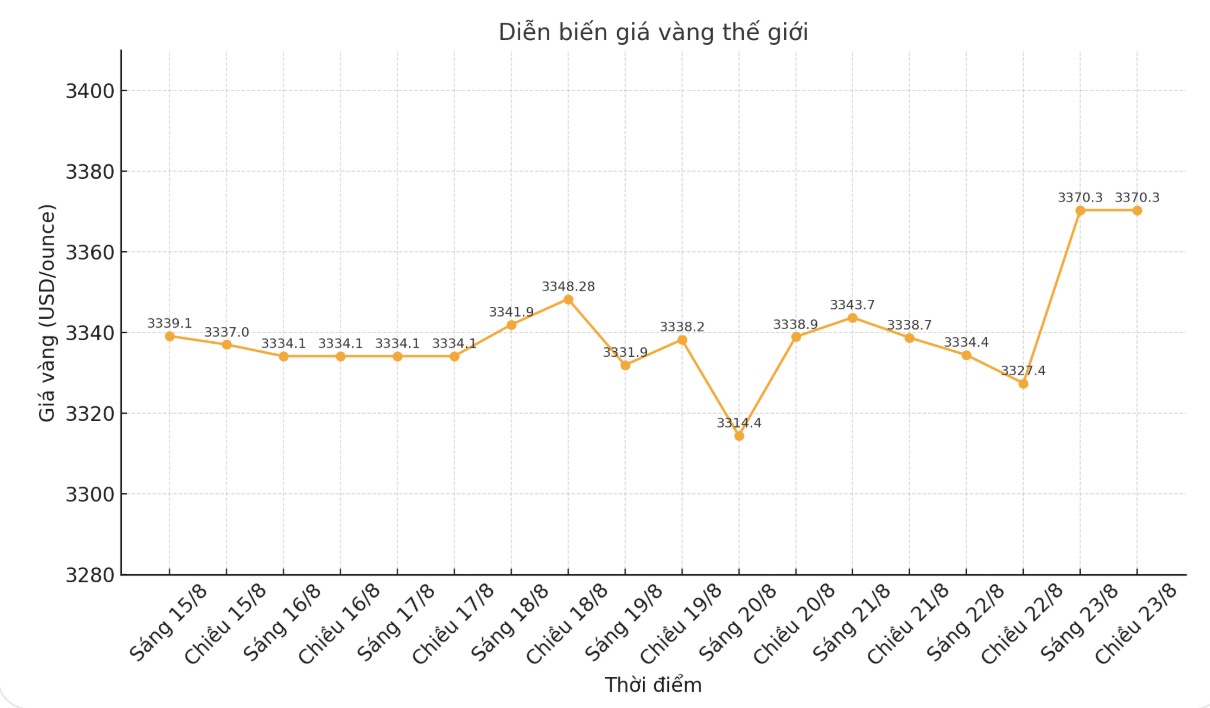

World gold price

The world gold price was listed at 7:15 p.m. at 3,370.3 USD/ounce.

Gold price forecast

World gold prices skyrocketed after the speech of the Chairman of the US Federal Reserve (FED) - Mr. Jerome Powell. The Fed chairman seems to be laying the groundwork for the possibility of a rate cut next month.

In his much-anticipated speech at the Fed's annual thematic conference, Jerome Powell maintained a neutral and cautious stance. He noted the risk of rising inflation and slowing economic growth. However, he also said that while risks are balanced, US monetary policy may need to be adjusted.

In the short term, the risk of inflation is on the uptrend, while the risk of employment is on the downtrend - a difficult situation, he said. When our dual goals are so tense, the policy framework requires us to balance both.

Interest rates are now close to being neutral by more than 100 basis points compared to a year ago, and the stability of the unemployment rate as well as other measures of the labor market allow us to be cautious when considering adjusting policies.

He emphasized: "However, with the policy in a limited area, the fundamental outlook and the shift of risks may force us to adjust our stance."

In his speech, Powell noted that while the US economy is generally quite strong, risks are increasing. He explained that the economy is facing new challenges as significantly higher import taxes are reshaping the global trade system.

He also pointed out that tighter immigration policies have led to a slowdown in labor force growth.

Economists say Powell has been closely monitoring the labor market, as the stability of this market is the main reason for the Fed's hesitation to cut interest rates. However, Powell warned of rising risks to workers, following disappointing July data and sharp downward adjustments to May and June figures.

He said: "In general, the labor market seems balanced, but it is a strange balance because the labor supply and demand are stagnant. This unusual situation shows that the risk of job decline is increasing. And if that risk occurs, it could come very quickly in the form of mass layoffs and high unemployment rates.

Meanwhile, Powell stressed that the risk of inflation remains a major concern. He said that the impact of tariffs on consumer prices has been clearly shown.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...