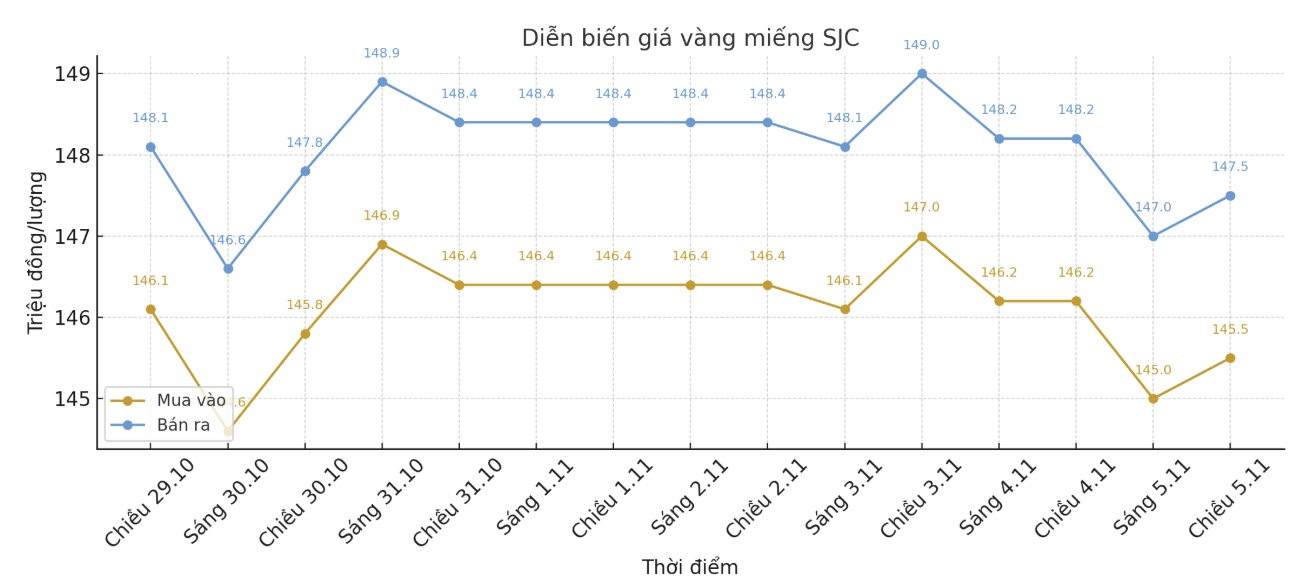

SJC gold bar price

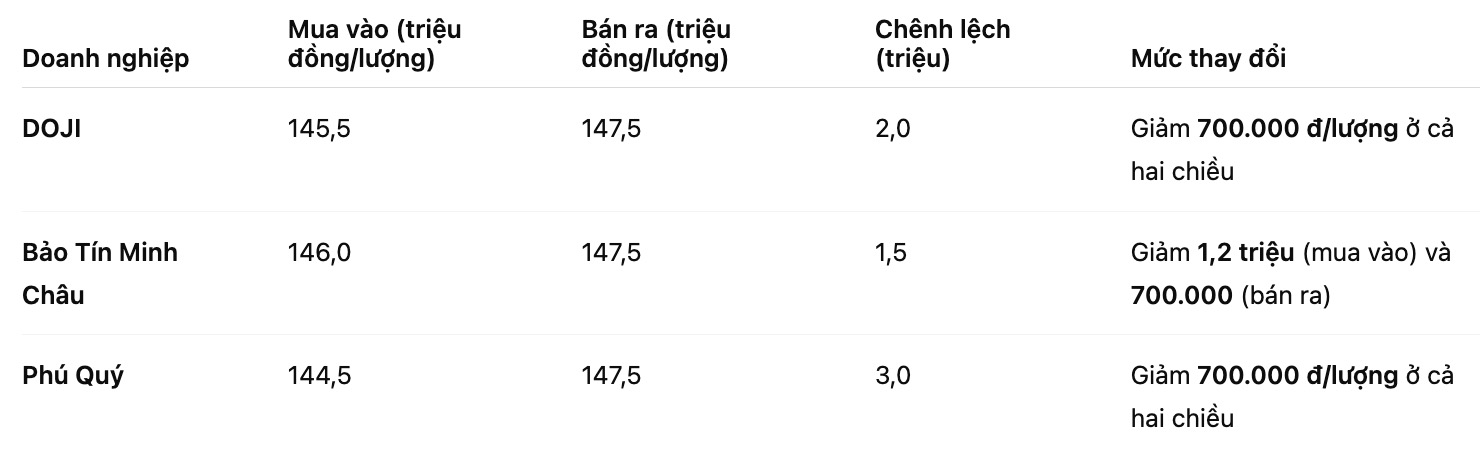

As of 6:00 a.m. on November 6, the price of SJC gold bars was listed by DOJI Group at VND145.5-147.5 million/tael (buy in - sell out), down VND700,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 146-147.5 million VND/tael (buy - sell), down 1.2 million VND/tael for buying and down 700,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND144.5-147.5 million/tael (buy in - sell out), down VND700,000/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

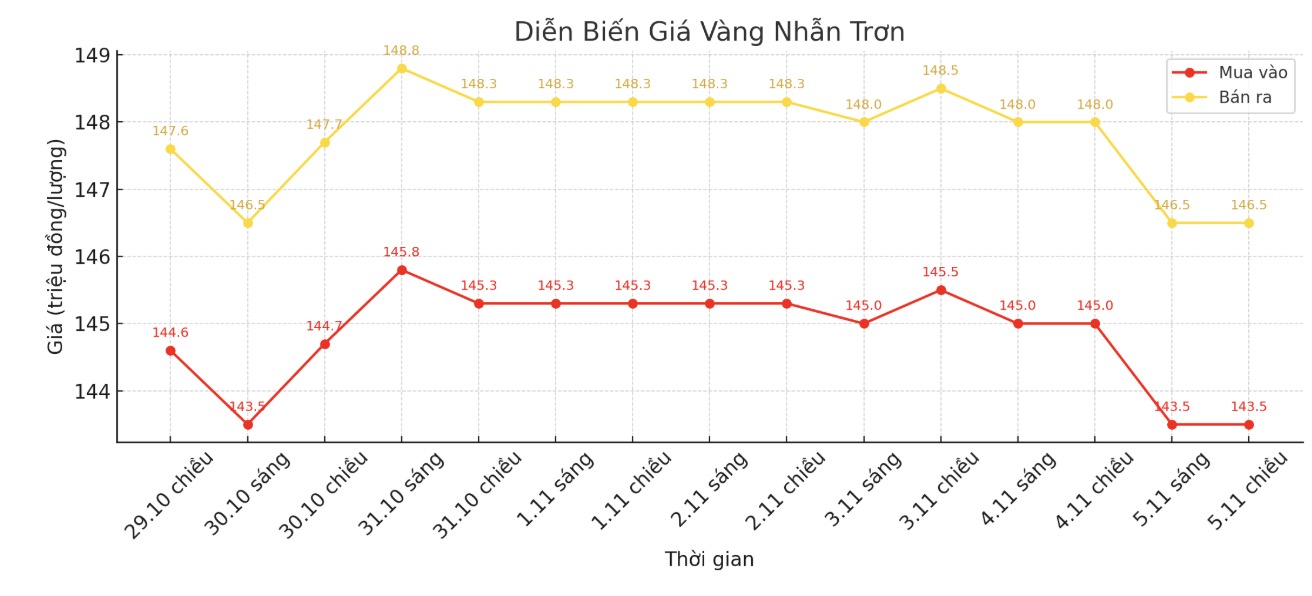

9999 gold ring price

As of 6:00 a.m. on November 6, DOJI Group listed the price of gold rings at 143.5-146.5 million VND/tael (buy in - sell out), down 1.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 144.8-147.8 million VND/tael (buy - sell), down 900,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 144.5-147.5 million VND/tael (buy in - sell out), down 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

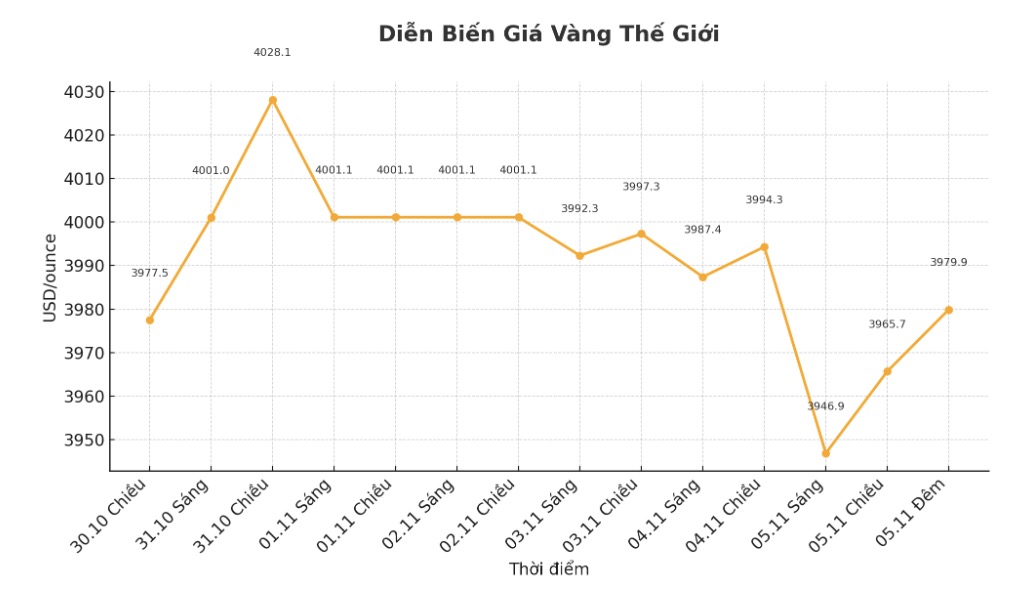

World gold price

The world gold price was listed at 22:55 on November 5 at 3,979.9 USD/ounce.

Gold price forecast

Gold prices were pressured as the ADP's jobs report showed the US private sector added 42,000 jobs in October. According to the report released on Wednesday, this figure is higher than analysts' forecasts, who only expect about 32,000 new jobs.

Private enterprises have resumed recruitment in October after three months of decline, but the speed is still quite modest compared to the beginning of the year. Meanwhile, wage growth has been almost steady for more than a year, showing that labor supply and demand are in a balanced state, said Nela Richardson, ADP chief economist.

The gold market maintained its upward momentum despite better-than-expected employment data. However, gold prices are still far from the $4,000/ounce mark. The latest spot gold price was at 3,971.2 USD/ounce, up 1% on the day.

The US economy continues to create jobs, although the pace is slower than at the beginning of the year, and the growth is mainly concentrated in a few areas. The report shows that education - health care, along with the group of trade, transportation and utilities, are the leading recruitment sectors. Meanwhile, for the third consecutive month, businesses in the fields of professional services, information and tourism - entertainment continue to cut staff.

Although gold prices are attracting bottom-fishing buying power as they hold the support zone above $3,900/ounce, some experts believe that the precious metal could face difficulties, as not-so-weak employment data will reinforce the view of Federal Reserve Chairman Jerome Powell that a rate cut in December is not a certain thing.

Throughout this year, the FED has remained cautious in cutting interest rates as inflationary pressures remain high and the labor market remains relatively strong.

Although private sector employment data increased again last month, Mr. Jeffrey Roach - Chief Economist at LPL Financial noted that ADP data often fluctuates strongly.

In recent years, the correlation between ADP data and the Official Employment Report (BLS) has improved, but both data streams could fluctuate strongly. If we look at the average to eliminate the short-term factor, both sources are sending signals that the job market is weakening. The Fed is likely to focus on this weakening trend as it continues its interest rate cutting cycle," he said.

Schedule of releasing important economic data for the week

Thursday: Bank of England (BoE) monetary policy meeting.

Friday: Preliminary survey of consumer confidence - University of Michigan.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...