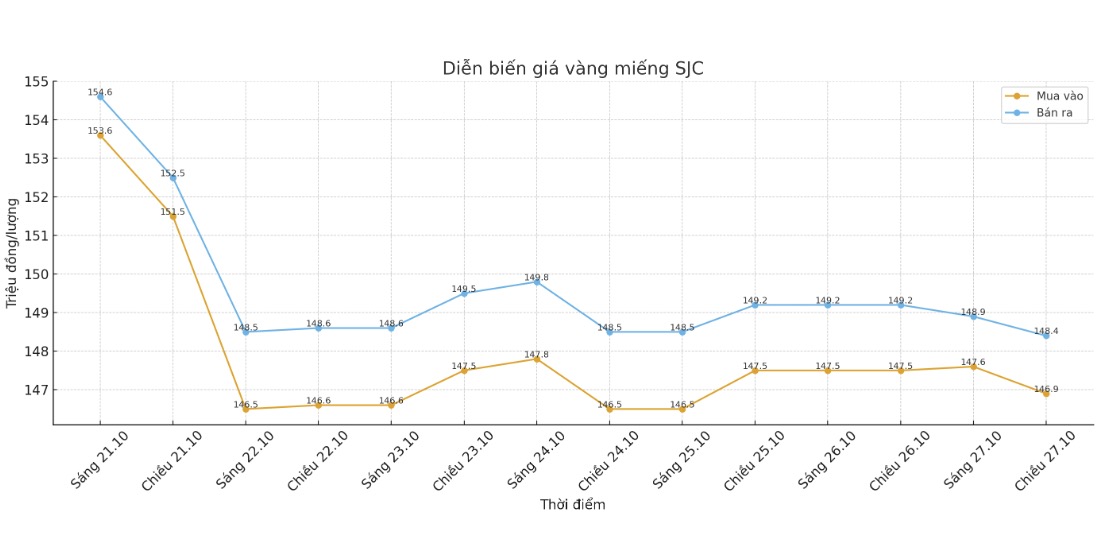

SJC gold bar price

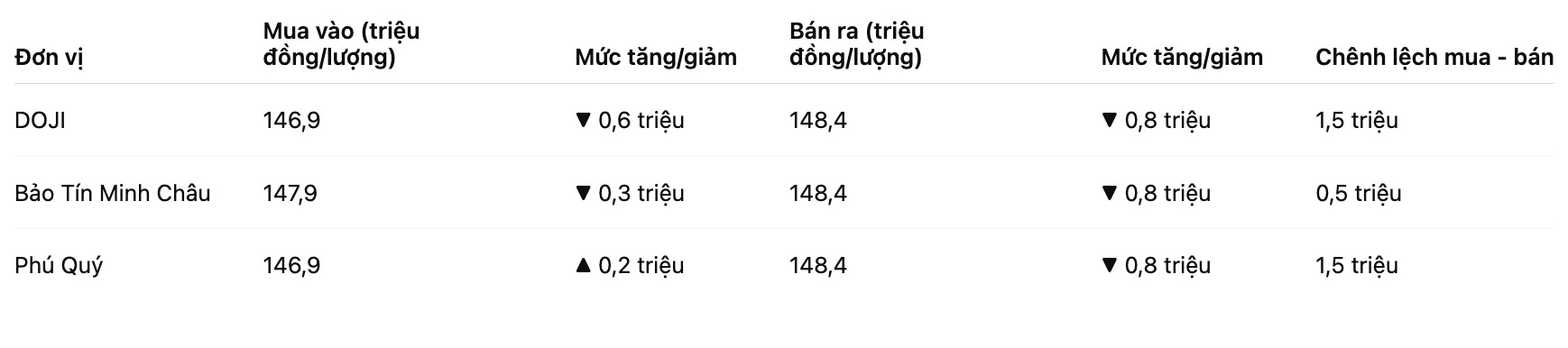

As of 7:00 p.m., DOJI Group listed the price of SJC gold bars at 146.9-148.4 million VND/tael (buy - sell), down 600,000 VND/tael for buying and down 800,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 147.9-148.4 million VND/tael (buy - sell), down 300,000 VND/tael for buying and down 800,000 VND/tael for selling. The difference between buying and selling prices is at 500,000 VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 146.9-148.4 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and a decrease of 800,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

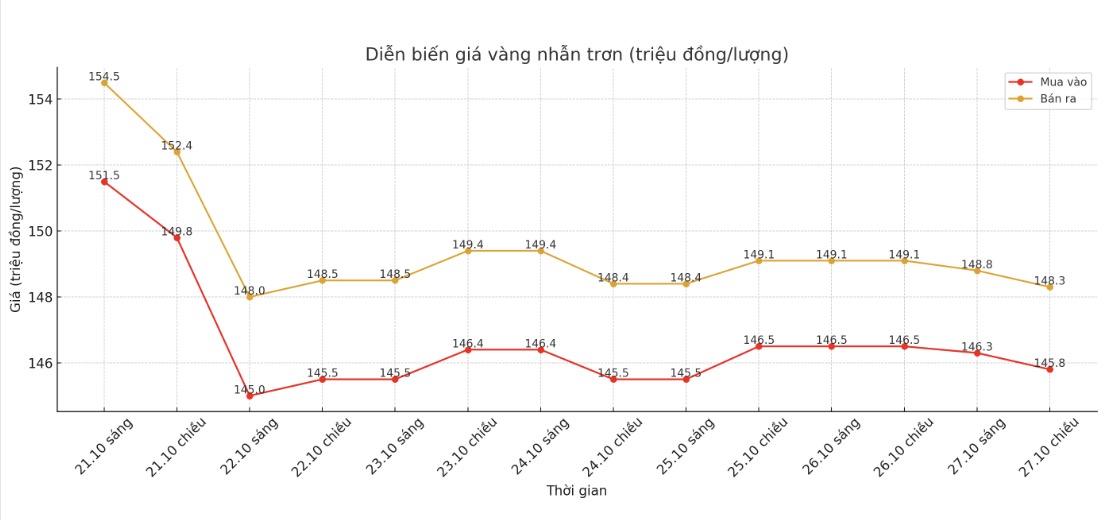

9999 gold ring price

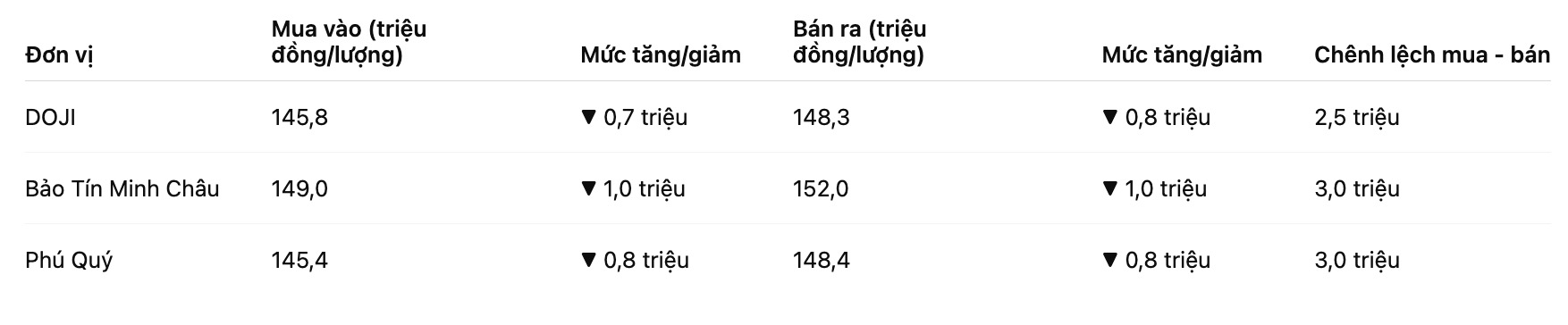

As of 7:00 p.m., DOJI Group listed the price of gold rings at 145.8-148.3 million VND/tael (buy - sell), down 700,000 VND/tael for buying and down 800,000 VND/tael for selling. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 149-152 million VND/tael (buy - sell), down 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.4-148.4 million VND/tael (buy - sell), down 800,000 VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

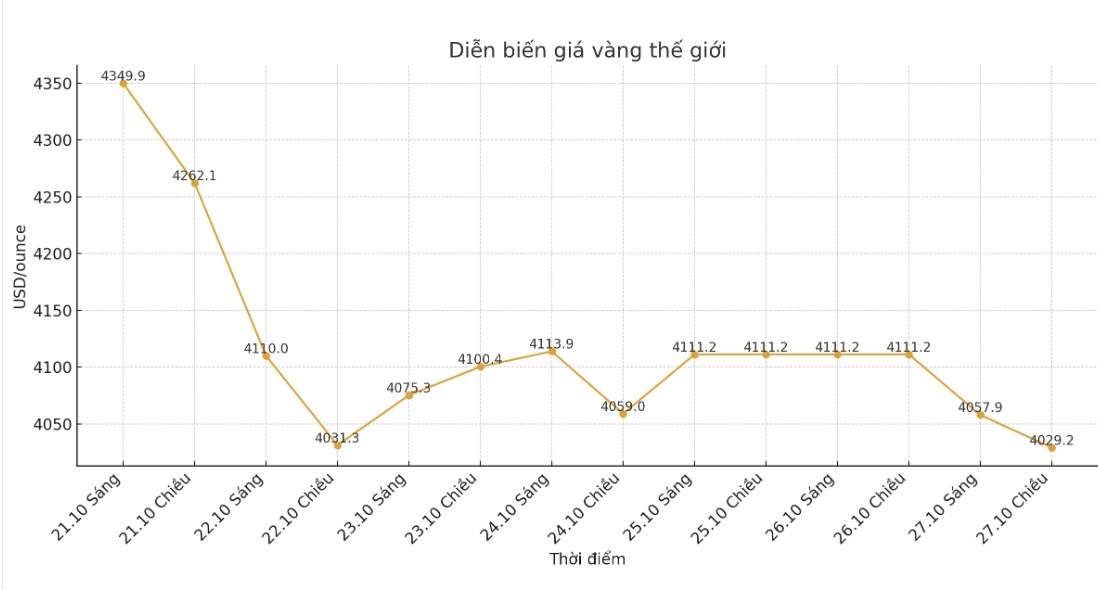

World gold price

The world gold price was listed at 7:15 p.m. at 4,029.2 USD/ounce, down 82 USD compared to a day ago.

Gold price forecast

Gold prices fell in the trading session on Monday, as the US dollar increased in price and signals of cooling down trade tensions between the US and China put pressure on the precious metal - which is considered a safe asset. Investors are waiting for important central bank meetings this week to find clues on monetary policy.

The US dollar rose to a two-week high against the Yen, making gold more expensive for holders of other currencies.

Previously, top US and Chinese economic officials agreed on a trade deal framework for US President Donald Trump and Chinese President Xi Jinping to consider and decide on this week.

"The surprise appearance of the possibility of reaching a US-China trade agreement is a positive factor for the market in general. Of course, that puts downward pressure on gold prices, said Kyle Rodda, an analyst at Capital.com.

"Currently, the market temperature has decreased and the sentiment is becoming more neutral. The reason gold still maintains its support is the expectation of loose fiscal and monetary policies in the coming time. If this continues, the upward trend in gold could still be maintained.

In another development, the London Gold Market Association (LBMA) said that from 2027, gold refiners on the list of approved for trading in London will have to provide data to a new digital platform to increase transparency in the precious metals industry.

LBMA - the world's largest decentralized gold exchange monitoring body in London - is pushing for more transparency in the market as gold prices have increased by 55% since the beginning of the year and set a record of $4,381/ounce on October 20, as concerns about US tariffs increased volatility.

From January next year, we will apply a voluntary periodic reporting mechanism and switch to mandatory from 2027, said Ruth Crowell, CEO of LBMA, at the associations precious metals conference in Kyoto (Japan).

Adhering to the above reporting mechanism could put refiners at higher governance costs, which could have a positive impact on gold prices in the coming time. In the context of the sharp increase in gold prices, reaching a historical peak of 4,381 USD/ounce, a move to tighten transparency is considered necessary for the market to operate stably, limiting risks when capital flows strongly into precious metals.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...