Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 120.2-122.2 million/tael (buy in - sell out), an increase of VND 2.4 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 120.2-122.2 million VND/tael (buy - sell), an increase of 2.4 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 120.2-122.2 million VND/tael (buy - sell), an increase of 2.4 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 119.8-122.8 million/tael (buy in - sell out), an increase of VND 3 million/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

9999 round gold ring price

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND115-118 million/tael (buy - sell), an increase of VND2.5 million/tael for buying and an increase of VND3 million/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.5-120.5 million VND/tael (buy - sell), an increase of 2 million VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.5-118.5 million VND/tael (buy in - sell out), an increase of 2 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

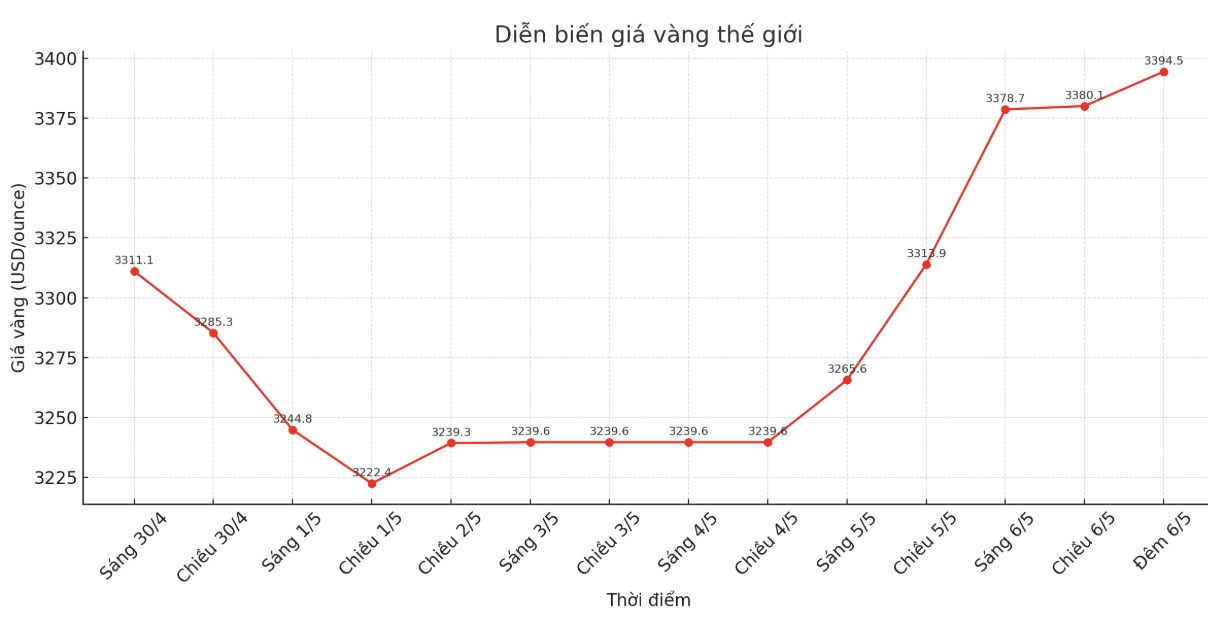

World gold price

At 10:15 on May 6, the world gold price listed on Kitco was around 3,394.5 USD/ounce, up 63.4 USD.

Gold price forecast

According to Kitco, world gold prices increased sharply thanks to strong safe-haven demand, especially from China. Silver prices also increased sharply. A weaker US dollar earlier this week further supported the rally in gold and silver.

June gold futures rose $29.1 to $3,381.40 an ounce. The price of silver futures for May increased by 0.855 USD, to 33.06 USD/ounce.

Dow Jones Newswires titled: "Gold futures skyrocket as hopes for a quick resolution of the trade war gradually fades."

brokerage SP Angel quoted Bloomberg as saying that the Shanghai Gold Exchange is planning to expand its warehouse network to Hong Kong (China), operated by the Bank of China.

"This move is aimed at boosting the valuation of gold in yuan, as Beijing strives to increase its influence on the global commodity market," Bloomberg said.

According to Bloomberg, the exchange has recorded record trading volumes in recent quarters, largely thanks to strong buying from retail investors in China.

This week, the market is waiting for the interest rate decision from the US Federal Reserve (FED), expected to be announced on Wednesday afternoon. The Fed is expected to leave monetary policy unchanged at this meeting.

Asian and European stock markets traded in opposite directions overnight. US stock indexes are expected to open down in today's session in New York. Risk-off sentiment is returning to the market due to no breakthroughs in global trade negotiations.

Technically, buyers in the June gold contract are holding a big advantage in the short term. The next target for buyers is to surpass the historical resistance level of $3,509.9/ounce. Meanwhile, the sellers will try to pull the price below 3,209.4 USD/ounce.

The nearest resistance level is 3,395 USD/ounce and followed by 3,400 USD/ounce. The most recent support was $3,350/ounce and then $3,332.1/ounce.

Key external factors today include the continued decline in the USD index. Nymex crude oil prices increased to about 58.50 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.343%.

Notable economic data schedule

Wednesday: Fed monetary policy decision.

Thursday: Bank of England interest rate decision; US weekly jobless claims.

Note: Gold price data is compared to the same time of the previous trading session.

See more news related to gold prices HERE...