Update SJC gold price

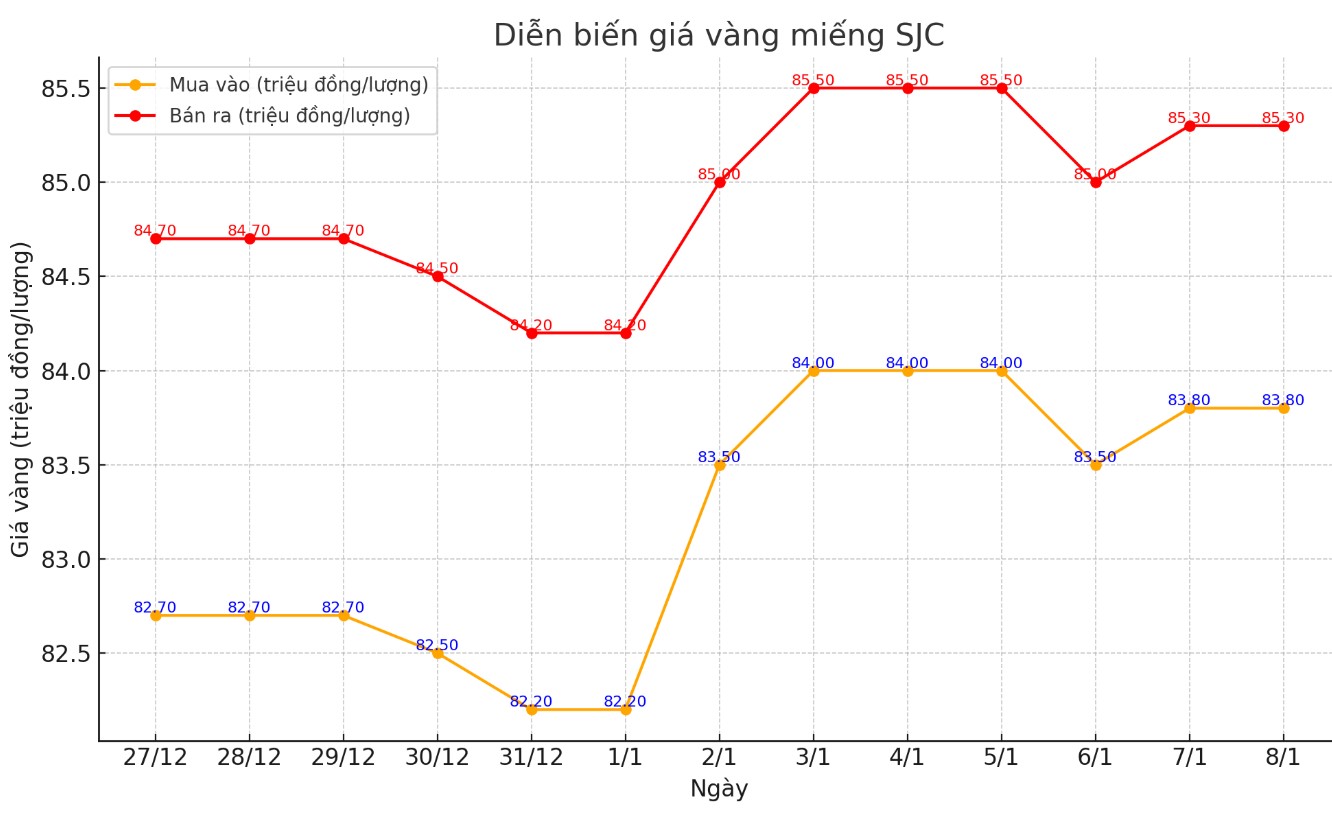

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND83.8-85.3 million/tael (buy - sell); an increase of VND300,000/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 83.8-85.3 million VND/tael (buy - sell); an increase of 300,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.4-85.6 million VND/tael (buy - sell); increased by 700,000 VND/tael for buying and increased by 600,000 VND/tael for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.2 million VND/tael.

Price of round gold ring 9999

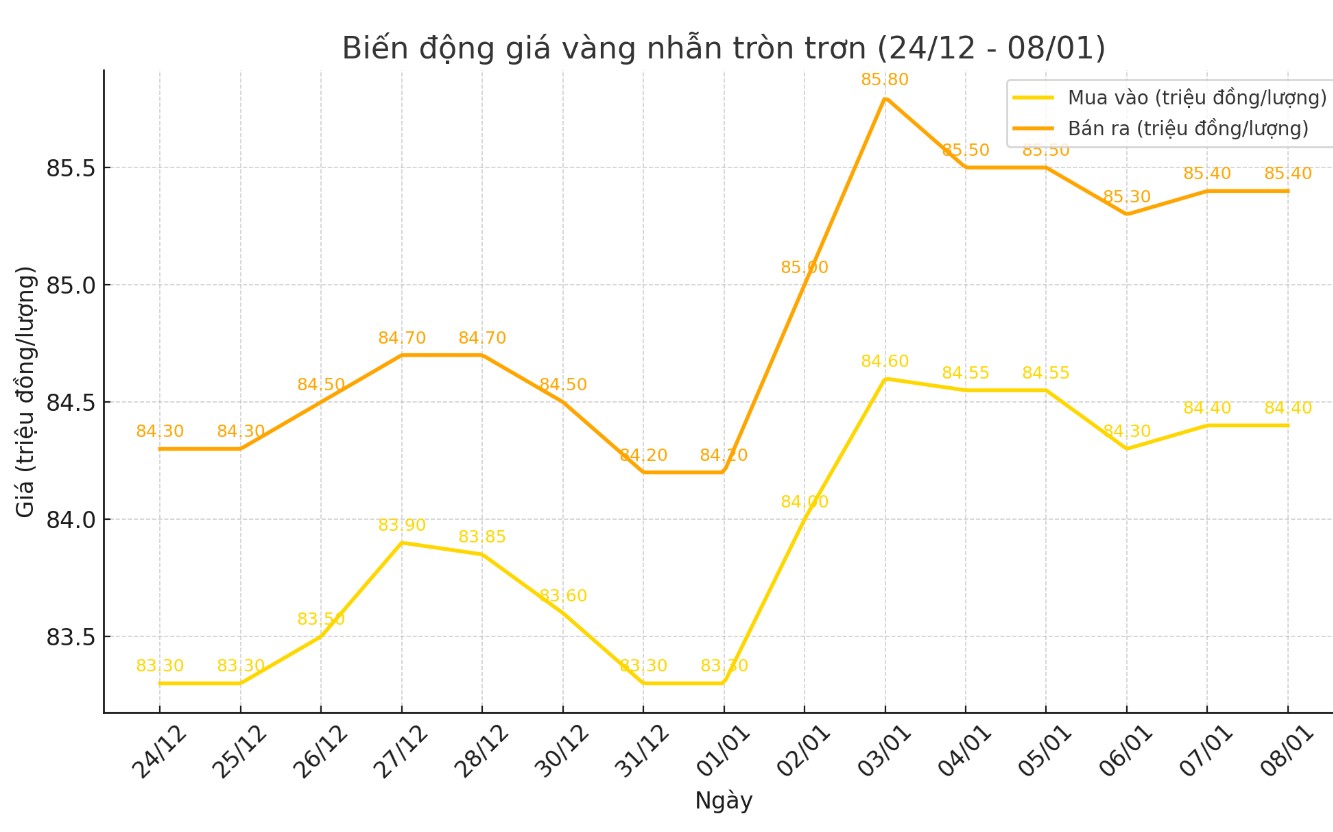

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.4-85.4 million VND/tael (buy - sell); an increase of 100,000 VND/tael for buying and a decrease of 250,000 VND/tael for selling compared to the beginning of the trading session yesterday afternoon.

Bao Tin Minh Chau listed the price of gold rings at 84.4-85.6 million VND/tael (buy - sell), keeping the buying price unchanged and increasing the selling price by 100,000 VND/tael compared to the beginning of the trading session yesterday afternoon.

World gold price

As of 11:15 p.m. on January 7 (Vietnam time), the world gold price listed on Kitco was at 2,650.4 USD/ounce, up 14.3 USD/ounce compared to the beginning of the trading session yesterday morning.

Gold Price Forecast

World gold prices increased despite the increase of the USD. Recorded at 23:20 on January 7, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 108.120 points (up 0.14%).

Gold prices rose on news that the People’s Bank of China was buying more gold. The People’s Bank of China reportedly increased its gold reserves in December, buying 300,000 ounces to bring its total reserves to 73.3 million ounces. This shows that China has resumed buying gold after a 6-month pause last year.

Gold prices rose after a report said aides to President-elect Donald Trump were considering plans to impose tariffs only on sectors deemed important to U.S. national security or the economy. However, Trump "ignored" the report, adding to uncertainty over future U.S. trade policies.

Gold bulls held on to their bullish momentum today, despite rising U.S. Treasury yields. February gold futures rose $21.30 to $2,668.70 an ounce, while March silver futures rose $0.407 to $30.99 an ounce.

Chantelle Schieven, head of research at Capitalight Research, said he remains bullish on the precious metal this year, but said the rally in gold prices would not happen now but would take several months.

Chantelle Schieven added that gold prices will trade between $2,500 and $2,700 an ounce in the first half of the year, breaking out and surpassing the $3,000 an ounce mark in the second half of 2025.

In other major markets, Nymex crude oil futures rose and traded around $74 a barrel. The yield on the 10-year US Treasury note rose to 4.642%, its highest since 2023.

See more news related to gold prices HERE...